December 2024

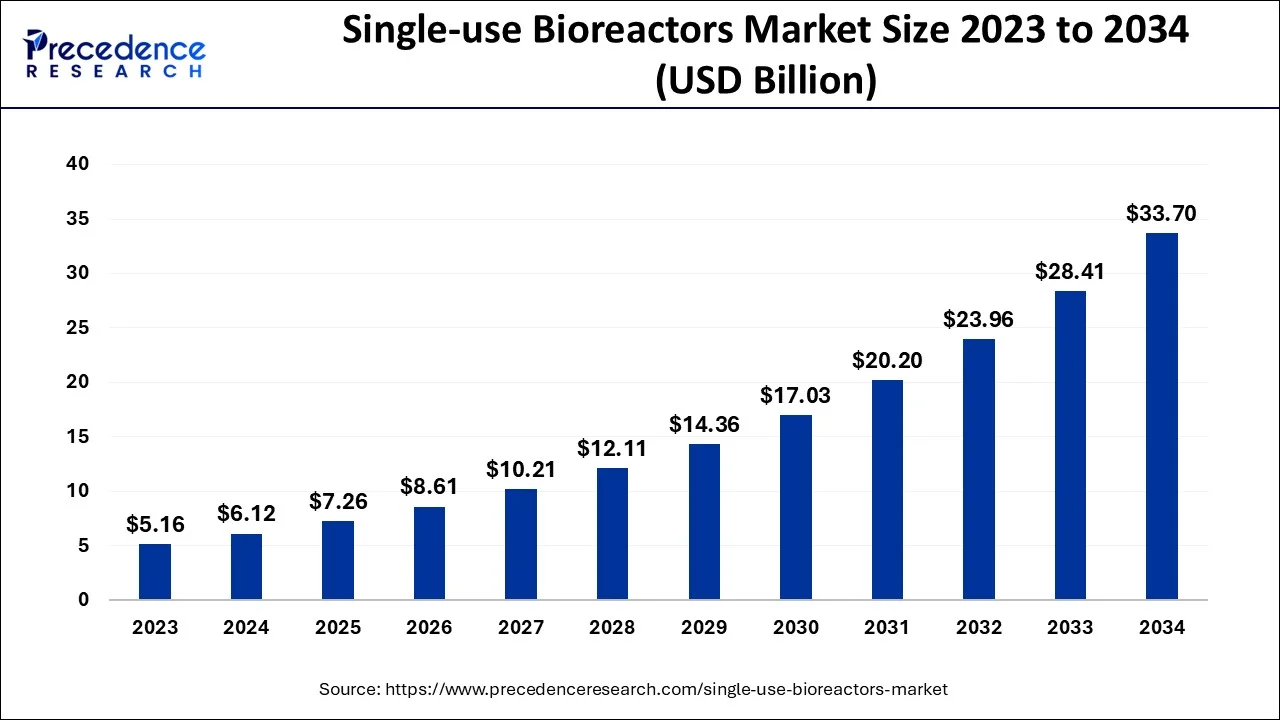

The global single-use bioreactors market size accounted for USD 6.12 billion in 2024, grew to USD 7.26 billion in 2025 and is predicted to surpass around USD 33.70 billion by 2034, representing a healthy CAGR of 18.60% between 2024 and 2034. The North America single-use bioreactors market size is calculated at USD 1.96 billion in 2024 and is expected to grow at a fastest CAGR of 18.77% during the forecast year.

The global single-use bioreactors market size is estimated at USD 6.12 billion in 2024 and is anticipated to reach around USD 33.70 billion by 2034, expanding at a CAGR of 18.60% from 2024 to 2034.

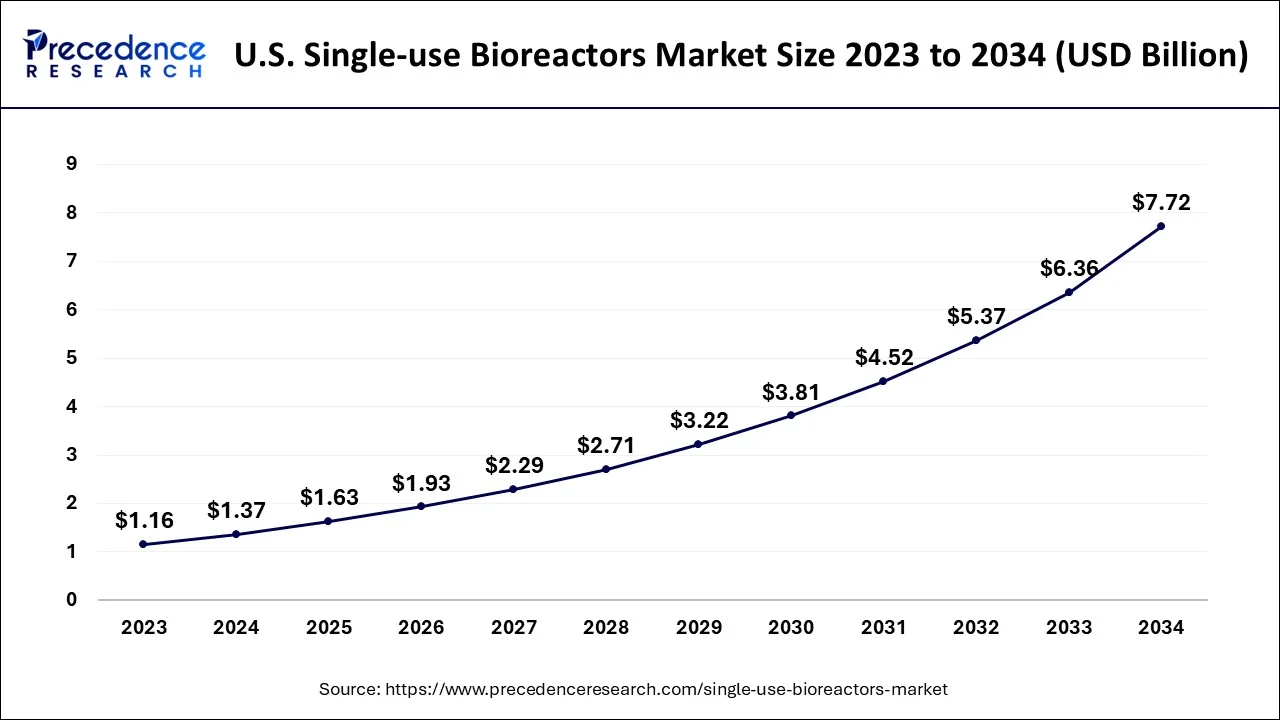

The U.S. single-use bioreactors market size is evaluated at USD 1.37 billion in 2024 and is predicted to be worth around USD 7.72 billion by 2034, rising at a CAGR of 18.80% from 2024 to 2034.

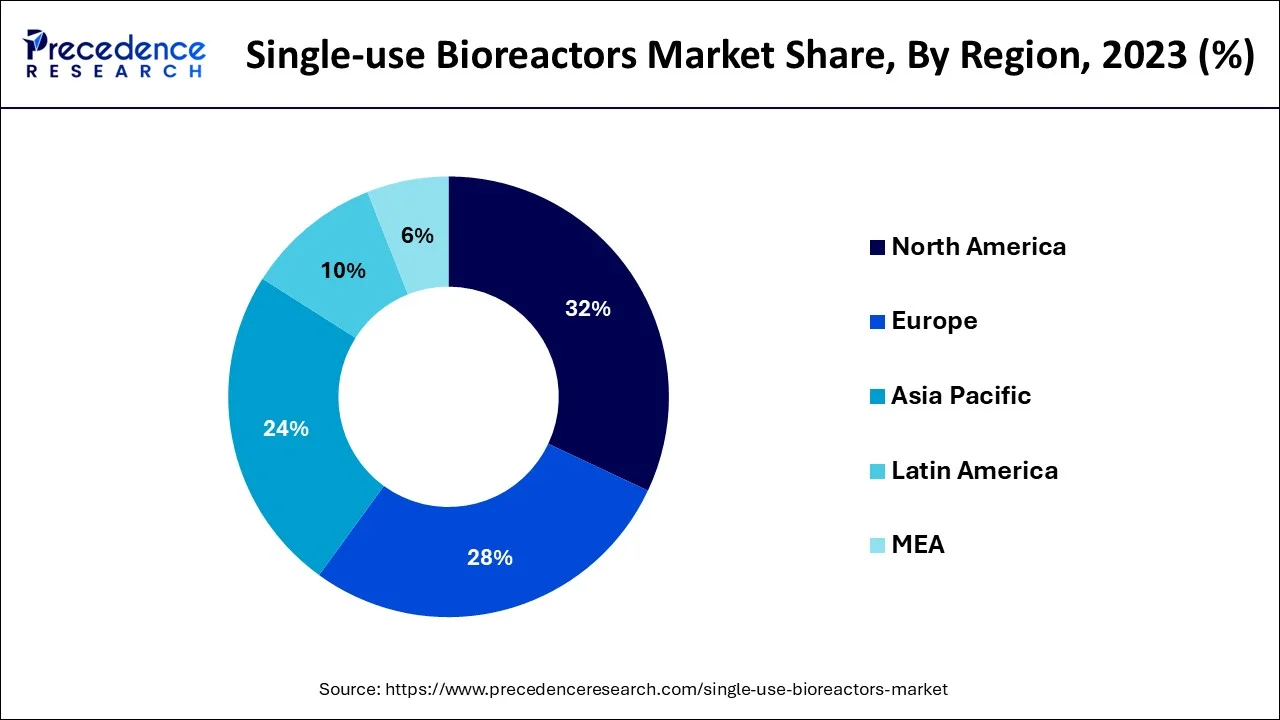

In 2023, North America's overall revenue was the highest. This is explained by the existence of significant operating firms and the country's well-established biotech industry. For example, Thermo Fisher Laboratories said in September 2021 that it intended to build a new production facility specifically for single-use bioprocessing solutions. During the projected timeframe, Asia Pacific is anticipated to have the fastest CAGR. According to estimates, Asian businesses, both domestic contenders and global behemoths are building around 50 per cent of the newest biorefinery facilities worldwide. In the coming years, this is anticipated to significantly drive the global market in Asia-Pacific. Due to its widespread usage of single-use technologies, China is predicted to be at the front.

The single-use bioreactors market has shown a notable increase in sales despite the worldwide COVID-19 epidemic. As a result, the need for single-use bioprocesses has skyrocketed. The size of stainless-steel fermenters and associated high capital costs have become an issue due to the shifting market for pharmaceuticals. Due to their adaptability, SUBs have achieved successfully the rising need for pharmaceuticals while overcoming issues that are often connected with bioreactors. One of the main business drivers of investing in single-use biopharmaceutical technologies is acknowledged to be versatility.

The single-use bioreactors have the potential to lower the price of traditional bioprocesses. Disposable biofilters typically have lower investment costs than traditional stainless-steel biopharmaceutical devices. Therefore, the cost-saving benefits in terms of development, operation, and maintenance can be primarily responsible for the acceptance of these items. Cost, reaction size, ideal operating capacity, temperature control, and throughput are all factors to be taken into account when choosing a single-use culture system. Additionally, it is projected that in the upcoming years, the use of throwaway bioreactors will increase due to the increased demand for highly effective medicines on a global scale that doesn't necessitate a significant number of bioprocesses. Small-scale, bench-top SUBs reduce the requirement for assembly, washing, and thermal treatment, which results in a quicker turnaround time. Such reactors are regarded as the workhorses of method advancement and optimization, promoting the use of SUBs for the production of biopharmaceuticals.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.12 Billion |

| Market Size by 2034 | USD 33.70 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 18.60% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Rising R&D spending on biopharmaceuticals

Better single-use devices are utilized

Single-use fermenter systems are now widely used in pharmaceutical production methods that prioritize high production yield. Single-use bioreactors' versatility, cost-effectiveness, and rapidly increased manufacturing will increase demand, which will have an impact on economic growth. Due to these benefits, there will be greater demand for quick growth, higher production of novel therapeutic drugs including vaccines, enzymes, antibodies, and hormones, and larger product volumes that may be produced in these bioprocesses, all of which will help the market expand.

Additionally, growing interest from major players in offering small-scale culture systems will fuel the company's rise in the upcoming years. The accessibility of reusable biocatalytic bags in a variety of shapes for just a variety of uses, including the storing of chemicals, cell cultures, buffers, or sterilized media is predicted to drive market expansion. Single mainstream bags improve production repeatability by providing resilience, hardness, and heat resistance.

In 2023, mixed plate biofilters accounted for the biggest revenue proportion. The market development of continuous stirred tank bioprocesses is at its maximum level thanks to features supplied by such bioprocesses such as good oxygen transmission and liquid mixing capabilities, cheap operational costs, simple scale-up, conformity to cGMP criteria, and different propellers. In addition, it is projected that the increased use of continuous stirred-tank SUBs in huge production would spur market expansion in the upcoming years. The ability to scale up and down with ease has helped fulfil the demands of the current output. Additionally, the availability of wave-induced separate bioreactors would increase in the coming years, boosting overall growth. For the past ten years, Waves Biotech AG has provided the first wave fermenter BIOSTAT RM. More lately, the business unveiled the second version, BIOSTAT RM II, which has upgraded capabilities and a better temperature regulation & propulsion system. During the projected period, these manufacturing improvements will fuel the demand for wave-induced solitary bioprocesses

In 2023, the sector of mammalian cells held the highest share. This might be due to the significant penetrating of these organisms in the creation of pharmaceutical therapies and the wide commercial successes of transgenic enzymes produced from human cells. 85% of pharmacological prospects in preclinical studies, according to Bioprocess Worldwide, are created in human cultured cells. Mammalian cell culture for the creation of recombinants has also swiftly advanced their use in clinical contexts. Another important aspect that is anticipated to have a considerable impact on market expansion in the forthcoming years is the expanding use of single-use bioprocesses for mammalian cultured cells in different research investigations. Yeasts are dependable eukaryotic carriers again for the synthesis of fusion proteins and offer special benefits in the generation of medicinal homologous sequences. The increasing attention given by numerous research organizations and scientists to the use of the fermentation process in medical or medicinal contexts will hasten market expansion during the projected timeframe.

With a larger overall revenue in 2022, that vaccine category dominated the marketplace. This is mostly because of the Severe acute respiratory virus's widespread outbreak, which has created an immediate requirement for a pandemic vaccine. According to the COVID-19 Effects on Bioprocessing research by Bio Plan Partners, single-use solutions used in commercial production are predicted to rise sharply. These initiatives rely heavily on single-use bioprocesses because they are adaptable, economical, and less likely to cause cross-contamination. The industry is expected to be driven by this steady rise in the consumption of single-use solutions. Additionally, the growing field of gene and cell therapy is anticipated to accelerate the uptake of SUBs throughout this market. Sartorius, as well as Rooster Bio, Inc., teamed up in Jan 2021 to improve the production capacities for cell and gene therapies. The partnership aims to increase the output of tissue regeneration. One of the major players in the marketplace for single-use bioprocesses is Sartorius.

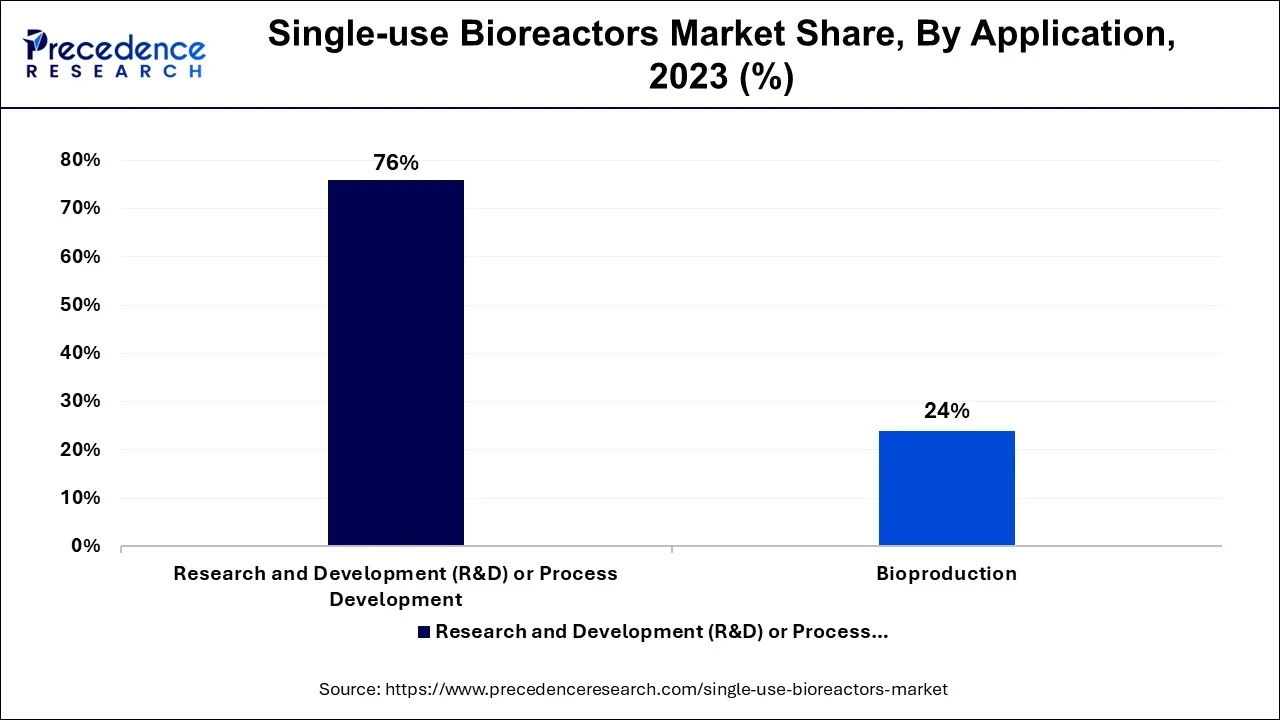

The expansion of research and innovation processes accounted for the biggest revenue proportion. Single-use fermenter utilization in systems integration is a driving force behind the industry's expansion. For example, according to the article written by American Pharmacy, the business used this single-use bioreactor for systems integration.

Moreover, every component of the bioprocessing sector uses single-use devices. This demonstrates the predominance of single-use bioprocesses in clinical production and R&D. In the nearest term, it is projected that the bioproduction sector will see a rise in the use of these bioprocesses. Removable reactors are increasingly being used on a broad scale, first from the laboratory to the industry, as a result of substantial improvements in bioreactor layouts, sensor systems, film technology, and swirling motors.

The segment with the highest revenue share in 2023 more than 36% was CMOs & CROs. CMOS has a significant desire for more variable manufacturing capacity as well as fast program switchovers. They thus use a greater variety of single-use parts and systems. CMOS & CROs are increasingly inclined to use SUBs as a result of the rising tendency of outsourced.

This development is linked to the effectiveness and application of SUBs in managing various pharmaceutical commodities and shifting market needs. These elements result in substantial SUS gadget adoption enabling quicker CMO acceptance of new SUS technology. The sector is being driven by CMOs' dynamic processing line & capabilities as well as more consistent product designers for biotechnological processes machinery and infrastructure.

Usage Type Insights

In 2023, the research facility production sector had the biggest income proportion. In the pharmaceuticals sector, throwaway fermenters are frequently employed in preliminary and clinical studies. The company's growth is anticipated to be significantly impacted by the growing usage of single-use technologies in cell treatment studies and vaccine manufacture. Throughout the projected period, it is expected that the massive production category would experience significant expansion. This is due to the fast-increasing need for the commercial operations of biological goods and the increase of manufacturing capacity to satisfy the need. During the projection term, biotechnology and pharmaceutical businesses should experience profitable growth possibilities. The market expansion was further reinforced by strategic alliances among product producers and pharmaceutical firms.

By Product

By Type

By Type of Cell

By Molecule Type

By Application

By End-Use

By Usage Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

January 2025

November 2024

November 2024