January 2025

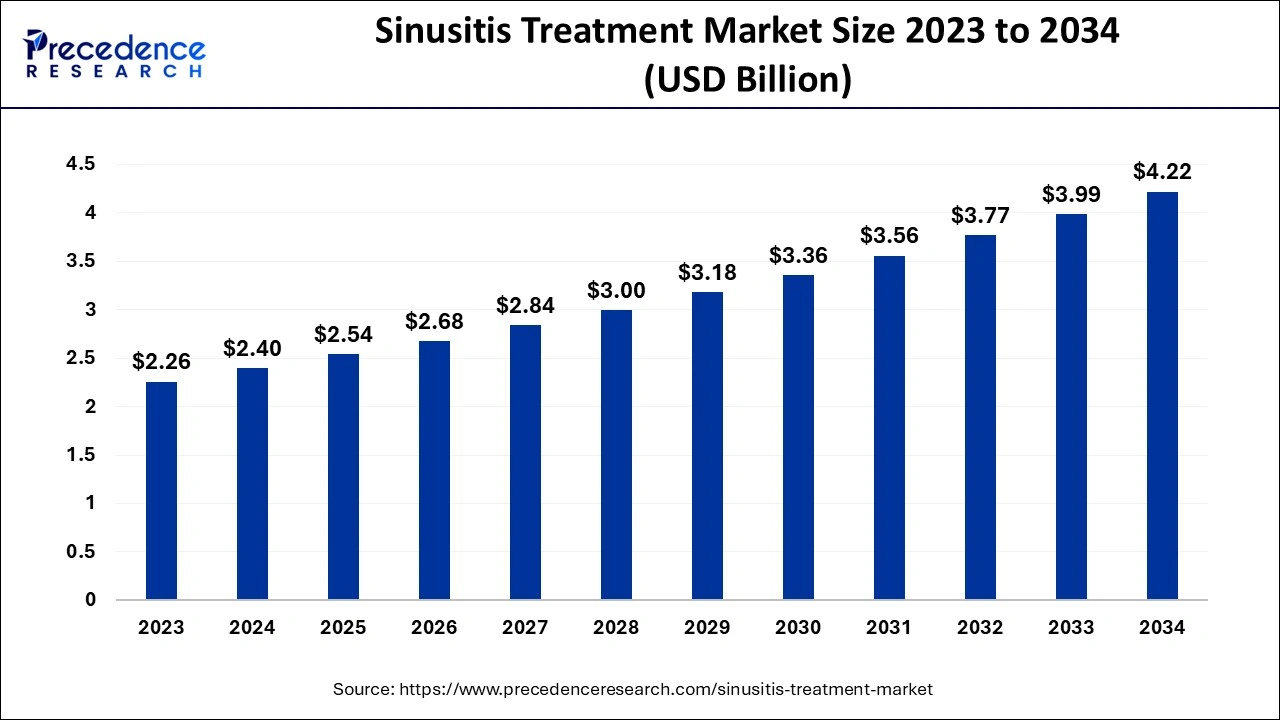

The global sinusitis treatment market size accounted for USD 2.4 billion in 2024, grew to USD 2.54 billion in 2025 and is projected to surpass around USD 4.22 billion by 2034, representing a CAGR of 5.82% between 2024 and 2034.

The global sinusitis treatment market size is calculated at USD 2.4 billion in 2024 and is anticipated to reach around USD 4.22 billion by 2034, expanding at a CAGR of 5.82% from 2024 to 2034. Increasing prevalence of the condition is the key factor driving the growth of the market. Also, the growing need for timely diagnosis, along with the growing demand for better treatment options, is expected to fuel market growth shortly.

Sinusitis is a disease condition that has adverse effects on the majority of the population in the world. The condition can be triggered by environmental factors like smoke, animal dander, dust, and polluted air. Sinusitis is also distinguished by inflammation of the sinus layer caused by irritants, viruses, allergens, bacteria, and microbes. The infected patient complains of facial pain, congestion, postnasal drip, and headache. Viral sinusitis is easier to treat, and patients can recover quickly without antibiotics.

Global Lung Cancer Statistics (2022)

| Country | Number |

| China | 1060,584 |

| United States of America | 226,033 |

| Japan | 136,723 |

| India | 81,748 |

| Russian Federation | 70,362 |

| Germany | 62,025 |

| United Kingdom | 50,700 |

| France (metropolitan) | 49,613 |

| Brazil | 44,213 |

| Italy | 43,808 |

| World | 2,480,675 |

Impact of AI on the Sinusitis Treatment Market

The integration of artificial intelligence (AI) is substantially impacting the market. AI-generated diagnostics and treatment options are improving the precision and efficiency of patient management. Furthermore, AI is optimizing workflow efficiencies, decreasing the time needed for diagnosis and customized treatment approaches. The rising adoption of AI in medical settings is expected to fuel the opportunities and advancements in the sinusitis treatment sector.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.22 Billion |

| Market Size in 2024 | USD 2.4 Billion |

| Market Size in 2025 | USD 2.54 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.82% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Route of Administration, Treatment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for nasal sprays

Advanced nasal spray designs are a fact-pacing phenomenon in the market. Innovators are suggesting that investors must go beyond drug advancements and emphasize various ways to deliver it in the cavities of sinus patients. Additionally, key players are taking advantage of such advances to develop new innovative devices that enable individuals to treat themselves in the comfort of their homes and lessen the symptoms of sinusitis in the primary stages.

Lack of skilled medical professionals

The lack of well-trained medical professionals who are unable to diagnose and treat patients with proper treatments can hinder the growth of the sinusitis treatment market. However, the huge expenditure related to the treatment of sinusitis can also negatively impact the market growth because it includes high-end drug types like antihistamines and corticosteroids.

Increase in prevalence of rhinosinusitis

The incidence of rhinosinusitis is increasing rapidly across the globe. Acute rhinosinusitis lasts less than 4 weeks, and subacute rhinosinusitis lasts approximately 12 weeks. Furthermore, Patients suffering from acute rhinosinusitis witness more than four acute episodes that last for at least f 7 days. The symptoms of chronic rhinosinusitis can last for more than 12 weeks. The extensive range of impact created by rhinosinusitis constrains individuals from doing mundane tasks and suggests a high time for searching for a better life.

The acute sinusitis segment dominated the sinusitis treatment market in 2023. The dominance of the segment can be attributed to the increasing introduction of biologics like omalizumab, etc. Key firms are continuously increasing their expenditure on innovation and marketing, which in turn results in a rising focus on process efficiency and cost management. Additionally, disease symptoms like Hay fever or common cold caused by allergies can be treated with biological treatments.

The chronic segment is expected to grow significantly in the sinusitis treatment market over the forecast period. The growth of the segment can be linked to the rising prevalence of chronic Hay sinusitis in the majority of the population across the globe. Chronic sinusitis is caused by bacteria growing in the sinuses and can last for more than three months. Furthermore, conditions like allergies, asthma, and cystic fibrosis can block the nasal airways, which can lead to the occurrence of chronic sinusitis.

The nasal segment led the sinusitis treatment market in 2023 by holding the largest market share. The dominance of the segment is due to the drug administration through the nasal root, which absorbs more drugs to exert local or systemic therapeutic effects. However, the nasal route has benefits for being non-invasive with rapid absorption, low infection, and brain targeting properties, which can drive the segment growth further.

The oral segment held a significant share of the sinusitis treatment market in 2023. This is because Oral administration is convenient and cost-effective. This route is the most commonly used drug administration route. The main site of drug absorption is generally the small intestine. Furthermore, the oral route offers a non-invasive, safer, and simpler way to administer medications for all types of diseases, including sinusitis. Drugs taken by oral routes can also show good patient compliance and response to the medications.

In 2023, the analgesic segment dominated the sinusitis treatment market by holding the share. The dominance of the segment can be credited to the increasing consumption of analgesics, which relieve the pain caused by pressure buildup in the sinus cavities. Also, analgesics and other pain relievers can help lessen fever and allergic conditions. Analgesics, such as ibuprofen, acetaminophen, and aspirin, can help relieve sinus pain and show the least side effects.

North America dominated the sinusitis treatment market in 2023. The dominance of the region can be attributed to the increasing incidence of rhinosinusitis. Furthermore, rising pervasiveness of viral and bacterial infections. Also, major players in the market are focusing on developing advanced drug products for sinusitis because of ongoing innovations and advanced technology.

Asia Pacific region is expected to grow at the fastest rate over the projected period. The growth of the region can be driven by the high prevalence of sinusitis. However, the developing countries in the region, such as India and China, have the world's worst air quality, which can lead to a rapid surge in respiratory disorders along with the growth in industrialization.

Segments Covered in The Report

By Type

By Route of Administration

By Treatment

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

February 2025

September 2024