January 2025

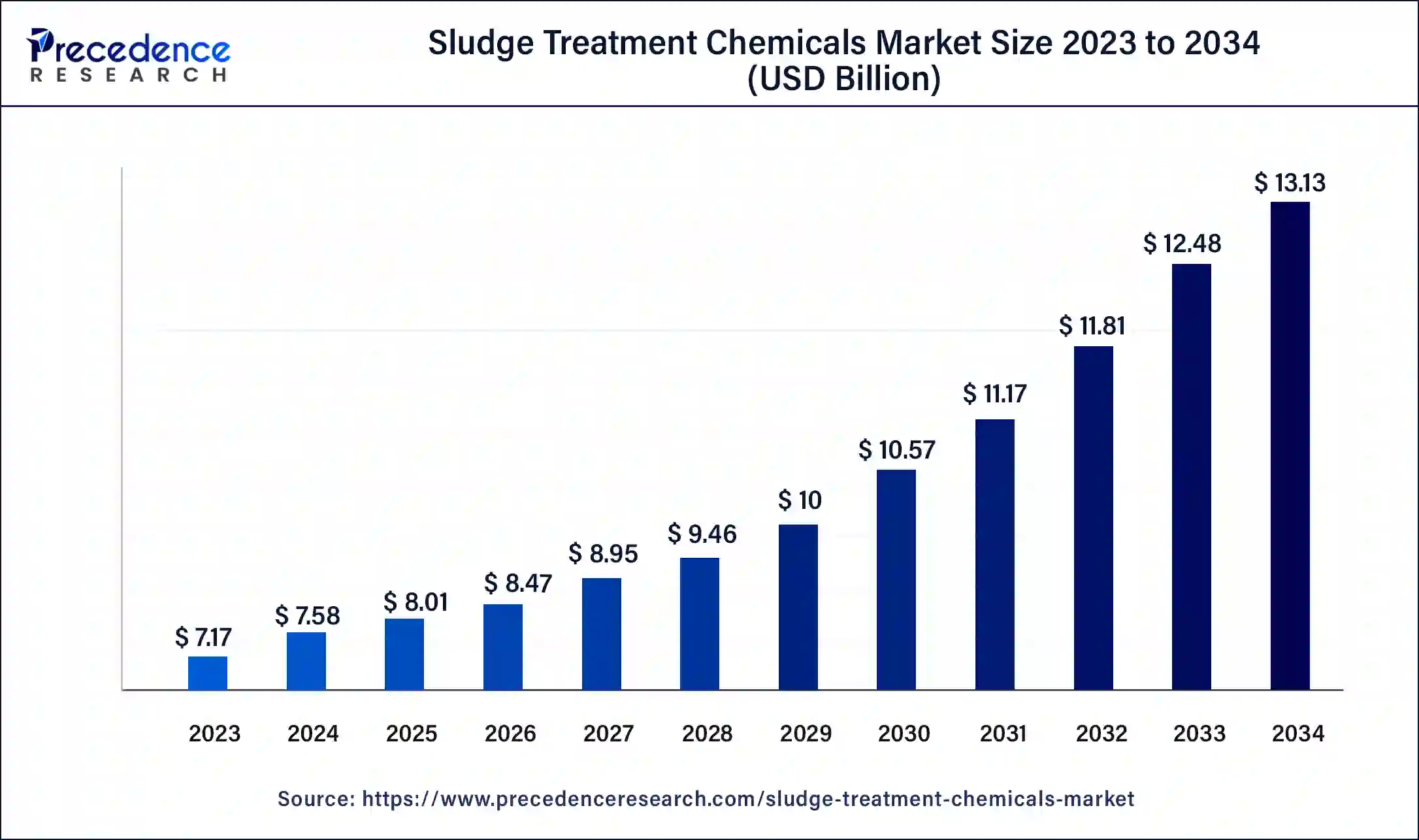

The global sludge treatment chemicals market size was USD 7.17 billion in 2023, estimated at USD 7.58 billion in 2024 and is anticipated to reach around USD 13.13 billion by 2034, expanding at a CAGR of 5.65% from 2024 to 2034.

The global sludge treatment chemicals market size accounted for USD 7.58 billion in 2024 and is predicted to reach around USD 13.13 billion by 2034, growing at a CAGR of 5.65% from 2024 to 2034.

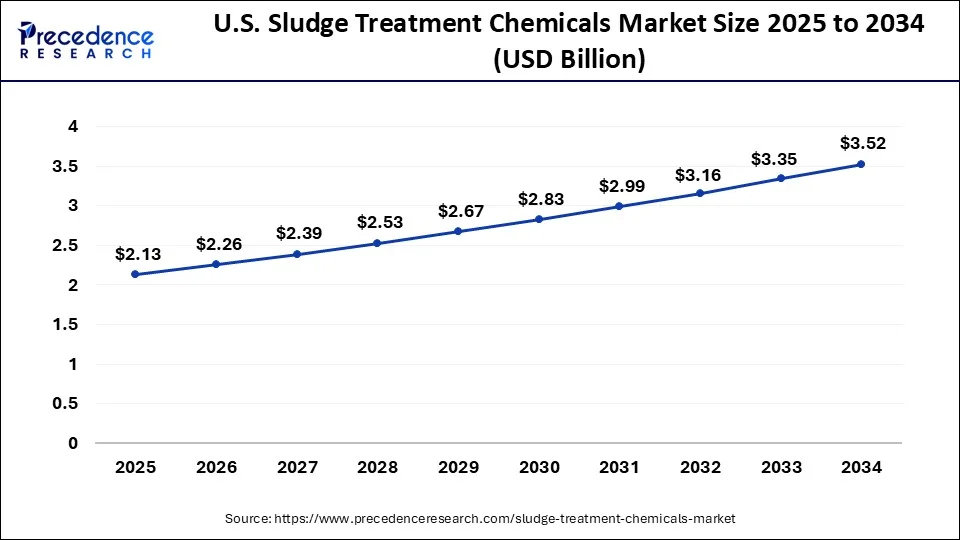

The U.S. sludge treatment chemicals market size was valued at USD 1.91 billion in 2023 and is expected to be worth around USD 3.52 billion by 2034, at a CAGR of 5.73% from 2024 to 2034.

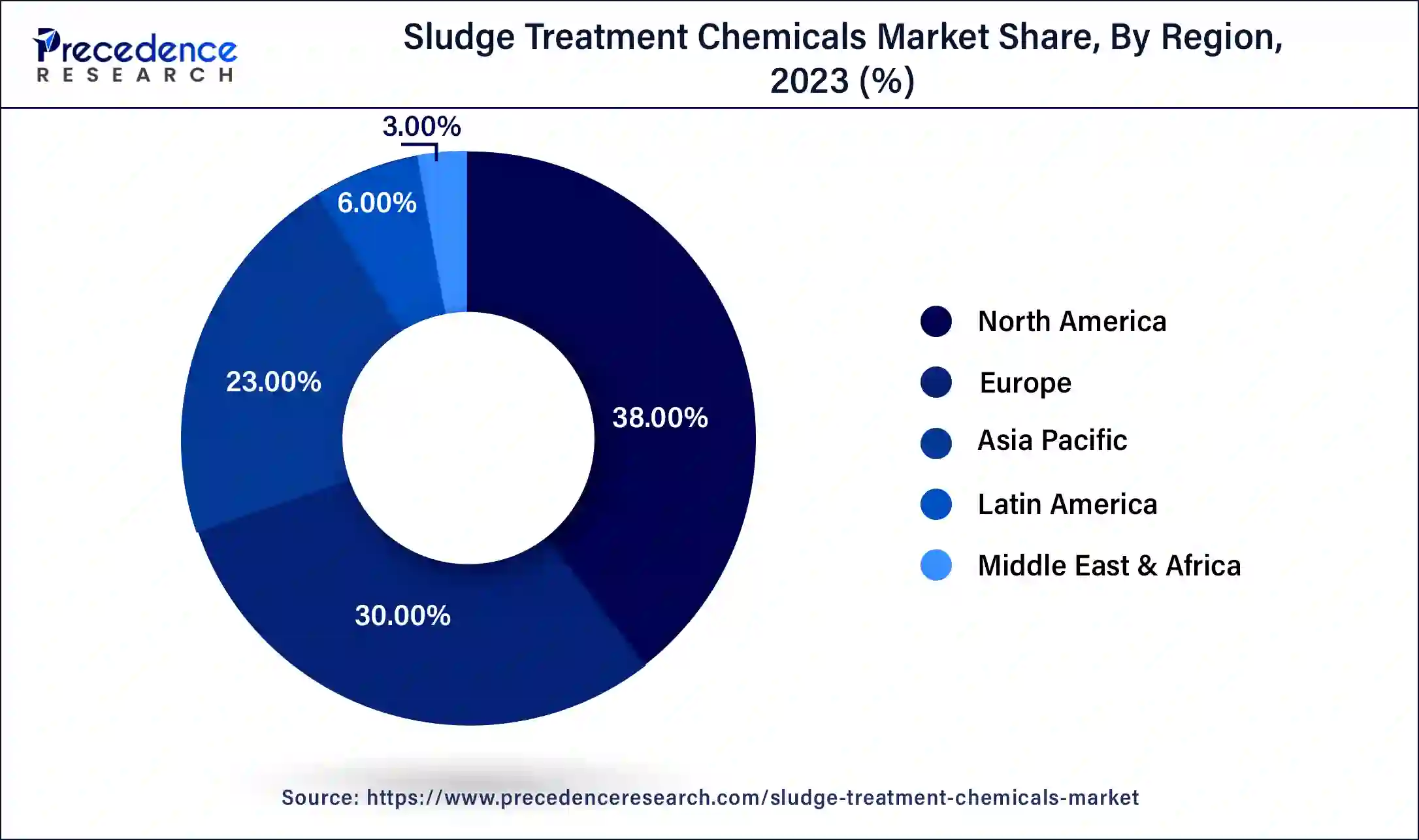

North America has held the largest revenue share 38% in 2023. In North America, the sludge treatment chemicals market reflects a strong focus on sustainability and regulatory compliance. Stringent environmental regulations drive the adoption of advanced sludge treatment chemicals, emphasizing eco-friendly formulations. The market experiences a surge in research and development investments, fostering technological innovations for cost-efficient and environmentally responsible solutions. Public-private collaborations and increasing awareness of responsible waste management contribute to the region's dynamic sludge treatment chemical trends.

Asia-Pacific is estimated to observe the fastest expansion. In the region, the sludge treatment chemicals market is witnessing dynamic growth driven by rapid industrialization and urbanization. Increasing awareness of environmental sustainability fuels the demand for advanced sludge treatment chemicals. The market experiences a shift toward cost-effective and eco-friendly formulations, addressing the diverse and evolving needs of industries. Government initiatives, coupled with a growing focus on responsible waste management practices, contribute to the expanding market presence of sludge treatment chemicals in Asia-Pacific.

Europe showcases progressive trends in the sludge treatment chemicals market, marked by a commitment to circular economy principles and green initiatives. Stringent regulations drive continuous advancements in chemical formulations and treatment technologies. The region emphasizes resource recovery and beneficial reuse of treated sludge, contributing to sustainable waste management practices. Collaborative public-private partnerships underscore Europe's leadership in adopting environmentally responsible sludge treatment chemical solutions.

The sludge treatment chemicals market involves the use of specialized chemicals to treat and manage sludge generated from wastewater treatment processes. These chemicals aid in the dewatering, conditioning, and stabilization of sludge, reducing its volume and promoting environmentally safe disposal or beneficial reuse. Key treatment chemicals include coagulants, flocculants, disinfectants, and dewatering agents.

Growing concerns about environmental impact, stringent regulations, and the need for sustainable waste management drive the demand for sludge treatment chemicals, particularly in wastewater treatment plants, industries, and municipal facilities globally. Moreover, continuous advancements focus on developing eco-friendly sludge treatment chemicals to align with sustainability goals. The market plays a crucial role in minimizing the environmental impact of sludge disposal while ensuring efficient and responsible waste management practices.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.65% |

| Market Size in 2023 | USD 7.17 Billion |

| Market Size in 2024 | USD 7.58 Billion |

| Market Size by 2034 | USD 13.13 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Treatment, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Global emphasis on sustainability, increasing municipal and industrial wastewater generation

The surge in market demand for the sludge treatment chemicals market is prominently driven by the global emphasis on sustainability and the escalating volume of municipal and industrial wastewater generation. With sustainability taking center stage, industries worldwide seek sludge treatment solutions that align with environmental stewardship and circular economy principles. Sludge treatment chemicals play a pivotal role in optimizing processes, enabling the beneficial reuse of treated sludge, and minimizing the ecological footprint of waste disposal.

Furthermore, the increasing generation of municipal and industrial wastewater amplifies the need for efficient sludge treatment chemicals. As urbanization and industrial activities intensify, the market experiences a heightened demand for innovative chemicals that address the challenges associated with sludge management. This trend underscores the critical role of sludge treatment chemicals in promoting responsible waste management practices, meeting regulatory requirements, and contributing to a more sustainable and environmentally conscious approach to wastewater treatment.

Cost of treatment chemicals and resistance to change

The sludge treatment chemicals market faces restraints primarily stemming from the cost associated with treatment chemicals. The expenses incurred in acquiring and utilizing these specialized chemicals can be a significant burden for wastewater treatment facilities and industries. This financial constraint may limit the adoption of advanced treatment solutions, particularly in regions or sectors with budgetary constraints, hindering the overall market demand.

Moreover, resistance to change poses another restraint as existing wastewater treatment systems may be reluctant to adopt new chemical treatments. Established methods and traditional chemicals might be deeply ingrained in operational processes, making the transition challenging. Overcoming resistance necessitates comprehensive education and awareness programs to highlight the benefits of modern sludge treatment chemicals in terms of efficiency, environmental impact, and compliance with evolving regulatory standards.

Development of eco-friendly formulations and technological innovations for cost-efficiency

The surge in market demand for the sludge treatment chemicals market is prominently driven by the development of eco-friendly formulations and technological innovations geared towards cost-efficiency. The growing emphasis on environmental sustainability fuels the demand for sludge treatment chemicals that align with eco-friendly practices. The development of formulations with reduced environmental impact, including biodegradable and non-toxic alternatives, resonates with industries striving for responsible waste management.

Technological innovations play a pivotal role in enhancing the cost-efficiency of sludge treatment processes. Advanced treatment technologies, such as smart monitoring and control systems, enable real-time optimization, minimizing resource usage and operational costs. The integration of innovative chemical formulations and application methods not only improves the overall efficacy of sludge treatment but also addresses the economic considerations of industries, fostering a robust market demand for sustainable and cost-effective sludge treatment solutions.

According to the type, the coagulants segment held 62% revenue share in 2023. Coagulants are chemicals that promote the aggregation of fine particles in sludge into larger flocs, facilitating easier removal during the treatment process. Commonly used coagulants include metal salts like ferric chloride and aluminum sulfate. Trends in coagulants involve the development of more effective and environmentally friendly formulations that align with sustainability goals. The adoption of advanced coagulation technologies, such as electrocoagulation, reflects a shift towards innovative approaches for enhanced sludge treatment efficiency.

The flocculants segment is anticipated to expand at a significant CAGR of 8.1% during the projected period. Flocculants are substances added to sludge to promote the formation of larger, settleable particles, improving the separation of solids from water. Polyacrylamides and polysaccharides are common flocculants used in wastewater treatment. Trends in flocculants include the exploration of bio-based alternatives and the development of high-performance formulations. The market sees a growing demand for flocculants that offer improved dewatering capabilities and cost-effective solutions, driving innovation and advancements in treatment technologies.

Based on the treatment, the primary segment held the largest market share of 59% in 2023. Primary sludge treatment involves the initial separation of solids from wastewater in the primary settling tanks. Chemical coagulants and flocculants are commonly used in this phase to enhance the sedimentation process. Trends in primary sludge treatment focus on optimizing coagulant and flocculant formulations for efficient solids removal, reducing the environmental impact of primary sludge, and incorporating eco-friendly alternatives.

On the other hand, the tertiary segment is projected to grow at the fastest rate over the projected period. Tertiary sludge treatment is the final stage, aiming to further reduce pollutants and pathogens. Advanced treatment chemicals, including disinfectants and polymers, are applied. Market trends in tertiary treatment involve the development of targeted and effective chemical solutions, emphasizing the removal of residual contaminants, meeting stringent discharge standards, and promoting the safe reuse or disposal of treated sludge.

Based on the application, the food & beverages segment held the largest market share of 29% in 2023. In the sludge treatment chemicals market for food & beverages, specialized chemicals are applied to treat sludge generated during the wastewater treatment processes of food and beverage manufacturing. Key trends include a rising demand for eco-friendly formulations to align with sustainability goals in the industry. Additionally, there's an emphasis on resource recovery solutions, extracting valuable by-products from treated sludge, reflecting a circular economy approach in addressing wastewater challenges.

On the other hand, the personal care & chemicals segment is projected to grow at the fastest rate over the projected period. Within the sludge treatment chemicals market for personal care & chemicals, chemicals are utilized to treat sludge arising from wastewater in personal care product manufacturing and chemical industries. Current trends involve the integration of advanced technologies for efficient sludge dewatering and conditioning. The market sees a growing demand for cost-effective and innovative treatment solutions, driven by the need for sustainable practices and adherence to stringent environmental regulations in these industries.

Segments Covered in the Report

By Type

By Treatment

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

September 2024

October 2024