January 2025

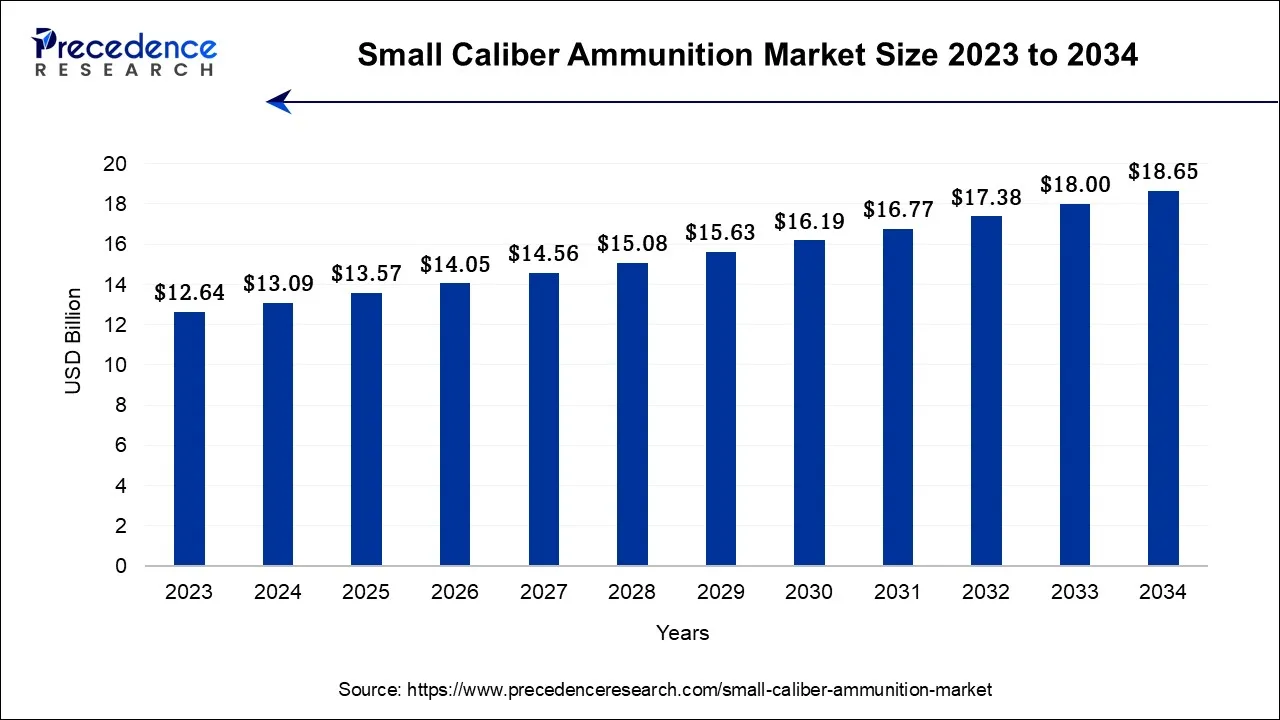

The global small caliber ammunition market size is calculated at USD 13.09 billion in 2024, grew to USD 13.57 billion in 2025, and is predicted to hit around USD 18.65 billion by 2034, poised to grow at a CAGR of 3.6% between 2024 and 2034. The North America small caliber ammunition market size accounted for USD 5.63 billion in 2024 and is anticipated to grow at the fastest CAGR of 3.72% during the forecast year.

The global small caliber ammunition market size is expected to be valued at USD 13.09 billion in 2024 and is anticipated to reach around USD 18.65 billion by 2034, expanding at a CAGR of 3.6% over the forecast period from 2024 to 2034.

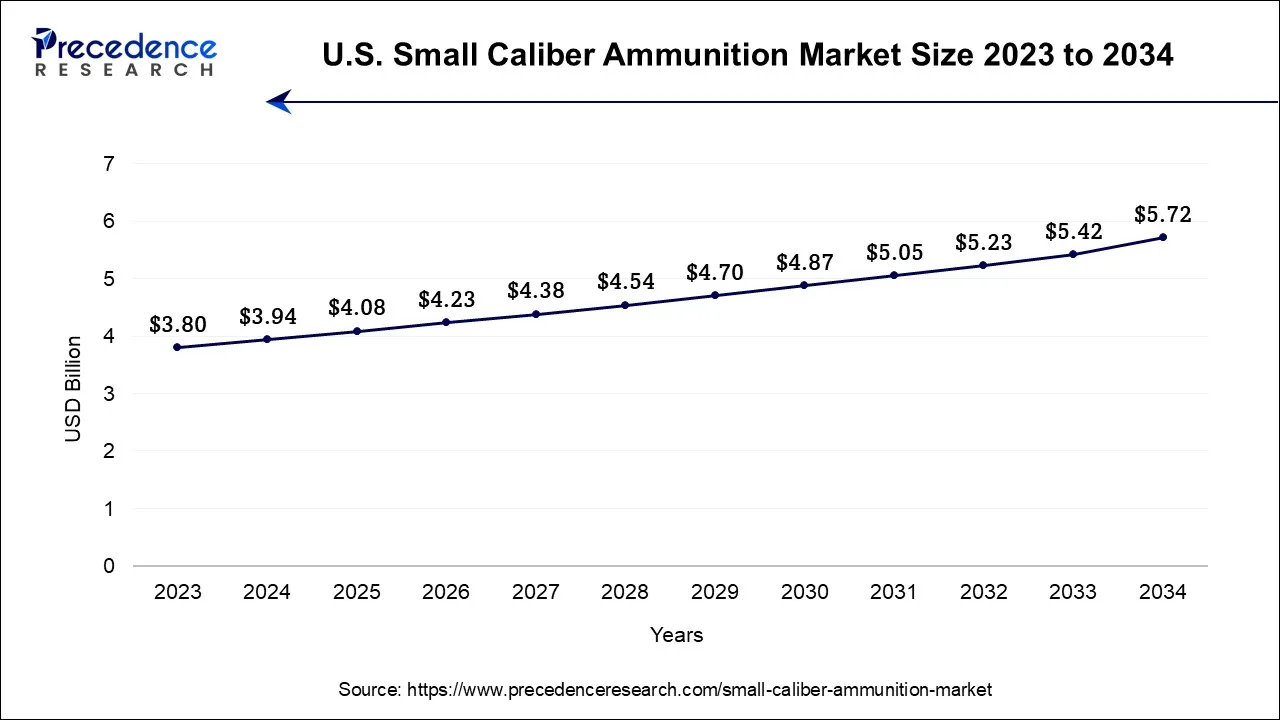

The U.S. small caliber ammunition market size is accounted for USD 3.94 billion in 2024 and is projected to be worth around USD 5.72 billion by 2034, poised to grow at a CAGR of 3.8% from 2024 to 2034.

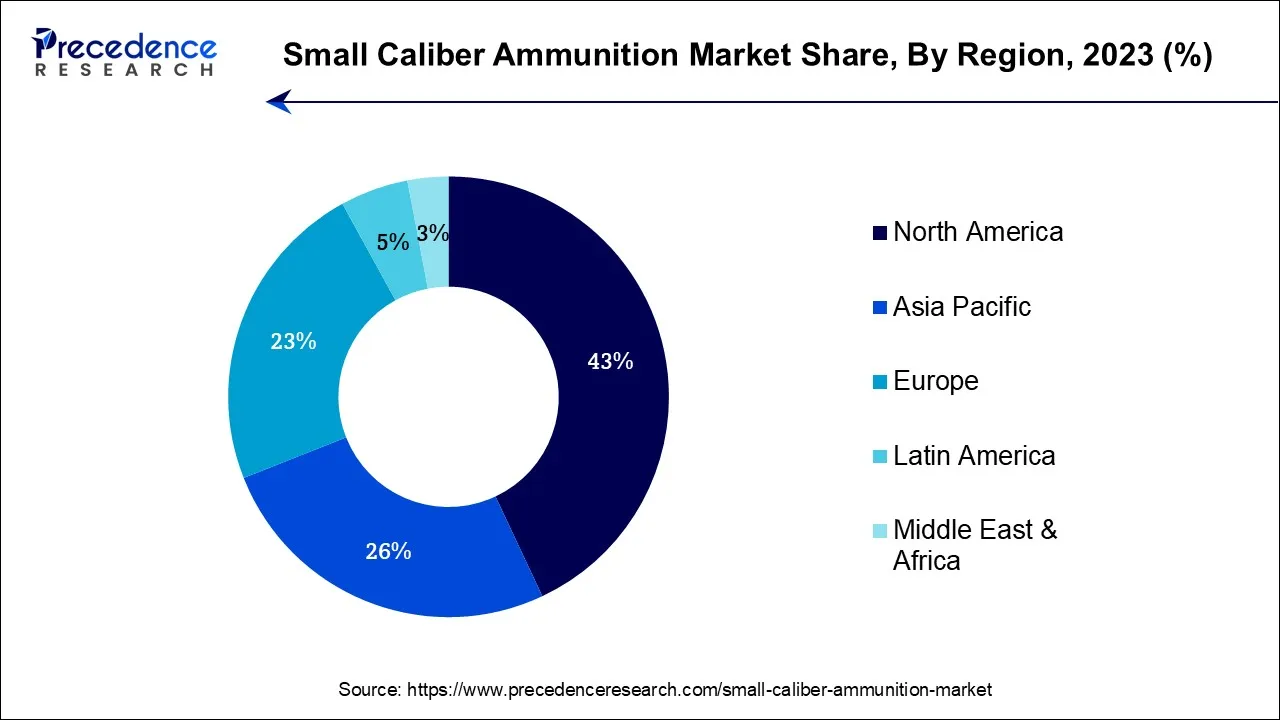

North America has held the largest revenue share 43% in 2023. In North America, the small caliber ammunition market is characterized by several prominent trends. There's a sustained demand for self-defense ammunition driven by personal safety concerns. Additionally, the market has seen a surge in civilian gun ownership, particularly during periods of uncertainty. Innovations in bullet design and materials are gaining traction, enhancing ammunition performance. The region also faces regulatory changes and safety concerns, prompting manufacturers to focus on compliance and safety features in their products, reflecting evolving consumer needs and government regulations.

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the small caliber ammunition market is witnessing several trends. Increased military modernization efforts in countries like India and China are driving the demand for technologically advanced ammunition. Moreover, the rising popularity of sport shooting and recreational shooting activities is boosting the market for small caliber rounds. Additionally, growing concerns about personal safety have led to increased civilian demand for self-defense ammunition. These trends, coupled with geopolitical factors, are shaping the dynamic landscape of the small caliber ammunition market in the Asia-Pacific region.

In Europe, the small caliber ammunition market is characterized by a growing emphasis on precision and accuracy. Sport shooting and competitive shooting events have gained popularity, driving demand for high-quality ammunition. Additionally, there is a strong focus on regulatory compliance and environmental sustainability, leading to increased research and development in eco-friendly ammunition solutions. Geopolitical factors also influence the market, with countries seeking to bolster their military capabilities, contributing to steady demand for technologically advanced small-caliber ammunition.

The small caliber ammunition market encompasses the production, distribution, and sale of ammunition designed for firearms with relatively small-bore diameters, typically below .50 caliber. These ammunitions are used for various purposes, including civilian firearms, military and law enforcement applications, and sports shooting.

The small caliber ammunition market nature is characterized by its sensitivity to geopolitical factors, military modernization efforts, and civilian gun ownership trends. Demand fluctuates based on defense budgets, civilian gun sales, and global security concerns, making it a dynamic and responsive sector within the broader ammunition industry.

The small caliber ammunition market revolves around the production and distribution of ammunition designed for firearms with bore diameters typically below 50 calibers. It serves a diverse range of users, including civilian gun owners, law enforcement agencies, and military forces.

This small caliber ammunition market dynamics are shaped by various factors, including geopolitical developments, global security concerns, and civilian gun ownership trends. Several key trends and growth drivers are influencing the market.

One significant trend is the rising demand for self-defense ammunition among civilian consumers, driven by concerns about personal safety. Additionally, military modernization efforts across the globe are fueling demand for technologically advanced small caliber ammunition. The increasing popularity of sport shooting and competitive shooting events is another factor contributing to market growth.

Moreover, there are opportunities for businesses in the small caliber ammunition market. Investments in research and development to create innovative and eco-friendly ammunition can set companies apart in a competitive market. Expanding into emerging markets with growing security concerns and military needs offers a pathway for growth. Collaboration with law enforcement agencies to develop specialized ammunition for their specific requirements can be a lucrative opportunity.

| Report Coverage | Details |

| Market Size in 2024 | USD 13.09 Billion |

| Market Size by 2034 | USD 18.65 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3.6% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Size, By Applications, and By Casing Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Military modernization initiatives worldwide are propelling the small caliber ammunition market's growth. As armed forces upgrade their weaponry, there's a heightened demand for advanced small caliber ammunition. These modernization efforts prioritize ammunition with improved accuracy, ballistics, and versatility to enhance soldier performance. Consequently, manufacturers are developing cutting-edge rounds to meet these requirements, driving demand in the civilian and military sectors, and fostering innovation in the small caliber ammunition market.

Moreover, Sport shooting has significantly boosted the small caliber ammunition market by driving demand for high-quality ammunition. Enthusiasts participating in competitive shooting events, such as target shooting and practical shooting sports, require precise and reliable ammunition to enhance their performance. This demand has led to the development of specialized small caliber rounds, propelling manufacturers to produce innovative, accurate, and consistent ammunition to cater to the growing sport shooting community, thereby increasing overall market demand.

Regulatory restrictions act as a significant restraint on the small caliber ammunition market. Stringent firearms regulations and legal limitations in various regions can impede market access, sales, and growth potential. These restrictions often result in increased compliance costs, reduced market size, and complexities in navigating the legal landscape. As a result, manufacturers and suppliers in the small caliber ammunition market must contend with a challenging regulatory environment that affects demand and profitability.

Moreover, Safety concerns can significantly restrain market demand in the small caliber ammunition market. Increased safety regulations and public awareness regarding the potential hazards associated with ammunition use and storage can lead to reduced consumer interest and sales. Additionally, stringent safety standards can increase manufacturing and compliance costs, impacting pricing and profitability. These concerns can influence both civilian and government procurement decisions, affecting the overall market demand for small caliber ammunition.

Diversification in the small caliber ammunition market can boost market demand by expanding product offerings beyond ammunition. Companies can introduce complementary products such as firearms accessories, optics, and gear, attracting a broader customer base. This approach not only increases revenue streams but also strengthens brand loyalty and customer retention. Diversification reduces dependency on a single product category and makes businesses more resilient, enhancing their overall competitiveness and market demand.

Moreover, Innovation and technology advancements have a profound impact on the small caliber ammunition market, driving increased demand. Consumers and military forces seek ammunition with improved accuracy, reduced recoil, and enhanced terminal ballistics. Manufacturers that invest in innovative bullet designs, propellants, and production techniques can offer superior products, appealing to both civilian and military markets. Technological innovations propel market growth by satisfying the demand for more effective and efficient small caliber ammunition.

According to the size, the 7.62mm segment has held 38.5% revenue share in 2023. The 7.62mm caliber, a standard for rifles and machine guns, represents a significant segment of the small caliber ammunition market. Its versatility makes it widely used in military and civilian applications. In the Small Caliber Ammunition Market, trends indicate a consistent demand for 7.62mm ammunition due to its role as a standard NATO caliber. In terms of market trends, the demand for 7.62mm ammunition has remained robust due to military modernization efforts and civilian firearm ownership. Recent trends indicate a shift towards enhanced ballistic performance, precision, and environmentally friendly options within the 7.62mm caliber range, reflecting the broader industry focus on innovation and sustainability.

The 5.56 mm segment is anticipated to expand at a significant CAGR of 5.8% during the projected period. The 5.56 mm ammunition, often used in military and civilian rifles, is characterized by its caliber size, representing the bullet's diameter. In the small caliber ammunition market, the 5.56 mm cartridge has shown consistent demand due to its versatility, commonly used in military and sporting applications. Recent trends indicate a focus on developing eco-friendly and lead-free variants of 5.56 mm ammunition to align with sustainability goals. Additionally, advancements in bullet design and propellants aim to enhance accuracy and reduce environmental impact, driving innovation in this caliber segment.

Based on the application, the military segment is anticipated to hold the largest market share of 49.3% in 2023. The military application in the small caliber ammunition market pertains to the supply of ammunition for armed forces. This includes infantry and special forces using small caliber ammunition for various firearms, ensuring national security and defense. Trends in this sector involve a growing demand for technologically advanced ammunition, including armor-piercing and precision rounds. Military modernization efforts drive procurement, while sustainability considerations increasingly influence procurement decisions, leading to the development of eco-friendly options. Additionally, geopolitical tensions and international conflicts continue to fuel demand for small caliber ammunition in military applications.

On the other hand, the Civilian segment is projected to grow at the fastest rate over the projected period. In the small caliber ammunition market, the civilian application refers to ammunition designed for civilian use, including self-defense, recreational shooting, and hunting. This segment is witnessing a significant trend characterized by an increased demand for self-defense ammunition, fueled by a heightened emphasis on personal safety. Moreover, the surge in popularity of sport shooting and competitive events has led to a growing need for precision-focused, high-quality ammunition. Customization is also gaining traction, with manufacturers offering specialized rounds tailored for specific civilian needs, reflecting the evolving preferences and priorities of civilian firearm owners.

In 2023, the Brass segment had the highest market share of 56.8% on the basis of the installation. In the small caliber ammunition market, brass refers to the material used in cartridge cases, offering durability, corrosion resistance, and ease of reloading. A notable trend is the increasing use of brass cartridge cases due to their reloadability, resulting in cost savings for civilian shooters. Additionally, manufacturers are developing innovative brass case designs, optimizing internal and external ballistics for improved accuracy and performance. This trend reflects the market's ongoing pursuit of ammunition that balance’s reliability, cost-effectiveness, and performance for various shooting applications.

The steel segment is anticipated to expand at the fastest rate over the projected period. Steel casings in the small caliber ammunition market refer to cartridge cases made primarily from steel. These casings offer durability, cost-efficiency, and reliability, making them a popular choice, especially for practice and training ammunition. A notable trend is the increasing use of steel casings due to their economic benefits. However, steel casings may be less suitable for certain firearm types, such as those with unsupported chambers, which can limit their applicability. Despite this, their cost-effectiveness and recyclability continue to drive their adoption in the small caliber ammunition market.

Segments Covered in the Report

By Size

By Applications

By Casing Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025