May 2024

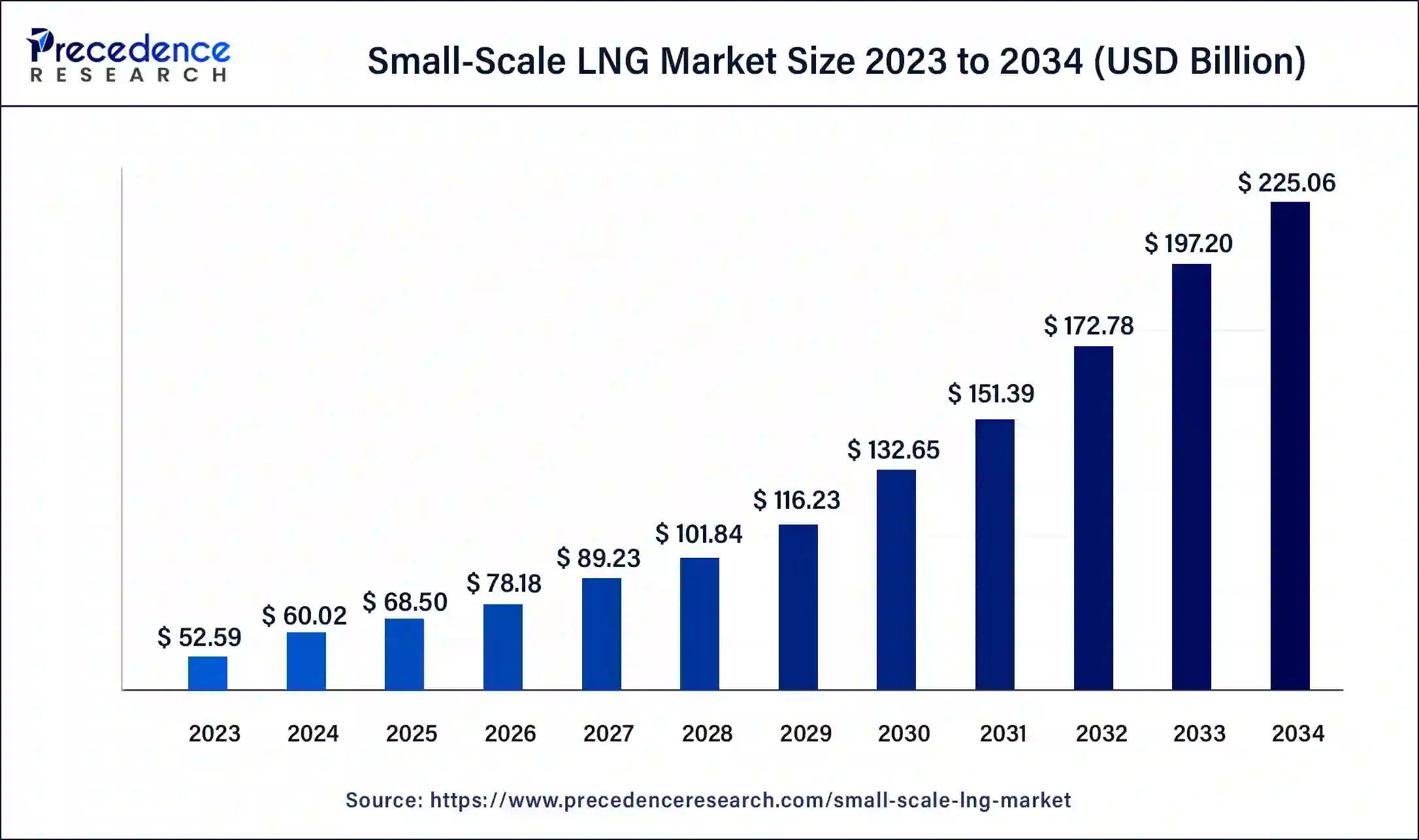

The global small-scale LNG market size was USD 52.59 billion in 2023, calculated at USD 60.02 billion in 2024 and is expected to be worth around USD 225.06 billion by 2034. The market is slated to expand at 14.13% CAGR from 2024 to 2034.

The global small-scale LNG market size is worth around USD 60.02 billion in 2024 and is anticipated to reach around USD 225.06 billion by 2034, growing at a CAGR of 14.13% over the forecast period 2024 to 2034. High expansion activities by multinational companies are expected to fuel the small-scale LNG market growth shortly.

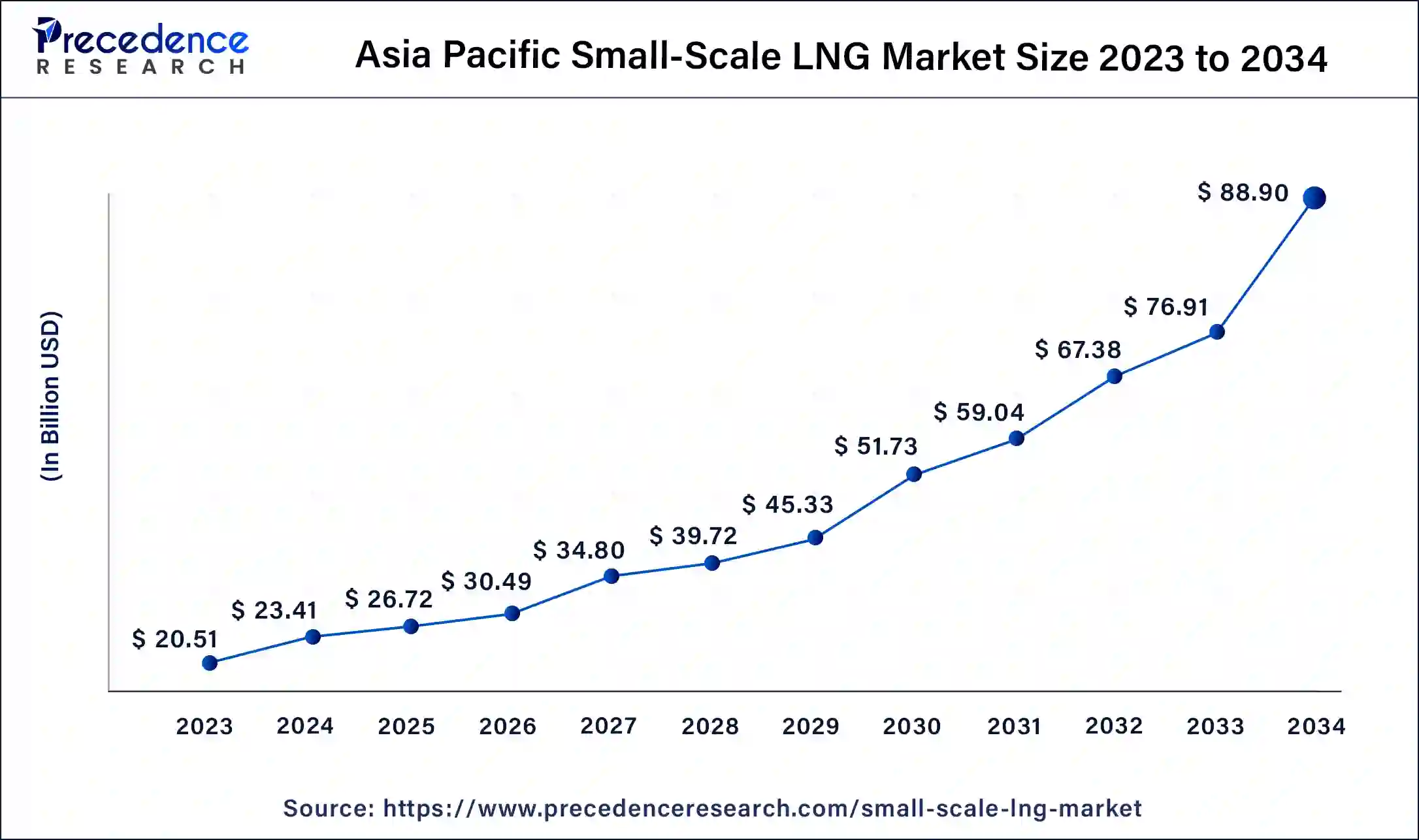

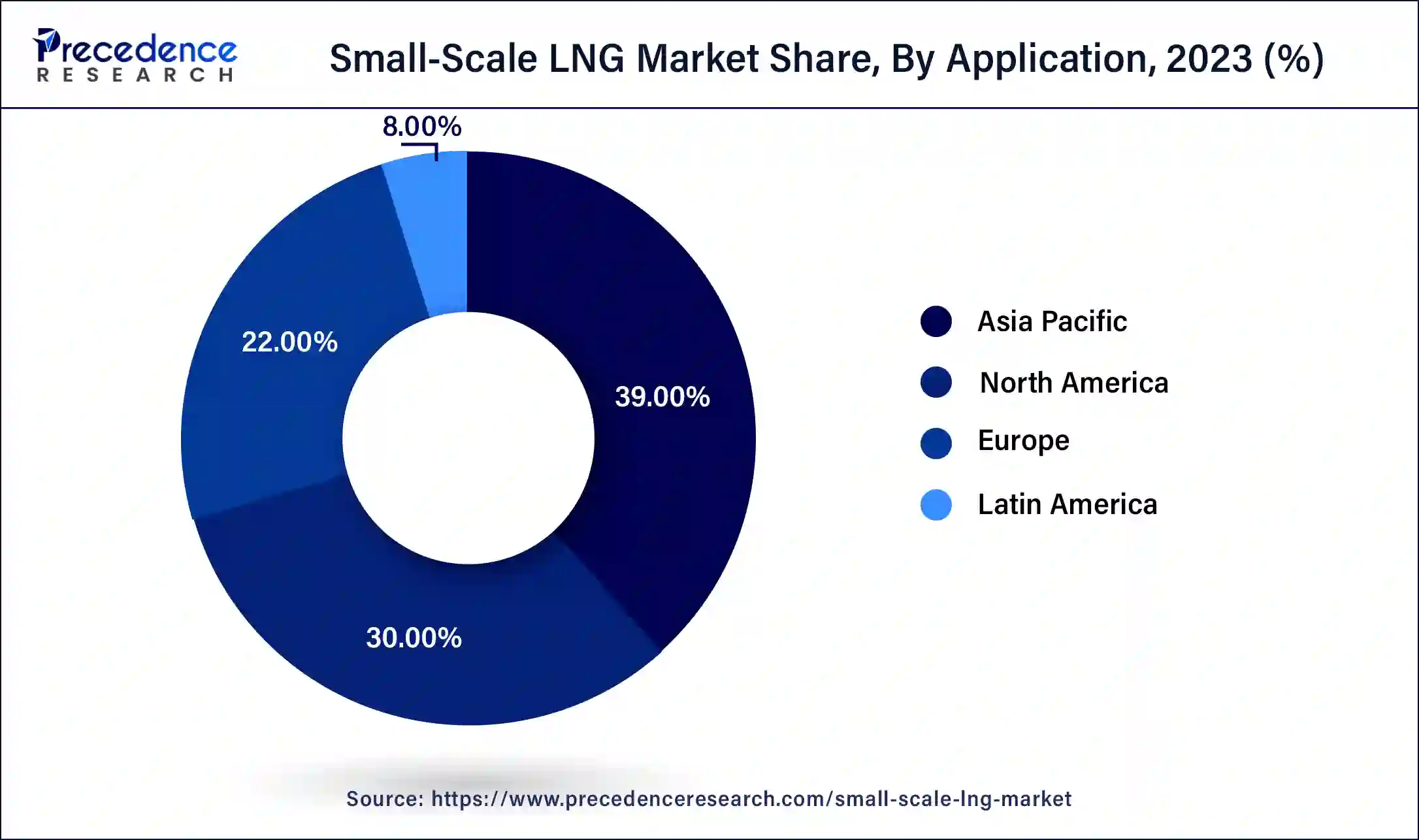

The Asia Pacific small-scale LNG market size was exhibited at USD 20.51 billion in 2023 and is projected to be worth around USD 88.90 billion by 2034, poised to grow at a CAGR of 14.26% from 2024 to 2034.

Asia Pacific dominated the small-scale LNG market in 2023. The dominance of the region can be linked to the growing utilization of LNG in power generation and production industries. Furthermore, Asia Pacific has stringent environmental regulations which are meant to reduce greenhouse gas emissions. LNG offers an opportunity for businesses to meet energy demands while disparaging environmental regulations. Furthermore, the region is also witnessing infrastructural and technological developments.

North America will show the fastest growth in the small-scale LNG market over the forecast period. The growth of the segment can be credited to the rising demand for fiber cement small-scale liquefied natural gas in the region. The high demand for LNG in the region is propelled by the abundance of shale gas deposits in nations like the United States. Moreover, there is a rise in government focus on growing renewable energy sources in the region.

Small-scale liquefied natural gas is one processed in limited industrial capacity. The gas is converted into a colorless and odorless liquid that can be re-gasified for various uses after being stabilized to very low temperatures. Small-scale LNG is more environmentally friendly than diesel and oil and is generally used to fulfill off-grid power generation needs. Increasing the utilization of LNG fuel in the marine industry can drive the small-scale LNG market growth further.

Gas is widely used in the commercial, industrial, and residential sectors as a career fuel and for heating. There is an increasing global demand for LNG-powered ships and vehicles compared to diesel - or gasoline-powered vehicles. Furthermore, LNG-powered vehicles are eco-friendly and have reduced operating expenses because they don't emit hazardous emissions.

Top Ten Natural Gas Consumption Countries

| Rank | Country | Annual gas consumption (MMcf) |

| 1 | United States | 27,243,858,000 |

| 2 | Russia | 15,538,246,850 |

| 3 | China | 6,738,151,620 |

| 4 | Iran | 6,567,636,495 |

| 5 | Japan | 4,364,157,070 |

| 6 | Canada | 4,053,420,385 |

| 7 | Saudi Arabia | 3,614,137,100 |

| 8 | Germany | 2,872,839,935 |

| 9 | Mexico | 2,756,000,000 |

| 10 | United Arab Emirates | 2,621,818,538 |

How AI is Transforming the Small-Scale LNG Market

AI, along with domain knowledge, offers a revolutionary solution in the small-scale LNG market. By using machine learning algorithms, AI optimizes the complex, non-linear connection between inputs and increased outputs of the production, lowers emissions, and also reduces variability. Furthermore, Predictive Maintenance Models can minimize downtime and stimulate maintenance schedules. AI algorithms can facilitate the smooth working of the overall production process, enabling AI to thrive in production.

| Report Coverage | Details |

| Market Size by 2034 | USD 225.06 Billion |

| Market Size in 2024 | USD 60.02 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.13% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Application, Mode of Supply, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

High demand for small-scale liquefied natural gas

Increasing demand for energy-efficient and cheap energy sources is the primary factor driving the small-scale LNG market growth along with the growing acceptance in the transportation industry. Additionally, the increasing need for liquefied natural gas has raised the demand for it, which ultimately results in growing LNG output. Various remote regions lack electricity, and government initiatives to enhance rural electrification have raised the demand for liquefied natural gas in future endeavors.

Supply chain disruptions

The disruption in supply change management due to various economic or environmental reasons is expected to hamper market growth during the forecast period. Moreover, the per KG operating cost for the small-scale LNG market is high compared to mid- and large-size liquefied natural gas.

Increased modular solutions and rising LNG bunkering facilities

The small-scale LNG market is experiencing a growth in portable LNG solutions and modular liquefaction plants. These module units provide scalability and flexibility, enabling rapid deployment and cheap expansion of LNG infrastructure in remote regions. Furthermore, the growing utilization of Small-scale LNG bunkering facilities catering to the increasing need for LNG as a marine fuel can further strengthen the market presence. These facilities also enable convenient refueling of LNG-powered vessels.

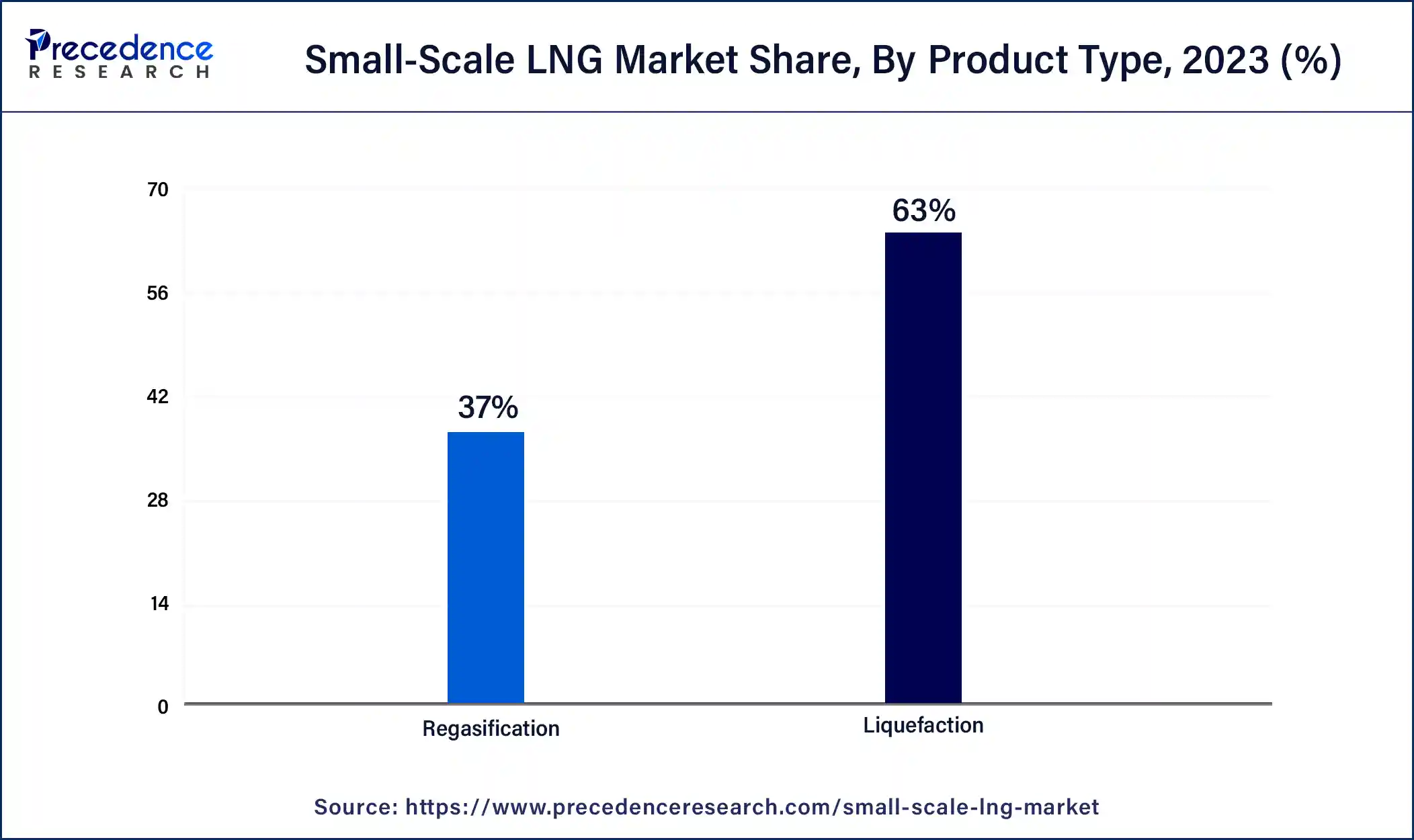

The liquefaction segment dominated the small-scale LNG market in 2023 and is expected to grow rapidly over the forecast period. The growth of the segment can be attributed to the increasing production of LNG from various places like from the deep in the gas basins. The growth of liquefaction infrastructure, along with the expanding export opportunities, drives the segmental growth. Additionally, there has been an upsurge in the establishment of liquefaction terminals across the globe to meet the growing demand for liquidation.

The heavy-duty segment led the small-scale LNG market in 2023 and is anticipated to grow further during the projected period. The dominance and growth of the segment can be attributed to the growing use of long-haul LNG-fueled trucks across the globe, along with the versatility and sustainable options offered by LNG in heavy-duty vehicles, showing its potential to fuel positive environmental impact to fulfill the demands of the transportation sector. Furthermore, the rising adoption of LNG as an alternative fuel in heavy-duty vehicles, especially in European countries and China, boosts segmental growth further.

The truck segment led the global small-scale LNG market in 2023. This is because trucks can navigate different paths and deliver LNG to challenging and remote locations that are out of reach of pipelines and other infrastructure. Moreover, the mobility and flexibility of trucks make them sophisticated tools for transporting LNG to various locations. Developments in tracking technologies like enhanced LNG storage and fueling systems have made it more effective to transport and distribute LNG via trucks.

Segments Covered in the Report

By Product Type

By Application

By Mode of Supply

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024