July 2025

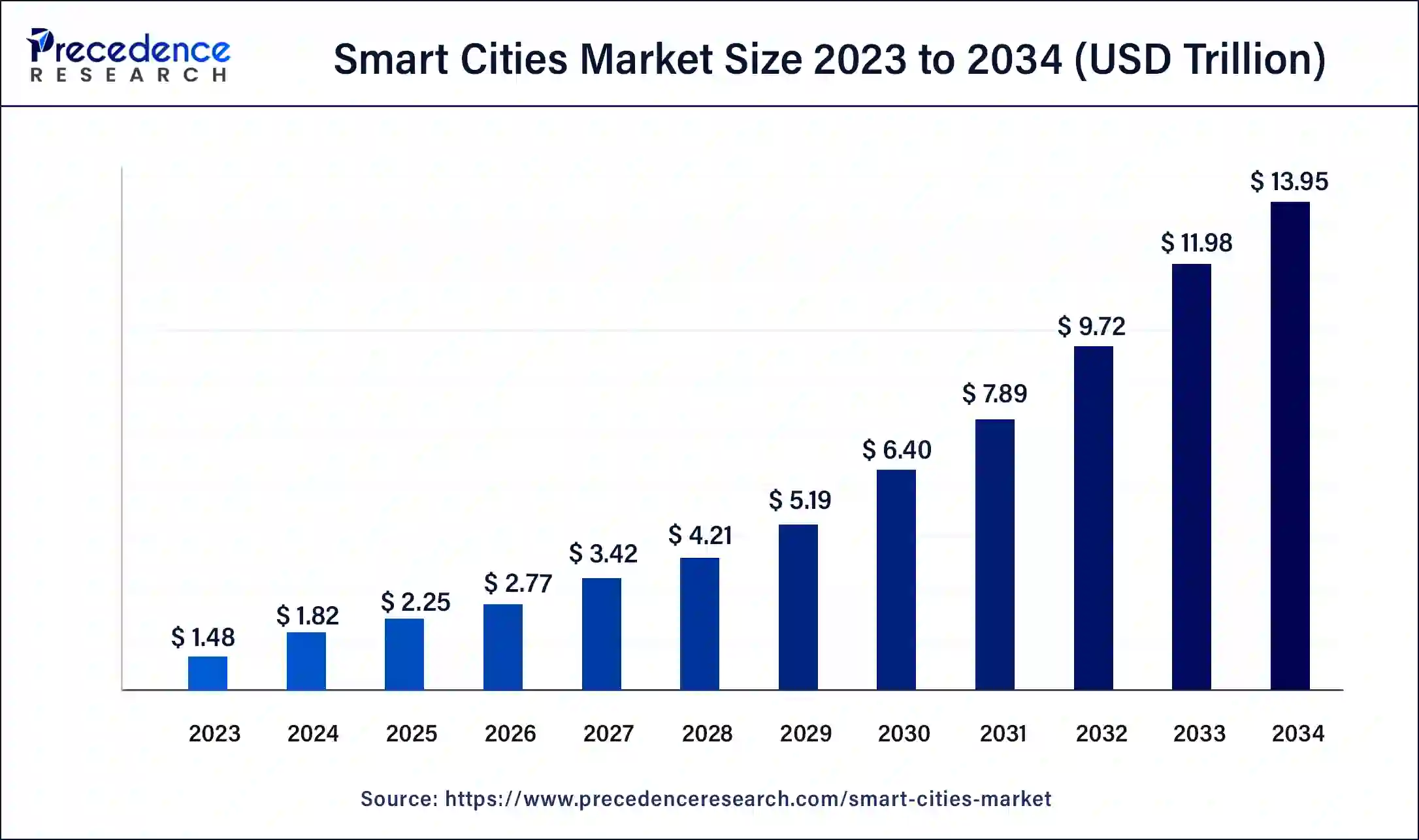

The global smart cities market size accounted for USD 1.82 billion in 2024 and is predicted to increase from USD 2.25 billion in 2025 to approximately USD 13.95 billion by 2034, growing at a CAGR of 22.59% from 2025 to 2034

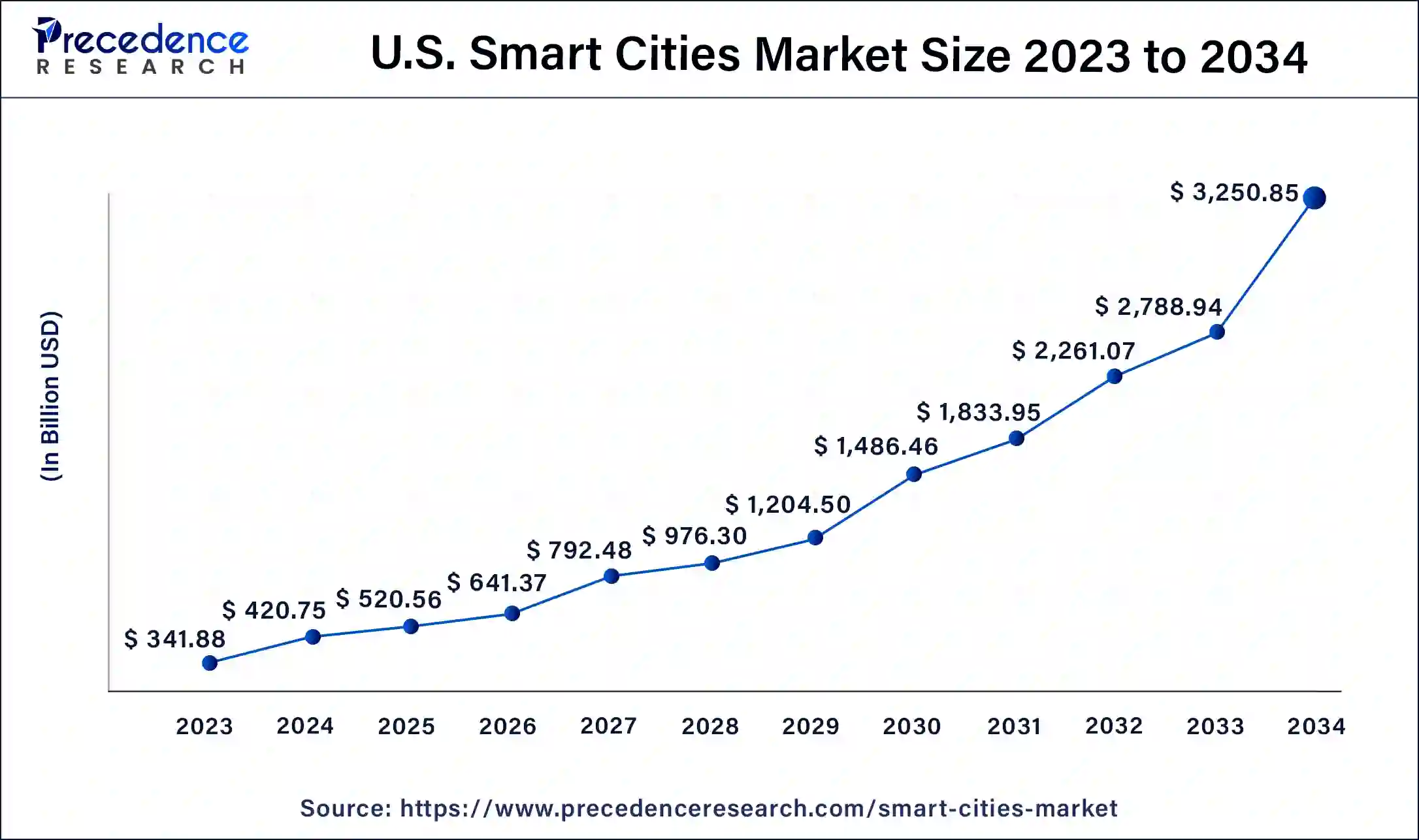

The U.S. smart cities market size reached USD 341.88 billion in 2023 and is anticipated to be worth around USD 3,250.85 billion by 2034, poised to grow at a CAGR of 23% from 2025 to 2034

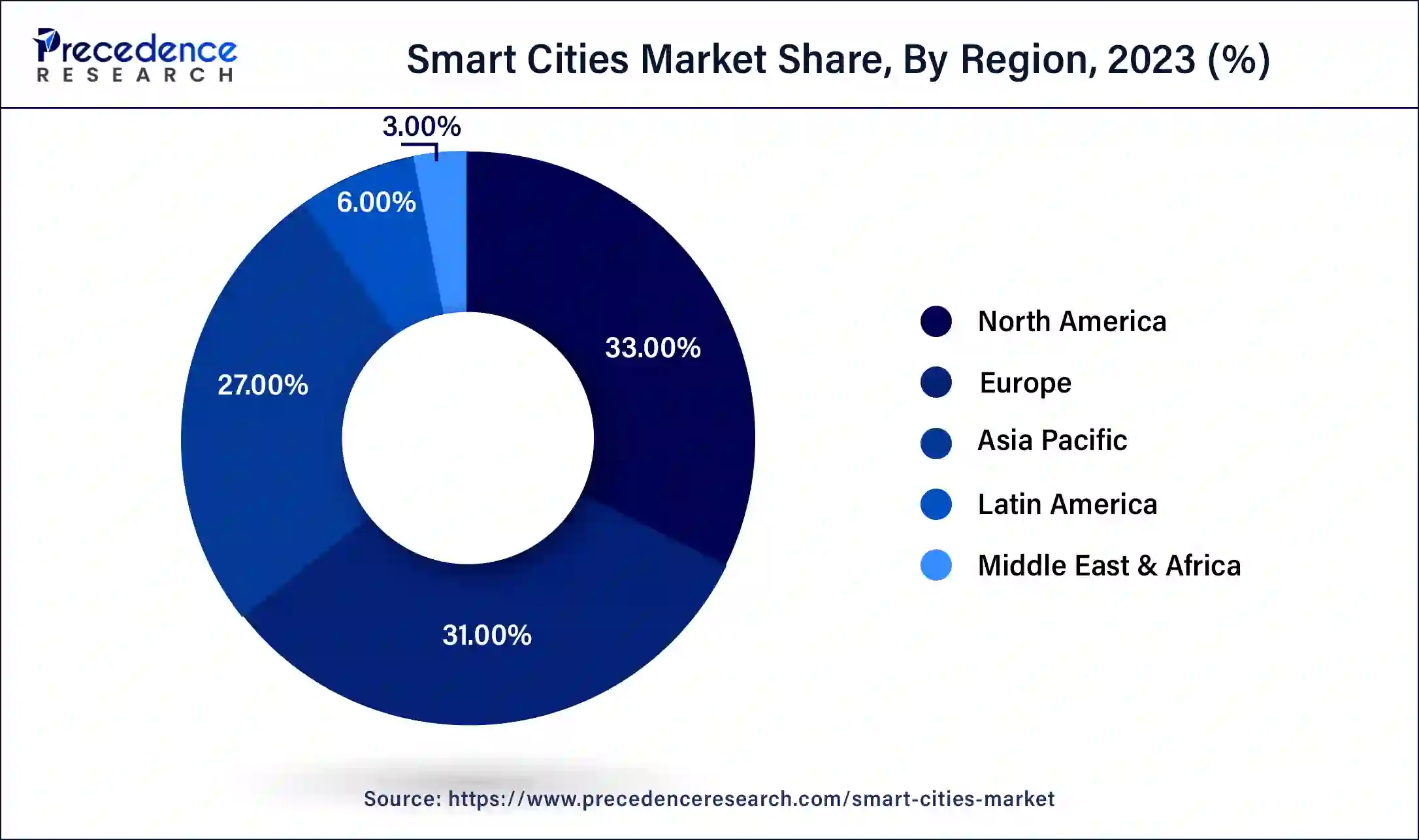

North America dominated the global smart cities market, accounting for around 33% of the market share in 2023. The rising technological advancements and digital transformations across various industry verticals such as telecommunications, IT, retail, and banking has led to the growth of the North America smart cities market. North America has well-established information and communication technology (ICT) infrastructure and the strong collaboration of the local and the Federal governments with the various startups and vendors in the ICT industry has significantly contributed to the growth of the North America smart cities market in the past few years. The rising deployment of the civic connectivity infrastructure will lead to the growth of the smart cities market growth. The US Department of Transportation and the Smart Cities Council together promote the smart cities concept in the North American region by organizing various networking events in the region.

Asia Pacific is expected to witness the highest CAGR of over 27.9% from 2025 to 2034. The increased focus of the government towards the digital infrastructure and digital transformation is spurring the growth of the smart cities market in Asia Pacific. Rapid urbanization, growing population, strong economic growth, and rise in globalization are the major factors that are expected to drive the growth of the Asia Pacific smart cities market during the forecast period. The rising government investments to spruce up various industries such as public security, transportation, and energy are anticipated to be the major growth drivers in the foreseeable future.

The rising urbanization, growing need for infrastructure management, and assets management are the various factors that are boosting the government investments towards the development of smart cities. As per the Consumer Technology Association, the global spending on the development of smart city is estimated to be US$34.35 billion in 2020. The advancements in the technology has fueled the adoption of the internet of things technology in the smart cities to manage traffic flows, monitoring city infrastructure, and monitor air and water quality. The rising need for ensuring public safety, efficient utilization of resources, rising demand for efficient energy consumption, and healthy environment are expected to boost the growth of the smart cities market during the forecast period. According to the United Nations Department of Economic and Social Affairs, the urban population in 2019 was 55.7%, which is projected to reach to 68.4% by 2050.

The rapidly increasing global population and rapid growth in the urban population is driving the demand for the sustainable infrastructure across the globe. The governments across various countries are taking steps and investing heavily to counter the concerns related to rising population rapid urbanization through the development of smart cities. Utility management, safety, and mobility are the major aspects that are efficiently handled in the smart cities. The surging adoption of the novel technologies like artificial intelligence, nanotechnology, big data analytics, cloud computing, internet of things, cognitive computing, and open data are the major drivers of the growth of the smart cities market across the globe.

The growing implementation of various public-private partnership models such as Build, operate, transfer (BOT), Build, own, operate (BOO), Organizational Behavior Management (OBM), and Bill of Materials (BOM) are significantly driving the implementation of the various smart city projects across the globe.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 22.59% |

| Market Size in 2025 | USD 2.25 Trillion |

| Market Size in 2024 | USD 1.48 Trillion |

| Market Size by 2034 | USD 13.95 Trillion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Smart Utilities, By Smart Governance, By Application, By Components, and By Technologies and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the smart utilities, the energy management segment accounted for a market share of around 57% and dominated the global smart cities market in 2023. With rising urbanization and industrialization, the demand for the energy has spurred significantly, which has fostered the adoption of the virtual power plants that uses artificial intelligence, internet of things, and machine learning technologies to ensure safety and higher efficiency. The rising investments by the market players in the research and development to boost the introduction and development of technologically advanced energy management systems and integrate technologies like Blockchain have favored the growth of this segment.

The water management segment is anticipated to be the fastest-growing segment during the forecast period. The rising scarcity of drinking water and growing initiatives to promote sustainable living has resulted in the implementation of laws and regulations to implement water management systems across the globe. Rising technological advancements has led to the adoption of IoT-based water management systems like Advanced Metering Infrastructure smart water meters, which facilitates smart water utilization and distribution in the cities.

The city surveillance was the dominating segment that accounted for 22% of the revenue in 2023 in the global smart cities market. The city surveillance plays a crucial role in the management and monitoring public assets, civil services, transportation systems, and community services in the smart cities. The increased concerns related to the public safety has led to the adoption of video management solutions IP cameras across the smart cities, which is boosting the growth of the city surveillance segment exponentially. Declining prices of IP cameras and rising advancements in the analytics and software technology are the major drivers of the city surveillance segment.

The command and control center (CCC) is anticipated to be the most opportunistic segment during the forecast period as it is expected to witness the highest CAGR of 21.5% from 2024 to 2033. Almost every smart city systems and applications such as smart lighting, city surveillance, waste management, energy management, intelligent traffic management systems, and water management system are accessed and controlled from the CCC. The CCC is considered to the brain of any smart city.

The smart lighting segment is predicted to reach at a CAGR of 25.9% during the forecast period.

Based on the application, the smart transportation segment garnered a revenue share of 21% and led the global smart cities market in 2023. The rapid urbanization and increasing economic activities has led to the increased traffic congestion. This factor is stimulating the various governments across the globe to adopt smart transportation solutions to manage assets and infrastructure. The growing adoption of the artificial intelligence and internet of things in the transportation field has led to the growth of the smart transportation segment across the globe. Further, the rising demand for the electric vehicles and on-demand ridesharing is significantly boosting the demand for the smart transportation solutions across the globe.

On the other hand, the smart governance segment is anticipated to be the fastest-growing segment during the forecast period. The rising adoption of the smart technologies by the government to improve and promote transparency, security, accountability, and collaboration is booting the growth of this segment. With the support of the distributors and OEMs, the various governments are deploying video surveillance solutions to ensure public safety and eliminate criminal activities, which are expected to improve smart governance.

Segments Covered in the Report

By Smart Utilities

By Smart Governance

By Application

By Component

By Smart Transportation

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2025

April 2025

August 2025

July 2025