January 2025

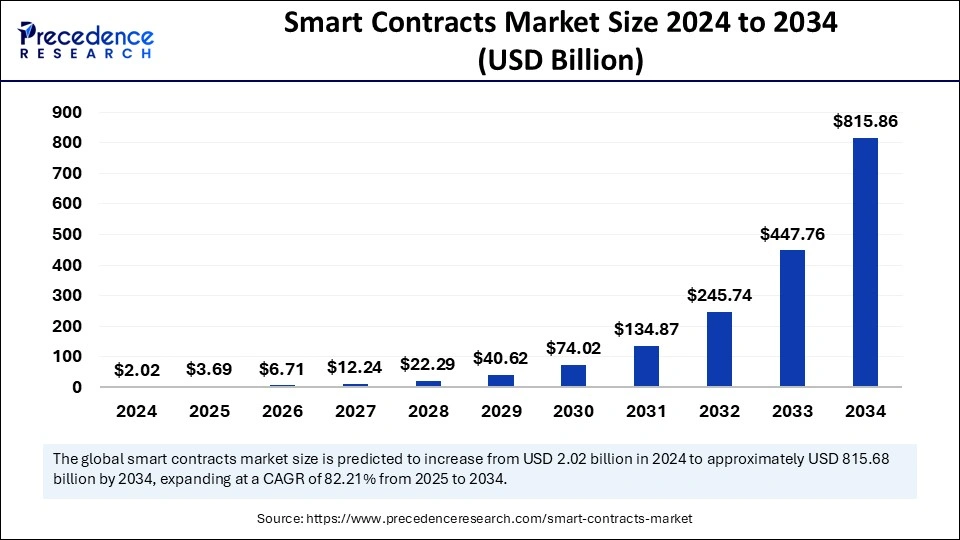

The global smart contracts market size is calculated at USD 3.69 billion in 2025 and is forecasted to reach around USD 815.86 billion by 2034, accelerating at a CAGR of 82.21% from 2025 to 2034. The North America market size surpassed USD 0.69 billion in 2024 and is expanding at a CAGR of 82.41% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global smart contracts market size accounted for USD 2.02 billion in 2024 and is predicted to increase from USD 3.69 billion in 2025 to approximately USD 815.86 billion by 2034, expanding at a CAGR of 82.21% from 2025 to 2034. Digital transactions undergo revolutionary change through the market since they provide secure automated agreements across various business sectors.

Smart contracts operate more effectively when they incorporate artificial intelligence because they gain advanced capabilities in data processing, predictive modeling, and automated environmental adaptation. The combination of artificial intelligence with these contracts allows data trend analysis, which initializes automated complex decision frameworks. By using artificial intelligence algorithms, the optimization of contractual terms becomes possible while predicting results, fraud detection, and self-modification.

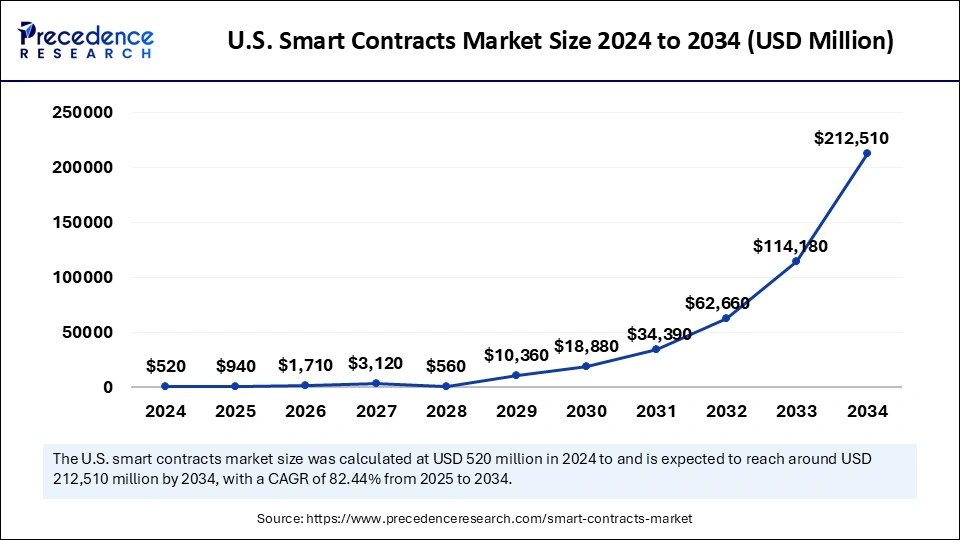

The U.S. smart contracts market size was exhibited at USD 520 million in 2024 and is projected to be worth around USD 212.510 million by 2034, growing at a CAGR of 82.44% from 2025 to 2034.

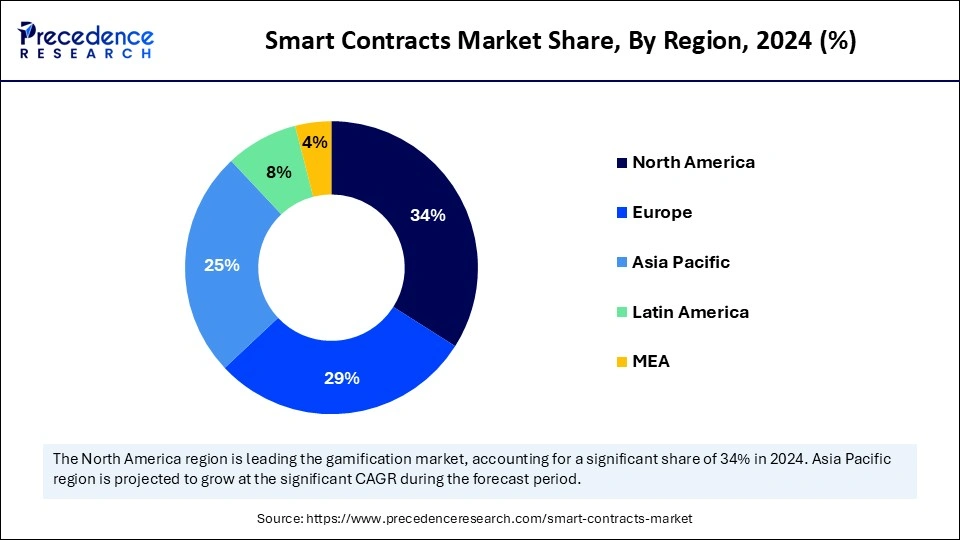

North America held the dominating share of the smart contracts market in 2024. The region benefits from its superior technological base with its advanced innovation network. Many established technology firms and leading blockchain startups have deployed their operations using smart contract solutions within this region. The adoption of blockchain technologies within early adoption periods, supportive government initiatives, and beneficial regulatory environments have propelled market expansion. The combination of advanced workforce capabilities and mature IT infrastructure allows North American organizations to test and deploy smart contracts within the finance, insurance, healthcare, and supply chain management sectors.

Asia Pacific is estimated to expand the fastest CAGR in the market between 2025 and 2034. Digital transformation, technological improvements, and government support drive this market forward. All governments across China, Japan, South Korea, and Singapore demonstrate strong support for blockchain adoption because these countries maintain their position as global leaders in blockchain innovation. The region has adopted blockchain technology at an advanced level for cross-border trade, logistics, and supply chain management because smart contracts make operations more transparent and efficient while ensuring greater visibility throughout the process.

Europe is experiencing gradual growth in the global market. The country advances through regulatory backing that supports digital innovation. The proactivity of the European Union towards adopting and regulating emerging technologies, with blockchain among them, creates favorable conditions for smart contract development. Smart contract solutions with blockchain technology receive substantial investment backing from Germany, France, and the Netherlands, which lead this European trend through their pilot implementation programs.

The smart contracts market represents digital solutions created from blockchain technology, which enables secure automated execution of agreements through transparent systems. Smart contracts enable organizations, governments, corporations, and individuals to transfer money, property stocks, or other assets reliably without fraudulent activities. The combination of decentralized networks gives smart contracts the ability to provide safe and quick alternatives to conventional contract platforms.

The adoption of smart contracts will surge because organizations actively seek automated and transparent solutions for their operations. The adoption of blockchain within banking sectors, insurance, and government institutions, with additional applications in real estate and supply chain management, serves as the main driver for technology growth. High demand from enterprises and increased public digital transformation drive smart contracts toward their role as basic enablers for upcoming digital transformations.

| Report Coverage | Details |

| Market Size by 2034 | USD 815.86 Billion |

| Market Size by 2025 | USD 3.69 Billion |

| Market Size by 2024 | USD 2.02 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 82.21% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Platform, Blockchain Type, Contract Type, enterprise size, End- use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rise in Adoption of Blockchain Technology

Smart contracts require the increasing availability of blockchain systems to achieve their development. The automated functionality of blockchain technology originates from self-executing computer programs that create efficient, tamper-proof, and transparent agreement execution methods. The integration of blockchain-smart contracts within business operations delivers secure deals at reasonable prices, which makes them highly desirable for transaction management purposes. It brings operational benefits that eliminate middlemen and establish digital trust within transactions.

Lack of Scalability and Standardization

The smart contracts market meets main challenges in its development phase, including scalability issues and standardization problems. The speed of blockchain network transactions gets slower, and costs increase substantially as platform networks continue to grow. The limitations that influence smart contracts prevent them from effectively running large-scale solutions in financial systems, supply chains, and healthcare applications. The security weaknesses of smart contracts include coding flaws, hacking attempts, and exploitation, which result in financial damages and a deterioration in customer trust levels. The lack of standards that are widely adopted standards and best practices for the development of the market is expected to hinder interoperability and increase the risk of inconsistent implementations in the future.

Increase in Adoption of Various Applications in Industries

The smart contracts market demonstrates significant growth potential because industries including supply chain operations, banking, government departments, insurance companies, and real estate sectors turn to smart contracts. Businesses use smart contracts to enhance operational efficiency as well as automate procedures and secure operations. The combination of IoT and blockchain for risk management strengthens the industrial capacity to discover risks, implement proper measurements, and mitigate risk. Growth in smart contract solutions investments turns several standard time-consuming operations into efficient automatic systems.

The Ethereum segment donated the largest smart contracts market share in 2024. The global developer and organizational community values Ethereum because it represents one of the original blockchain platforms that offers developers a flexible and robust infrastructure for smart contract development. Ethereum's reputation maintains strength through its essential business relations and its proven performance track record, enabling organizations to select it for financial solutions and gaming, as well as real estate and supply chain operations. The platform gained dominance in the market through its advanced state and industry-wide connectivity with various sectors.

The Polkadot segment is anticipated to show considerable growth over the forecast period. Polkadot offers a network framework that allows different blockchain systems to interact without interruptions for data exchange among networks. Developers benefit from Polkadot because it allows the execution of smart contracts through various programming languages. The processing power of Polkadot for supporting decentralized complex systems and high-throughput applications makes it attractive to rapidly growing businesses.

The public dominated the global market in 2024 and is expected to be dominant throughout the projected period. The public blockchain structure will keep its leading position within the blockchain system through the entire projection period because it hospitalities all participants to validate transactions. The combination of regulatory framework developments with maturing public blockchain solutions will boost their market expansion role and their leadership position as they define future blockchain applications.

The private segment is expected to show substantial growth in the market. Private blockchain systems enable authorized membership access to their secure environment, thus providing better administration, enhanced confidentiality, and faster operational performance. The power of private blockchains helps businesses maintain secure network communications and handle supply chain activities while handling confidential financial operations. The speed of digital transformation across the healthcare, finance, and logistics industries will cause an increase in the market demand for private blockchain-powered smart contracts.

The decentralized autonomous organizations segment donated the leading smart contracts market share in 2024. Code-based governance through DAOs provides both transparent operations and efficient work without any need for command centralization. The model decreases administrative expenses by using blockchain-based verification and community-based management, which creates better stakeholder trust. The broader adoption of smart contracts will rely heavily on DAOs because more companies and communities choose to build their organizational structure based on blockchain technology.

The application logic contracts segment is anticipated to show considerable growth in the forecast period. Secure and autonomous communication networks between IoT devices and blockchain systems find significant value in these components. Companies can utilize application logic contracts to integrate with ERP systems for automated supply chain operation management combined with inventory control and financial procedure automation. The growing need for digital operation optimization has created a rising industry demand for application logic contracts, which stimulates blockchain-enabled application development.

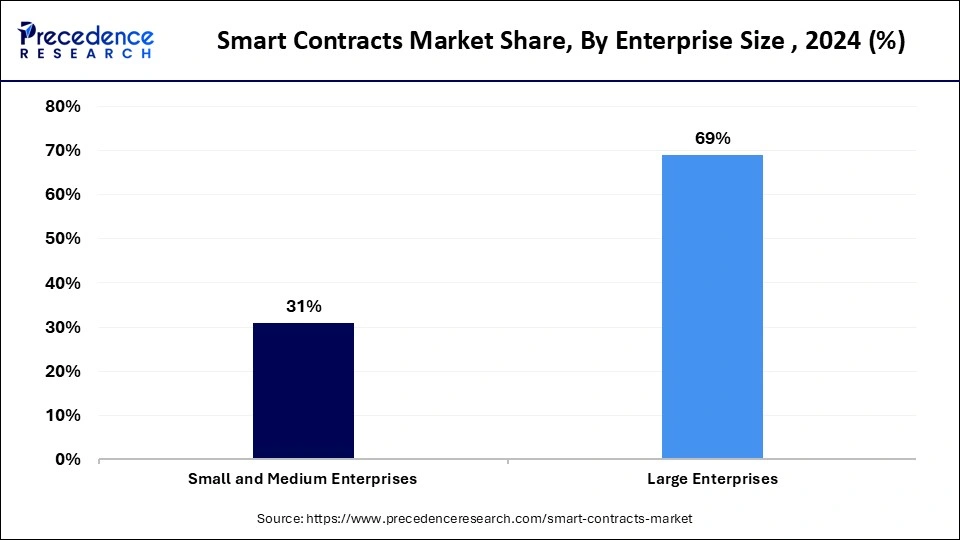

The large enterprise contributed the most smart contracts market share in 2024 and is expected to be dominant throughout the projected period. The organizations oversee intricate large-scale operations that operate in financial services, healthcare, and manufacturing, as well as logistics sectors, which require precise compliance and efficiency levels. Large businesses utilizing their superior financial capabilities and technological resources tend to adopt blockchain-based solutions ahead of other market participants.

The small and medium enterprises segment is expected to show substantial growth in the market. Their small budgets and limited workforce allow them to streamline functions, including invoicing, compliance checking, contract implementation, and payment handling. Smart contracts generate significant time and cost efficiencies that play an essential role in the sustainable growth and larger-scale operations of SMEs. SMEs have become a vital market driver through their rising adoption, which specifically enhances future market growth initiatives across developing economies and technology-based industries.

The BFSI segment donated the leading smart contracts market share in 2024. The BFSI sector implemented blockchain technology because it requires enhanced automation as well as more transparency and security for financial transactions. Through smart contracts, the BFSI industry experienced a transformation by establishing peer-to-peer transactions with automatic loan approvals as well as automated claims processing and simplified Know Your Customer (KYC) procedures. Smart contracts provide full audit capabilities alongside transparency because of their design structure, which leads to instant real-time performance reports as well as unalterable records that help financial institutions operate more trustfully while maintaining compliance standards and reducing expenses.

The retail segment is anticipated to show considerable growth over the forecast period. The retail industry uses smart contracts to develop automatic purchasing processes, inventory tracking systems, and supply chain management solutions. Retailers achieve time-saving and cost reduction through process automation of payment settlements, supplier agreements, and restocking activities. Smart contracts will play a progressively bigger role in retail operations as businesses accept digital solutions to stay competitive while customer demands evolve throughout the subsequent years.

By platform

By blockchain type

By contract type

By enterprise size

By end-use

By region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

October 2024

April 2024