May 2024

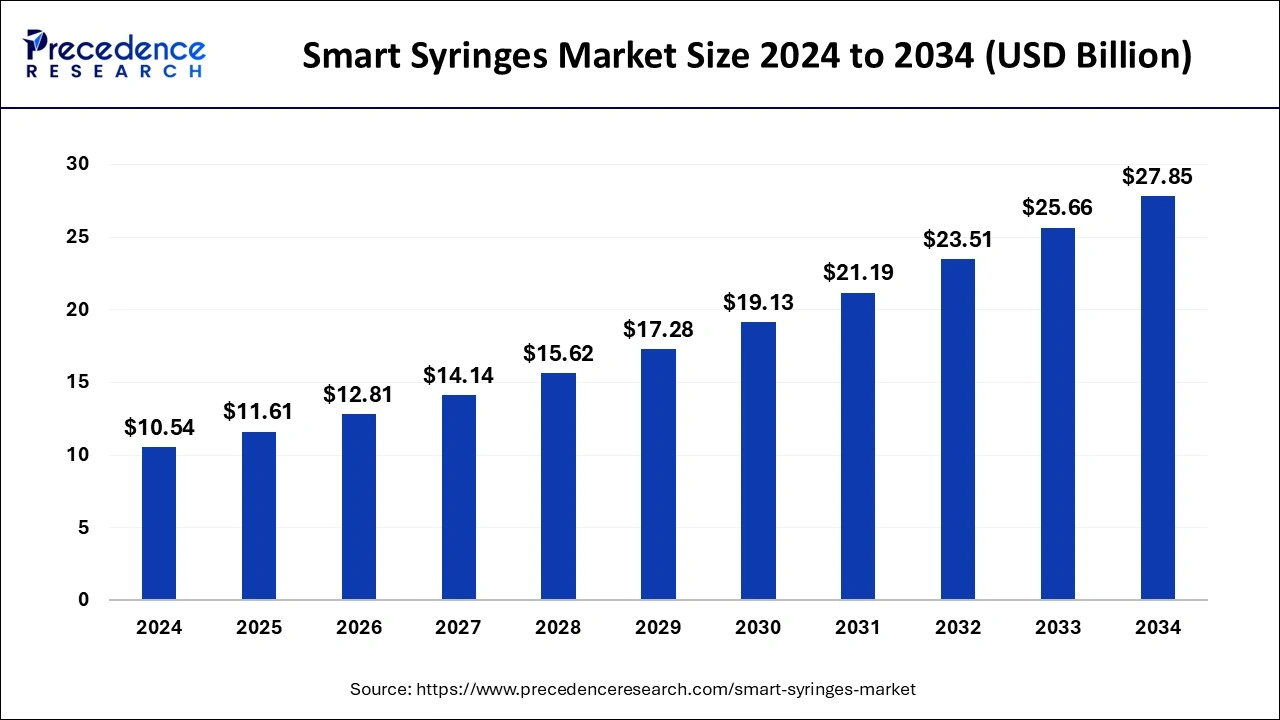

The global smart syringes market size is calculated at USD 11.61 billion in 2025 and is forecasted to reach around USD 27.85 billion by 2034, accelerating at a CAGR of 10.20% from 2025 to 2034. The North America smart syringes market size surpassed USD 4.11 billion in 2024 and is expanding at a CAGR of 10.25% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global smart syringes market size was estimated at USD 10.54 billion in 2024 and is anticipated to reach around USD 27.85 billion by 2034, expanding at a CAGR of 10.20% from 2025 to 2034. With the growing geriatric population, to protect clinics or hospitals from infection, and increase awareness regarding vaccination.

AI plays a huge role in the smart syringes market as it helps in continuous evolution by improving its functionality, streamlining the delivery of healthcare products, and enhancing the safety of the product. It ensures the needle insertion process accuracy by pointing to the correct placement as it can optimize the depth, timing, and angle of insertion. It enhances the market demand by precise release of the dose of the medicine.

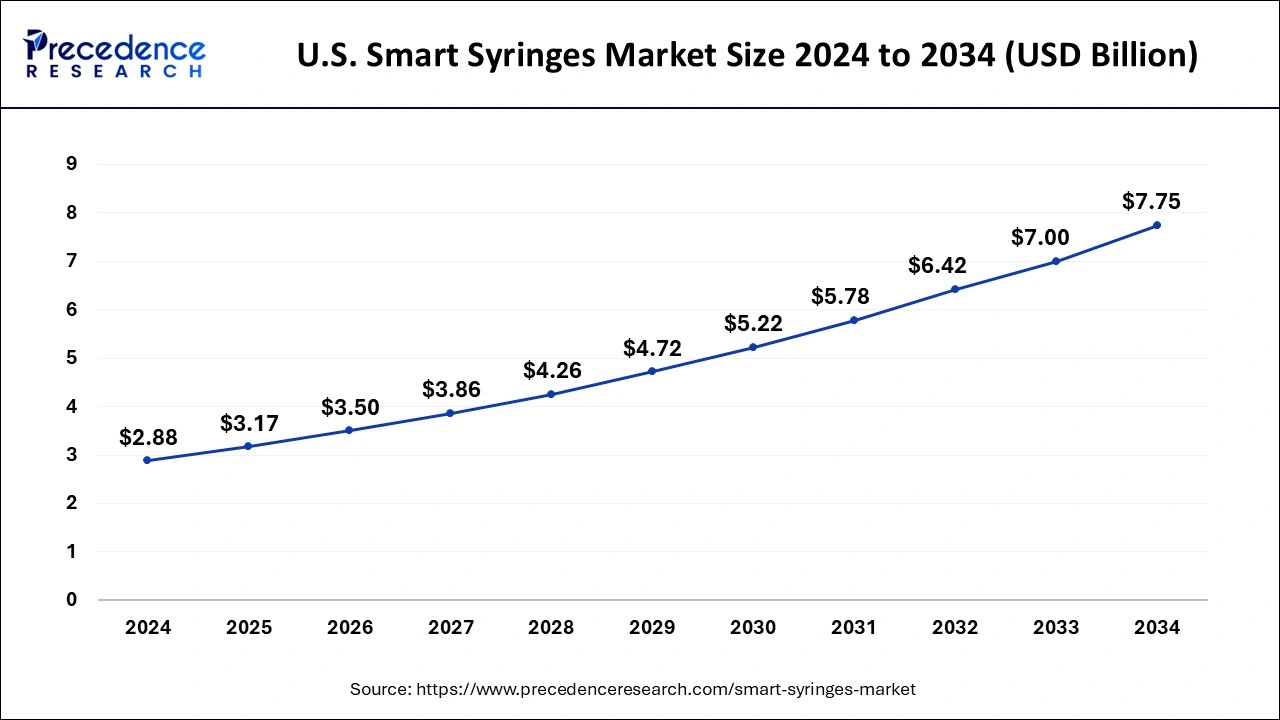

The U.S. smart syringes market size was evaluated at USD 2.88 billion in 2024 and is predicted to be worth around USD 7.76 billion by 2034, rising at a CAGR of 10.27% from 2025 to 2034.

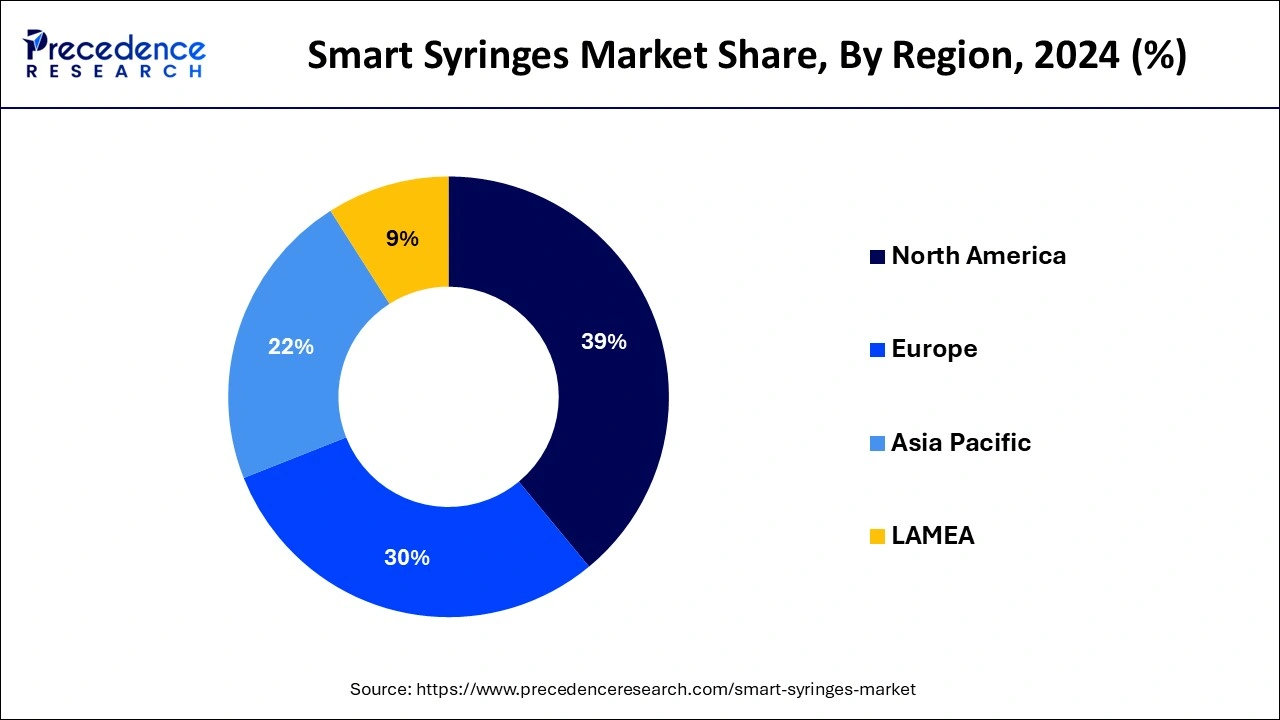

North America was the leading smart syringes market in 2024. The region is characterized by the increased demand for the advanced technologies in the healthcare sector. Moreover, the increased awareness regarding the blood-borne diseases owing to the unsafe injecting practices is a major factor that spurred the demand for the smart syringes in North America. North America accounted for over 39% of the market share in 2024. Moreover, the increased prevalence of chronic diseases and presence of considerable number of geriatric people in the region coupled with the increased healthcare expenditure is further fueling the demand for the smart syringes across North America.

Asia Pacific is estimated to be the most opportunistic market during the forecast period. The rising government and corporate expenditure in the development of smart healthcare infrastructure along with the rising focus in providing enhanced patient care is boosting the growth of the Asia Pacific smart syringes market. Moreover, the rising disposable income of the consumers, growing healthcare expenditure, and rising awareness regarding the needle stick injuries is expected to augment the growth of the smart syringes market in the forthcoming years.

| Report Coverage | Details |

| Market Size In 2024 | USD 10.54 Billion |

| Market Size In 2025 | USD 11.61 Billion |

| Market Size In 2034 | USD 27.85 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 10.20% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Applicaion, End User |

| Regions Covered |

North America, Asia Pacific, Europe |

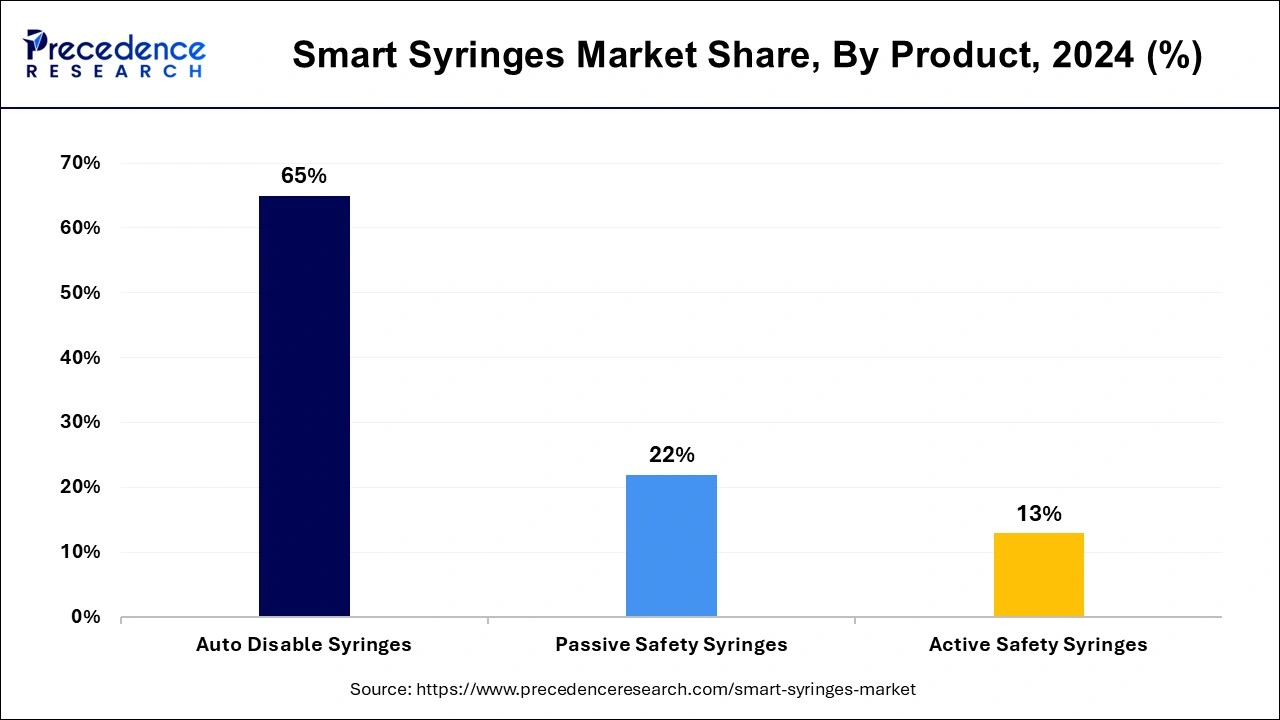

The auto disable syringes segment accounted for the highest market share of 65% in 2024. The auto disable syringes are the most preferred type of smart syringes across the hospitals and the health maintenance organizations as they are single-use syringes and cannot be utilized for re-use. The extensive usage of the auto disable syringes in the routine administration of drugs to the patients. Hence, this segment is dominant. The safety mechanism of these syringes prevents the transmission of blood-borne diseases and hence the most important need of the smart syringes is served.

On the other hand, the passive safety syringes is estimated to be the most opportunistic segment during the forecast period. The increased safety, auto-activation of the safety features, and the convenience associated with use of the passive safety syringes is expected to drive the growth of this segment. The rising awareness regarding the benefits of the passive safety syringes among the diabetic population further estimated to spur its demand across the globe.

The drug delivery was the dominant segment in 2024. The increased adoption of the smart syringes as a drug delivery device across the hospitals and clinics has augmented the demand for the smart syringes. The rising prevalence of various chronic diseases is boosting the use of the smart syringes as it serves a good mode of drug delivery and also the absorption of drugs through the injections is high, which boosts the growth of this segment.

The vaccination segment is expected to be the fastest-growing market during the forecast period. The rising burden of various infectious diseases across the globe and the constant research and developmental activities by the vaccine producing organizations is expected to fuel the growth of this segment in the forthcoming years.

The hospitals segment dominated the global smart syringes market in 2024. This is attributed to the increased adoption of the smart syringes in the hospitals. The rising incidences of the needle stick injuries and growing transmission of the blood borne disease is boosting the need for the safe injection practices across the hospitals.

The diabetic patients is estimated to be the fastest-growing segment during the forecast period. The diabetic patients are increasing at an alarming rate. The diabetic patients regularly needs to take insulin in order to control and manage the blood glucose levels. Hence, the demand for the smart syringes among the diabetic patients is significantly growing.

By Product

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

May 2025

September 2024

December 2024