August 2024

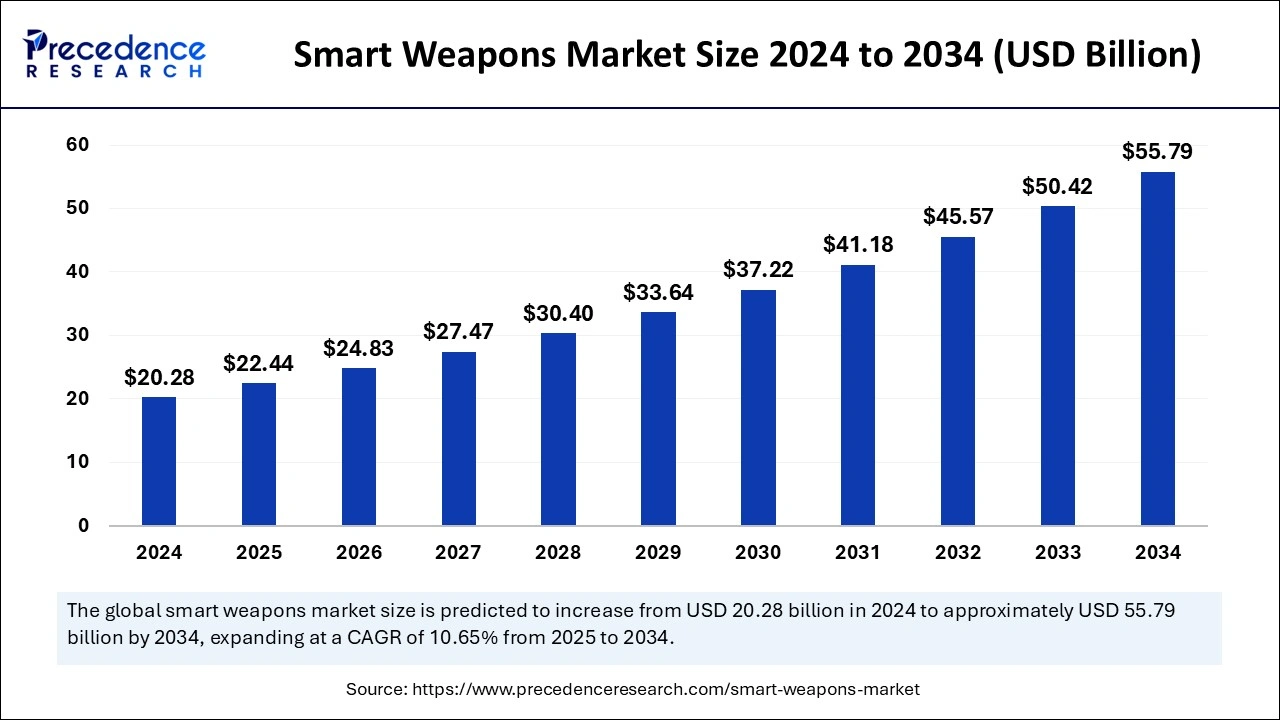

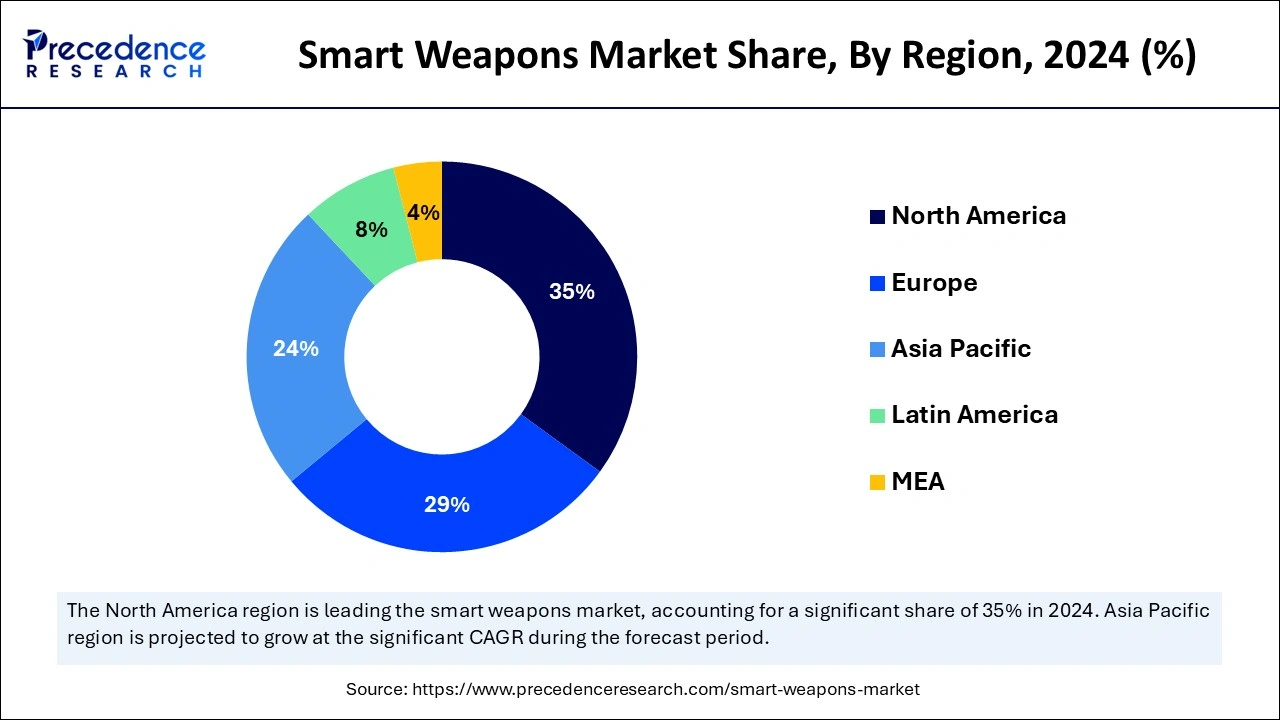

The global smart weapons market size is accounted at USD 22.44 billion in 2025 and is forecasted to hit around USD 55.79 billion by 2034, representing a CAGR of 10.65% from 2025 to 2034. The North America market size was estimated at USD 7.10 billion in 2024 and is expanding at a CAGR of 10.80% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global smart weapons market size was estimated at USD 20.28 billion in 2024 and is predicted to increase from USD 22.44 billion in 2025 to approximately USD 55.79 billion by 2034, expanding at a CAGR of 10.65% from 2025 to 2034.

The rapid technological advancements in Artificial Intelligence and autonomous systems have led to the development of highly automated smart weapons. The modernization of weapons depends on technology, which allows immediate decisions and adjusts to environmental changes, achieving missions without human assistance. The Smart Weapons market develops through several drivers, which include AI-assisted targeting technology and machine learning-based decisions alongside autonomous weapon system development, non-lethal crowd control system creation for urban environments, heightened cybersecurity measures, hacking protection needs, and efforts to decrease smart weapon dimensions for better deployment ability.

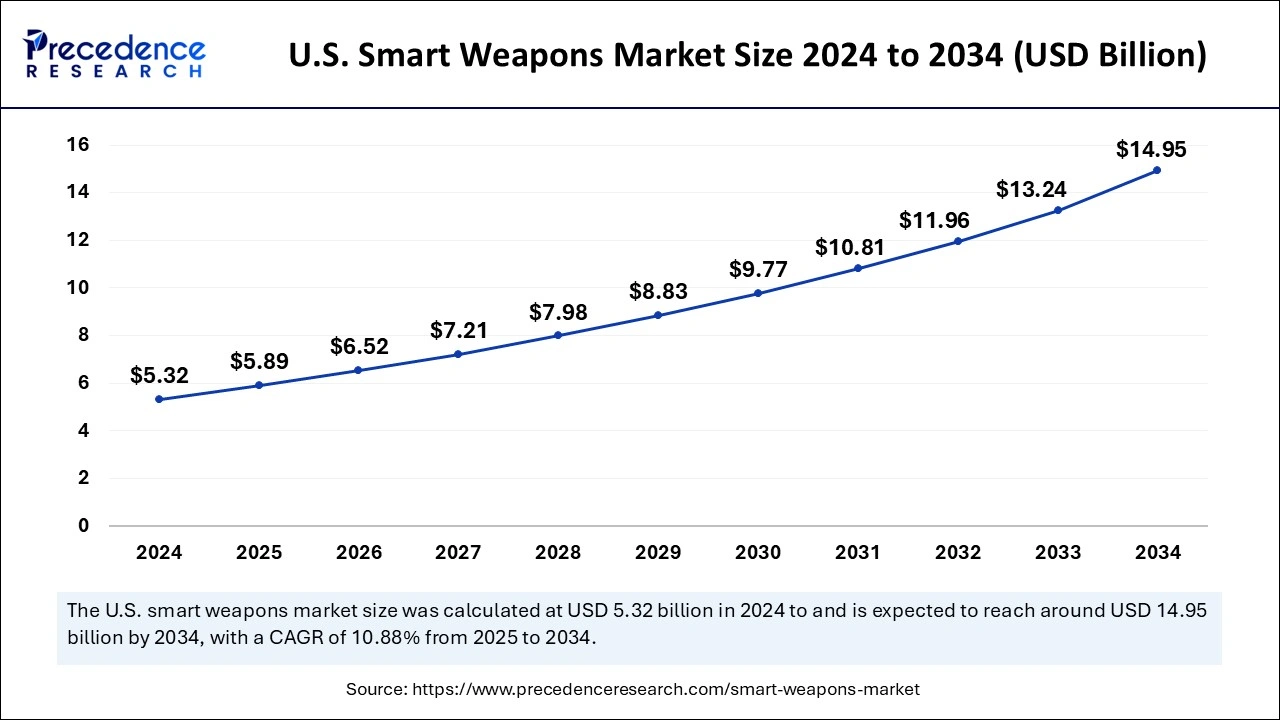

The U.S. smart weapons market size was exhibited at USD 5.32 billion in 2024 and is projected to be worth around USD 14.95 billion by 2034, growing at a CAGR of 10.88% from 2025 to 2034.

North America accounted for the largest share of the smart weapons market in 2024. Growth in this region occurs due to high defense expenses and rising modernization investments for military purposes. The U.S. military dedicates efforts to merging precision-guided munitions and smart targeting systems through its work on Joint Direct Attack Munition (JDAM) programs. The military demonstrates its modernization direction through its network-enabled weapon acquisitions. Market expansion in the region receives additional support from two areas: public investments in counter-UAS defense solutions and strategic business partnerships with defense industries.

Asia Pacific is anticipated to witness the fastest growth in the smart weapons market during the forecasted years. The defense sector drives this market expansion through escalating investments from India, China, South Korea, and Japan. Cross-border conflicts combined with political unrest and rising terrorism levels create demand for advanced smart weapons. The region’s defense organizations concentrate on the development of security threat solutions. This market growth occurs because producers make more smart weapons and develop partnerships with defense companies.

The investments in artificial intelligence with autonomous weapon systems enable China to advance its smart weapons capabilities. The nation dedicates resources to manufacturing precision-guided munitions, which consist of air-to-surface and anti-ship weapons, to enhance its defensive forces. Smart weapons are being integrated into land, air, and naval platforms by the People’s Liberation Army in support of their modernization drive.

Smart weapons use computer-assisted guidance technologies, including radio, infrared, laser, global positioning systems, and satellite guidance systems, to deliver precise accuracy. The term precision-guided weapon is used for smart weapons because they aim to deliver accurate strikes precisely while minimizing collateral damage and lethality. The operation and assistance of smart weapons depend on external operating systems by the use of external operating systems located far away in the geographical area. The advancement of the smart weapons market has transformed the course of war engagement and its strategies.

The smart weapons market is growing because of technological improvements, rising defense funding, and heightened geopolitical tensions requiring improved military equipment. Defense technology investments by governments with ongoing military transformation programs and threats demanding advanced combat solutions influence the market. Elevated expenses associated with equipment maintenance and deteriorating military equipment infrastructure drive the market demand for smart weapons applications. The market will expand due to transforming warfare practices with heightened requirements for precise ammunition and arms and the increasing need to reduce security damage.

| Report Coverage | Details |

| Market Size by 2034 | USD 55.79 Billion |

| Market Size in 2025 | USD 22.44 Billion |

| Market Size in 2024 | USD 20.28 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.65% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Platform, Technology, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Rising demand for advanced precision strike weapons

Precision-guided munitions or smart weapons refer to weapons that allow the exact targeting of specific locations. Advanced weapons encompass arms, munitions, and equipment that enhance operational results while minimizing harm to personnel and civilian populations. The development of long-reaching missile systems with elevated impact capabilities remains a priority. The global conflicts demonstrate an essential requirement for both precise military attacks and operational strike capabilities. The immediate advantageous impact on warzones requires an efficient attack power potential that avoids security-related collateral damage.

The defense forces are rapidly adding smart weapons to their fleet because these weapons fulfill essential operational requirements. The rising demand for smart weapons to transfer precision strikes is a main factor driving the growth of the smart weapons market. The capabilities of precision weapons to achieve range, accuracy, striking, power, and probability, combined with powerful warfare. Weapons systems create the basis for recognizing low-cost damage methods that defense systems use for price protection.

Arms transportation regulations

Arms regulations on import and export trade are not adequately regulated under current legislation since illegal arms stockpiling remains a problem. The growth of market demand for smart weapons will be hindered by multiple factors, which include issues surrounding arms trade regulation and arms control treaties coupled with the complexity of interests supporting small arms development and insufficient trading regulations leading to stifling the smart weapons market growth. The international agreement establishes rules that restrict smart weapons trade worldwide, which slows down their market expansion.

Different countries maintained strict export regulations and regulatory frameworks that hindered the worldwide trade of smart weapons systems. The limitations on transferring sensitive technologies and non-proliferation worries have created hurdles for the export and import of smart weapons. Critical export control measures and rigorous regulations for military technologies inhibit market potential within global smart weapons.

Integrating cybersecurity and electronic warfare

The global smart weapons market can benefit from the current digital military transformation by integrating strengthened cyber security defenses combined with innovative electronic warfare technologies. The demand for customized cybersecurity solutions has established a profitable industry segment for developers to craft processes that protect weapon systems' integrity while maintaining continuous command capabilities during enemy engagements.

Defense departments and government agencies across global territories dedicate their funding to dual technology research development programs. Modern military strategy will experience a transformation through this exclusive chance to bolster smart weapon operational reliability in contested environments. Through this strategic move, innovators and investors will define future warfare by assuring the resilience of smart weapons against digital threats without compromising their battlefield supremacy.

The missiles segment generated a significant share of the smart weapons market in 2024. The military defense sector leads its adoption of smart technology through missiles because they employ precision guidance systems that achieve precise attacks on significant targets. Smart ammunition utilizes guided bullets alongside shells to gain popularity because it delivers precise strikes while avoiding damage to adjacent assets. The improved versions of these weapons are designated as smart missiles. Small planes and reduced aircraft numbers can reach their targets accurately through smart bombs and missiles when attacking static targets, including buildings and fortifications or bridges. Smart weapons constitute an accurate system of missiles that guide its direction toward specific locations.

The munitions segment is projected to witness the fastest growth during the forecast period. Advanced automation integrated into munitions creates smart weapons that guide toward targets with exceptional precision. The military uses them under the official term precision-guided munitions (PGMs). PGMs combine GPS technology with laser guidance alongside infrared sensors, which guide different types of missiles and artillery shells in hitting precise targets. Advanced guidance systems in precision-guided munitions (PGMs) establish smart weapon classifications through their ability to perform accurate target hitting. Real-world terrorism, alongside unrest and international military conflicts, drives continuous growth in advanced precision-guided munitions demand.

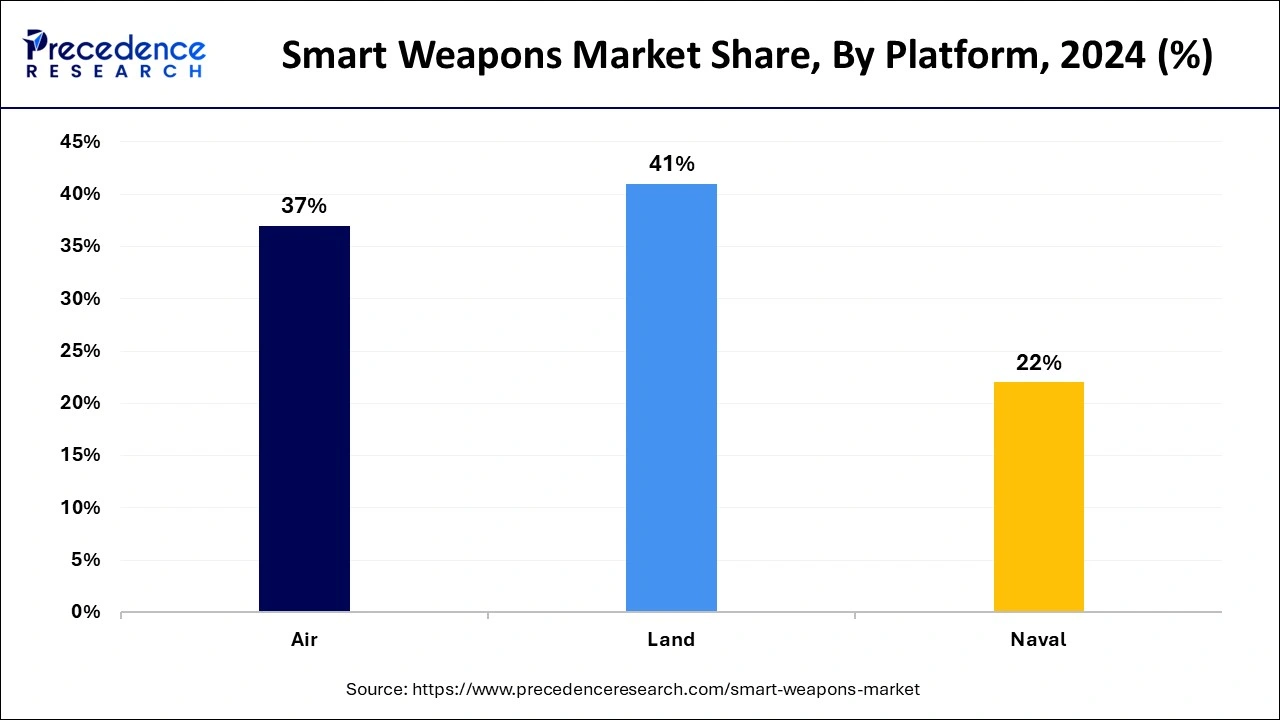

The land segment has generated a significant smart weapons market share in 2024. The market depends heavily on the rising requirement for modern military technologies that protect ground-based defense platforms. Modern weapons technology consists of PGMs with smart bombs and smart weaponry systems that enhance accuracy and performance during combat missions. The implementation of AI with machine learning creates enhanced operational abilities in these systems because they enable decisions based on real-time battlefield data.

Smart weapon systems installed in land platforms create better tactical capabilities that deliver precise actions and decrease unintentional destruction during combat operations. Automatic weapons systems serve as defense platforms for counterinsurgency tasks and border defense operations in addition to military combat operations in difficult terrains. The advancement of warfare strategies requires automatic weapons platforms to develop new operational capabilities.

The air segment is estimated to witness the fastest growth during the forecast period. Modern military weapon systems advance through drone technology combined with precision-guided air-to-ground missiles alongside AI integration in air battle platforms. Smart weapons are computer-guided munitions that can be used in air, naval, and land platforms. The weapon systems possess precise target capabilities that generate minimal collateral damage during their targeted engagements. Unmanned aerial systems (UAS) and precision weapons launched from aircraft experience rapid development that fosters substantial growth because they play an essential role in modern military strategies.

The laser guidance segment noted the largest smart weapons market share in 2024. Laser-guided smart weapons employ laser beams to reflect against targets before controlling projectiles to their intended destination. The applications of this technology appear in aerial bombs, missile systems, and various vehicles. GPS technology enables this system to reach superior accuracy across military operations, and thus, it has become a common selection for multiple defense applications. Laser guidance technology reveals the highest growth rate since the military sector started adopting it across smart weapon systems because of superior precision target-locking and day-or-night operational abilities.

The satellite guidance segment is estimated to witness the fastest growth in the forecast period. Satellite guidance is a technology used in smart weapons to help them hit targets with precision. Smart weapons function by using computers for navigation purposes because they were created to minimize damage and decrease the number of fatalities. Satellite guidance is extensively utilized for its global positioning and navigation capabilities, enabling weapons to perform with high accuracy over long distances. Line-of-sight guidance becomes ineffective for target detection and tracking, which makes radar guidance essential for working through both physical and weather-related obstacles.

By Product

By Platform

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

January 2025