November 2024

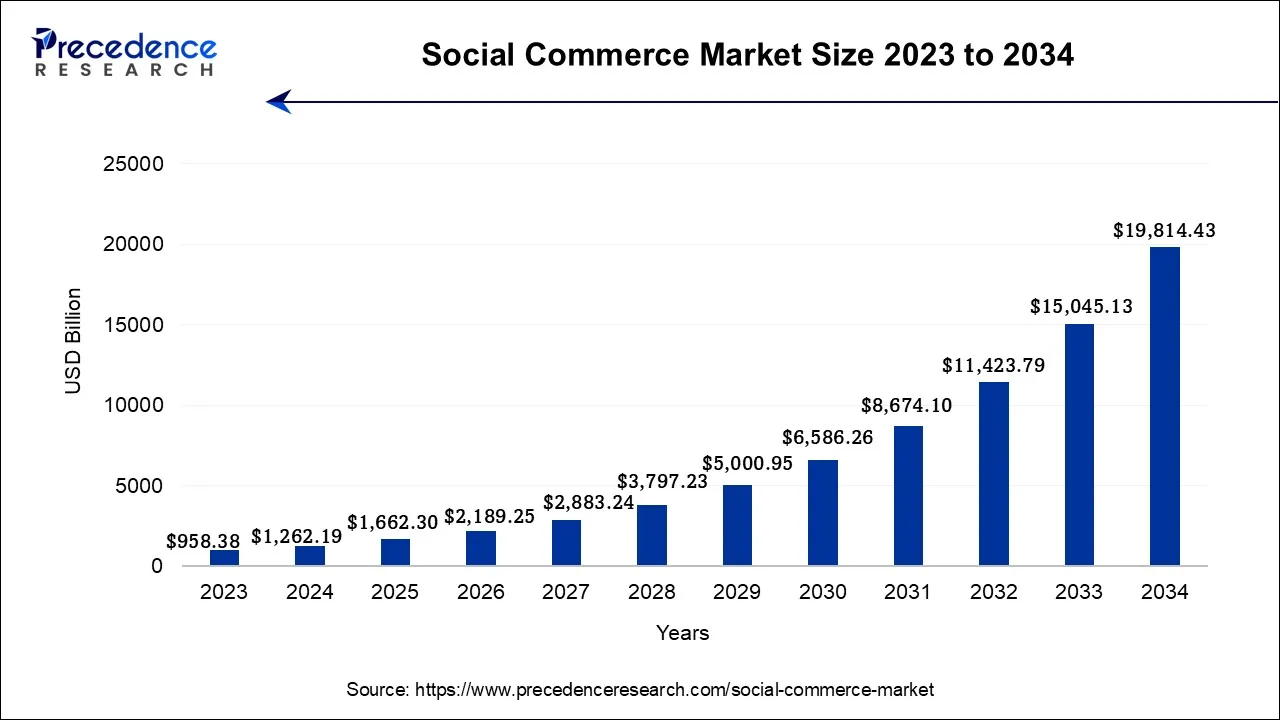

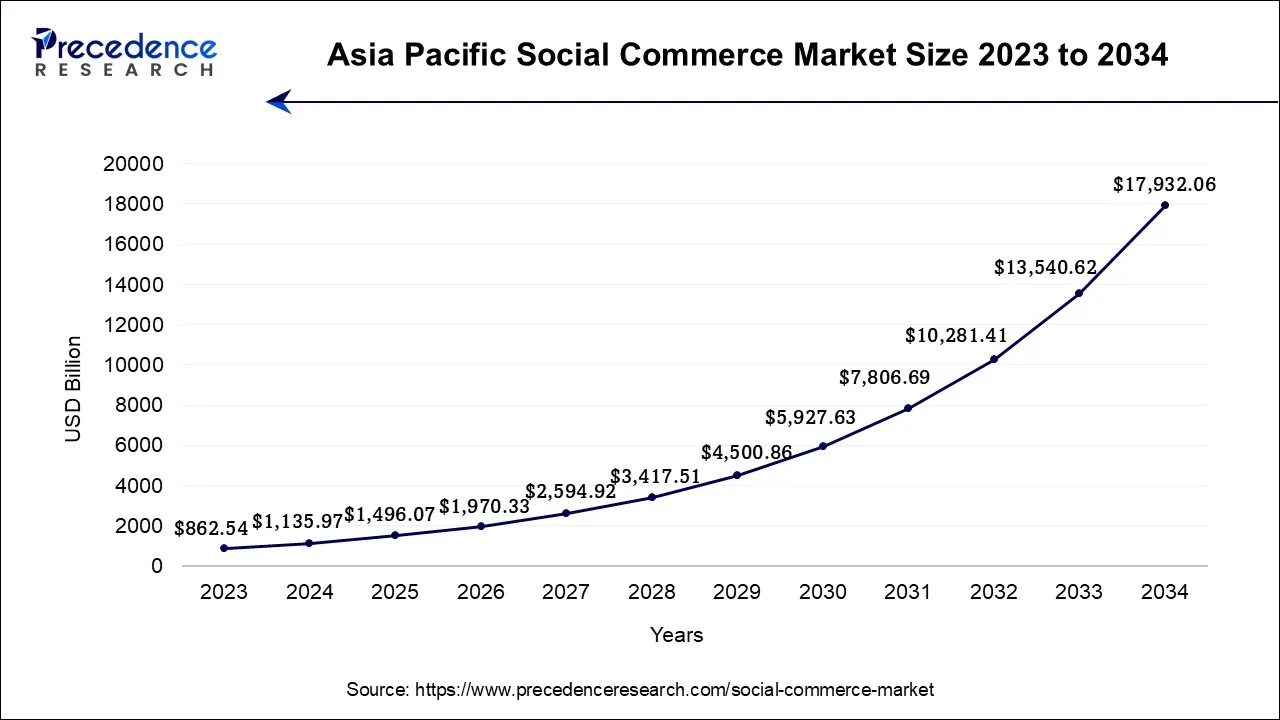

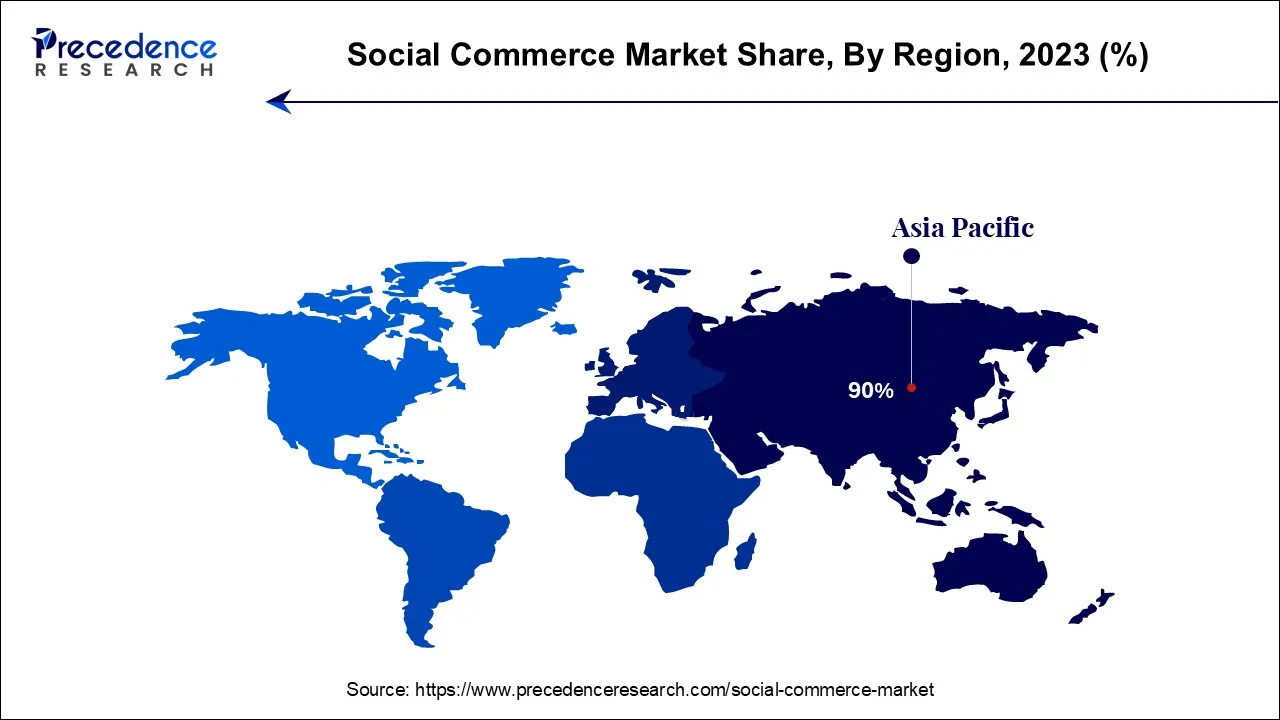

The global social commerce market size is calculated at USD 1,262.19 billion in 2024, grew to USD 1,662.30 billion in 2025, and is predicted to hit around USD 19,814.43 billion by 2034, poised to grow at a CAGR of 31.7% between 2024 and 2034. The Asia Pacific social commerce market size accounted for USD 6.84 billion in 2024 and is anticipated to grow at the fastest CAGR of 33.67% during the forecast year.

The global social commerce market size is expected to be valued at USD 1,262.19 billion in 2024 and is anticipated to reach around USD 19,814.43 billion by 2034, expanding at a CAGR of 31.7% over the forecast period from 2024 to 2034.

The Asia Pacific social commerce market size is accounted for USD 1,135.97 billion in 2024 and is projected to be worth around USD 17,932.06 billion by 2034, poised to grow at a CAGR of 31.77% from 2024 to 2034.

Asia-Pacific held largest revenue share in 2023. Similar to the rapid growth of e-commerce in countries like India and China, where they dominated the regional market in 2018, social commerce is also anticipated to augment in China. It is projected that by 2025, social commerce will constitute nearly one-third of China's e-commerce market. While platforms like WeChat and Taobao are widely recognized outside of China, newer platforms such as Douyin (TikTok) and Pinduoduo are also gaining international prominence. Social commerce capitalizes on the immense popularity of social media in China, where research indicates that consumers spend over 48% of their time on social media apps. From 2017 to 2020, respondents reported a substantial increase in the influence of social media on their online shopping behaviors.

This encompassed around 38% rise in using social media for product awareness, an 85% surge in using social media to evaluate products, and an astonishing 252% upswing in using social media for making purchases. This is likely to support the regional growth of the market in the years to come.

North America is expected to grow at the fastest CAGR during the forecast period. The US dominated the North America region in 2023. Express, a US-based apparel business, is enabling influencers and regular shoppers to take on the role of "Style Editors." These Style Editors have the opportunity to create their own Express storefronts and earn rewards based on their ability to attract new customers and generate sales. This is likely to support the growth of the market in the region during the forecast period. Furthermore, the increasing usage of smartphones and tablets is also likely to support the growth of the market in the region.

Social commerce occupies a central position in the ongoing convergence of functionalities found on numerous online retail and social interaction platforms. This phenomenon is fueled by the introduction of commerce features by social-first platforms (for instance, social media platforms incorporating in-app product catalogs) and the integration of social shopping components by commerce-oriented websites (such as marketplaces introducing live streaming or group buying options).

The prevalent manifestation of Social Commerce involves commerce-driven websites incorporating social shopping elements (e.g., marketplaces). Simultaneously, in certain regions like China, where online retail platforms are more commonly utilized by brands, social media serves as a means to inspire and facilitate purchases, seamlessly integrating e-commerce into these experiences through popular formats like group buying and live-streaming. Furthermore, brands are increasingly investing in social commerce advertising to target specific audiences and drive conversions. Social media platforms offer targeted advertising options based on user interests, demographics, and behavior, allowing brands to reach potential customers with relevant and personalized advertisements.

The increasing social media users across the globe is anticipated to augment the growth of the market during the forecast period. In 2022, approximately 58% of the global population, which translates to around 4.6 billion individuals, actively engage with social media platforms. These users dedicate an average of 2 hours and 27 minutes per day to these channels. Simultaneously, consumers exhibit greater digital proficiency, spending an average of 6.58 hours online each day, with 3.43 hours consumed through mobile devices (Hootsuite, 2022).

With e-commerce now ingrained in everyday life, consumers are increasingly driven by the desire for instant gratification, offering platforms a significant opportunity to monetize the time users spend online and their social influence within the digital realm. To remain competitive, platforms continuously expand and refine their features, aiming to provide faster and more relevant experiences within the consumer's own environment. This evolution allows consumers to seamlessly connect, share, discover, and make purchases. The emergence of peer-to-peer platforms and influencers also fuels the growth of 'Social Commerce,' while generating curiosity about the metaverse. Brands seeking to engage with shoppers in their preferred digital surroundings must determine their strategic approach to leverage this emerging channel.

| Report Coverage | Details |

| Market Size in 2024 | USD 1,262.19 Billion |

| Market Size by 2034 | USD 19,814.43 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 18.58% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type, By Platform, By Business Model, and By Access |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing adoption of mobile devices

The increase in adoption of mobile devices is expected to augment the growth of the social commerce market during the forecast period and this trend is likely to continue in the years to come. Based on the GSMA Intelligence's Mobile Economy 2022 report, it is projected that by 2025, there will be nearly 7.5 billion smartphone connections, accounting for more than 80% of all mobile connections. In the coming six years, the majority of regions are expected to witness a threefold increase in mobile data usage, driven by the widespread adoption of smartphones and the growing consumption of videos. Previously, it was observed a similar surge in content engagement on desktop and laptop devices, and now, with mobile-optimized solutions, the same upward trend is expected on the mobile platforms.

When analyzing content generation among all of Reevoo's retail and brand clients, it was evident that 25% of consumers who receive post-purchase requests to provide reviews or answer questions via email choose to respond using their mobile devices. This percentage of reviews and answers submitted through mobile is predicted to continually rise in the future. Although mobile conversion rates may currently start at a lower baseline, these numbers are anticipated to grow as consumers increasingly engage and conduct transactions through their mobile devices. Consequently, this is anticipated to contribute to the market growth within the estimated timeframe.

Limited social media reach

One of the major social media challenges is that in every 10 Americans, seven of them, especially young adults, make use of social media to engage, share connect, and entertain themselves. Though most of people today are on social media, it still has a limited reach and is very saturated. The saturation of users on social media creates a highly competitive environment, making it more difficult for businesses to expand their customer base and stand out amidst the noise. Furthermore, the limited reach hampers the ability to effectively target niche audiences, hindering the precision and effectiveness of marketing efforts. As users are flooded with a constant stream of content, including advertisements, ad fatigue sets in, causing users to ignore or actively block ads, leading to a decline in the organic reach of businesses.

To ensure business growth on social channels, one needs to ensure to create rich and engaging content. Moreover, social media product reviews are also very important when it comes to selling products on social media platforms. If the reviews are not enough and bad it affects the purchasing of the products. However, by using a product content management system, one can create rich product information that will keep the customers informed, create credibility and trust, and help to rank better. This will make it easier to attract the target audience to these platforms and support market growth in the near future.

Emerging new shopping formats

According to recent data, 40% of global shoppers (and 27% in Europe) express a desire for live streaming as an additional component to enhance their immersive shopping experience. Additionally, 60% of global shoppers (and 50% in Europe) show interest in shopping experiences driven by Augmented Reality technology. These statistics highlight the growing demand for interactive methods of product discovery and commerce in new shopping formats.

The desire for live streaming as an enhancement to the shopping experience aligns with the growing trend of social commerce platforms incorporating live streaming features. This allows shoppers to engage in real-time interactions, product demonstrations, and influencer-driven content while making purchasing decisions. Similarly, the interest in augmented reality (AR) shopping experiences reflects the integration of AR technology into social commerce platforms, enabling virtual try-on, product visualization, and interactive elements that enhance the overall shopping experience.

The demand for interactive methods of product discovery and commerce directly aligns with the essence of social commerce, which focuses on merging social interactions, content sharing, and e-commerce functionalities to create a seamless and engaging shopping environment.

On the basis of product type, the apparel segment held a considerable revenue share in 2023. This is owing to the increasing promotion of apparels by influencers over the various social media platforms. Their ability to engage and connect with their followers, showcase outfit ideas, and provide style inspiration drives consumer interest and boosts sales in the apparel segment of social commerce. Additionally, the integrated payment systems and streamlined checkout processes enhance the convenience and efficiency of shopping and is further likely to drive the growth of the apparel segment during the forecast period.

Based on the business model, the business-to-consumer segment is expected to grow at a considerable CAGR during the forecast period. This is owing to the increasing adoption of smartphones along with the shift in consumer behavior as well as digital mode. Furthermore, the growing number of social media users provides a vast audience for B2C businesses to target. As more people spend time on social media platforms, the potential reach and engagement opportunities for B2C brands expand, driving the segmental growth of the market in the years to come.

Segments Covered in the Report

By Product Type

By Platform

By Business Model

By Access

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

July 2024

January 2025

December 2024