November 2024

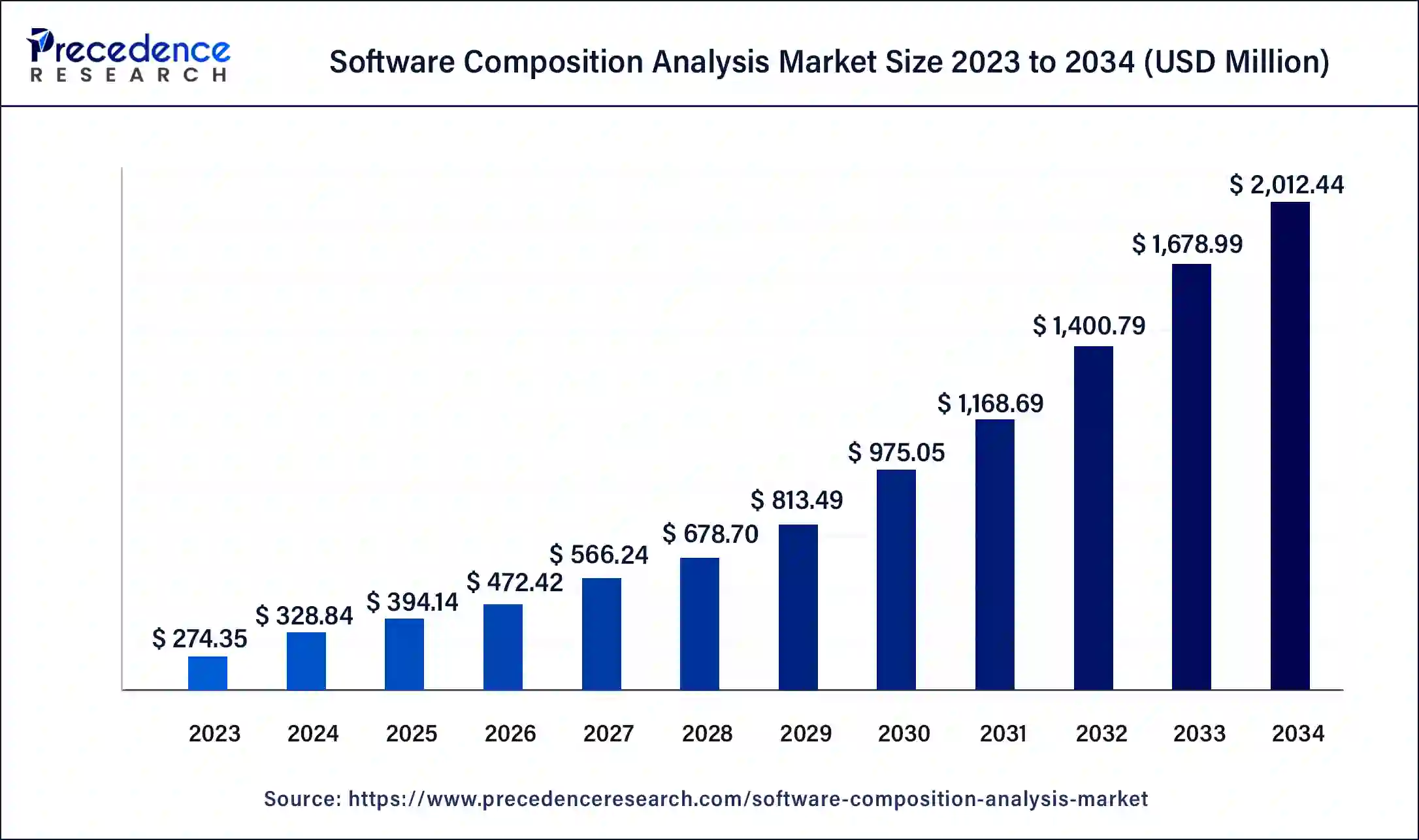

The global software composition analysis market size was USD 274.35 million in 2023, calculated at USD 328.84 million in 2024 and is expected to be worth around USD 2,012.44 million by 2034. The market is slated to expand at 19.86% CAGR from 2024 to 2034.

The global software composition analysis market size is projected to be worth around USD 2,012.44 million by 2034 from USD 328.84 million in 2024, at a CAGR of 19.86% from 2024 to 2034. The software composition analysis market growth is attributed to increasing reliance on open-source software, rising cybersecurity threats, and stringent regulatory requirements.

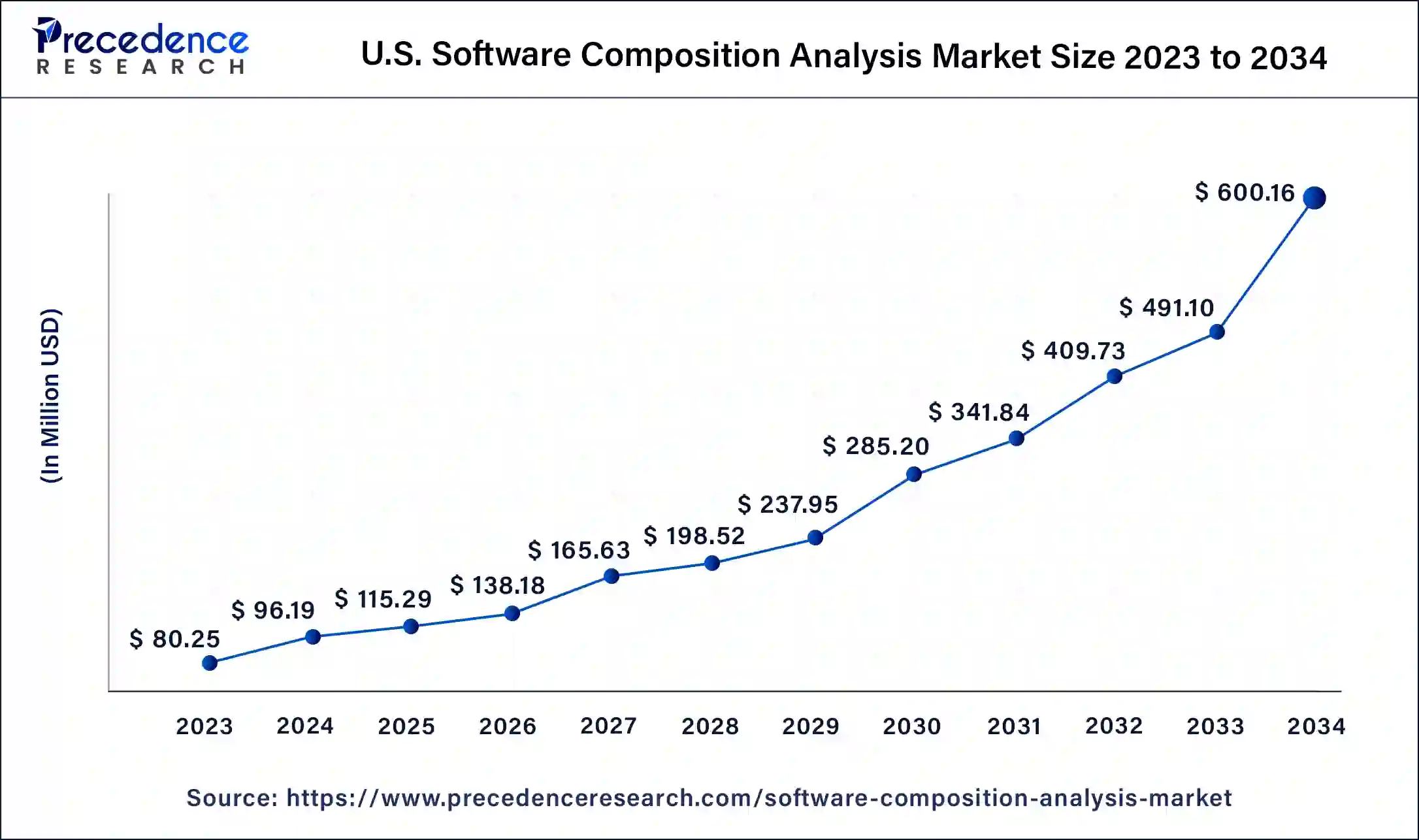

The U.S. software composition analysis market size was exhibited at USD 80.25 million in 2023 and is projected to be worth around USD 600.16 million by 2034, poised to grow at a CAGR of 20.07% from 2024 to 2034.

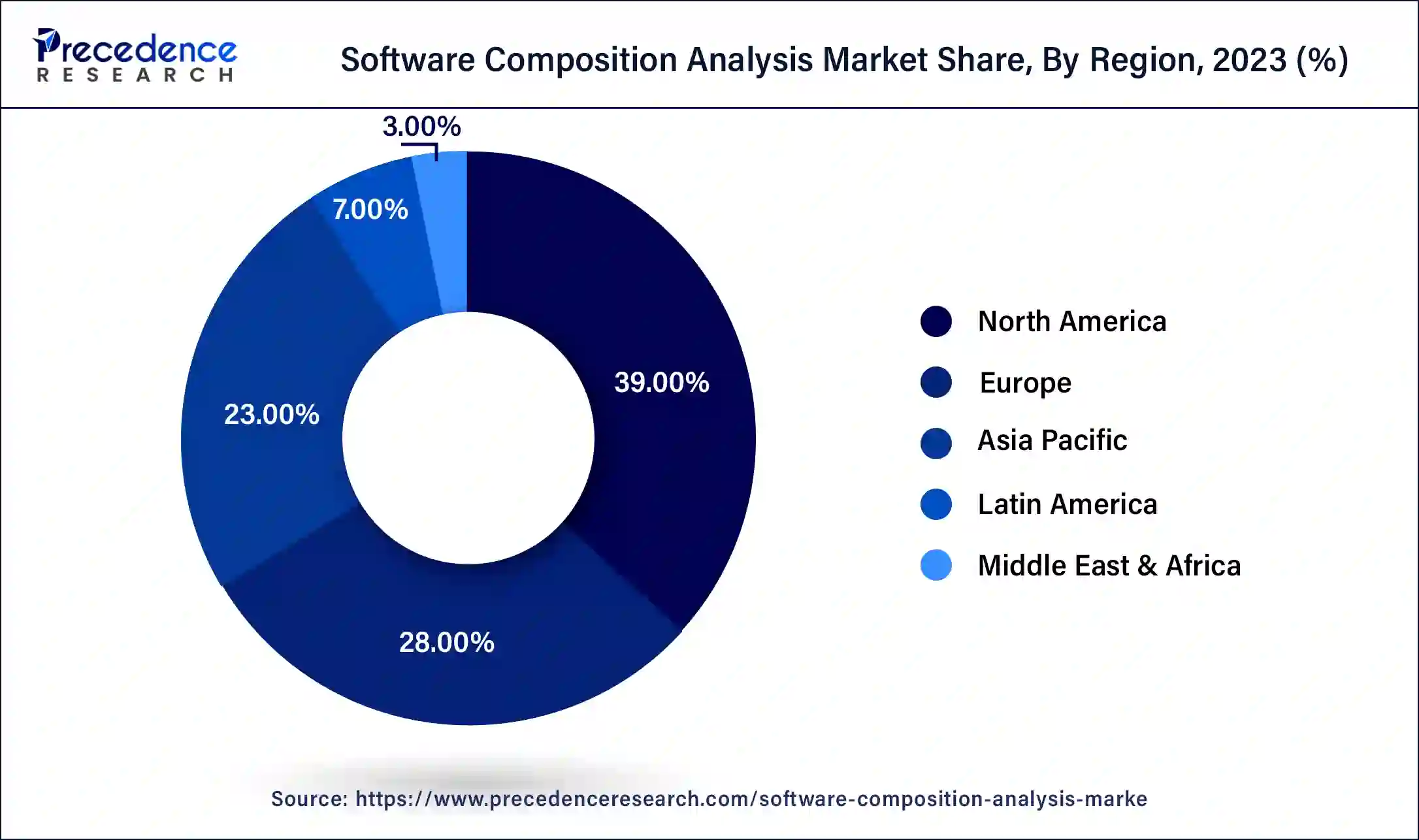

North America held a significant share of the software composition analysis market in 2023 due to technological development and major vendors. Large corporations and leading technology companies present in this region develop software products using significant proportions of open-source components. These organizations are subject to high levels of regulation. Therefore, they have been forced to normalize the software composition analysis solutions to the HIPAA and GDPR standards to ensure compliance and protect sensitive data. The need for new security measures has been further propelled by the constant enhancement of cybersecurity risks across the region, complemented by frequent incidents of cybercrime.

Asia Pacific is expected to grow at the highest CAGR in the software composition analysis market during the forecast period due to digitalization and the integration of open source software in several sectors. Emerging economies, such as China, India, and Japan, are showing tremendous growth, especially in their technological sector, whereby many companies are adopting the use of technology in their operations.

The growing uptake of cloud solutions, internet of things (IoT), and artificial intelligence (AI) across the region also creates a demand for better software composition analysis to strengthen software supply chain protection. Furthermore, the emerging Asia Pacific market for software composition analysis due to a large number of SMEs and the existence of affordable and scalable solutions for software composition analysis is expected to contribute to the market growth.

The software composition analysis market has grown due to the rising use of open-source components in developing software products. Organizations and companies across different industries have embraced open-source solutions to increase the rate of innovation and decrease costs, leading to an increased need for open-source component control. Software composition analysis tools help define important features regarding risks, licenses, and safeguards that are useful in applications. The market has the capacity to expand due to increased awareness of cyber threats and regulatory compliance that force organizations to invest in software security.

Impact of Artificial Intelligence on Software Composition Analysis Market

Organizations in the software composition analysis market use AI to speed up the process in search of threats in open-source components, which personnel used to do manually. AI algorithms are capable of scanning through large codebases much faster, which means that organizations can identify threats that are not yet major problems. This integration of AI not only helps enhance software development efficiencies but also enshrines better security postures across businesses, resulting in an impartment of software security in the marketplace. Furthermore, AI changes the competition by promoting the development of new ideas and enhancing the use of more elaborate software analysis tools in different fields.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,012.44 Million |

| Market Size in 2023 | USD 274.35 Million |

| Market Size in 2024 | USD 328.84 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 19.86% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Organization Size, Deployment Type, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing awareness of open-source vulnerabilities

Increasing awareness of open-source vulnerabilities is anticipated to drive the demand for the software composition analysis market. Companies in many industries understand that using open-source components in their software has its dangers and is riddled with threats. This increases awareness and makes it necessary for businesses to employ sound analysis tools to evaluate threats that are likely to affect software solutions for businesses to protect them.

The increasing focus on defending software-provided chains also increases and enhances the need for such tools, including the financial, healthcare, and government sectors. Furthermore, the utilization of open-source software in SCADAs and their spread in cloud services require approaching the question of vulnerability more actively.

High implementation costs

High costs associated with the implementation of these technologies are expected to hamper the market. SMEs complain of the high initial costs of implementation and also of the costs of sustaining the tools, including subscription fees. This adds to the expenses and prevents the majority of organizations, especially the ones with a lean IT budget, from adopting it. Furthermore, updating the software and offering support services makes it expensive, and the long-term cost implication for these small businesses further hinders the software composition analysis market.

Growing focus on DevSecOps practices

Growing focus on DevSecOps practices is expected to create immense opportunities for the players competing in the software composition analysis market. The demand for products that naturally fit CI/CD processes grows as organizations are incorporating security in DevOps. Such software composition analysis tools used for real-time suggestion or vulnerability scanning become an inevitable part of these security-oriented software development practices. IT vendors concerned with DevSecOps of their products now have a quickly growing market of customers requesting secure software at the development life cycle.

DevSecOps practitioners aim to utilize solutions that are easily integrated into existing CI/CD tools such as Jenkins, GitLab, and CircleCI, thus creating a demand for specific SCANOVA solutions. Furthermore, the nature of DevSecOps environments is continuous, which always requires tools that offer persistent and effective security monitoring capabilities. All these factors further boost the demand for the software composition analysis market in the coming years.

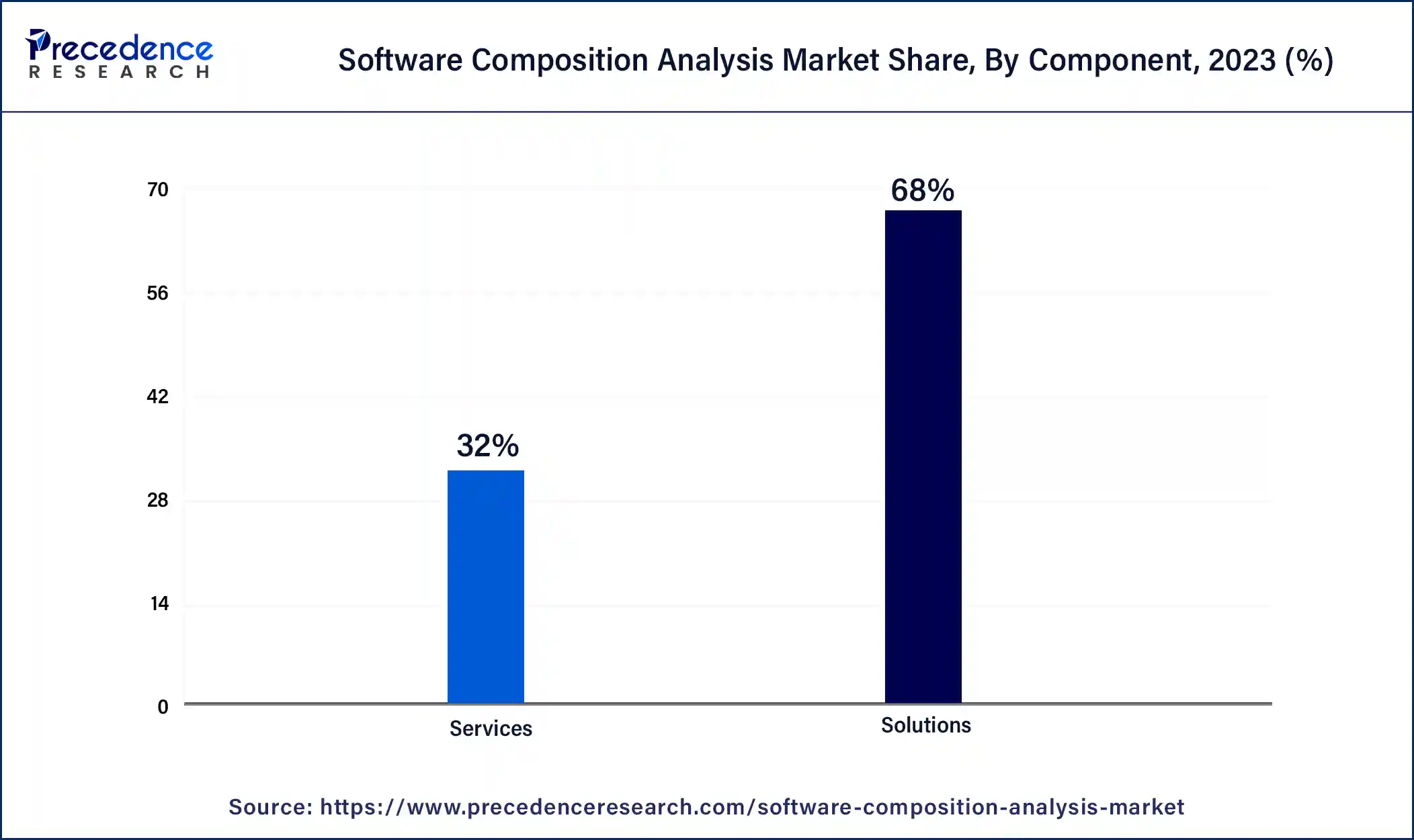

The solutions segment dominated the global software composition analysis market in 2023, as the increasing demand for tools allows for the management of the numerous challenges of software development. Several industries emphasized the need to use SCMs for the analysis of open source-related risks in their software supply chains. These solutions provided features including real-time detection of vulnerabilities, automatic compliance checks, and reporting factors, which are crucial for the security and integrity of software systems.

The increasing usage of open-source software, combined with continuously improving cyber threats, accelerated the need for more solid analysis tools. Furthermore, through the incorporation of artificial intelligence and machine learning into these tools, they have stepped up their capacity to identify new threats that are being forged and, as such, have become vital tools for organizations that are seeking to safeguard against security threats. This segment is likely to remain dominant as more organizations come to appreciate the importance of a proactive approach to vulnerability management in the protection of their digital assets.

The services segment is projected to grow rapidly in the software composition analysis market in the future years, owing to the increasing demand for additional services such as consultancy, training, and managed services. The scope of these services encompasses the necessary professional guidance to ensure that the tools of software composition analysis integrate into a business’s operations to the best extent possible.

IT environments have become more complex as firms continue to develop siloed pipelines in the development of systems. Furthermore, the adoption of DevSecOps as a culture increases the need for constant assistance and monitoring during the application’s development process since the security perspective is considered a criterion in the SDLC.

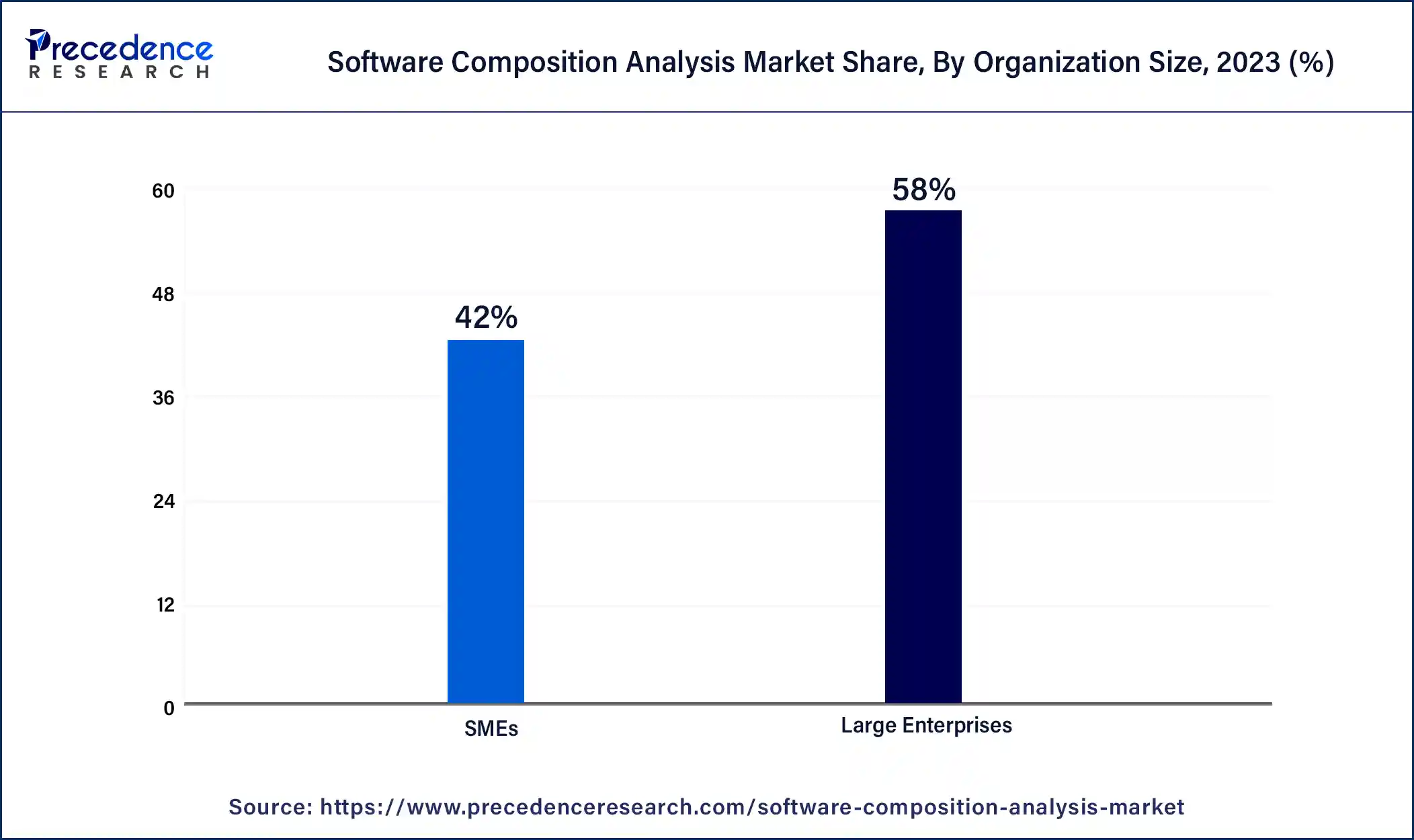

The large enterprises segment held the largest share of the software composition analysis market in 2023 due to the growing demand for the incorporation of open-source components, which remains paramount, and the concern for managing risks encapsulated by such components. These organizations are at risk of cyberattacks; as organizations manage large and complicated software environments, menacing vulnerabilities within open-sourced parts remain unnoticed.

The large enterprises adopted sophisticated software composition analysis tools that provided even more functionalities for real-time and periodical checks, compliance, and reporting. The relatively large budgets that large enterprises have been in a position to make provision for end-to-end solutions that are readily deployable in the enterprises’ existing IT architectures. Moreover, the rising demand for software security compliance in finance, healthcare, and government fuels the demand for software composition analytics tools.

The SMEs segment is projected to expand in the software composition analysis market in the coming years significantly, owing to cybersecurity awareness and the availability of cheap analysis tools. SMEs are gradually becoming aware of the security risks of their software supply chains, especially when they instigate their application with more and more open-source components in their apps.

The availability of inexpensive and easily implemented software composition analysis solutions designed for the LBM segment alone also encourages the segment to adopt. Additionally, the growing awareness of cybersecurity among SMEs to develop protective measures adds to the necessary spending on the tools for the safe running of the company and preserving customers’ data.

The on-premises segment dominated the global software composition analysis market in 2023 due to the increased need for data and application security. The biggest companies and organizations in the financial, medical, and government sectors preferred to have their applications and data kept within their own internal IT systems. This deployment type provided these organizations with the opportunities to select and integrate the specific software composition analysis tools into their existing ecosystem, which helped improve security and compliance.

On-premises solutions also provided finer control of large numbers of software ingredients and their dependencies, which was important in large organizations with complex IT estates. Furthermore, there is a growing trend, particularly in industries that require data localization and industries that are subjected to strict regulatory standards that require the data to be hosted within the organizational premises. All these factors are contributing to propelling the on-premises software composition analysis solutions.

The cloud segment is projected to expand rapidly in the software composition analysis market in the coming years, owing to the rising use of cloud solutions in businesses. Such tools allow for the flexibility of scale and simple deployment of the new instruments, which enhances their interest in SMEs and other rapidly developing organizations. Cloud solutions are also real-time and can be used for constant surveillance of vulnerabilities since threats are always evolving in the current fast-paced world. Moreover, the capital-intensive nature of most on-premise solutions presents a disadvantage, especially for organizations that have limited capital to invest. Thus, the increase in the adoption of cloud-based solutions also increases the growth rate of this sub-sector.

The BFSI segment led the global software composition analysis market in 2023 due to increasing concern for safety and compliance. The regulatory compliance standards that apply in the BFSI sector, including the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR), elevate the need for software composition analysis tools as well. They facilitate open-source tool analysis and assist institutions in fixing or avoiding risks that are inherent to the software MOSA and that cause problems such as industry compliance breaches or hacks. Furthermore, the intensification of banking operations through the share of digital services also increases the demand for software composition analysis.

The healthcare segment is projected to grow at the fastest pace in the software composition analysis market in the future years, owing to the growing popularity of electronic health solutions and the significance of data protection in the healthcare industry. This happens especially in light of the rising use of digital records and telemedicine solutions, along with the incorporation of concepts such as IoMT. Software composition analysis tools facilitate detecting source code vulnerability to protect the patient’s data from cyber threats. The steep rise of regulations over the protection of healthcare data, such as the Health Insurance Portability and Accountability Act (HIPAA), also fuels the use of these tools. Moreover, cyber threats to the healthcare sector remain rampant and pose a threat to the market in the coming years.

Segments Covered in the Report

By Component

By Organization Size

By Deployment Type

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

January 2025

October 2024