November 2024

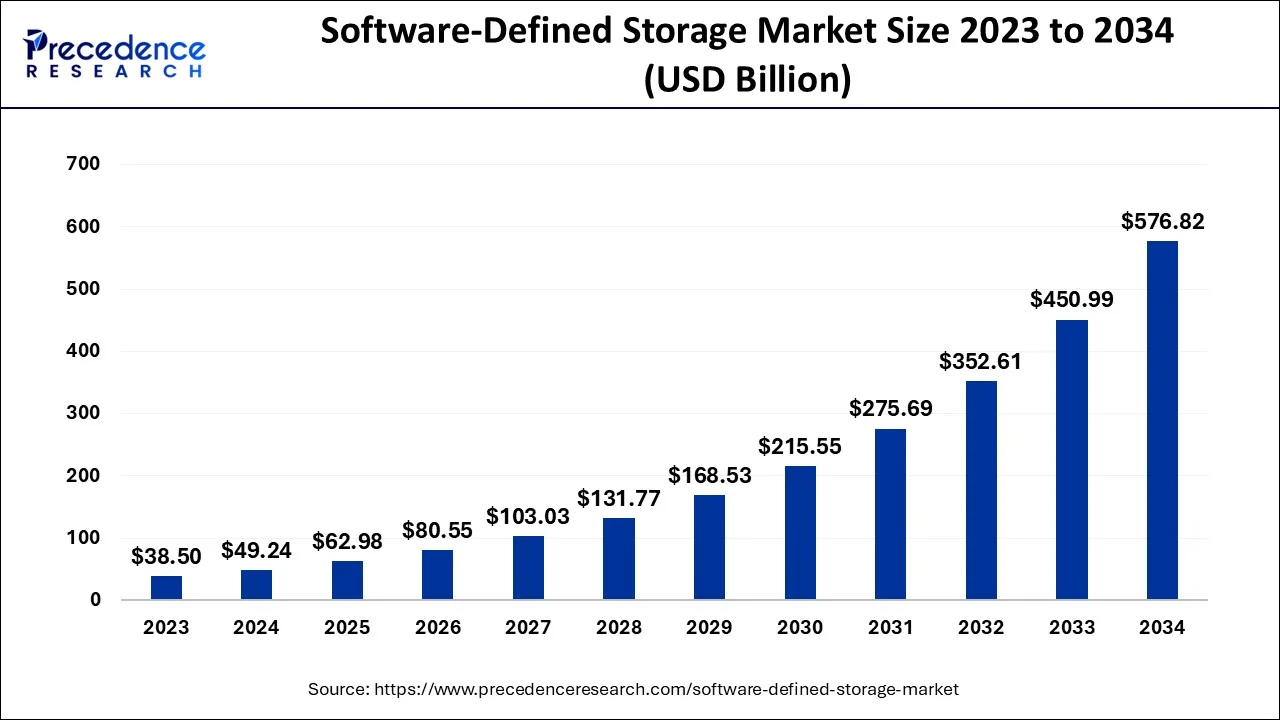

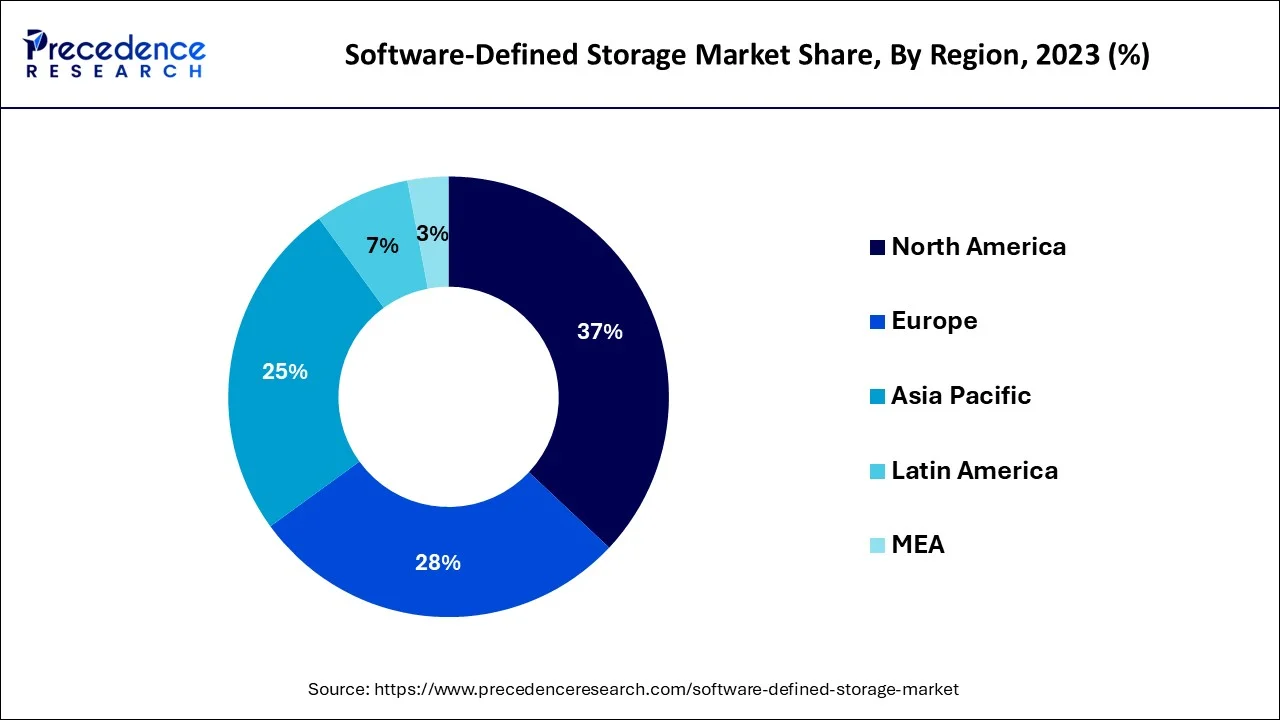

The global software-defined storage market size is estimated at USD 49.24 billion in 2024, grew to USD 62.98 billion in 2025 and is predicted to hit around USD 576.82 billion by 2034, expanding at a CAGR of 27.90% between 2024 and 2034. The North America software-defined storage market size accounted for USD 18.22 billion in 2024 and is anticipated to grow at a fastest CAGR of 28.05% during the forecast year.

The global software-defined storage market size accounted for USD 49.24 billion in 2024 and is anticipated to reach around USD 576.82 billion by 2034, expanding at a CAGR of 27.90% between 2024 and 2034.

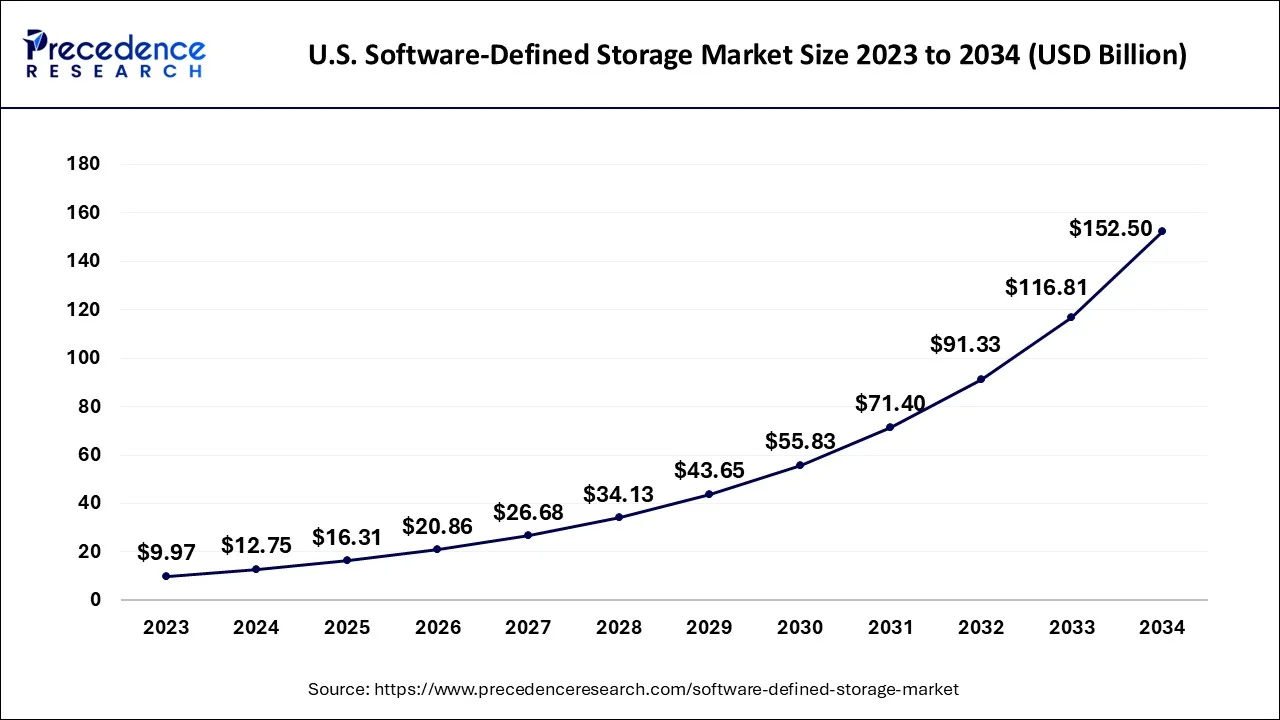

The U.S. software-defined storage market size is estimated at USD 12.75 billion in 2024 and is expected to be worth around USD 152.50 billion by 2034, growing at a CAGR of 28.14% from 2024 to 2034.

Europe is considered as second largest region in the software-derived storage industry. The region's favorable economic conditions, such as tax breaks, a plentiful supply of renewable energy, and sensible laws governing data privacy and protection, are what is driving the need for data centers. European enterprises are putting software-defined data centers into place swiftly because of favorable rules around data protection and privacy. Nordic countries also provide tax advantages to data center market participants, increasing demand for SDDC systems. Market participants are expanding their software-defined data center business in Europe to broaden their global reach.

Furthermore, it is projected that the market in North America will increase as a result of fueled by big firms increasing their global reach through new products and collaborations. The United States has the greatest market share. The SDDC industry will likely be dominated by North America for some time to come, according to predictions.

Asia Pacific is anticipated to experience the fastest growth during the foreseen period. The region has greatly increased in size as a result of expanding industrialization and developing markets. The basic IT infrastructure of the APAC area is evolving more swiftly, resulting in a self-replicating cycle that promotes further investment and growth. Therefore, IT management will need greater power, money, and responsibility. This area has qualified programmers who are at least on par with those found everywhere in the world. Rapid global communication is made possible by the contemporary telecommunications infrastructure. Another important advantage is the extensive use of the English language. In higher education, only English is spoken.

The need for SDS solutions in small and medium-sized businesses is driven by the need to increase efficiency and business operations using data. Companies have moved their attention to new technologies in order to get a competitive edge as a result of the competitive climate. By automating process controls and substituting software for conventional hardware, SDS usage reduces costs. The necessity for a scalable storage architecture that is dependable and safe is increased by the explosive growth of amorphous data across several companies. Additionally, the amount of data generated at the edge is continuously growing as IoT spreads around the globe. By enhancing deployment flexibility and enabling businesses to use the software with any storage platform through a single interface, the SDS model responds to these objectives. Due to the expanding needs of big businesses in the banking and telecom industries, the leading vendors in the market have been releasing SDS software solutions with improved data safety and dependability.

A computer program called software defined storage (SDS) handles data storage resources and functionality without relying on the underlying physical storage hardware. Instead of being dependent on proprietary hardware like traditional Network Attached Storage (NAS) or Storage Area Network (SAN) systems, SDS is typically built to run on any industry-standard or x86 system. The exponential proliferation of amorphous data, which increases the requirement for a scale-out storage architecture, is one factor that contributes to the rise in SDS products. The SDS market is anticipated to expand as a result of the increased usage of cloud infrastructure and its multiple advantages, including cost effectiveness, improved flexibility, automation, and the skyrocketing value of amorphous data.

The market's goal is to be adaptable, nimble, and to have higher efficiency and control. The fact that the data center can be implemented on any arbitrary hardware is an extra benefit. Due to COVID-19, several IT behemoths were forced to secure their locations and encourage staff to work from home, which had an impact on income. However, the market for software-defined data centers for data storage, solutions, and recovery saw a sharp increase. The demand for operating and monitoring SDDCs for the efficient operation of the business may be considered as a sign of the market's expansion and as a factor influencing market growth. Other qualities include a decrease in capital expense, a reliance less on physical storage, a need for less people, and development.

| Report Coverage | Details |

| Market Size in 2024 | USD 49.24 Billion |

| Market Size by 2034 | USD 576.82 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 27.90% |

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Usage, By Enterprise Size and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Amorphous data quantities are rapidly increasing

The amount of amorphous data gathered from various sensors, equipment, and connected devices across a variety of industries has increased as a result of the expanding usage of contemporary technologies like artificial intelligence (AI) and the Internet of things (IoT). A highly scalable and effective unified data storage and management solution becomes essential since these enormous amorphous data volumes must be constantly processed and stored.

The explosive growth of amorphous data across various organizations has had an impact on the fosterage of software defined storage (SDS) solutions with proficiencies like non-virtualization support, scale-out architecture, integration with cloud environments, high data performance speeds, and so on. Amorphous data volumes are increasing at a rate of 23 percent per year, or roughly doubling every 40 months, according to Igneous' State of Amorphous Data Management 2021 research. The need for SDS solutions to enhance reliability, productivity, and flexibility when handling machine-generated amorphous data and streamline decision-making processes has also been influenced by the drive towards digitalization or automation trends across a variety of industries.

Inadequate knowledge and technological expertise

Lack of technical expertise in the deployment or execution of software defined storage (SDS) infrastructures is a significant roadblock to the commercial spread of SDS infrastructures. Due to the difficulties of installation, SDS systems' power, intricacy, and flexibility can only be utilized by a specialized staff, which limits its use in all data storage applications. Lack of end-user customer awareness, education, and training regarding the advantages of using SDS solutions over conventional storage is impeding the market's growth. In order to boost end users' confidence in SDS solutions, software defined storage manufacturers must also focus on enhancing software solutions capable of reducing data theft concerns that appear during cloud location storage.

Software storage solutions provides hardware-independence and offer better storage optimization

The fact that software-defined software storage systems are hardware independent is one of their advantages. This implies that software storage systems are not constrained by a certain hardware setup. The strong and ready-to-use redundancy offered by software-defined software storage solutions include software capabilities like data agility and scalability. For companies of all sizes, software storage solutions provide potential for storage optimization. Storage virtualization, which offers high storage efficiency storage capacity over conventional hard disc drive storage capacity, is advantageous for businesses of any size. By removing empty space on larger block storage devices, virtual storage management software boosts storage efficiency while decreasing costs. This allows more data to be stored on the available storage resources.

Small and medium businesses are included in the software defined storage market segmentation based on organization size, as well as large businesses. The large enterprise category, which dominated the market in 2022, is expected to increase at a higher rate. Large businesses are more likely to adopt cutting-edge storage solutions like software-defined storage since they often have larger expenditures for IT infrastructure. These organizations need storage solutions that can manage large data volumes and adhere to strict security standards. On the other hand, as they search for affordable and effective storage solutions, small and medium-sized businesses are anticipated to experience significant growth. As a flexible and scalable alternative to conventional storage solutions, these organizations are embracing software-defined storage solutions at an increasing rate. Overall, the rising demand for effective and affordable storage solutions across organizations of all kinds is what is driving the rise of both groups. These all have a beneficial effect on the market growth for software-defined storage.

Platforms and Services are included in the market segmentation for software defined storage based on components. In terms of revenue, the services sector accounted for the largest share of the software-defined storage market in 2022. The professional services and managed services in the services section offer assistance and upkeep for software-defined storage solutions. The hardware and software elements of the platform segment are necessary for the implementation of software defined storage solutions. The increased adoption of software-defined storage solutions by businesses of all sizes and in a variety of industries is what is fueling the platform segment's rise. Overall, the market for software-defined storage is expanding due to the rising demand for effective and affordable storage solutions as well as the rising popularity of cloud computing and virtualization.

The segment for data backup and disaster recovery is anticipated to expand quickly between 2024 and 2034. Due to their high costs and administrative burdens, traditional storage systems used for data backup have become obsolete, leading to an increase in the use of software defined storage solutions. Traditional storage requires a range of data protection solutions, including cloud backup tools, virtualized backup tools, physical server backup tools, and others, all of which add to the environment's complexity and cost. The adoption of software defined storage (SDS) solutions that offer increased flexibility has been supported by overcoming data security and storage silos as well as by lowering the requirement to use different tools in order to restore files, drives, systems, or an entire site.

Additionally, SDS might manage all aspect of storage through a single user interface, doing away with the need for independent data security, replication, recovery systems which are disastrous, or backup and boosting the enterprise's profits. Regardless of the storage location—on-site, off-site, or in the cloud—SDS solutions assist organizations in transferring, protecting, and recovering data and are crucial to their expansion across a range of industries.

The market is divided into the following industry verticals: Banking, Financial Services, and Insurance (BFSI), Telecom and ITES, Education, Logistics and warehouse, Media and entertainment, Healthcare, and Others. During the projected period of 2024–2034, the Banking, Financial Services, and Insurance (BFSI) category is anticipated to expand quickly. Financial organizations require appliances that can communicate between sites as well as highly secure and accessible storage capabilities that can scale up and out. BFSI procedures including processing big data sets, controlling file access with encryption, and even data backup and recovery are all made easier by software-defined storage systems. For the shift to software-defined infrastructure and the closure of three data centers, Bank of America spent $300 million in 2017.

Segment Covered in the Report:

By Component

By Usage

By Enterprise Size

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2024

March 2025

February 2025