October 2024

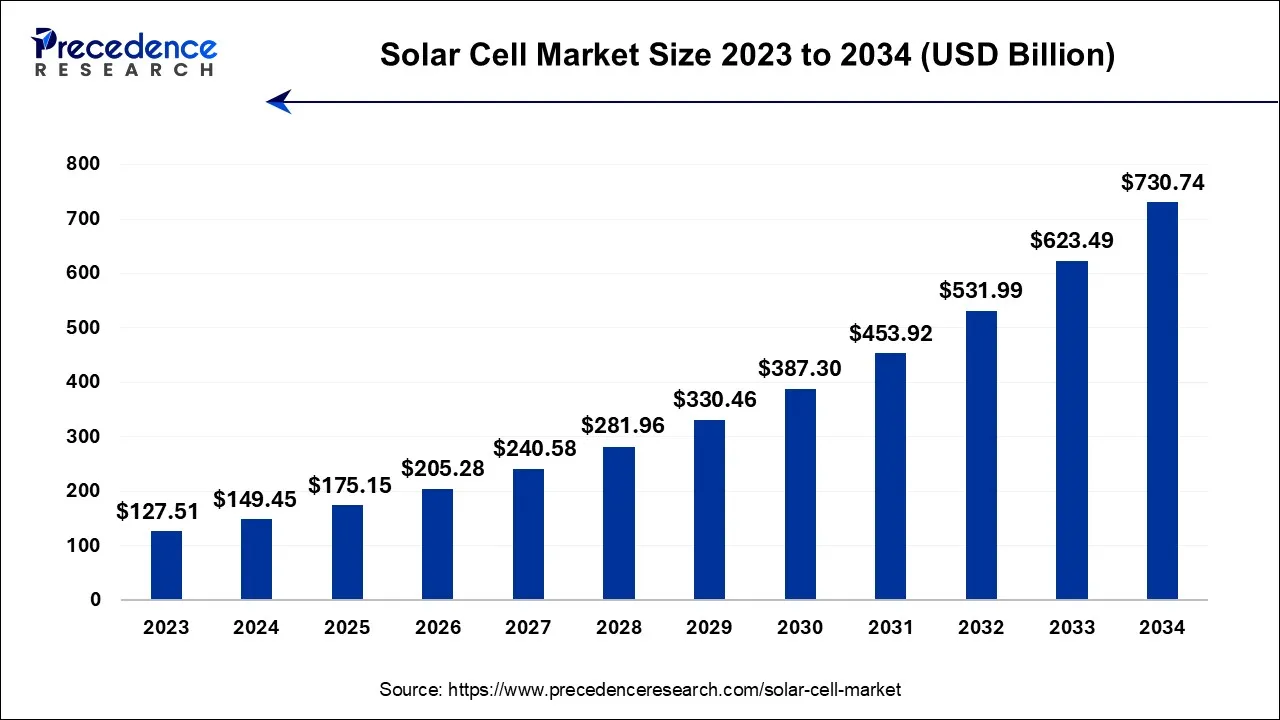

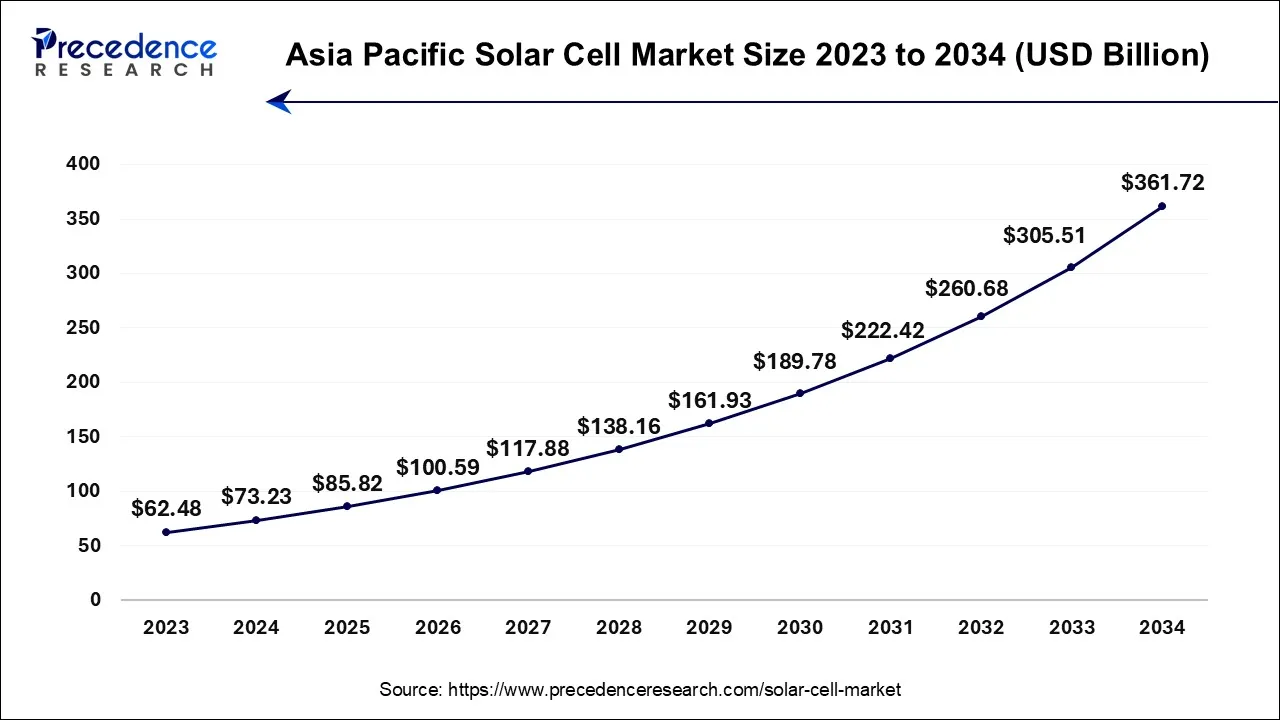

The global solar cell market size is calculated at USD 149.45 billion in 2024, grew to USD 175.15 billion in 2025, and is predicted to hit around USD 730.74 billion by 2034, representing a healthy CAGR of 17.2% between 2024 and 2034. The Asia Pacific solar cell market size accounted for USD 73.23 billion in 2024 and is anticipated to grow at the fastest CAGR of 17.32% during the forecast year.

The global solar cell market size is expected to be valued at USD 149.45 billion in 2024 and is anticipated to reach around USD 730.74 billion by 2034, expanding at a CAGR of 17.2% over the forecast period from 2024 to 2034. Due to the growing worries about rising carbon footprints worldwide and the efforts of policymakers to adopt cleaner fuels & technologies throughout the residential, industrial and commercial sectors, solar cells are predicted to experience significant growth over the forecast period.

The Asia Pacific solar cell market size accounted for USD 73.23 billion in 2024 and is projected to be worth around USD 361.72 billion by 2034, poised to grow at a CAGR of 17.32% from 2024 to 2034.

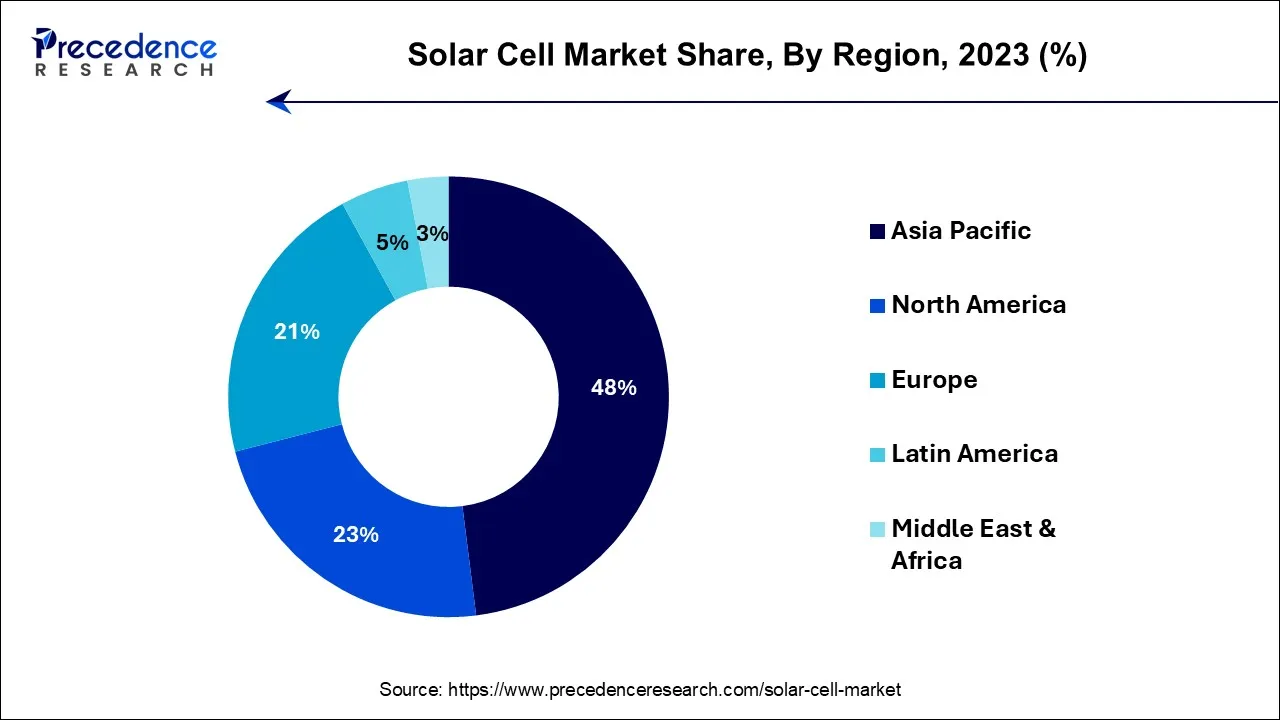

In 2023, Asia Pacific demand for solar cells exceeded 48% of the installed capacity worldwide. Over the projected period, growth is anticipated to be boosted by the availability of favorable government regulations and incentives related to PV installations. The market is anticipated to be driven by rising demand for these cells in the commercial and utility sectors. Over the projection period, declining PV prices are anticipated to expand the market for crystalline silicon modules. Furthermore, the demand for thin film solar cells in residential and commercial applications is anticipated to rise as a result of technical developments aimed at enhancing operational efficiency.

In 2023, it was anticipated that North America's solar cell demand exceeded 20 GW. The industry is anticipated to gain from an increase in PV installations as a result of consumers' growing knowledge of the financial advantages of renewable energy systems in this area. However, a lack of federal incentives and subsidies after 2016 is anticipated to result in fewer installations from the residential and commercial sectors, which is anticipated to impede growth. Chinese PV companies are aggressively entering growing markets by acquiring international manufacturers and constructing factories abroad, favorably affecting the size of the solar cell industry. By 2023, the Indian government wanted to generate 40 GW of electricity using solar technology. The market share will increase with increased government programs and investment in sustainable energy.

The growing use of renewable energy sources because of their advantages for the environment and rising power demand is predicted to drive market expansion. Demand is anticipated to increase as a result of technological developments aimed at lowering manufacturing costs and enhancing performance effectiveness. Over the next seven years, growth is anticipated to be fueled by increased demand for clean, dependable, and environmentally friendly energy sources that will help reduce reliance on fossil fuels.

Over the course of the projection period, the sector is anticipated to benefit from a number of policies and incentives provided by various governments to boost the usage of solar systems. The usage of renewable energy sources is anticipated to increase during the next seven years as a result of strict regulatory requirements to reduce the environmental effects. Several programs were launched by the different governments to promote industrial expansion, including tax breaks, subsidies, net metering, financial aid, reduced import duties, and feed-in tariffs. Due to the increased demand for PV systems for industrial, residential, and utility applications, the solar cell market is anticipated to have considerable development throughout the projected period. Integration across the value chain is a distinguishing feature of the sector, as demonstrated by firms like SunEdison, First Solar, and SolarWorld.

Future solar energy penetration will be aided by the growing need for distributed energy-generating systems in emerging countries. More than 1 billion people worldwide lack access to electricity or have it insufficiently. Solar PV systems linked with off-grid electrification initiatives will increase product demand in the short future. Technological progress and expanding production capacity will lead to a decrease in the overall cost of the product system, which might be advantageous to the sector. The expansion of the solar cell industry will be further supported by an increase in the number of household energy storage systems incorporating solar PV charging panels.

| Report Coverage | Details |

| Market Size in 2024 | USD 149.45 Billion |

| Market Size by 2034 | USD 730.74 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 17.2% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Product, Technology, Installation Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The market for solar energy is increasing

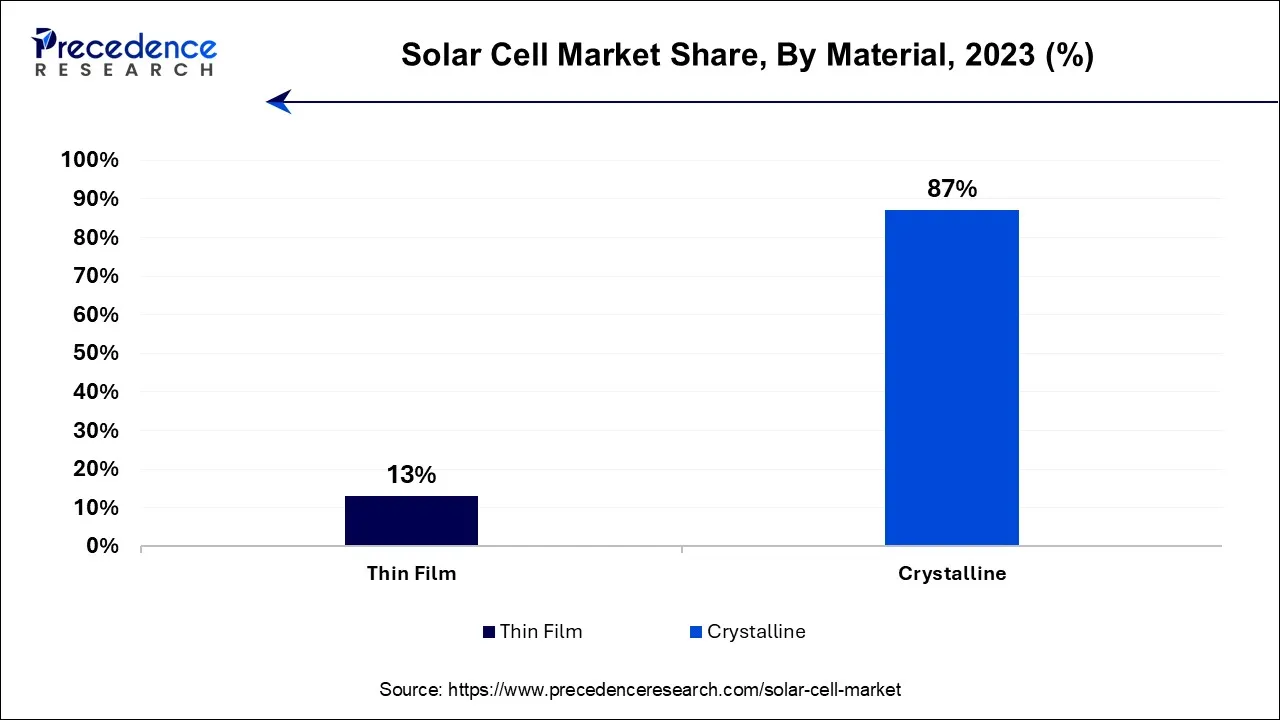

The most popular solar cell material used worldwide is crystalline silicon. Due to their widespread availability and relatively low price, these are expected to rise significantly throughout the projected period. When tested under typical operating settings, crystalline silicon cells may achieve energy conversion efficiencies of 18-22%, which will advance the spread of the technology.

Additional benefits provided by N-type cells include reduced energy losses and resilience to boron-oxygen flaws, which will help the market for crystalline silicon material develop.

Monocrystalline cells are produced utilizing a single crystal growing process, which lowers the entire unit cost and makes them significantly more economical than other options. They give a commercial efficiency of 20% to 24%. These units complement recent product deployment by offering high efficiency, durability, great embedded energy, and less operational costs. Additionally, advantageous programs and incentives are being introduced by regulators throughout the world to support solar technology, which is further positioned to boost industry growth globally during the prediction period. From 2023 to 2032, multi-crystalline silicon cells are anticipated to increase at the quickest rate, exceeding 25.0%. Market expansion is anticipated to be fueled by technological manufacturing process simplicity that results in reduced production costs compared to competitors. Additionally, rising demand for these cells is anticipated throughout the projection period due to reduced beginning costs and higher efficiency in both residential and commercial applications.

To decrease solar cell efficiency loss, industry participants are concentrating on micro features like crystallization and individual solar cell production procedures. Multi-crystalline solar cells developed by the German Research Centre Fraunhofer ISE are remarkably efficient, converting 22.3% of incoming solar energy into electricity.

The deployment of effective alternatives drove the BSF segment's USD 3.9 billion revenue in 2023. Major firms in the sector are willingly investing in Research and Development operations to create cutting-edge solar goods to obtain a competitive advantage, so enhancing the outlook for the company. These units are painted black to absorb sunlight, reflecting low light and providing more energy than painted cells that are often seen in buildings.

Segments Covered in the Report

By Material

By Product

By Technology

By Installation Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

April 2025

June 2025

August 2024