October 2024

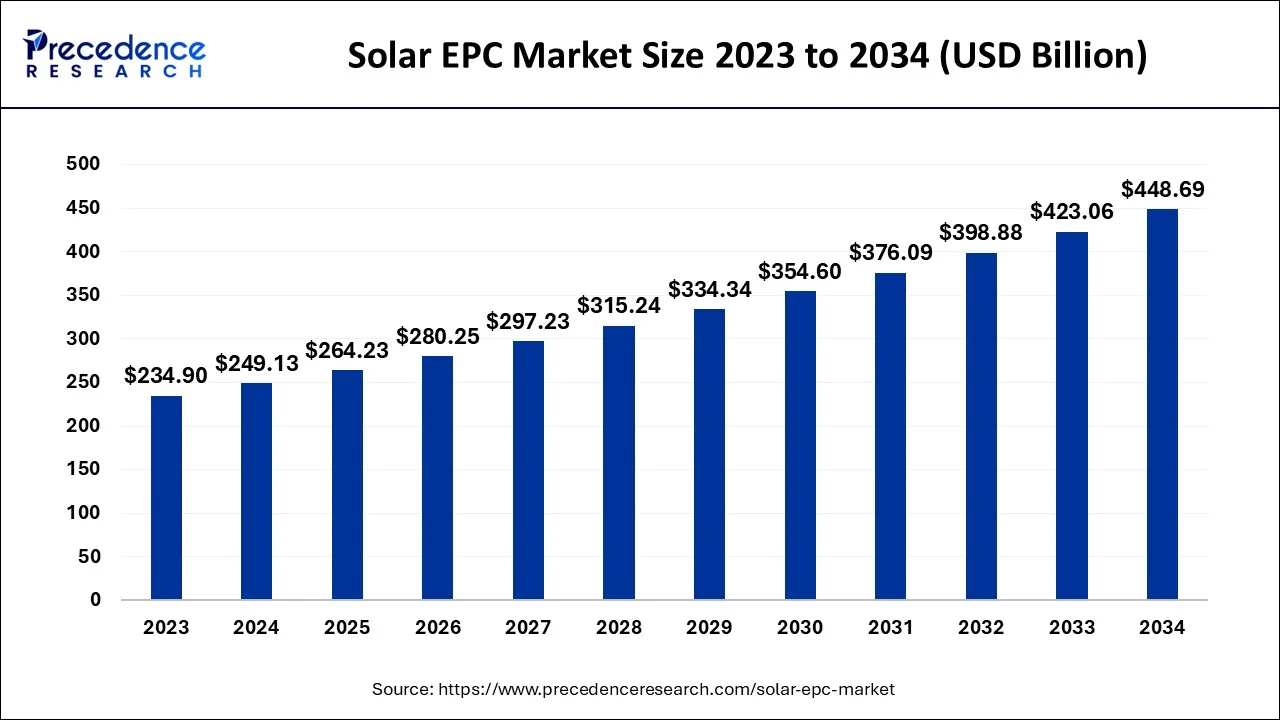

The global solar EPC market size accounted for USD 249.13 billion in 2024, grew to USD 264.23 billion in 2025 and is projected to surpass around USD 448.69 billion by 2034, representing a healthy CAGR of 6.06% between 2024 and 2034.

The global solar EPC market size is estimated at USD 249.13 billion in 2024 and is anticipated to reach around USD 448.69 billion by 2034, expanding at a CAGR of 6.06% between 2024 and 2034.

Growing environmental concerns, as well as stringent regulatory mandates to reduce GHG emissions, are fueling the development of the Solar EPC Market. EPC is used to provide end-to-end solar services such as system design, component procurement, as well as project installation. Engineering design involves customer requirement analysis, site survey, weather monitoring, structural design, determining power generation capability, equipment selection, engineering design, and 3D modeling of the proposed solar power plant.

The growth factor, such as favorable government plans, which include investment tax credits, tax rebates, and FiT, along with the rising environmental concerns to limit GHG emissions, are projected to propel the Solar EPC industry. Furthermore, rising demand from end-user industries such as commercial, residential, industrial, utility, and institutional is also projected to propel the Solar EPC Market.

| Report Coverage | Details |

| Market Size in 2024 | USD 249.13 Billion |

| Market Size by 2034 | USD 448.69 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.06% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By End-User and By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Concerns regarding fuel demand are growing

Due to the ongoing debate over the degradation of the environment, the worldwide solar EPC industry has gained significant traction. Significant increases in consumer environmental issues, as well as the adoption of different stringent rules to lower greenhouse gas (GHG) emissions, forced organizations to implement impactful energy-saving methods such as solar EPC. Considerable improvements and modifications, as well as enhanced cost, are expected to benefit the market in the coming years.

Rising electricity demand

Global power consumption increased considerably as a result of growth in population and economic activity. The rising standard of living and infrastructure development is driving the requirement for power generation. To meet rising demand, most countries are constructing new solar power plants or widening the capacity of currently operational ones. This is expected to encourage the growth of the solar power sector, generating potential for key players in the solar EPC market over the forecast period.

Investment, as well as a lack of facilities, continue to pose a risk to market expansion

The overall expenditure for solar PV is greater than the expense of installing routine solar panels, which may limit its approval in residential houses with low energy demands. For instance, 15 ground-mounted 300-watt solar panels would cost USD 14,625. With each solar panel costing an additional USD 500 due to the solar structure, the solar power generation structure is used less frequently. Furthermore, a shortage of facilities is a barrier to investment in this market. Lack of knowledge regarding the advantages of solar PV over primary grid electricity in countries like Asia-Pacific and Europe may hinder market expansion.

As solar tariff barriers fall, large IPPs and incorporated utilities are likely to invest in internal EPC capabilities in order to improve the project economy, boosting the percentage of industries with in-house EPC features. This changing industry trend may result in the consolidation of the Solar EPC market. As a result, stand-alone EPC companies are anticipated to merge with larger players or incorporate into full project developers and power producers. Furthermore, the rise of automation technology has resulted in leaner operations, resulting in higher initial capital costs but larger savings over the project's lifetime. Due to the growing usage of information technology in the solar energy sector, automation is going to have to be included as a key component.

The rooftop segment is anticipated to grow at the highest CAGR from 2024 to 2034. The rooftop sector is projected to be in high demand since it receives a greater quantity of solar power than ground mounted. Solar EPC rooftop segment involves several steps, including site assessment, system design, equipment procurement, installation, and commissioning. Rooftop solar installations have become increasingly popular in recent years due to the declining cost of solar panels, government incentives, and increasing environmental awareness. These installations provide numerous benefits, including lower electricity bills, reduced carbon emissions, and increased energy independence.

The ground-mounted sector is expected to expand at the fastest CAGR from 2024 to 2034. A ground-mounted solar energy system is installed on the ground rather than on a rooftop. Ground-mounted solar systems offer several advantages over rooftop systems, including the ability to install larger systems, improved energy production due to optimal panel orientation and tilt, and easier maintenance and cleaning. Ground-mounted solar systems are typically larger in size and capacity than rooftop systems and are often used for utility-scale or commercial projects.

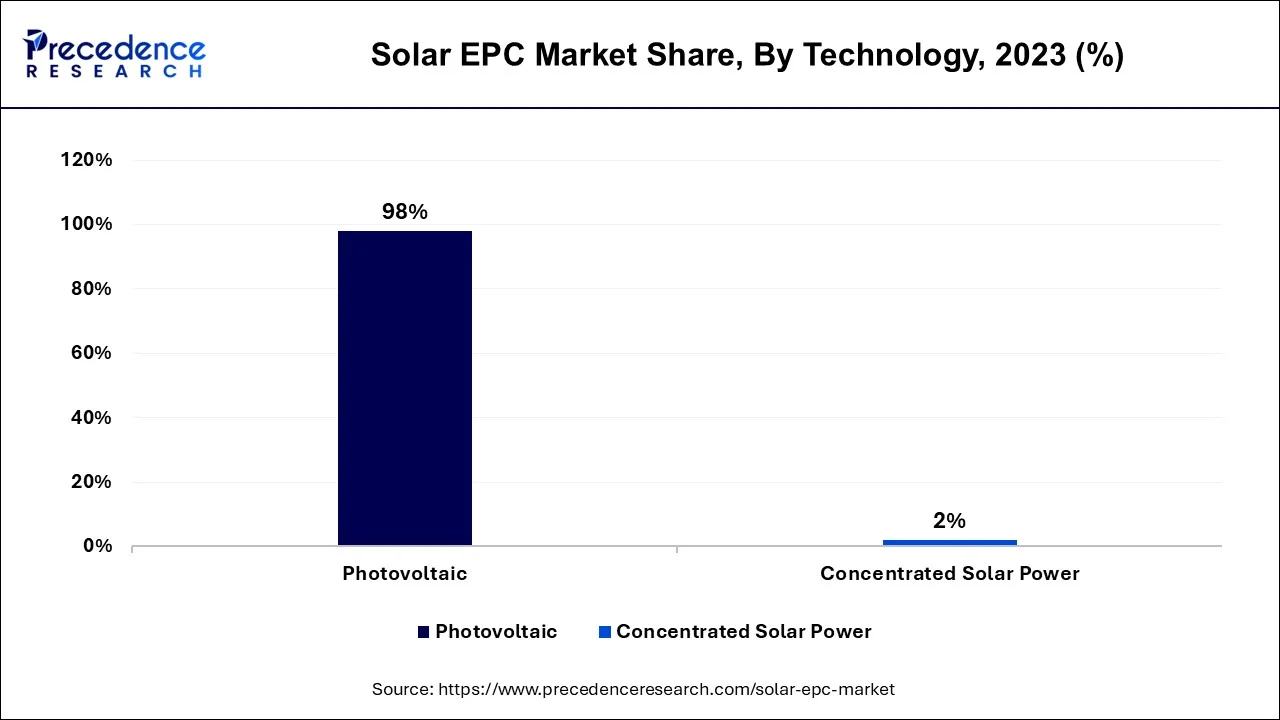

The photovoltaic sector held a maximum market share in 2023, and this trend is expected to continue during the projected period due to ongoing initiatives and growth in the energy sector. Photovoltaic technology converts sunlight into electricity by using a semiconductor material, such as silicon, to create an electric field. When sunlight hits the semiconductor material, it releases electrons, which are captured and used to generate electricity. Solar EPC (Engineering, Procurement, and Construction) refers to the process of designing, procuring, and building solar power plants or solar energy systems. These are widely used due to their adoption in various industrial sectors.

The concentrated solar power sector is anticipated to expand at the fastest CAGR from 2024 to 2034. CSP installation is expected to increase in the solar EPC industry because of greater efficiency, lower operating expenses, installation simplicity, and lower carbon emissions. Furthermore, a significant decrease in the price of plant components due to tax and duty revisions or improvements has impacted technological deployment. Ongoing manufacturing trends have encouraged solar deployments around the world, which is expected to boost product demand even further.

Due to the favorable regulatory scheme as well as rapid technological advancement, the residential sector is projected to expand rapidly in this industry from 2024 to 2034. The residential segment of solar EPC involves installing solar energy systems in residential buildings, such as single-family homes, townhouses, and apartments. The residential segment of solar EPC is gaining popularity as more homeowners are looking to reduce their energy bills and carbon footprint. The solar energy systems installed in residential buildings typically include solar panels, inverters, and a monitoring system.

The solar panels are installed on the roof of the building or in a location with optimal sunlight exposure. The inverters convert the direct current (DC) power generated by the solar panels into alternating current (AC) power that is used in the home or fed back into the grid. The monitoring system allows homeowners to track the performance of their solar energy system.

The commercial sector is anticipated to grow at a remarkable pace from 2024 to 2034. Solar EPC for a commercial project involves several steps, including site assessment, design and engineering, procurement, installation, commissioning and testing, and ongoing monitoring and maintenance. Working with an experienced solar EPC contractor is crucial to ensure the successful installation and long-term performance of a commercial solar power system.

North America is expected to be an important region for the Solar EPC Market during the projected period. As one of the industrialized regions, the energy and power sectors are critical to the operations of many companies in this region. This is one of the key elements driving the Solar Engineering, Procurement, and Construction (EPC) Market in these areas. The solar EPC segment in North America is highly competitive, with many companies vying for a share of the growing market. Some of the top solar EPC companies in North America include First Solar, SunPower, Swinerton Renewable Energy, and Mortenson. These companies provide turnkey solar solutions, from design and engineering to procurement and construction.

During the projected period, Asia Pacific is expected to be one of the fastest-growing regions for the Solar Engineering, Procurement, and Construction (EPC) Market. The demand in this region is anticipated to be driven by several of the fastest emerging markets and the rising need for power and energy to support a large population and numerous industries. India and China are expected to have significant demand during the projected period.

Segments Covered in the Report:

By Type

By End-User

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

August 2024

January 2025

August 2024