October 2024

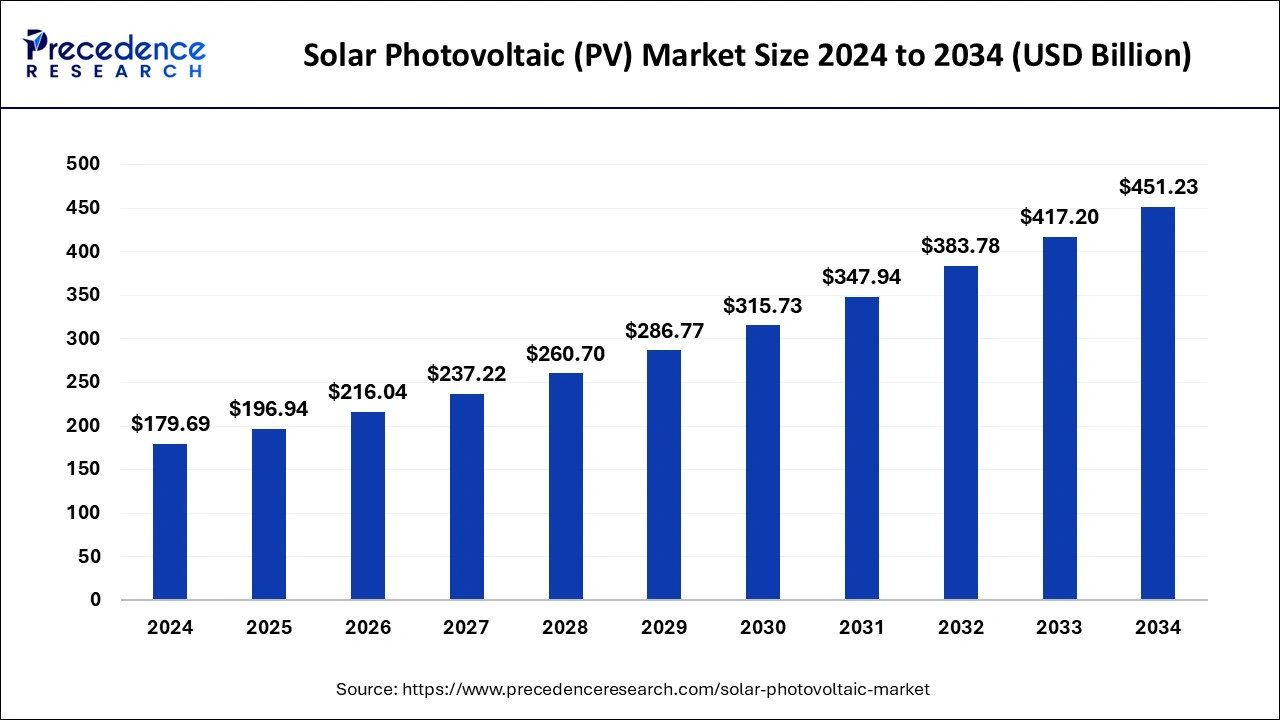

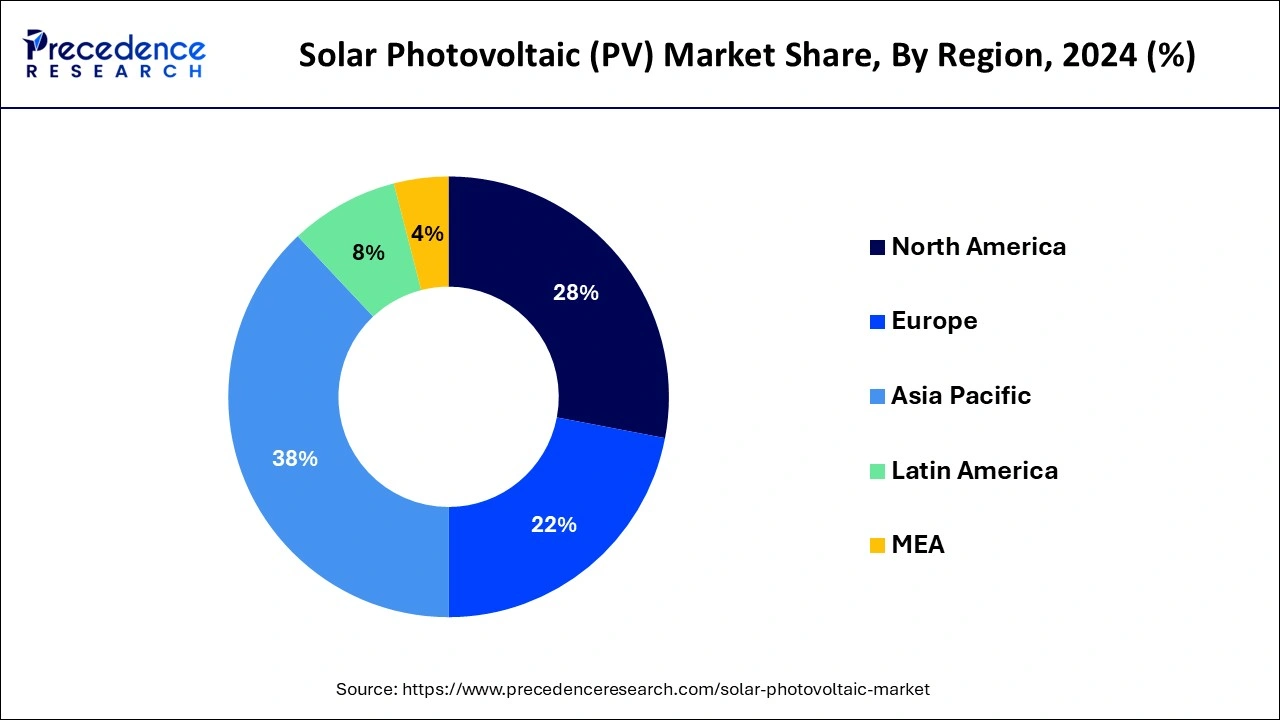

The global solar photovoltaic (PV) market size is accounted at USD 196.94 billion in 2025 and is forecasted to hit around USD 451.23 billion by 2034, representing a CAGR of 9.64% from 2025 to 2034. The North America market size was estimated at USD 68.28 billion in 2024 and is expanding at a CAGR of 9.65% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global solar photovoltaic (PV) market size was calculated at USD 179.69 billion in 2024 and is predicted to reach around USD 451.23 billion by 2034, expanding at a CAGR of 9.64% from 2025 to 2034. The solar photovoltaic (PV) market is driven by government incentives and policies, such as tax credits, subsidies, and renewable energy mandates.

AI is an emerging technology in weather and solar generation forecasting. Its algorithms help determine meteorological information to create precise forecasts, excelling solar output. This helps solar operators better plan and mitigate the effect of intermittent energy supply.

Moreover, it enhances reporting and data querying speed and efficiency through advanced chat interfaces. Energy management platforms integrate human-in-the-loop intelligence and natural language processing (NLP) into their systems.

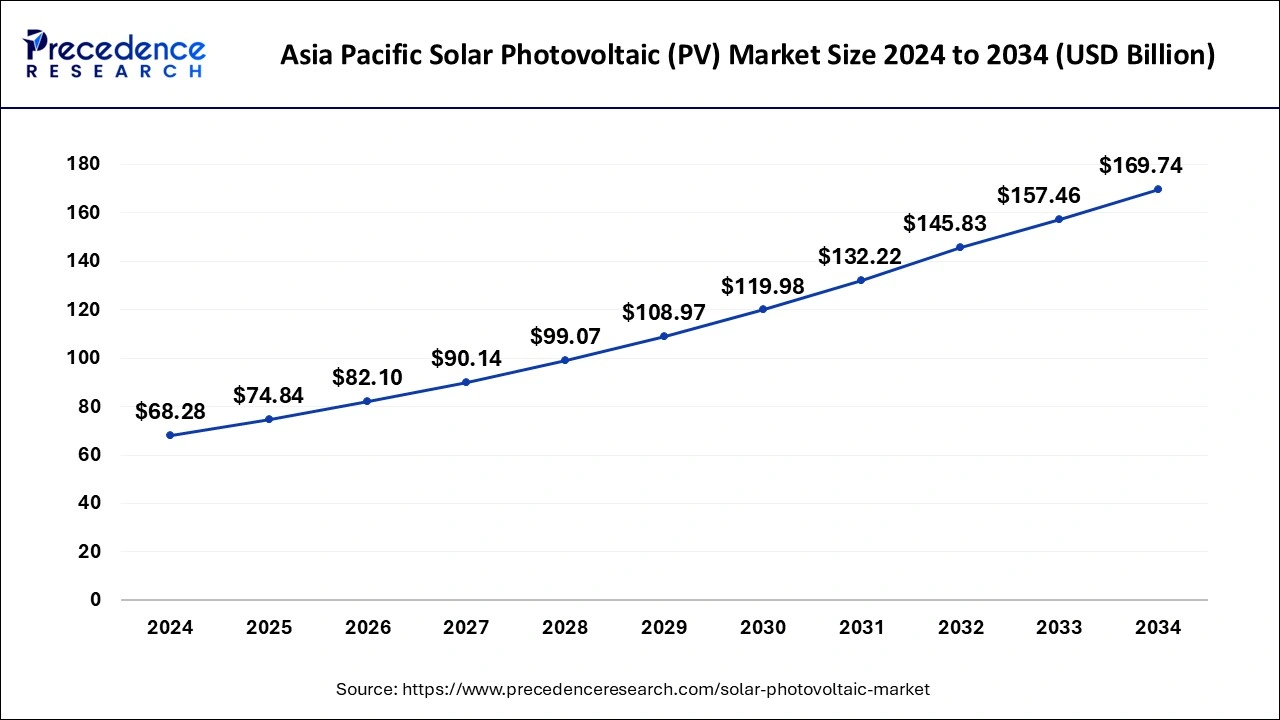

The Asia Pacific solar photovoltaic (PV) market was exhibited at USD 68.28 billion in 2024 and is projected to be worth around USD 169.74 billion by 2034, growing at a CAGR of 9.65% from 2025 to 2034.

Asia Pacific dominated the solar photovoltaic (PV) market in 2024. The fast development of solar farms as well as favorable laws is driving the solar photovoltaic (PV) market’s expansion. The deployment of sustainable power technologies such as solar photovoltaic (PV) will be aided by government actions to properly meet expanding electricity demand.

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The increased demand for more power generation capacity as well as continued international engagement, favorable foreign direct investments, and the establishment of capacity quota targets, will have a beneficial impact on technological acceptability.

Solar photovoltaic (PV) is a simple technique that uses sunshine to generate electricity without moving parts. The sunlight separates electrons from their host silicon atoms in a photovoltaic cell. The photons are tiny packets of light energy collected by electrons, providing enough energy to propel the electron away from its high atom. The favorable government schemes and incentives, including tax exemptions and tariffs, will strengthen the commercial outlook as well as continued technology advancements and growing consumer and regulatory predisposition toward clean energy sources. The reduced solar energy prices, along with more financial support, will help the solar photovoltaic (PV) market to flourish. The product acceptance will be aided by broad resource availability and cost-effectiveness, as well as increased industry potential.

Various regulatory measures, including asset and financial leveraging, subsidies, and other financial tools, will be implemented to increase product acceptability. Furthermore, the implementation of many solar photovoltaic (PV) installation targets, as well as a shift in focus to reduce carbon emissions, would propel the solar photovoltaic (PV) market growth during the forecast period.

| Report Coverage | Details |

| Market Size in 2025 | USD 196.94 Billion |

| Market Size in 2034 | USD 451.23 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.64% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The polycrystalline silicon solar photovoltaic (PV) will be widely adopted in near future due to their inexpensive production costs and simple manufacturing procedures. Furthermore, the product’s broad applicability across large scale solar power projects as well as federal renewable energy integration mottos, will drive the demand for solar photovoltaic (PV) on large scale. Moreover, the solar photovoltaic (PV) market will be enhanced by the lowered pricing structure coupled with tax credit schemes to support solar photovoltaic (PV) technology.

In recent years, the solar sector has seen a number of rapid technological advancements. The photovoltaic is a relatively new solar material with a favorable crystal structure for sunlight absorption. The solar photovoltaic (PV) cells also perform better than silicon cells at lower light intensities such as on rainy days, allowing for higher conversion rate. The fundamental advantage of using photovoltaic (PV) to make solar cells is that it is a cheap and readily available material that might create low-cost solar power. The solar photovoltaic (PV) cells may also be made in very thin layer structures with high degrees of transparency, allowing them to be used in a number of unique applications such as building integrated photovoltaic projects and flexible panel designs.

However, over the projection period, the solar photovoltaic (PV) market is likely to be hampered by an increase in grid connection challenges and interconnection delays as well as insufficient grid capacity creating barrier to the construction of new solar plants.

In 2024, the monocrystalline silicon segment dominated the solar photovoltaic (PV) market. This form of solar panel is more prevalent in solar rooftop systems and is frequently utilized for large scale installations, whether they are residential, commercial, or residential.

The thin film segment, on the other hand, is predicted to develop at the quickest rate in the future years. The thin-film technology has always been less expensive than traditional technology, but it has also always been less efficient. Nevertheless, over the period of time, it has vastly improved.

The ground-mounted segment dominated the solar photovoltaic (PV) market in 2022. Due to increased efficiency, the quantity of installations, ground mounted solar for utility or commercial projects, maintenance and operation efficiencies are quite cost-effective.

The rooftop is fastest growing segment of the solar photovoltaic (PV) market in 2020. When compared to traditional energy sources, the solar rooftop model poses extremely little pollution threats to the environment.

In 2024, the on-grid segment dominated the solar photovoltaic (PV) market. An on-grid solar photovoltaic (PV) system is one that is connected to the utility grid and uses solar power to generate electricity. The small domestic systems to massive utility scale solar power plants are all examples of these systems.

The off-grid segment, on the other hand, is predicted to develop at the quickest rate in the future years. In emerging and remote regions, the use of off-grid solar photovoltaic (PV) systems is steadily expanding during the forecast period.

In 2024, the utility segment dominated the solar photovoltaic (PV) market. Several large-scale solar projects are now under construction around the world.

The residential segment, on the other hand, is predicted to develop at the quickest rate in the future years. This is driven by an increase in residential construction projects and a growing public awareness of the benefits of using efficient and renewable energy sources.

By Technology

By Grid Type

By Installation

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

April 2025

August 2024

January 2025