September 2024

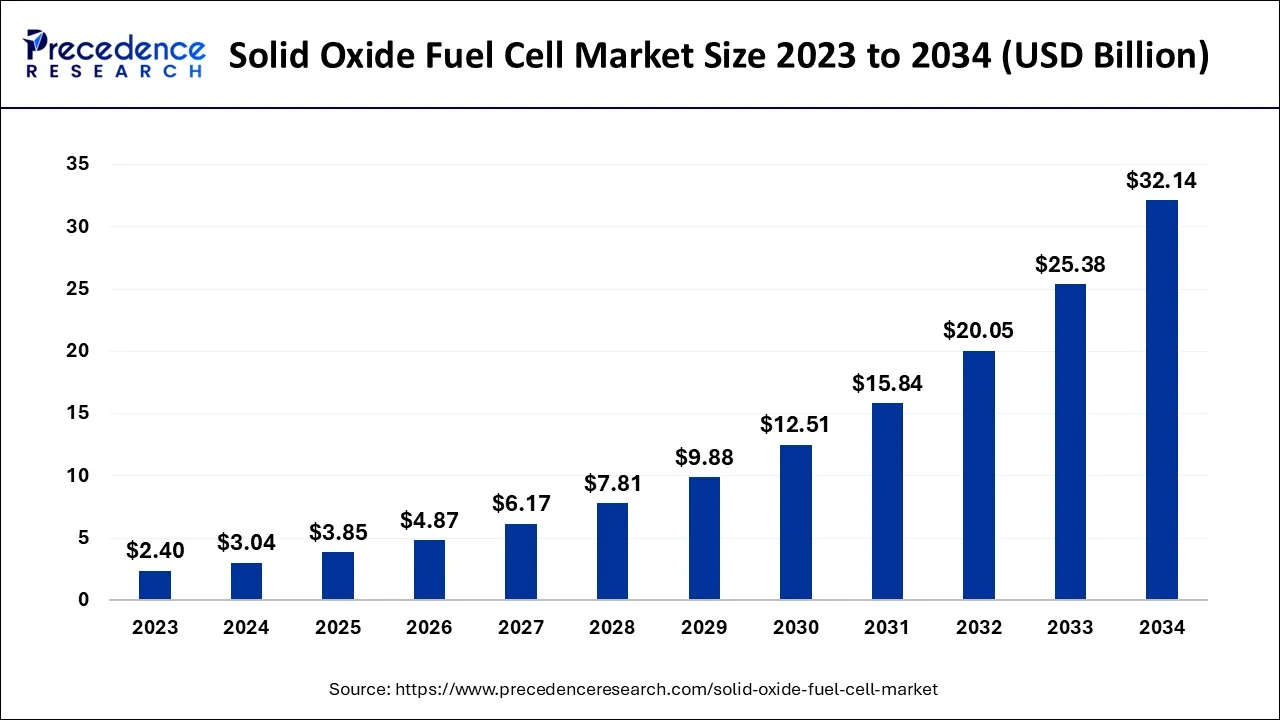

The global solid oxide fuel cell market size accounted for USD 3.85 billion in 2025 and is predicted to surpass around USD 32.14 billion by 2034, representing a healthy CAGR of 26.60% between 2025 and 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global solid oxide fuel cell market size accounted for USD 3.04 billion in 2024 and is predicted to increase from USD 3.85 billion in 2025 to approximately USD 32.14 billion by 2034, growing at a CAGR of 26.60% from 2025 and 2034.

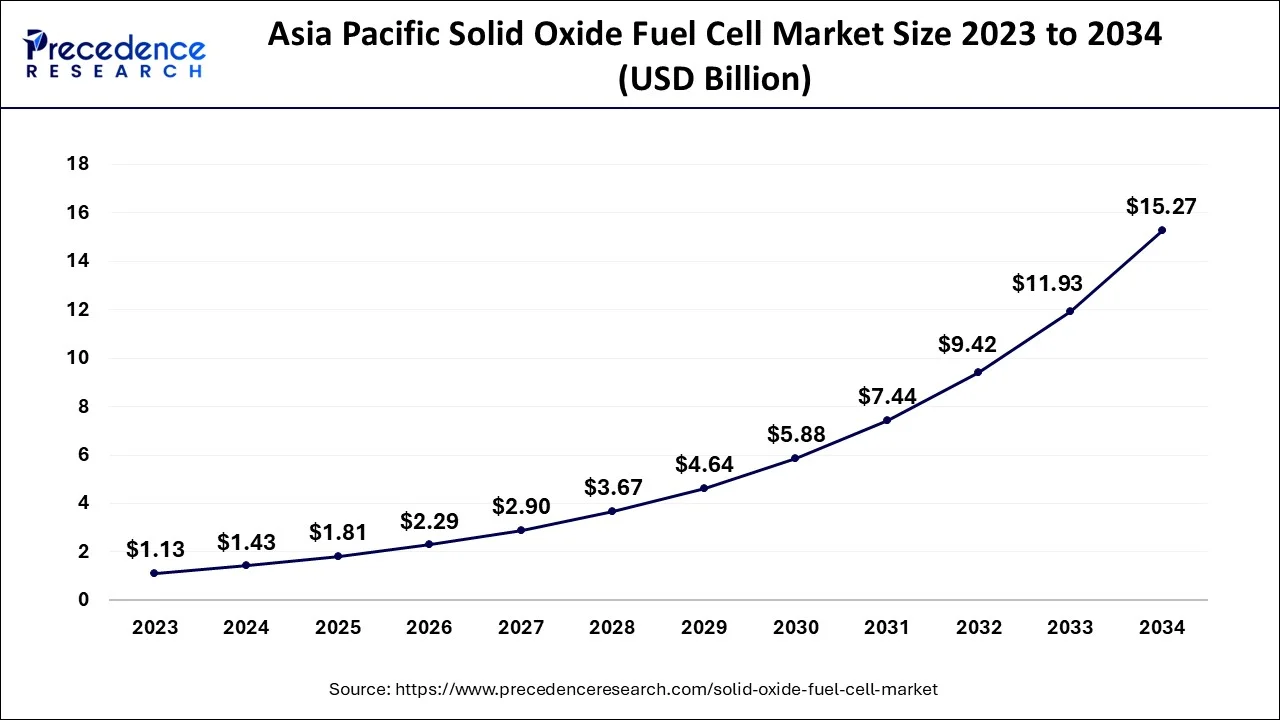

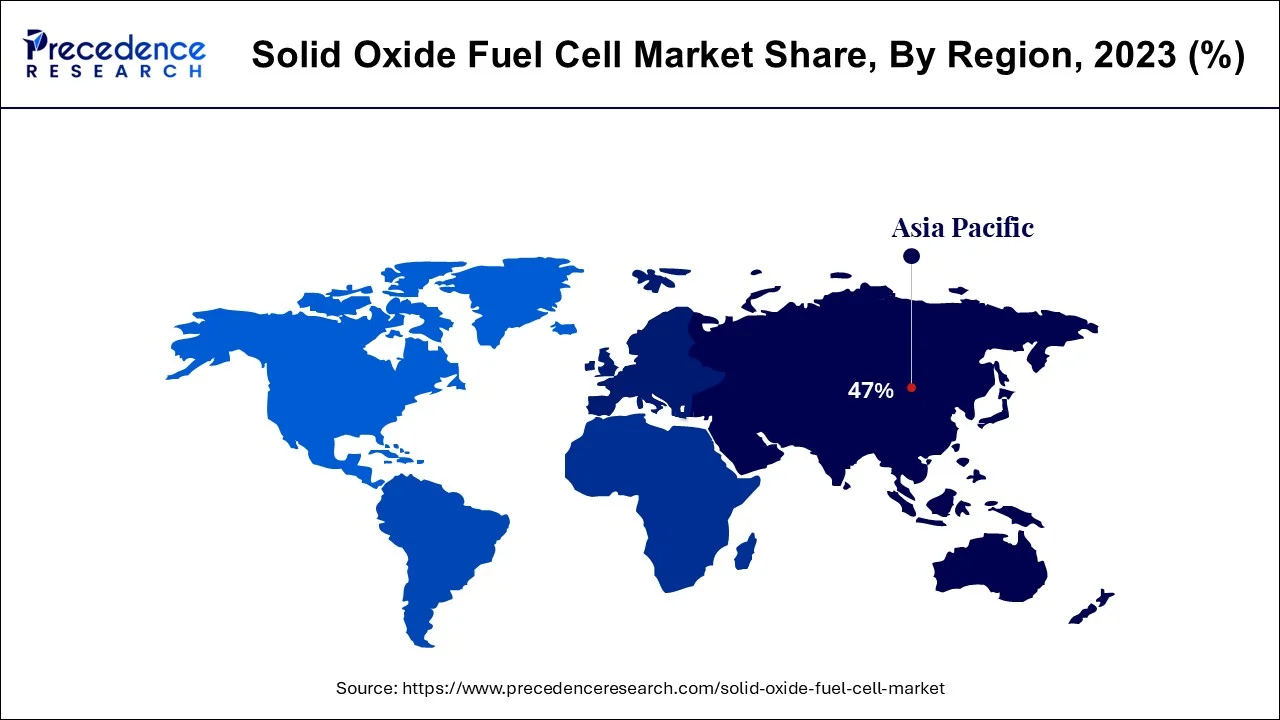

The Asia Pacific solid oxide fuel cell market size is evaluated at USD 1.43 billion in 2024 and is predicted to be worth around USD 15.27 billion by 2034, rising at a CAGR of 26.71% from 2025 and 2034.

The Asia Pacific region is the largest solid oxide fuel cell market, as well as projected to be the fastest growing region during the next decade, because of strong government support, growing industrial applications, and a robust clean energy strategy, particularly in Japan, South Korea, and China. Japan's ENE-FARM project promotes residential installations of SOFCs, and South Korea has 240 MW of fuel cell power plants, which boosts the accelerating adoption of SOFCs in the region. The ongoing demand for decentralized power generation solutions and energy efficiency systems in residential and commercial applications is leading to the increased use of SOFC technologies.

With the majority of the market as well as a respectable CAGR, "North America" largely dominated the sector. The creation of hydrogen filling stations, the rise in desire for battery automobiles, and other factors are largely responsible for this nation's expansion. Based on the IEA, there will be more than 540 hydrogen filling facilities operational globally just at the close of 2020, a rise of about 15% from 2019. In addition to that, the Non-volatile memory Power Conversion Association Programme of the Department of Energy is one of the key factors propelling development in the North American market. Because authorities of Japan, China, and South Korea are concentrating on the proper development of renewable energy, they have chosen power SOFC energy, which is predicted to expand at the greatest CAGR during the estimated timeframe.

North America hosts the fastest-growing market and will experience the largest CAGR in the solid oxide fuel cell market, driven by clean energy technologies, increased research and development (R&D) in fuel cell applications, and increasing investment that is supported by federal and private funds. In the past 12 months, both the federal and provincial governments have used their mandate to fund clean energy technologies, and we have seen anecdotal reports of funding being supported in this way. In addition, the increased use of SOFCs in data centres and backup power systems in the region is projected to evolve very quickly.

Materials like ceramics electrolytes which are suitable using energy resources are included in the partial oxidation fuels. A few characteristics of SOFC make this a highly coveted energy. The partial oxidation gasoline is temperature-resistant. This can operate between 800 and 1,000 °C, which is extreme heat. One of the main drivers of the development of the propellant battery market is a growing understanding of alternative sources of fuel.

Energy adaptability, low operating costs, and power efficiency are additional industrial customer variables. Carbon emissions produced by energy systems are a global problem nowadays. Many countries are using cutting-edge technology to handle this problem. As a result, a lot of gasoline corporations are choosing renewable energy or environment-conscious energy production. In the future years, the market for such solid-oxide fuel cells market is expected to increase due to such reasons. Government incentives also change industry trends for solid-oxide fuel cells.

The requirement for power energy production & stringent emission controls everywhere in the world could be directly linked to this rise. Because it contributes to sustainable development and provides decent energy versatility, SOFC innovation is becoming more and more popular. The sector is always monitoring fresh public and commercial endeavors to enhance technological advancements. In the upcoming years, the SOF cell market share would increase due to favorable policy and regulatory actions to increase the development of decarbonization in electricity production. For instance, the European Union had set a lengthy aim target to reduce emissions of greenhouse gases by 80–95% from 1990 levels by 2050, primarily by increasing the proportion of sources of renewable electricity in the EU's electricity sector. EU claims that partial oxidation technology like SOFC may be essential for this kind of unification. From 2021 and 2027, the industry for solid oxide cells would grow dramatically as a result of increased R&D activities supported by federal expenditures on energy storage initiatives. For example, the European Research Council's Ultra SOFC Initiative, which is supported by the EU's Horizon 2020 research and development program, intends to push the SOFC cloud computing thermal boundaries and provide new possibilities for extremely thin transportable power generators.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.85 Billion |

| Market Size in 2024 | USD 3.04 Billion |

| Market Size by 2034 | USD 32.14 Billion |

| Growth Rate from 2025 and 2034. | CAGR of 26.60% |

| Base Year | 2024 |

| Forecast Period | 2025 and 2034 |

| Segments Covered | Type, Application, End User, Region |

Government financial assistance and expanded fuel cell program R&D: One of the key determinants of the expansion of a solid oxide cell sector is the government's solar cell rules and initiatives. Energy storage programs are among the forefront in states like Delaware, California, and Connecticut, which also provide incentives and assistance for hydrogen fuel deployments, resulting in SOFC as well as other fuel infrastructure in the United States. The Identity Incentive System of California provides incentives for producers to assist current, newer, and emergent decentralized electricity production. The program has now been expanded, with the most recent change becoming a seminar on SGIP Renewable Power hosted by the Power Department.

The global market for SOFC is positively impacted by the desire for renewable energy: Another element that raises the need for the industry is understanding sustainable SOFC power. The natural gas industry is being developed at an accelerating rate. The solid-oxide fuel cells' economic outlook has fundamentally changed as a result of these issues. To supply constant energy, it is incorporated into the current fuel infrastructure. There are several business and industrial uses for SOFC energy. Every fuel mixture will work with that too. Partial oxidation fuels do not generate any carbon pollution. Government backing and the necessity for sustainable energy globally are thus the main drivers propelling the SOFC industry.

High operational heat and the SOFC's long start-up times: In comparison to other electrochemical devices, SOFC takes a greater time to get started. Because SOFCs are technologically advanced, they take longer to start up because they need to achieve the essential thermal performance before they can operate at full efficiency. Additionally, a SOFC's functioning generates a lot of energy that is released into the environment, which considerably raises the requirement for effective thermal insulation and eventually adds to the mass of the device. Those are the primary factors contributing to SOFC's low market penetration in transportable and disaster high power applications. The process of creating SOFC devices with quicker start rates has just begun. Organizations like Sunfire, SOLID Power, and Bloom Energy were presently making R&D investments to address the technical issues related to SOFC.

The SOFC operation's start-up time is longer: When compared to certain other energy sectors, the SOFC firm's startup time is longer. It takes longer for the element to achieve the essential working temperature because it's an elevated element. Therefore, longer starting times are necessary for the energy to operate and run at its maximum capacity.

Extreme heat emissions when the operation is underway: When operating, the SOFC emits a tremendous volume of heat into the environment. Inordinate insulation is needed to manage the temperature. The thick thermal insulation helps make a solid oxide fuel heavier. The SOFC is much less popular in transportable and power supply systems as a result of these reasons. Such performance problems are significant obstacles for the whole SOFC sector.

End users' increasing utilization in data centers and the military sector: The end-user need offers the SOFC market tremendous growth potential. The main end customers with the highest energy usage are computed clusters. They are indeed the ones using SOFC power that are expanding the quickest. The uninterrupted supply of electricity also is necessary again for visualization tools' proper operation and the avoidance of losing data. The SOFC is just a source of energy that satisfies all criteria for cloud services. Additionally, a cost-effective energy supply is needed for the data centers because of their high electricity usage. The industry has enormous room to grow as a result of SOFC usage by cloud services.

SOFC marketplace in the military segment: A significant market of SOFCs seems to be the governments, where fixed and mobile SOFC power output is rising. A market opportunity for SOFC exists within this industry as well, given the need for efficient & noise-free power generation for military uses. This is projected that SOFC moveable technology used in military applications will progress as the likelihood of this company's continuous growth increases.

In 2023, the "Linear" sector had the biggest market share of almost 60.5%, and it is projected that it would continue to rule throughout the allotted time frame. It is because building it was a lot simpler procedure. The ceramics solar cell module in the Flat kind of SOFCs were arranged one on top of another, resembling a baguette with just an electrolyte layered in between electrodes. The SOF cells market has been dominated by the flat category. Due to the square shape and very simple building procedure, the development is obvious. The ceramics fuel cell module is normally placed one of these on top of the next in a sandwich-style arrangement with the electrolytes placed between both the poles in flat solid oxide cells.

In 2023, the "Stationary" sector of the market prevailed with a customer base of almost 81%. The increased interest in liquid fuels fueled by protons for the production of backup generators is the main reason for the expansion of this market. Among the purest and also most effective methods of producing energy and heat is a fixed solid oxide fuel cell containerized applications. Three major factors net energy effectiveness, total effectiveness inside the event of energy conversion, and robustness are used to evaluate how well such systems function.

According to use, the static business market is anticipated to be the biggest during the projected timeframe. The growing emphasis on hydrocarbon liquid fuels as a source of electrical batteries is what is driving the expansion of the stationary market. Because the authorities of China, South Korea, and Japan are placing a high priority on utilizing green energy and have chosen to build power SOFC energy plants, the fixed sector of the market in Asia-Pacific is anticipated to develop at the fastest CAGR throughout the forecast period.

In 2023, the "Commercial & Industrial" sector had the highest end-user proportion of the market, accounting for over 48% of the total. This is a result of the steadily increasing need for SOFCs for industrial and commercial uses.

By Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

December 2024