November 2024

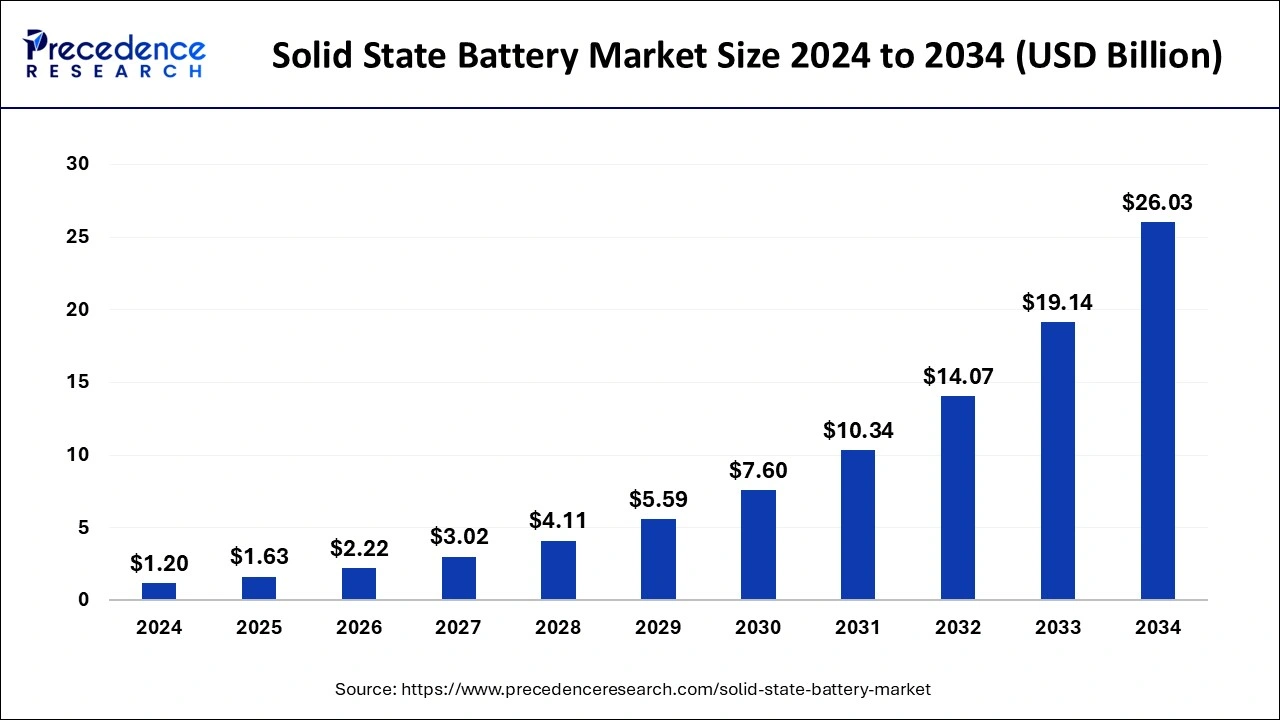

The global solid state battery market size is calculated at USD 1.63 billion in 2025 and is forecasted to reach around USD 26.03 billion by 2034, accelerating at a CAGR of 36.03% from 2025 to 2034. The Asia Pacific solid state battery market size surpassed USD 880 million in 2025 and is expanding at a CAGR of 36.06% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global solid state battery market size was estimated at USD 1.20 billion in 2024 and is anticipated to reach around USD 26.03 billion by 2034, expanding at a CAGR of 36.03% from 2025 to 2034.

AI plays a prominent role in the battery industry. Nowadays, most of the battery companies have invested huge amount for integrating AI in their manufacturing facilities for developing high-grade batteries in less amount of time. In solid state battery industry, AI-based platform helps in enhancing battery performance by optimizing charging methods, predicting battery health, and extending battery life. Moreover, AI helps in designing of solid-state batteries according to the requirement of the users. Thus, the adoption of AI in solid state battery industry plays a transformative role in shaping the industry in a positive direction.

Increasing Research and Development Activities Propels the Market Expansion

Due to increased research and development activities linked to solid state batteries, the market for solid state battery is growing at a rapid pace. The high adoption of solid-state battery in electric vehicles, expanding application scope of solid-state battery in diverse industries, mass production of electronic devices and equipment, and increasing deployment of internet of things to promote solid state battery adoption, as well as the incorporation of light weight and flexible batteries in digital wearable devices, are all the factors fueling the growth of the global solid state battery market during the forecast period.

Presence of Alternatives Restrains the Industrial Growth

The alternatives or substitutes for the solid-state batteries are graphene batteries, fluoride batteries, sand batteries, ammonia-powered batteries, and lithium-Sulphur batteries. The fluoride batteries can last up to eight times as along as solid-state batteries. The new type of battery is lithium-ion battery that employs silicon instead of graphite to reach three times the performance of current graphite li-ion batteries. The battery is still lithium-ion, like those used in smartphone, but the anodes are made of silicon rather than graphite. All these batteries are restricting the growth of the solid-state battery market over the projection period.

Rapid Investment in Solid State Batteries Industry to Shape the Future

The solid-state battery industry has gained serious attention in recent times. These batteries are useful for numerous applications in different end-user industry due to several benefits such as high energy density, space efficiency, high charging speed and some others. Also, this battery technology is considered safer than other traditional batteries. Thus, battery manufacturers and government of several countries have invested rapidly for developing solid-state batteries for gaining maximum consumer attraction in the upcoming future.

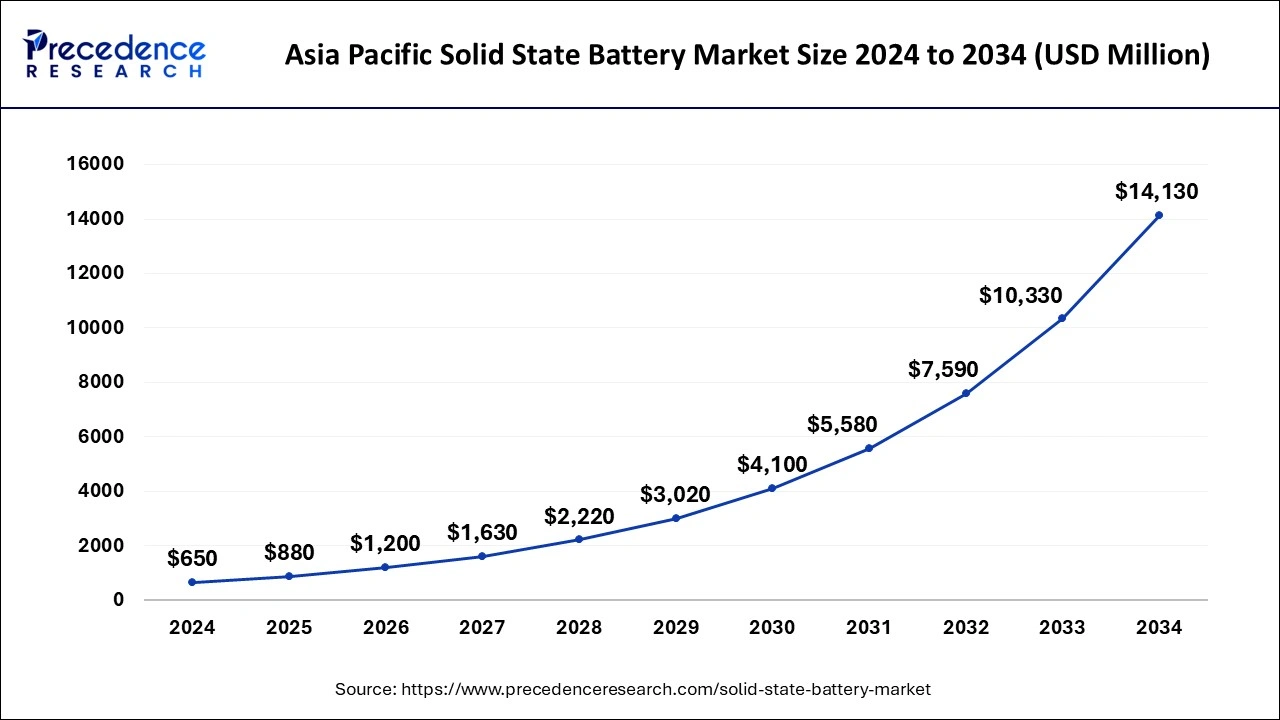

The Asia Pacific solid state battery market size was evaluated at USD 650 million in 2024 and is predicted to be worth around USD 14130 million by 2034, rising at a CAGR of 36.06% from 2025 to 2034.

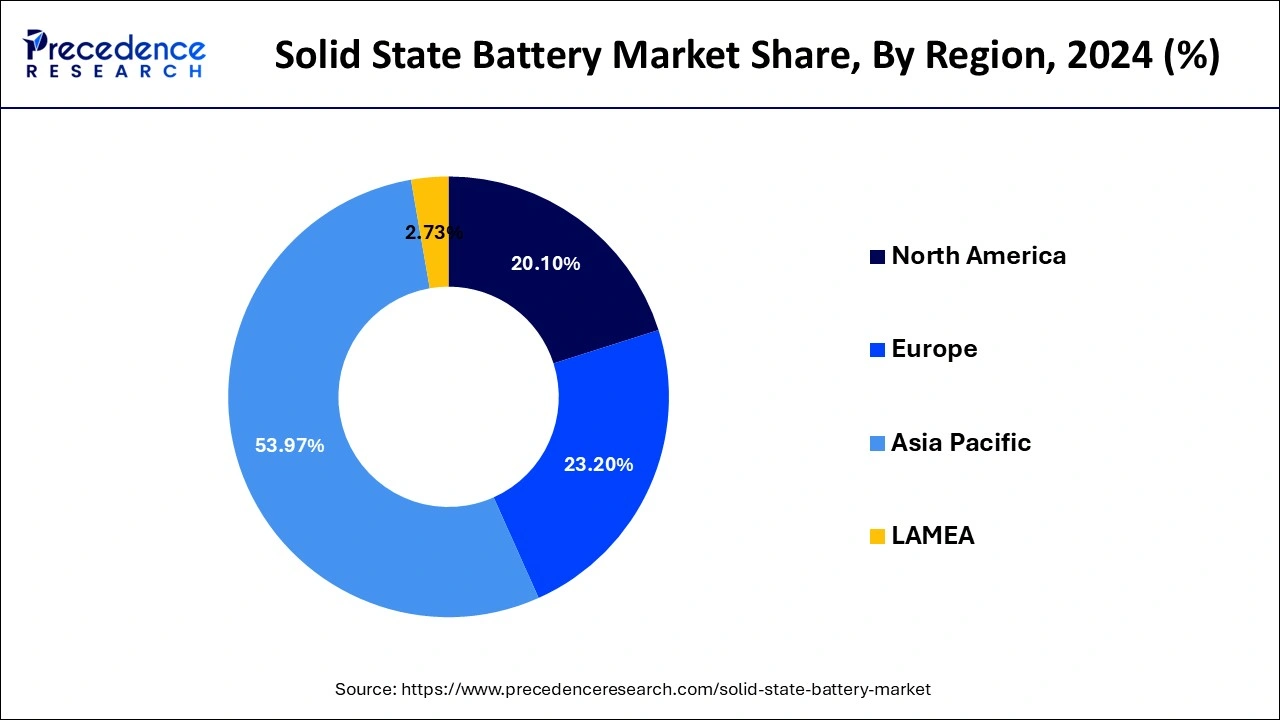

Asia Pacific dominated the solid-state battery market with the largest market share of 53.97% in 2024. Over the projection period, rising population in India and China, as well as favorable government regulations aimed at reducing carbon emissions from automobiles and encouraging the usage of electric vehicles, is likely to boost the growth of the solid-state battery market in the Asia-Pacific region. Moreover, the government of several countries such as China and South Korea has made investment for developing high-grade solid-state batteries, thereby boosting the market growth.

Europe is expected to develop at the fastest rate during the forecast period. The rapid expansion of the solid-state battery market in the Europe can be attributed to the region’s stringent application of favorable regulatory frameworks and laws for the deployment of battery energy storage systems and electric automobiles. Moreover, the presence of several electric vehicle manufacturers such as BMW, AUDI, Volkswagen and some others has boosted the market growth in this region.

The solid-state battery market is an integral segment of the battery industry. This industry deals in manufacturing and distribution of solid-state batteries for numerous end-users. There are different types of solid-state batteries available in the market consisting of thin film batteries and portable batteries. These batteries comes with different capacities such as below 20mah, 20mah-500mah and above 500mah. It finds several applications in various sectors comprising of consumer & portable electronics, electric vehicles, energy harvesting, wearable & medical devices and some others. The growing demand for sustainable battery technology has boosted the market growth. This market is expected to rise significantly with the growth of the energy and power industry around the world.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.20 Billion |

| Market Size in 2025 | USD 1.63 Billion |

| Market Size by 2034 | USD 26.03 Billion |

| Growth Rate from 2025 to 2034 | 36.03% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Capacity, Application, Region |

| Regions Covered | North America, Europe, Asia Pacific, LAMEA |

The thin-film battery segment has held the largest market share of 37% in 2024. Due to their efficient recharge rate and compact shape, these batteries are mostly employed in internet of things and wearable devices such as smartwatches and fitness bands. Thin film batteries, unlike traditional batteries, have low impact on environment, which is predicted to boost the growth of the global solid state battery market throughout the projection period.

The portable battery segment is anticipated to grow with the highest CAGR during the forecast period. Solid state batteries are currently found in a variety of portable gadgets and consumer electronics. Despite the fact that the use of these batteries in electronics is still in their early stages, they have a wide range of applications, including cameras, mobile phones, laptops, calculators, and torches.

the Below 20 mAh segment captured the biggest market share of 43% in 2024. The thin film batteries are the most common type of battery used in this segment, and they are used in variety of applications such as wireless sensors, cosmetic patches, and others. The rising demand for portable devices among the people has boosted the market expansion.

The above 500mAh segment, on the other hand, is predicted to develop at a rapid rate over the projection period. The demand for this kind of batteries is being driven by government policies promoting renewable energy transportation. Furthermore, rising demand for battery energy storage systems in the diverse sectors is likely to boost the segment growth.

The consumer & portable electronics segment contributed the highest market share of 34% in 2024. The increased purchases of electronic gadgets such as computers and mobile phones are projected as a result of rapid urbanization and growing disposable incomes. Over the forecast period, this tendency is expected to support the segment expansion.

The electric vehicles segment, on the other hand, is predicted to develop at the quickest rate in the future years. The battery technology developments, as well as favorable regulatory frameworks encouraging the adoption of electric vehicles over gasoline or fuel-based vehicles, are likely to drive the growth of the segment.

By Type

By Capacity

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

July 2024

October 2024

October 2024