April 2025

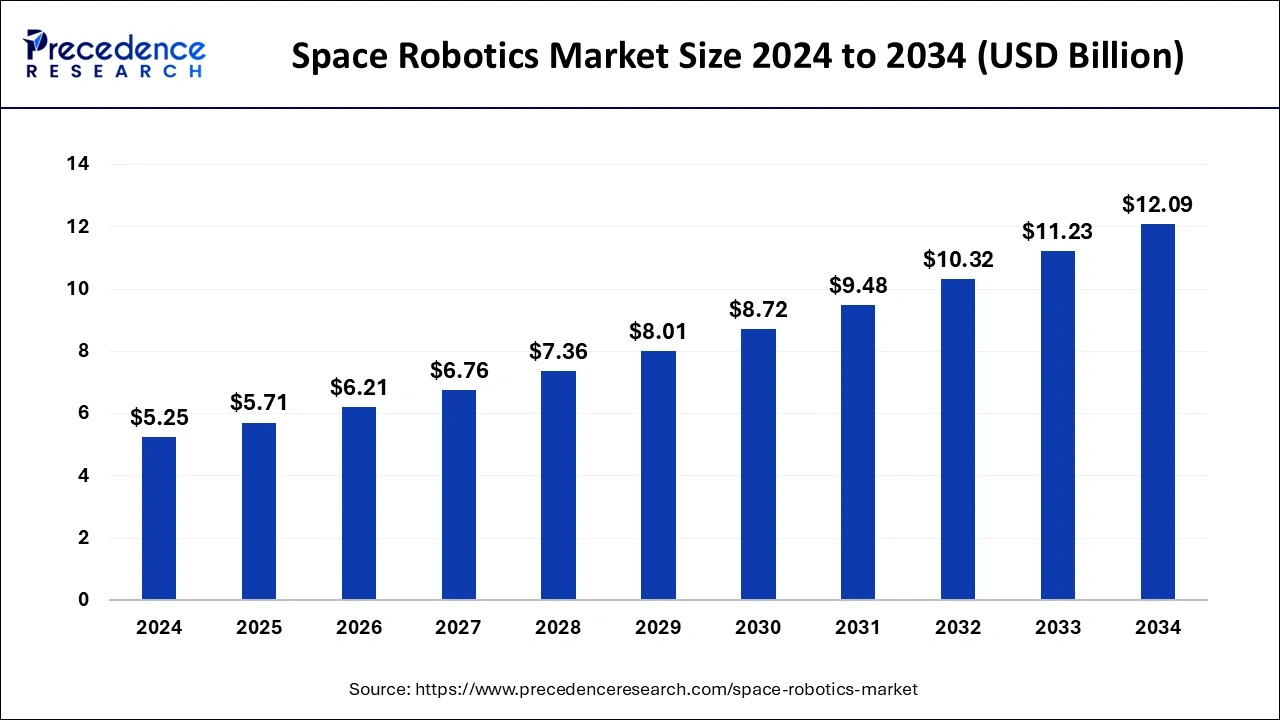

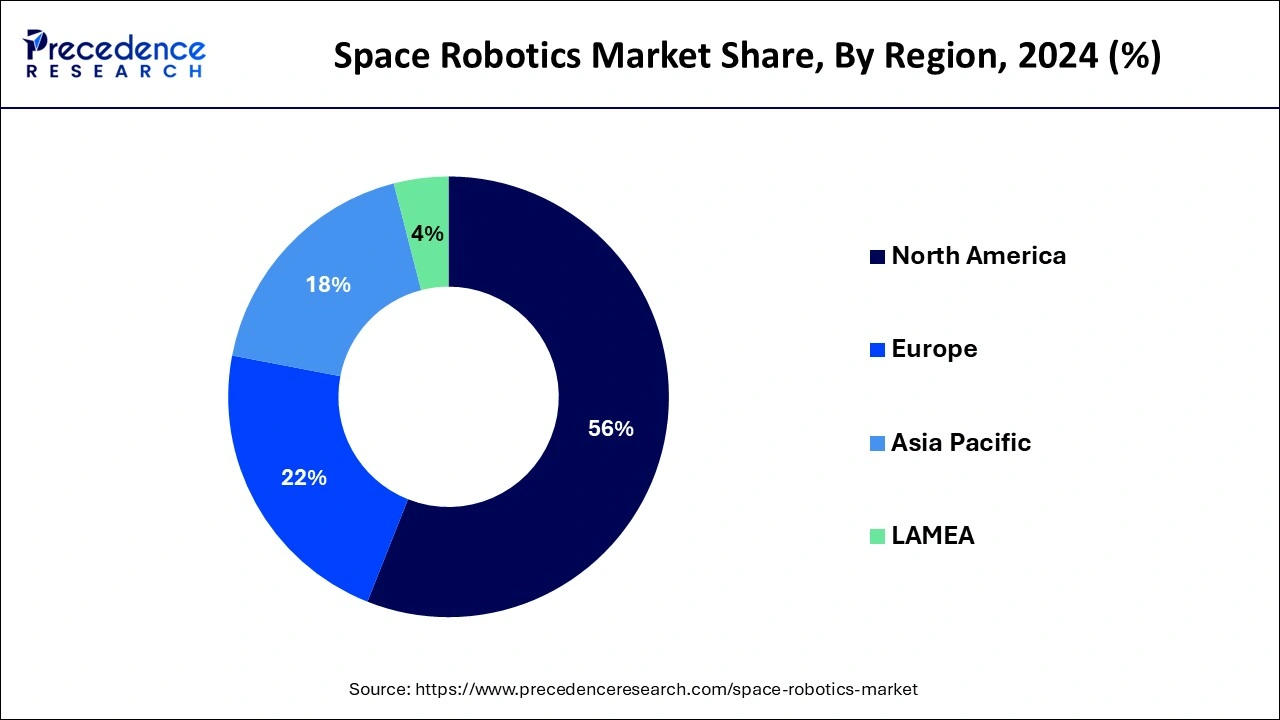

The global space robotics market size is calculated at USD 5.71 billion in 2025 and is forecasted to reach around USD 12.09 billion by 2034, accelerating at a CAGR of 8.70% from 2025 to 2034. The North America space robotics market size surpassed USD 2.94 billion in 2024 and is expanding at a CAGR of 8.79% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global space robotics market size was estimated at USD 5.25 billion in 2024 and is predicted to increase from USD 5.71 billion in 2025 to approximately USD 12.09 billion by 2034, expanding at a CAGR of 8.70% from 2025 to 2034.

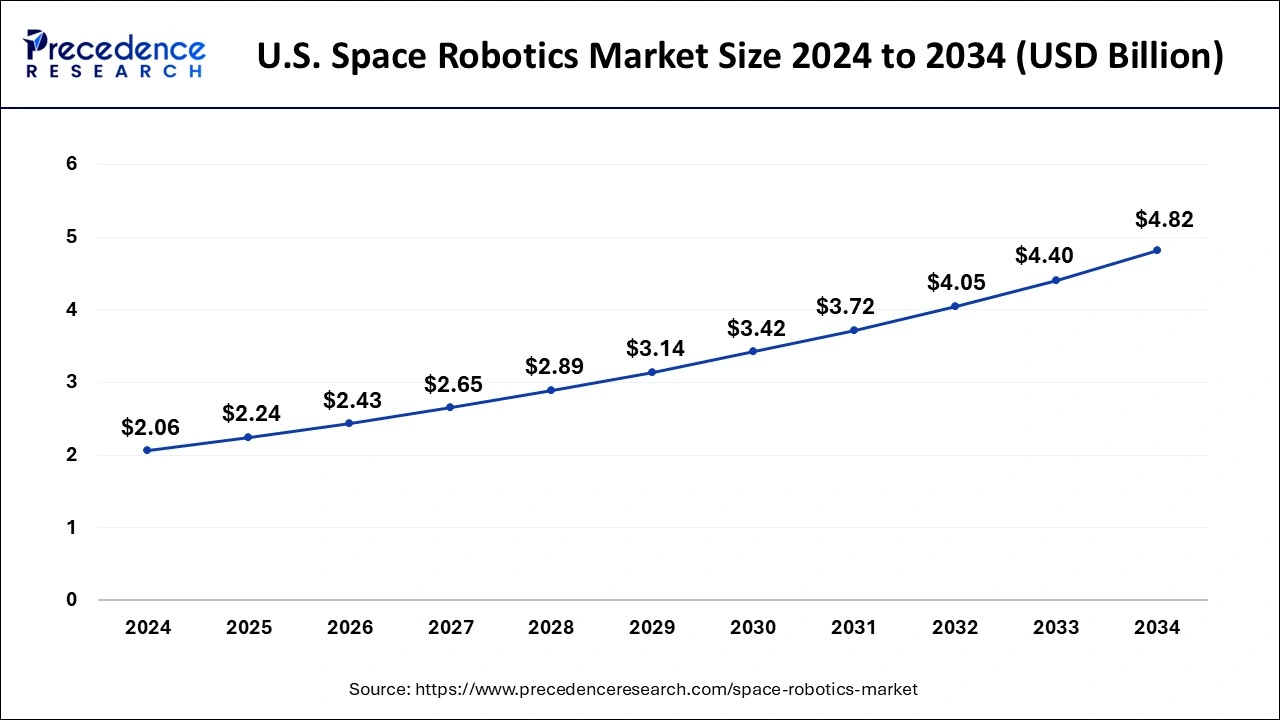

The U.S. space robotics market size was estimated at USD 2.06 billion in 2024 and is predicted to hit around USD 4.82 billion by 2034 at a CAGR of 8.87% from 2025 to 2034.

North America emerged as a dominant force propelling the growth of the space robotics market, driven by a rich history of innovation and technological advancement. The legacy of U.S. space exploration has inspired generations of students and innovators, laying the foundation for a thriving ecosystem of research and development. While NASA's role has evolved over time, the region continues to foster innovation through investments in education and scientific research.

The rise of robotics further underscores North America's leadership in technology adoption and industrial innovation. With over 232,000 robots deployed in U.S. factories, the region ranks second globally in robot use, showcasing a strong commitment to automation and efficiency. While the automotive industry remains a significant driver of robot adoption, diverse applications are emerging across sectors such as food services, construction, and agriculture.

North American key companies in the space robotics market witnessed a remarkable surge in robot purchases, with a 24% increase in orders compared to the previous year. Although fourth-quarter orders experienced a slight slowdown, the overall growth trajectory remains impressive, signaling a robust market demand for automation solutions. As industries across North America continue to embrace robotics and cutting-edge technologies, the region is poised to maintain its position as a global leader in innovation and economic competitiveness.

Space robotics is indispensable for the current and future advancement of mission-defined machinery tailored to survive and excel in space environments. They excel in exploration, assembly, construction, maintenance, and servicing tasks. This burgeoning field draws from diverse disciplines, including space engineering, terrestrial robotics, computer science, materials, and IT, representing a multi-disciplinary approach to innovation. Autonomous systems, in particular, play a pivotal role in reducing cognitive load on humans amidst the vast amounts of information requiring timely processing, thus enhancing both human and systems’ safety. The development of robotic system technologies, encompassing both hardware and software, is pivotal in enabling and enhancing future space exploration missions.

As human presence in space expands, reliance on intelligent and versatile robots for mundane tasks will increase, allowing human and ground control teams to focus on more complex activities requiring human cognition and judgment. There is a pressing need for technological advancements in robotic systems to facilitate the efficient transport of crew, instruments, and payloads across planetary surfaces, small celestial bodies, and in-space environments.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.70% |

| Market Size in 2025 | USD 5.71 Billion |

| Market Size by 2034 | USD 12.09 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Solution, By Application, and By Organization |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Achievable technical goals

Advancements in space robotics are strategically aligned with crucial technical objectives aimed at extending humanity's reach and capabilities in space. These objectives include enabling efficient manipulation of assets and resources, enhancing access to space, supporting human crews in their operations, and maintaining preparing environments for human presence, and enhancing the efficiency of mission operations. Key areas of technological development driving these goals encompass improvements in robotic sensing and perception, mobility and manipulation capabilities, rendezvous and docking procedures, onboard and ground-based autonomous functionalities, and integration with human operators. These advancements not only address critical needs in space exploration and operations but also foster growth within the space robotics market by enabling safer, more efficient, and more effective space missions.

Harsh space environment

The increasing reliance on robots for maintenance and repair tasks in space is driven by their adaptability to the challenging space environment, offering a solution to mitigate health risks for human astronauts and address spacecraft repair challenges.

However, the harsh conditions prevalent in outer space, characterized by radiation exposure, vacuum conditions, temperature fluctuations, and unpredictable terrain, present significant obstacles to the development and operation of robotic systems. These constraints limit the growth potential of the space robotics market, as advancements in technology are required to overcome these environmental challenges and expand the capabilities of robotic systems for effective space exploration and maintenance tasks.

AI integration

Space robotics, augmented with artificial intelligence (AI), represents a pivotal technology for both planetary exploration and orbital services. Future space programs necessitate the utilization of AI-powered robotics to undertake tasks such as satellite construction, repair, and maintenance in orbit. The integration of AI into space robotics enhances their capacity to perform complex tasks, including experiments, structure construction, and planetary surface exploration.

These AI-powered robots offer unparalleled accuracy, versatility, and autonomy, making them indispensable assets for space missions. The incorporation of AI technology in space robotics not only enhances the capability to study and operate in space but also creates significant opportunities for growth in the space robotics market. This integration unlocks new possibilities for innovation, efficiency, and exploration within the space industry, driving the demand for advanced space robotics solutions.

The remotely operated vehicles (ROVs) is emerging as the dominant segment within the space robotics market, offering unparalleled benefits for exploration and safety in remote locations. These advanced vehicles have become the tool of choice for scientists, enabling exploration of the deepest parts of the sea and the farthest reaches of the solar system with minimal weight penalties and maximum flexibility. Their specialized designs eliminate the need to sustain human life in hazardous environments, mitigating risks and ensuring safety.

One standout example is the world-renowned all-terrain ROV, equipped with high payload capacity and multiple attachment options, facilitating various mission support activities. Its ability to operate hundreds of meters away enables reconnaissance and active surveillance, benefiting military, security, and police forces by keeping operators out of harm's way. ROVs excel in replacing humans in confined space work, offering safe and effective equipment handling, thus protecting employees and reducing operational risks.

Although ROVs may entail high initial costs, the long-term benefits are substantial. The investment in ROV technology translates into safeguarding personnel and assets, ultimately contributing to cost savings and operational efficiency. Moreover, their application in commercial and manufacturing settings offers additional avenues for cost reduction and improved productivity. With ROVs leading the charge in remote exploration and safety, businesses across industries stand to gain significant advantages in efficiency, risk mitigation, and overall operational performance.

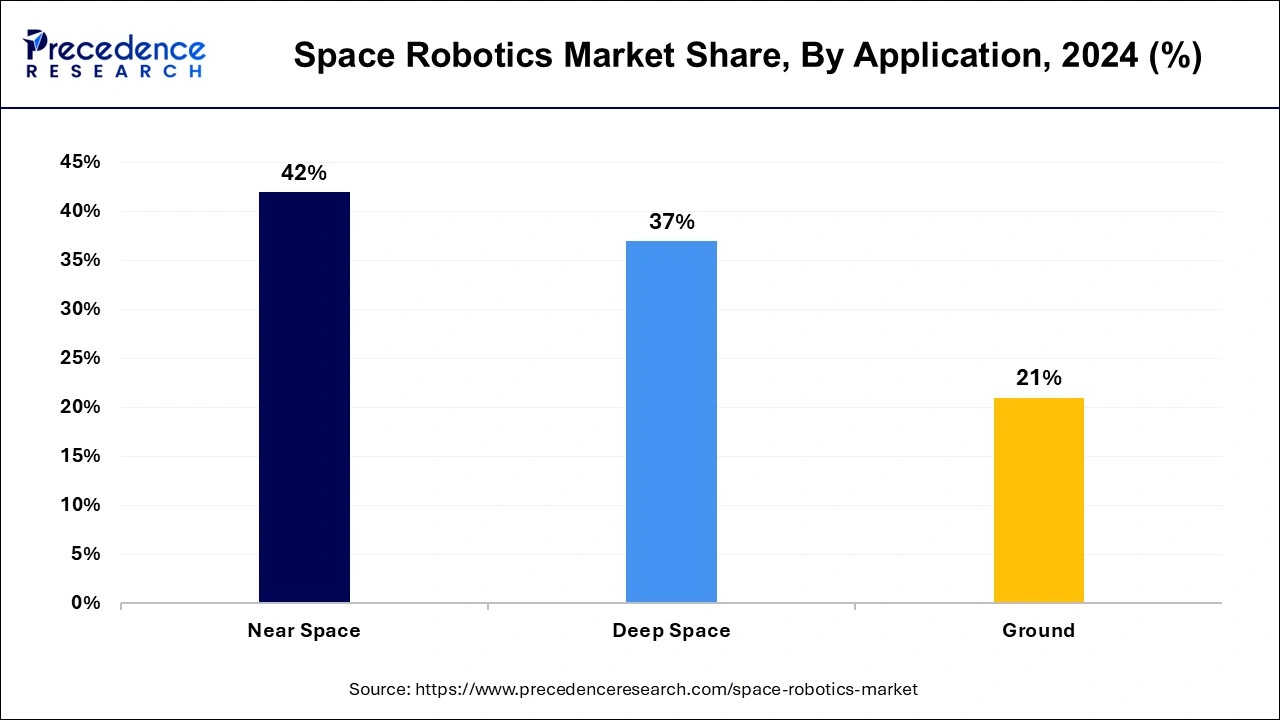

The near space emerged as the dominant segment propelling growth within the space robotics market, with Near Space Labs leading the charge by actively providing timely, scalable, 10 cm imagery utilizing the largest fleet of zero-emission, stratospheric robots worldwide. Leveraging the Near Space Network, which offers robust communication services within one million miles of Earth, the company seamlessly integrates government and commercial assets to support a wide range of missions. With a focus on near-space exploration, including low-Earth orbit (LEO), geosynchronous orbit (GEO), and other regions just beyond Earth's atmosphere, Near Space Labs facilitates vital communication with spacecraft and supports various missions in science, human spaceflight, and technology demonstration.

The innovative blend of imaging capabilities and communication services offered by near space robotics not only advances understanding of the planet and the solar system but also opens up new opportunities for scientific discovery and exploration. As businesses and organizations seek to expand their presence and activities in near space, the solutions provided by near space labs offer unparalleled reliability, scalability, and efficiency, driving significant advancements in space exploration and technology development.

The government segment held the largest share in the space robotics market. The dominance of this segment is supported by the plethora of aids and schemes supporting the research and development activities in the field of robotics as well as aeronautics industries. Due to the future scope of these sectors and their subsidiaries, private as well as state organizations are heavily investing in projects related to the market.

By Solution

By Application

By Organization

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

December 2024

January 2025

November 2024