August 2024

Specialty Insurance Market (By Type: Political Risk and Credit Insurance, Entertainment Insurance, Art Insurance, Livestock and Aquaculture Insurance, Marine, Aviation and Transport (MAT) Insurance, Others; By Distribution Channel: Brokers, Non-brokers; By End User: Business, Individuals) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

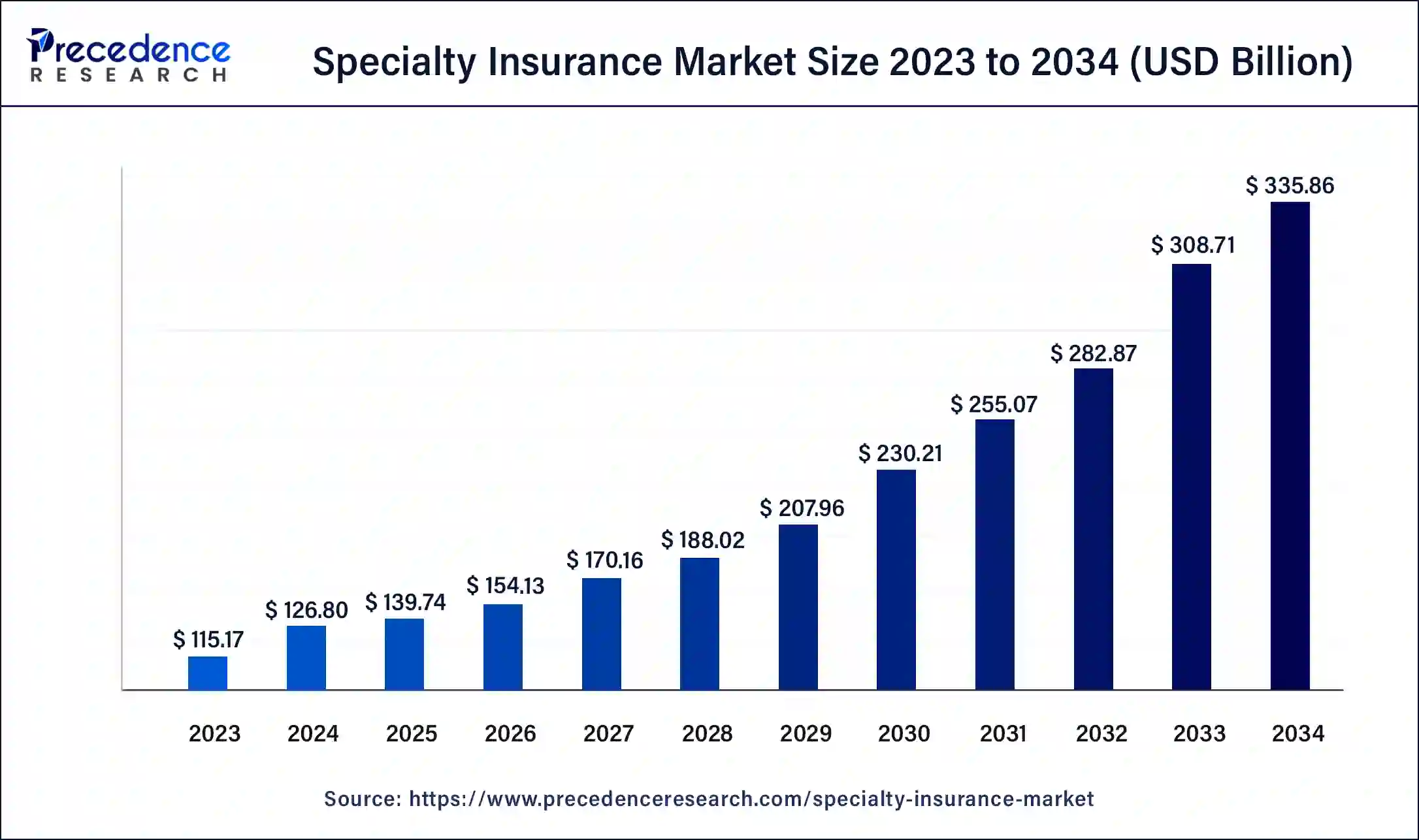

The global specialty insurance market size was USD 115.17 billion in 2023, calculated at USD 126.80 billion in 2024 and is expected to reach around USD 335.86 billion by 2034, expanding at a CAGR of 10.23% from 2024 to 2034.

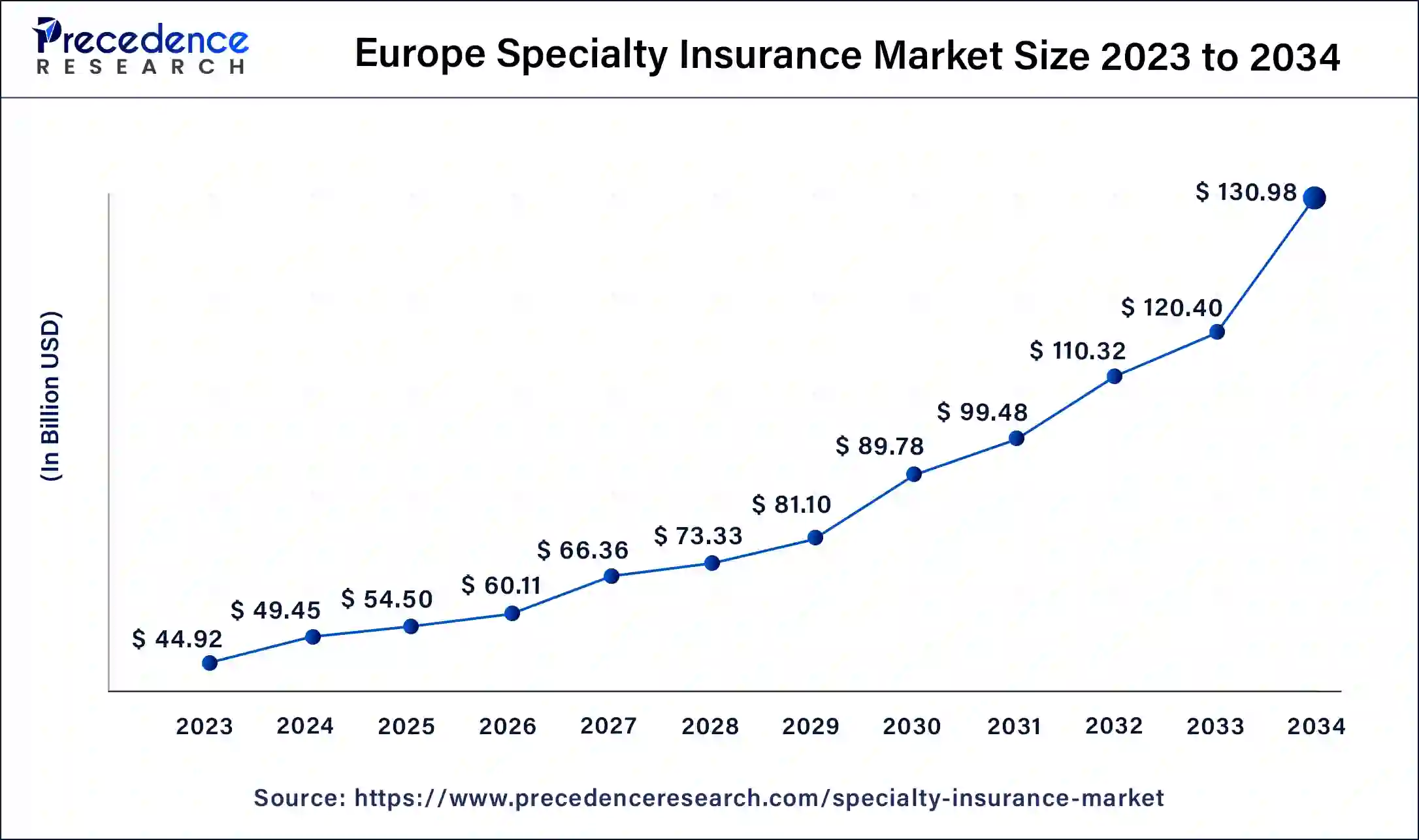

The Europe specialty insurance market size was valued at USD 44.92 billion in 2023 and is expected to reach USD 130.98 billion by 2034, growing at a CAGR of 10.50% from 2024 to 2034.

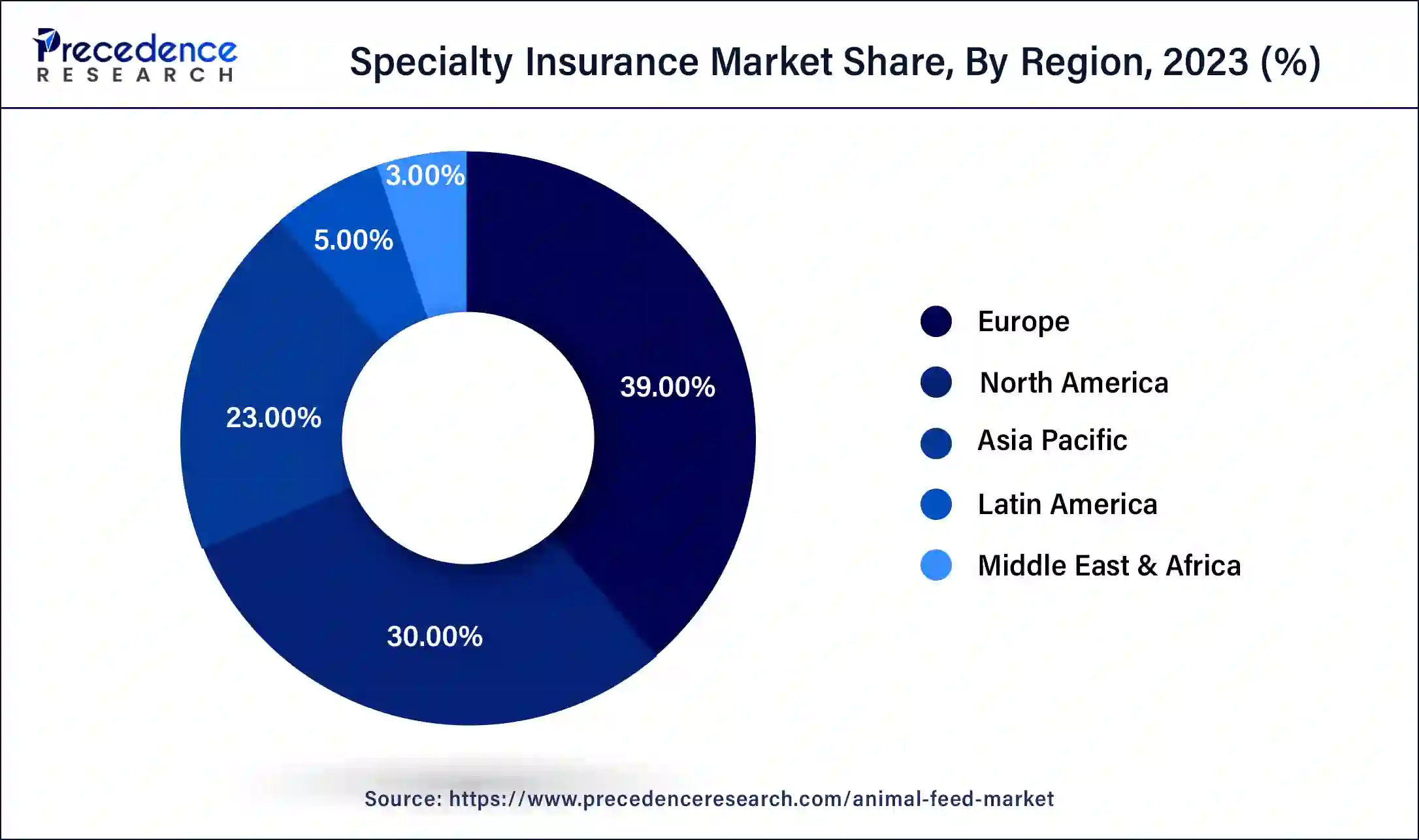

Europe has held the largest revenue share 39% in 2023. Europe holds a substantial share in the specialty insurance market due to a combination of factors. First, the region's diverse economy and industries, including the art market, marine activities, and high-net-worth individuals, create a strong demand for specialized coverage. Second, stringent regulatory environments drive the need for specialty policies to navigate complex compliance requirements. Third, Europe's focus on sustainability and renewable energy projects offers opportunities for insurers to address environmental risks. Additionally, Europe's mature insurance market infrastructure and well-established specialty insurers contribute to its significant presence in this niche market, attracting customers and investments.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region has gained significant growth in the specialty insurance market due to several key factors. Rapid economic growth and a burgeoning middle class have led to increased wealth and asset ownership, spurring the demand for specialized insurance coverage, such as fine arts, cyber liability, and health-related policies. Additionally, as the region experiences industrialization and globalization, businesses are seeking protection against unique and international risks, further boosting the demand for specialty insurance. Furthermore, supportive regulatory environments and the proliferation of insurtech solutions have facilitated market growth, making Asia-Pacific a major player in the global specialty insurance landscape.

Specialty insurance refers to a category of insurance that caters to distinct, exceptional, or atypical risks which fall outside the scope of standard insurance policies. Unlike traditional insurance, which offers general coverage for commonplace perils such as auto accidents or property loss, specialty insurance is specifically crafted to address particular, rare, or high-risk scenarios. These policies are customized to match the distinctive requirements of individuals, companies, or sectors.

Specialty insurance encompasses a wide array of domains, including but not restricted to aviation, maritime, valuable artworks, cyber liability, seismic events, and even coverage for pets. Typically, these policies are underwritten by specialized insurers possessing expertise in the specific field, as they necessitate a profound understanding of the associated risks. While specialty insurance might come at a higher cost compared to standard coverage, it serves as a valuable solution for those confronting non-standard risks, offering assurance and safeguarding against unforeseen circumstances that standard insurance products may not adequately address.

| Report Coverage | Details |

| Market Size by 2034 | USD 335.86 Billion |

| Market Size in 2023 | USD 115.17 Billion |

| Market Size in 2024 | USD 126.80 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.23% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Distribution Channel, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Fine arts and collectibles

The fine arts and collectibles sector is a significant driver of growth in the specialty insurance market. This is primarily attributed to the increasing value and diversity of art collections and valuable collectibles worldwide. As the art market continues to expand, art collectors and institutions are seeking tailored insurance solutions to safeguard their assets against theft, damage, or loss.

The uniqueness and high value of art and collectibles necessitate specialized coverage that goes beyond what standard insurance policies can offer. Specialty insurance providers offer policies that account for the intrinsic value, rarity, and specific needs of these assets. They provide coverage for a wide range of perils, including accidental damage during transport, restoration, and exhibition, theft, and market value fluctuations.

Furthermore, the demand for fine arts and collectibles insurance has grown in parallel with the proliferation of private art collections, art galleries, and the globalization of the art market. This niche insurance segment caters to the unique risks associated with art and collectibles, making it a driving force behind the growth of the broader specialty insurance market.

Limited market size

The limited market size is a significant constraint on the growth of the specialty insurance market. Specialty insurance is, by definition, designed to address unique and niche risks, which naturally limits the potential customer base. These specialized policies cater to a relatively small number of individuals, businesses, or industries facing non-standard risks, as opposed to the broader customer base of standard insurance products. This niche focus restricts the scalability and expansion opportunities for insurers operating in the specialty insurance sector.

With a smaller addressable market, it can be challenging for insurers to achieve significant economies of scale, resulting in potentially higher operational costs and, at times, less competitive pricing. Moreover, as specialty insurance providers vie for a limited pool of clients, market competition intensifies, which can further limit profit margins. In sum, the constrained market size poses challenges to the sustainable growth and profitability of the specialty insurance market, even as it serves a crucial role in addressing unique risk exposures.

Agricultural sector

The agricultural sector is emerging as a significant source of opportunities in the specialty insurance market. As the industry faces evolving challenges driven by climate change, technological adoption, and global supply chain complexities, specialty insurers have a unique chance to provide tailored solutions. These may encompass crop insurance, livestock coverage, and weather-related risk management. In an era of unpredictable weather patterns, droughts, and pests, agricultural producers seek specialized policies to safeguard their investments and ensure business continuity.

Furthermore, the adoption of cutting-edge technologies in agriculture, such as precision farming and drone usage, presents novel risk exposures that can be mitigated through specialized insurance products. The growth in sustainable and organic farming practices also creates an opportunity for insurers to offer coverage that aligns with environmentally conscious agriculture. Overall, the agricultural sector's diverse and evolving risks provide a fertile ground for specialty insurance innovation and expansion.

The marine, aviation and transport (mat) insurance segment has held a 25% revenue share in 2023. The Marine, Aviation, and Transport (MAT) Insurance segment holds a significant share in the specialty insurance market due to its unique focus on addressing complex, high-value risks associated with global trade and transportation. MAT insurers offer specialized policies for cargo, vessels, aircraft, and logistical operations, essential in a highly interconnected world.

With the expansion of international trade and the increasing value of transported goods, businesses and organizations increasingly rely on MAT insurance to mitigate risks related to shipping, aviation, and transportation, making it a pivotal and high-demand component of the specialty insurance sector.

The others segment is anticipated to expand at a significant CAGR of 11.2% during the projected period. The "others" segment holds a major growth in the specialty insurance market because it encompasses a wide range of unique and niche insurance categories that don't fit into standard classifications. This catch-all category caters to specialized risks that are not covered by conventional insurance policies, such as pet insurance, event cancellation coverage, and unusual or emerging risks like space tourism. Given the diverse and constantly evolving nature of specialty insurance needs, the "others" segment has become a versatile and substantial component of the market, offering solutions for a variety of non-standard and unique risk exposures.

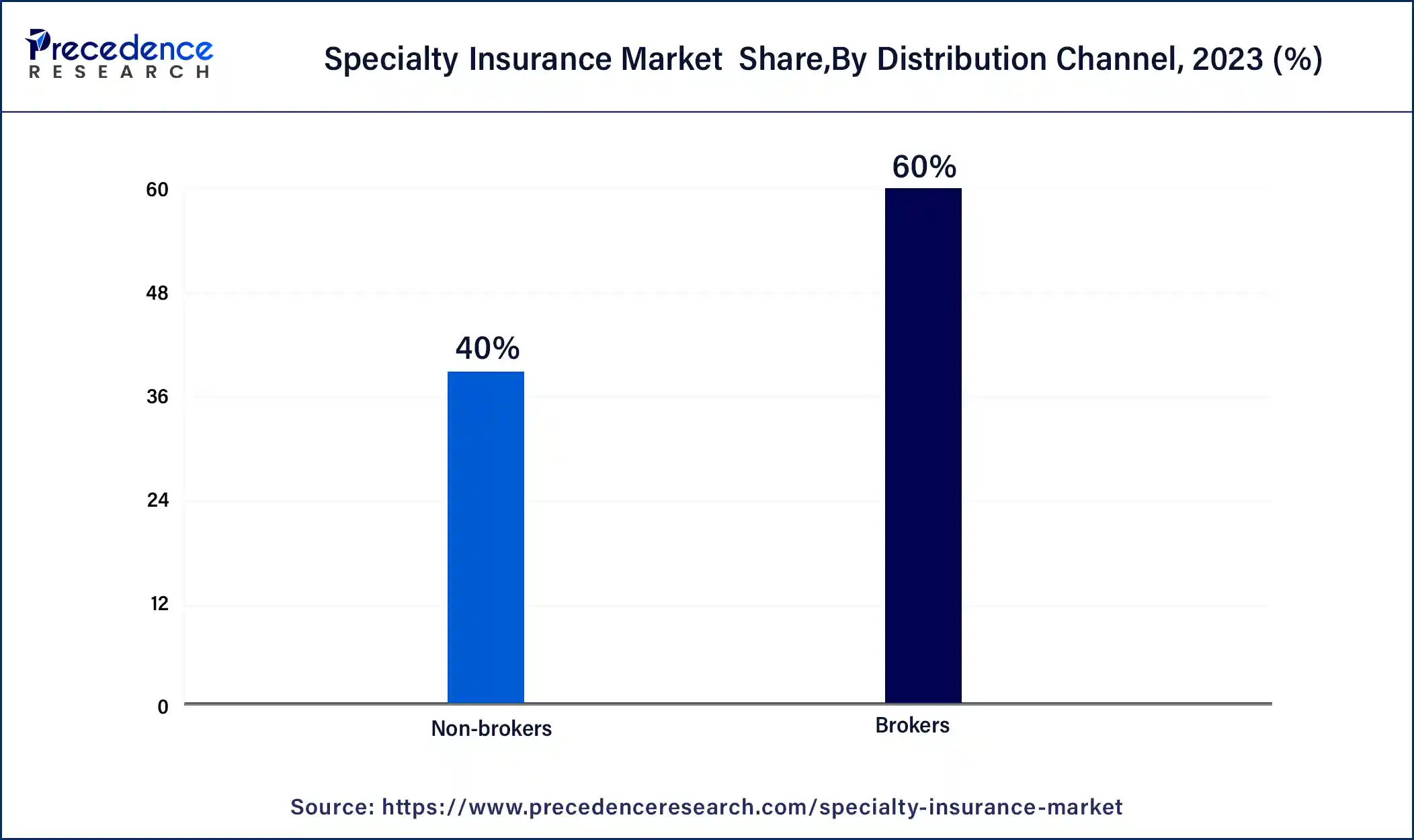

The brokers segment had the highest market share of 60% in 2023 based on the distribution channel. The brokers segment commands a major share in the specialty insurance market primarily due to its role in connecting clients with specialized insurance providers. Brokers act as intermediaries, leveraging their expertise to assess client needs and source customized coverage solutions from a wide array of insurers.

They provide invaluable guidance in a complex and nuanced field, offering clients access to a broader range of options and helping them navigate the intricacies of specialty insurance. This approach builds trust and ensures that clients receive tailored, comprehensive coverage, making brokers a preferred distribution channel for many seeking specialized risk management solutions.

The non-brokers segment is anticipated to expand fastest over the projected period. The Non-brokers distribution channel holds a major growth in the specialty insurance market due to several factors. Many specialty insurance products are highly specialized and require a deep understanding of unique risks, making direct sales channels more effective. Additionally, for businesses and industries with specific needs, dealing directly with insurers allows for tailored coverage.

Non-brokers often include in-house risk managers and dedicated teams, enabling more efficient communication and customization of policies. This direct approach fosters stronger relationships, quicker decision-making, and cost-effective solutions, making it a preferred choice for acquiring specialty insurance among many clients and companies.

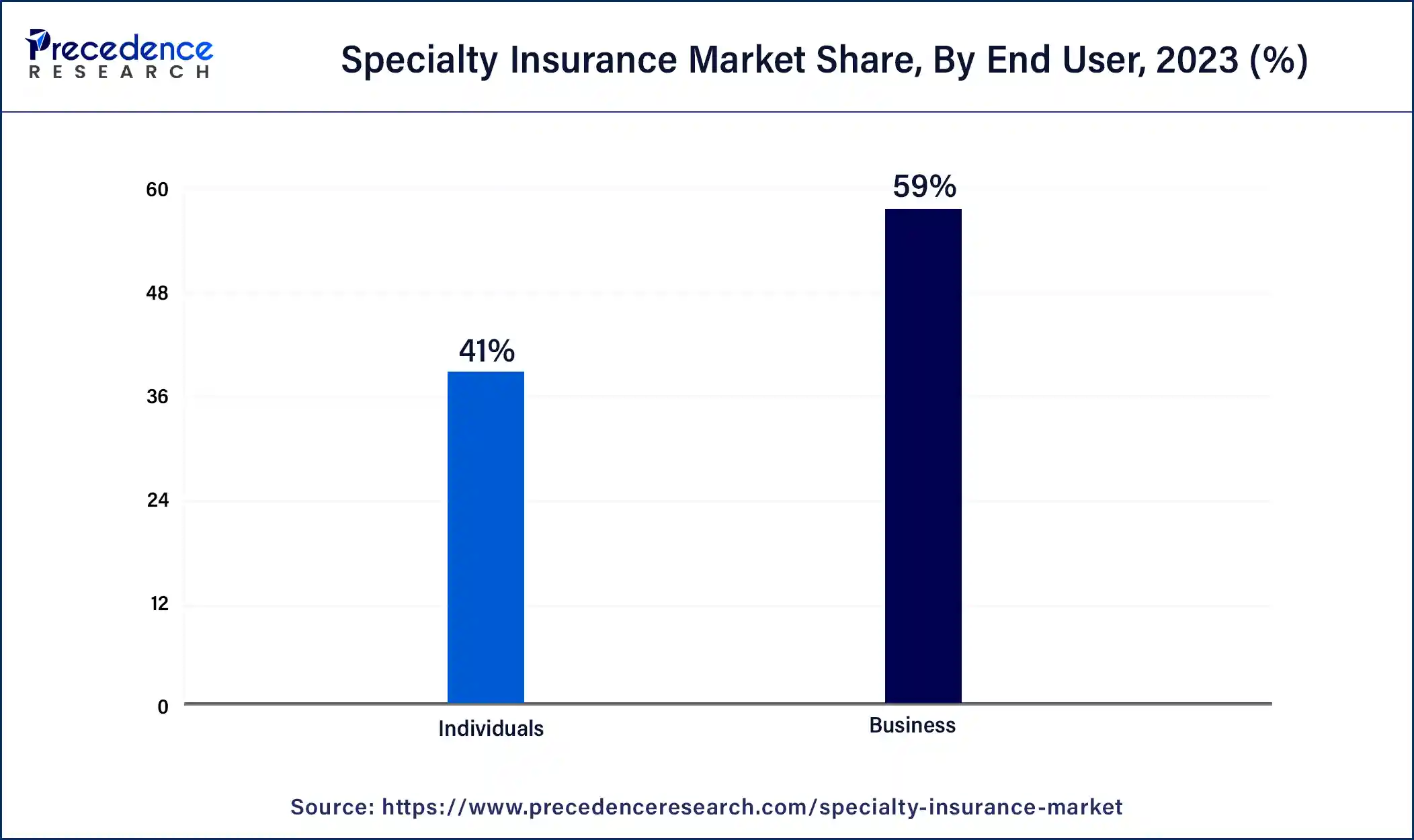

The business segment had the highest market share of 59% in 2023 based on the end user. The business segment commands a significant share in the specialty insurance market due to its diverse risk exposures. Businesses encounter a wide range of unique and complex risks, including cyber threats, professional liabilities, supply chain disruptions, and international trade uncertainties. Specialty insurance offers tailored solutions to address these specific perils, ensuring comprehensive protection and regulatory compliance.

As a result, businesses rely on specialty insurance to safeguard their assets, operations, and reputations, making it a major driver of market share as they seek risk management and continuity in an increasingly complex and interconnected global economy.

The individuals segment is anticipated to expand fastest over the projected period. The Individuals segment holds significant growth in the specialty insurance market primarily due to the increasing recognition among individuals of the need for personalized coverage. Specialized insurance products cater to unique risks faced by high-net-worth individuals, collectors, art enthusiasts, and those seeking coverage for niche activities like adventure sports or pet care.

Moreover, the desire for added protection against cyber security threats, fine arts, and collectibles has driven the demand for specialty policies among individuals. As a result, the Individuals segment continues to expand, commanding a substantial growth of the specialty insurance market.

Segments Covered in the Report

By Type

By Distribution Channel

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

September 2024

January 2025

October 2024