January 2025

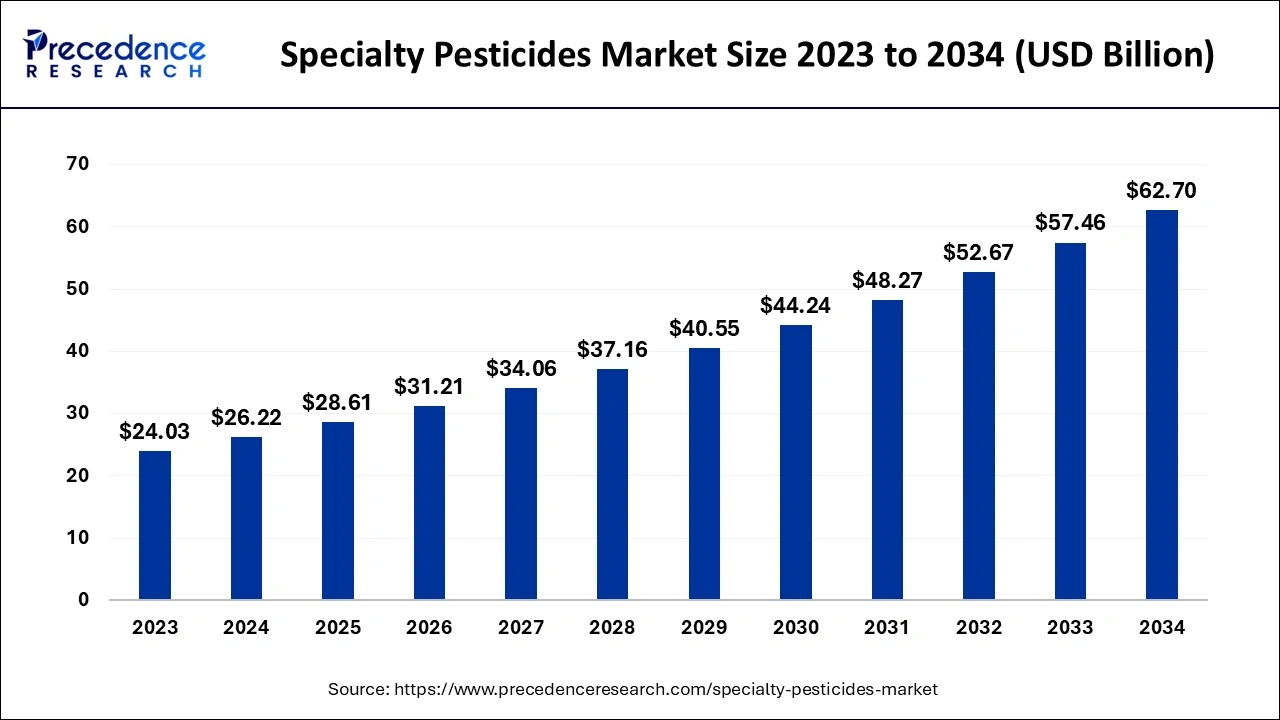

The global specialty pesticides market size is evaluated at USD 26.22 billion in 2024, grew to USD 28.61 billion in 2025 and is projected to reach around USD 62.70 billion by 2034. The market is expanding at a CAGR of 9.11% between 2024 and 2034.

The global specialty pesticides market size is accounted for USD 26.22 billion in 2024 and is predicted to surpass around USD 62.70 billion by 2034, growing at a solid CAGR of 9.11% from 2024 to 2034. The rapidly increasing population is one of the major reasons behind the increasing demand for the specialty pesticides market.

Pesticides are chemical substances used to kill, repel, and control plants and animals that are pests. Specialty pesticides focus on a specific category, including products applicable beyond traditional agricultural practices like public health settings that could control fungal diseases, especially in urban areas. They also play a crucial role in managing pets like rodents, weeds, insects, and fungi, where agricultural applications cannot be used. The specialty pesticides market is witnessing significant growth due to the rising demand for specialty pests in public health settings. The increasing prevalence of diseases caused by insects is leading to a greater adoption of pests in these settings.

What is the Role of AI in the Specialty Pesticides Market?

The emergence of technologies like artificial intelligence and ML has been playing a crucial role in improving the specialty pesticides market’s reach in the agricultural industry. Specialty pesticide-producing companies are adopting technologies like sensors that would track and identify pest movement patterns in real time. This helps reduce the time required for production and allows for the focus on innovations. The application of drones and robots in the specialty pesticide market is increasing as they help enhance the overall process without any human intervention. Additionally, the increasing demand for sustainable pesticides has been contributing to the demand for specialty pesticides.

A Switzerland-based company named Syngenta AG partnered with Insilico Medicine to apply deep-learning AI tools that help in producing sustainable weedkillers.

| Report Coverage | Details |

| Market Size by 2034 | USD 62.70 Billion |

| Market Size in 2024 | USD 26.22 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.11% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Formulation, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rapid urbanization

Rapid urbanization has led to many pest-related concerns in the cities due to the widespread of mosquitoes, which might lead to diseases like dengue, malaria, and others. These factors have led to the deployment of the specialty pesticides market services beyond non-agricultural practices. Additionally, urbanization has led to many congested living or commercial spaces, which has led to the need for these solutions. Urban agricultural practices are also adopting heavy usage of specialty pesticides.

High demand for pesticide-resistant crops

The food demand has increased rapidly due to the rising population, especially in the urban areas. This has resulted in many initiatives from organizations and governments that are focusing on developing more reliable production of crops that would protect public health.

Complex approval processes

Several concerns related to the use of chemical pesticides have led to complex approval rates in the specialty pesticides market. The regulatory bodies have started to focus deeply while approving pests that could harm public health, which delays the introduction of new products in the market.

Rising preference for sustainable solutions

Changing consumer preferences towards the adoption of sustainable farming practices has increased the demand for the specialty pesticides market. Adoption of this sustainable solution is also expected to lead to the growth of innovative products that help in tackling consumer demand. Many governments are promoting sustainable farming practices that help maintain public health as well as the environment.

Increasing educational programs

Many governments are focusing on farmer training, especially in the rural areas of the developing countries which might help the farmers to learn new technologies in the agricultural industry. Many educational institutes are also introducing agricultural courses and programs that help increase awareness regarding agricultural practices.

The herbicides segment dominated the global specialty pesticides market in 2023. Herbicides are chemical substances used to eliminate weeds in crop fields and forests. The dominance of the segment is attributed to the increasing number of sports fields, parks, and golf courses in urban settings, which has led to the rising need for herbicides to maintain the field. Urbanization has been a major contributor to the rising need for turf management. These pests have gained significant popularity, which has led to mass production that also helps reduce production costs. Many companies are investing heavily in the development of more efficient herbicides that might help in tackling weed-related issues.

The insecticides segment is expected to grow at the fastest rate in the specialty pesticides market during the forecast period of 2024 to 2034. Insecticides refer to the chemicals used to control or kill insects that are a threat to human health or the environment. The growth of the segment is attributed to the rising prevalence of diseases like malaria, dengue, Zika, and other viruses caused by insect bites. Multiple factors like ecosystem disruption are major causes that lead to the spread of these insects. This has increased the focus on adopting solutions for controlling these insects that cause harm to humans. Health organizations and governments are investing heavily in adopting solutions.

The liquid segment led the global specialty pesticides market in 2023. Liquid-based specialty pesticides are formed by dissolving the ingredient into oil or water, which can be used as a sprayer in particular areas. The dominance of the region is attributed to the wider use of these sprayers in crop protection, which is easy to apply in the fields. These liquid pesticides are also gaining popularity in turf management due to their effectiveness, which helps with easy absorption in the designated area. Farmers use liquid pests in multiple agricultural practices, which makes them applicable to the whole agricultural sector. Rising technologies are focusing on adopting automated robots and drone-based spraying systems, which could help increase their effectiveness and save time.

The powder segment is expected to grow rapidly in the specialty pesticides market during the forecast period of 2024 to 2034. Powder pesticides, also referred to as dust pesticides, can be directly applicable to plants or surfaces. Powdered-based pesticides are gaining notable popularity due to their effectiveness, especially in turf management. These pests are considered to be more effective against diseases, which has led to increasing demand in urban areas.

The crop protection segment registered its dominance over the specialty pesticides market in 2023. The segment refers to the use of specialty pesticide products like herbicides, insecticides, and others that are used to protect crops from various threats like weeds and insects. The dominance of the segment is attributed to the massive agricultural practices all over the world. The agricultural industry has been a major contributor to the specialty pesticides market. Many governments are focusing on implementing policies that help farmers to adopt new technologies in their agricultural practices. They are focusing on adopting pest control management to avoid potential threats to the human population and the environment.

The non-crop protection segment is expected to witness the fastest growth in the specialty pesticides market during the forecast period. Non-crop protection refers to the use of pesticides apart from traditional agriculture. The specialty pesticides market is growing efficiently due to the rising demand for pests in public areas, homes, and other commercial areas that require pests to avoid potential health threats to the people or the property. Governments and private companies are focusing on investing in these services that would help them maintain a clean environment. Additionally, the adoption of non-crop pesticides is expected to drive due to the growth in the tourism sector.

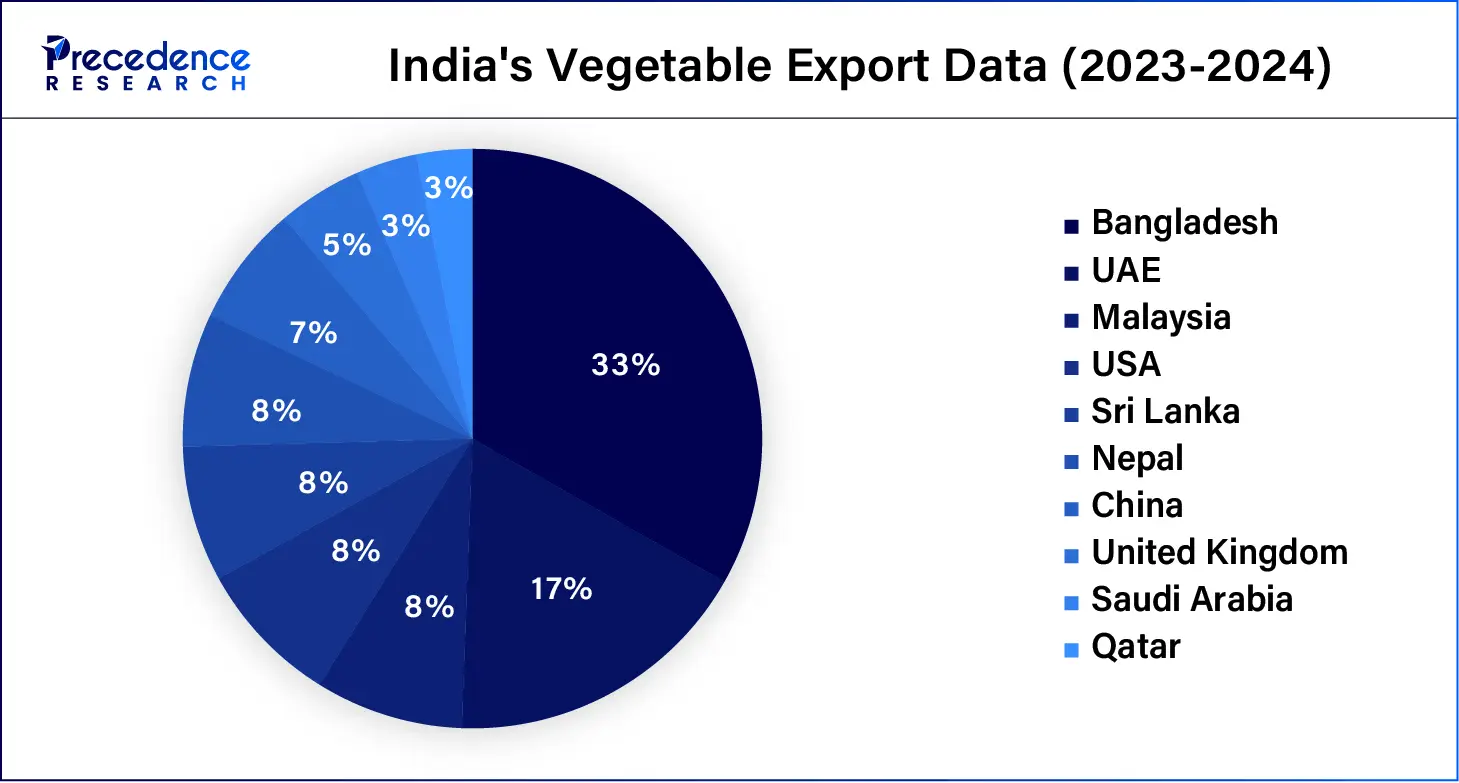

Asia Pacific dominated the global specialty pesticides market in 2023. The dominance of the region is attributed to the massive agricultural practices in countries like India, China, and Japan. The region stands out with two of the most populated countries, India and China, which are witnessing rapid food demand that leads to more agricultural production. These factors have attracted investments from governments that focus on the adoption of technologies that help increase the use of pesticides to avoid human and environmental threats.

North America is anticipated to register the fastest growth in the specialty pesticides market during the forecast period of 2024 to 2034. The growth of the region is attributed to the rising advanced technology in countries like the United States and Canada, which are focusing on improving their agricultural sector. The specialty pesticides market is witnessing significant demand due to the adoption of non-crop pests in multiple settings in the region.

The U.S. uses pesticides to control pests in food production, with the EPA ensuring their safe use under the Food Quality Protection Act (FQPA), focusing on children's safety. It has adopted smart pest control technologies to protect public health from mosquitoes.

Segments Covered in the Report

By Product

By Formulation

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

January 2025

November 2024