January 2025

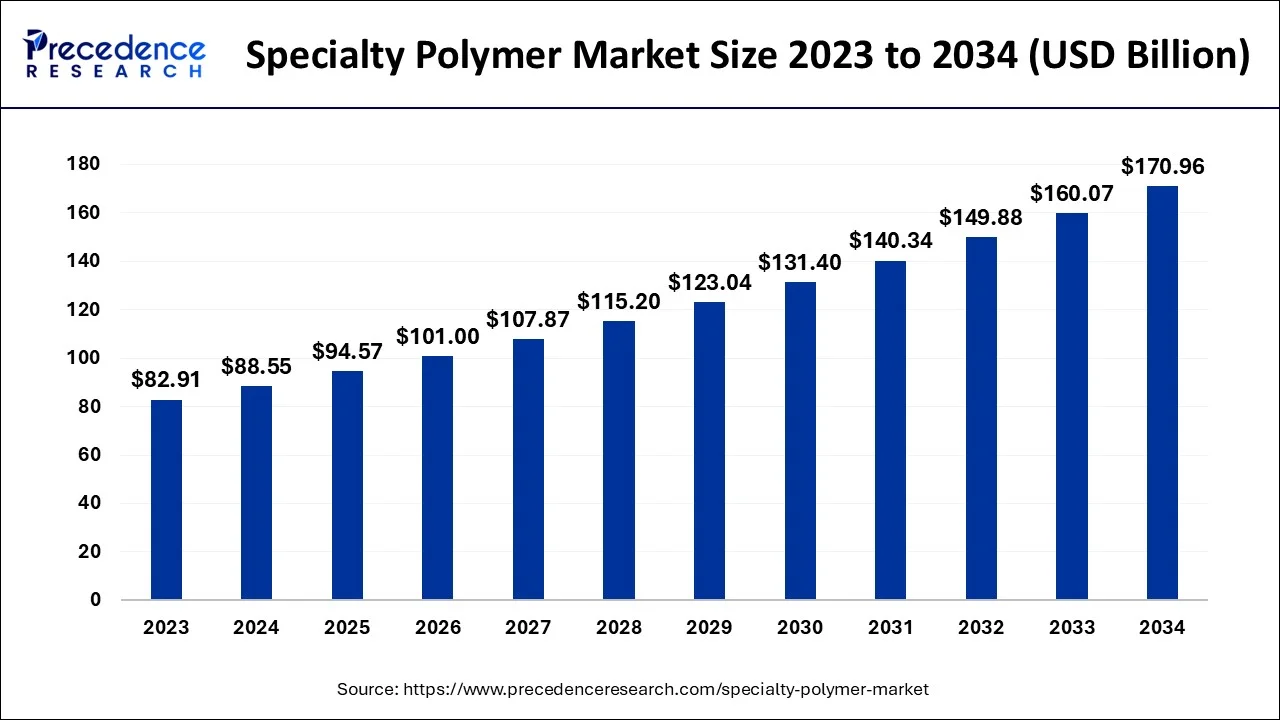

The global specialty polymer market size accounted for USD 88.55 billion in 2024, grew to USD 94.57 billion in 2025 and is projected to surpass around USD 170.96 billion by 2034, representing a healthy CAGR of 6.80% between 2024 and 2034.

The global specialty polymer market size is estimated at USD 88.55 billion in 2024 and is anticipated to reach around USD 170.96 billion by 2034, expanding at a CAGR of 6.80% between 2024 and 2034.

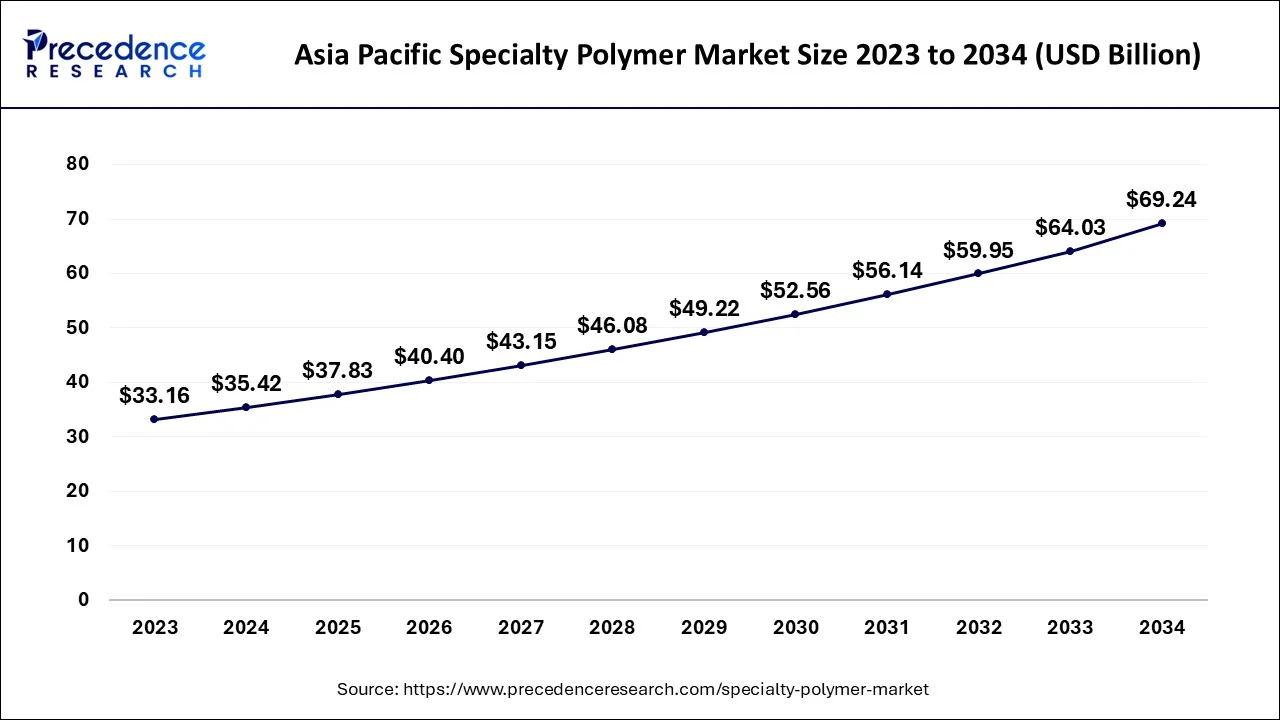

The Asia Pacific specialty polymer market size accounted for USD 35.42 billion in 2024 and is expected to be worth around USD 69.24 billion by 2034, growing at a CAGR of 6.92% between 2024 and 2034.

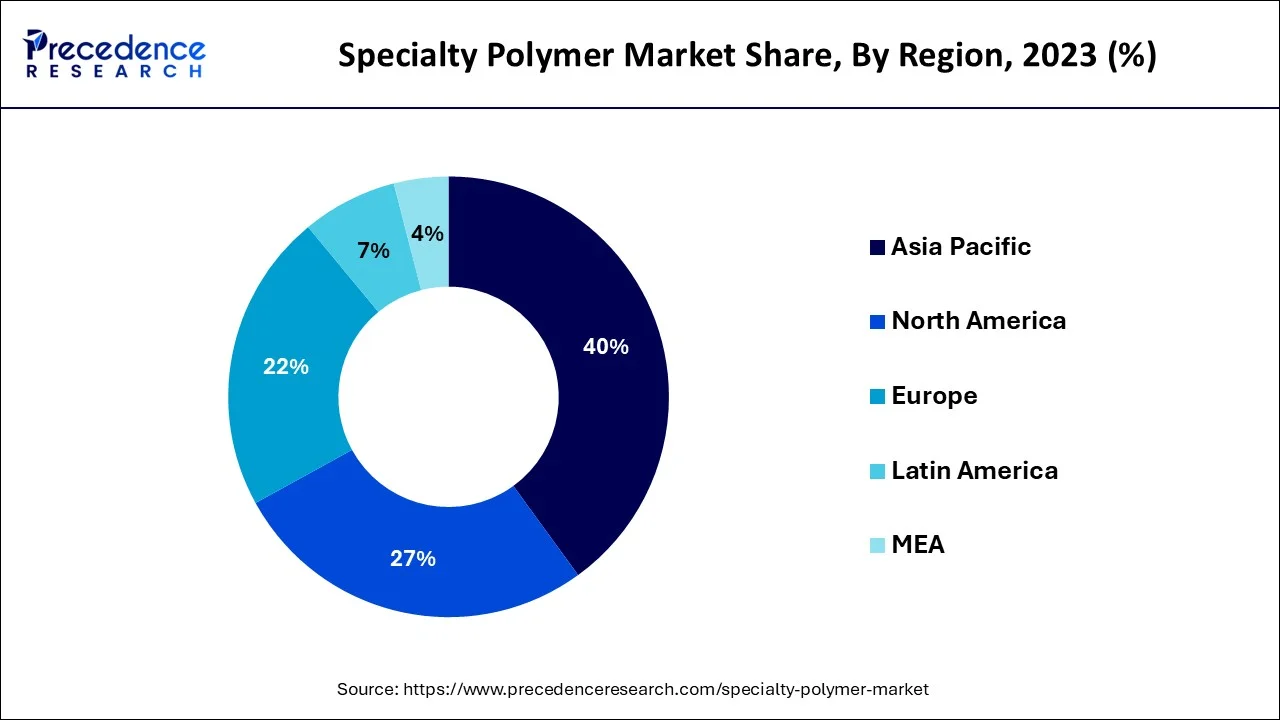

With a share of more than 40%, APAC leads the market for specialty polymers in 2023, which is then dominated by North America and Europe. The economy of APAC is mostly driven by the economic dynamics of nations like China and India, although the current situation is changing due to an increase in foreign direct investment for the growth of South East Asia's economy. Southeast Asian nations are seeing rapid expansion in the building and construction industry. You can consider the expansion of specialty polymers to be directly correlated with the expansion of the building and construction sector. Construction production is predicted to increase by 70% to $12.8 trillion by 2023, making up 14.6% of the global output. Along with the United States, some of the largest rising economies driving expansion are China, India, Russia, Brazil, and Poland. In 2020 and 2022, the global GDP is projected to expand by 3.8% and 3.9%, respectively.

However, nations like China, India, and the United States will have the fastest growth, which will outperform the global GDP. With an average annual growth rate of 7.63% in construction, India will surpass Japan to become the third-largest construction industry. During the anticipated term, this aspect will fuel the market's expansion.

The expansion of the electronics and construction industries is anticipated to increase demand for specialty polymers globally. The demand for high-performance polymers in specialized settings is also expected to increase throughout the projected period due to their enhanced endurance limit, electrical insulation, corrosion resistance, resistance to wear, and thermal stability. However, it is anticipated that price volatility for the raw ingredients used to make specialized polymers would be a major market restraint. The difficulty for the companies in the specialty polymers market is to keep up with the changes and alter their products in line with the constantly shifting demands of the end-use industries and technical breakthroughs in the application sectors. Given the aforementioned nature of the sector, there may be tremendous growth prospects for the market in the next years.

In order to provide polymers with the appropriate qualities for improved performance, specialty polymers are employed as polymeric additives. These are now utilized in lower amounts but are priced more for the customer. Construction, electronics, pharmaceuticals, and the automotive sectors are just a few of the many fields in which specialty polymers may be employed. In 2013, the demand for specialized polymers was mostly driven by the construction and electronics industries, which are also predicted to develop at the quickest rates going forward. A new trend in the market for specialty polymers is the customization of goods to meet the needs of a particular application as opposed to improving the overall product features. To generate possibilities in the specialty polymers market throughout the course of the forecast period, businesses should integrate digitally linked processes and concentrate on operational efficiency, supply source diversification, and cost control. Understanding and assessing the specialty polymers market landscape is complicated by the uneven recovery in various end markets and regions.

The demand for the specialty polymer market is expected to increase due to growing industrial and construction projects with high standards of design and an emphasis on developing dependable and lasting buildings to prevent early repairs. One of the key reasons propelling the growth of the specialty polymer market is the rising awareness among multiple industries regarding such polymers that give great performance in challenging conditions without impairing particular activities.

| Report Coverage | Details |

| Market Size in 2024 | USD 88.55 Billion |

| Market Size by 2034 | USD 170.96 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.80% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

In 2023, the specialty polymers market's elastomers category held the greatest market share. Elastomers are polymers with both viscosity and elasticity, and as a result, they are referred to as viscoelasticity. The weak intermolecular forces that hold the molecules of elastomers together cause them to typically have low Young's modulus, high yield strength, or high failure strain. They take on the special ability to recover their former size and shape after being greatly stretched. The sector of elastomers with the biggest share was natural rubber. The elastomers that can be found naturally are those made of natural rubber.

The substance that makes it up is latex, a milky white liquid that falls from the peel of tropical and subtropical trees. It is made up of solid particles floating in the liquid. The primary locations for this latex rubber are Brazil, India, Indonesia, Malaysia, and Sri Lanka. The natural rubber has been a useful material in engineering for a long time since it can withstand abuse while still carrying out essential tasks. High tensile and tear strength are combined with exceptional fatigue resistance in natural rubber. For dynamic or static engineering applications like tires, printer rollers, agitators, and other parts that will frequently come into touch with abrasive surfaces or other harmful materials, natural rubber is the perfect polymer due to its properties. During the anticipated term, this aspect will fuel the market's expansion.

In 2023, the automotive industry was the main market for specialty polymers, rising at a CAGR of 8.9%. Automobile applications for specialty polymer materials have seen a significant surge, and these uses are expected to continue growing. The low weight and generally improved qualities of the polymers are the main reasons why they are making their way deep within the majority of applications. The average penetration of specialty polymers worldwide is 120 kg/vehicle, whereas the average penetration of plastics in India is 60 kg/vehicle. Vehicles employ a broad range of polymers. The fundamental purposes of such extensive usage of specialty polymer materials in automobiles determine the aesthetics, usefulness, economy, and low fuel consumption of the vehicles.

Concerns have changed from supply-side manufacturing problems to diminished business as the virus has expanded throughout the world. The major industrialized economies most impacted include South Korea, Italy, and Japan. As a result, 80 percent of businesses in the automobile and allied industries claim that the coronavirus will directly affect their 2021 sales. 78% of businesses lack the personnel necessary to staff a full manufacturing line. The global auto supply chain is related to China to a greater than 80% extent. China's vehicle sales fell by more than 18% in January 2020. According to the China Passenger Car Association (CPCA), sales for the first two months of 2020 may have decreased by at least 40%. Global automakers will be impacted by production deficits brought on by China's supply chain interruptions this year, but once things have returned to normal, the market will increase steadily during the projected period.

Segments Covered in the Report

By Type

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

November 2024

November 2024