July 2024

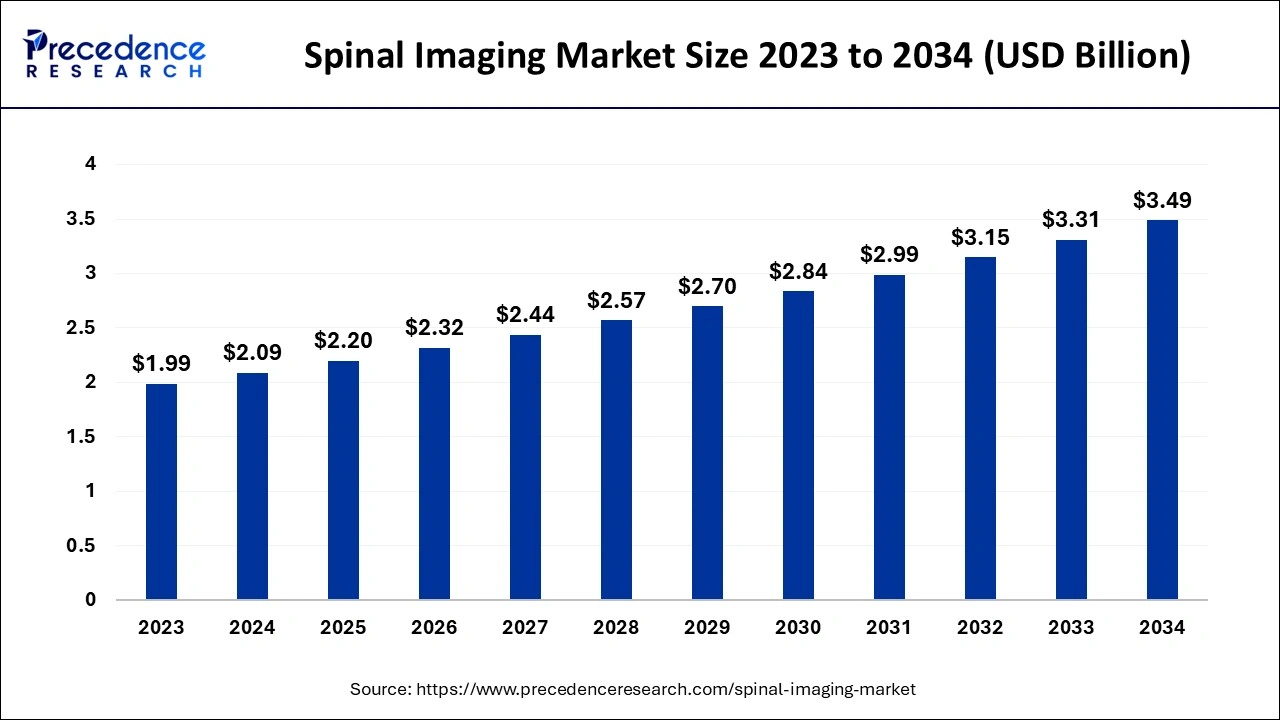

The global spinal imaging market size accounted for USD 2.09 billion in 2024, grew to USD 2.20 billion in 2025 and is expected to be worth around USD 3.49 billion by 2034, registering a CAGR of 5.23% between 2024 and 2034. The North America spinal imaging market size is calculated at USD 690 million in 2024 and is expected to grow at a CAGR of 5.34% during the forecast year.

The global spinal imaging market size is worth around USD 2.09 billion in 2024 and is anticipated to reach around USD 3.49 billion by 2034, growing at a CAGR of 5.23% from 2024 to 2034. The spinal imaging market is driven by the growing need for sophisticated diagnostic instruments like MRIs, CT scans, and X-rays to enable precise diagnosis and treatment planning due to the rising incidence of spinal illnesses like degenerative disc disease, spinal stenosis, and ruptured discs.

Numerous illnesses, such as degenerative, neoplastic, infectious, traumatic, and inflammatory demyelinating diseases, can affect the spine, which is a significant location of pathology. Diagnostic imaging frequently plays a crucial role when diagnosing spinal disorders. Artificial intelligence could greatly impact every stage of spinal imaging. By enhancing image quality, imaging effectiveness, and diagnostic precision, AI can increase spine scans' value for patients and physicians.

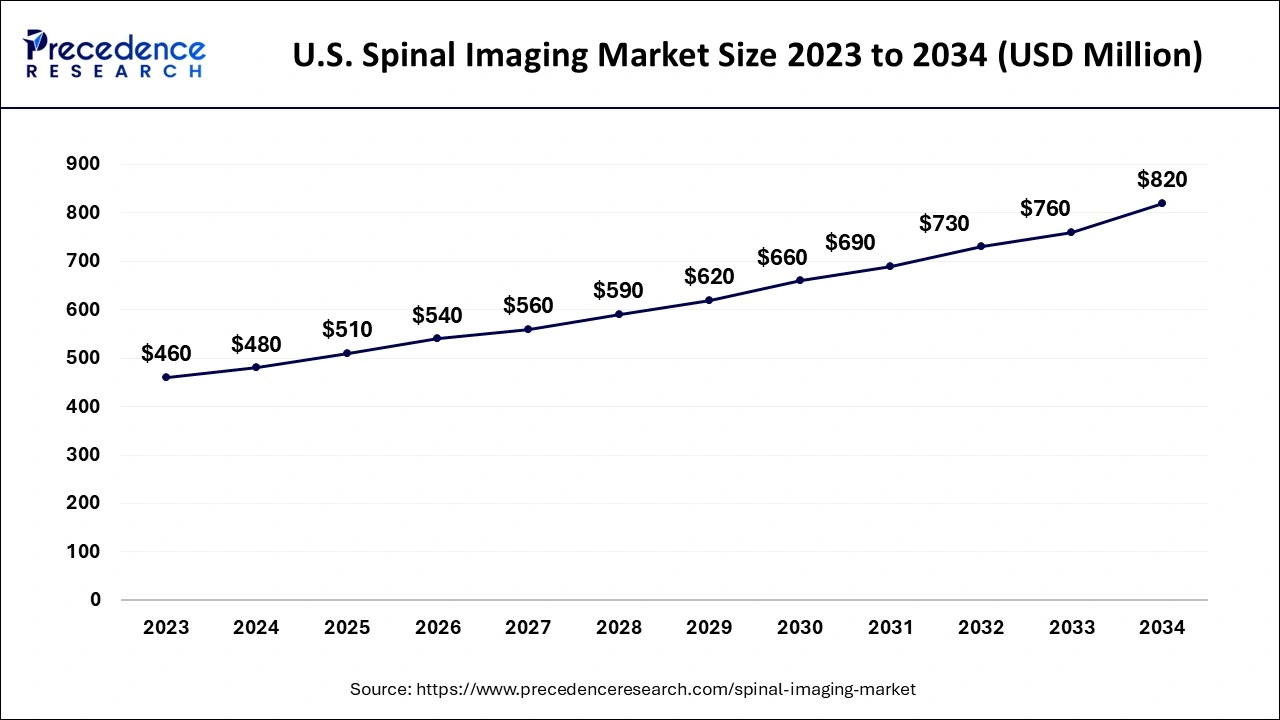

The U.S. spinal imaging market size is evaluated at USD 480 million in 2024 and is projected to be worth around USD 820 million by 2034, growing at a CAGR of 5.40% from 2024 to 2034.

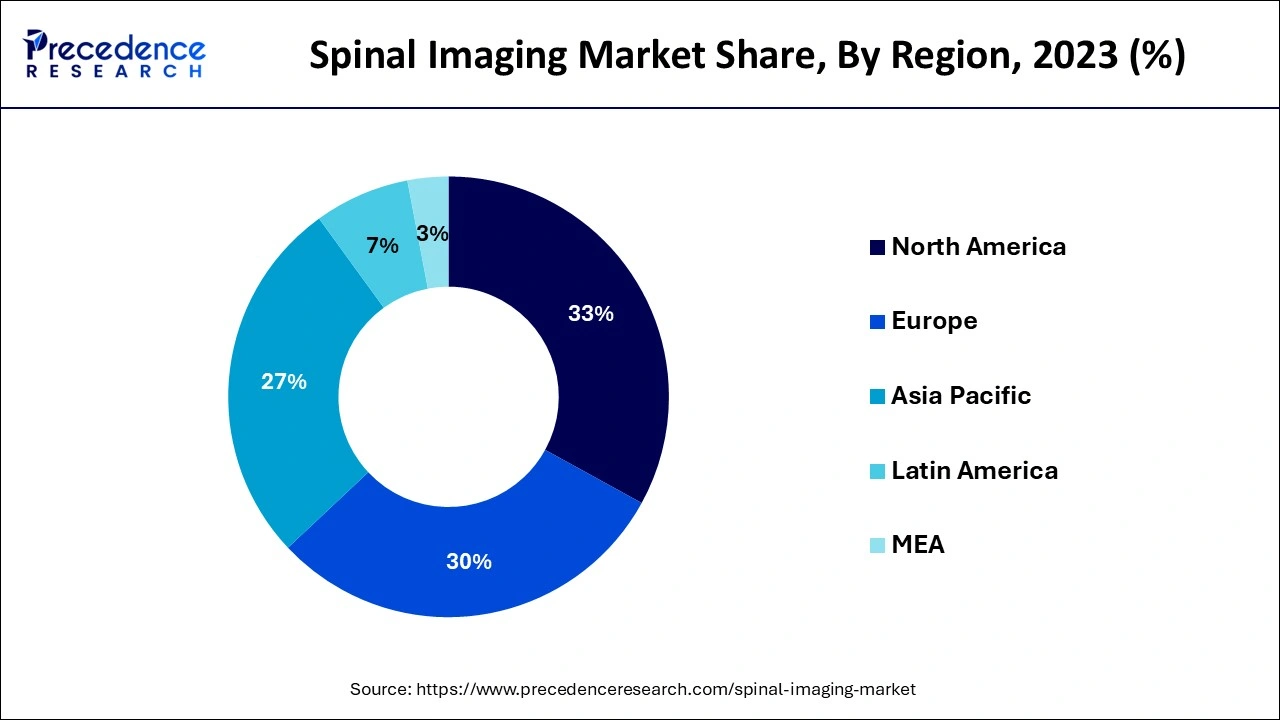

North America has the largest share of the spinal imaging market in 2023. North America has a highly developed healthcare system with extensive access to the latest diagnostic facilities. Modern imaging technologies, including MRI, and PET scans, are available in hospitals, clinics, and diagnostic centers, making spinal imaging services easily accessible. Insurance companies and government healthcare programs in the United States, including Medicare and Medicaid, widely cover spinal imaging techniques. These regulations promote use while lessening the financial strain on patients.

Asia-Pacific is observed to be the fastest growing in the spinal imaging market during the forecast period. Due to the region's sizable and quickly expanding senior population, spinal problems like osteoporosis, degenerative diseases, and spinal cord injuries are becoming more common. The need for diagnostic procedures like spine imaging (MRI, CT scans, X-rays) to evaluate spinal health is growing along with the number of older persons. Healthcare facilities progressively use high-quality imaging technologies that provide comprehensive insights into spine anatomy, including identifying intricate problems such as degenerative disc diseases and fractures.

Several methods are used in spinal imaging to produce fine-grained images of the spine and adjacent tissues. These pictures aid in the diagnosis of spinal disorders, therapy planning, and illness progression tracking. Both spine MRI and X-ray are common imaging methods that provide distinct advantages for visualizing spinal structure and disease.

According to the World Health Organization, more than 15 million people suffer from spinal cord injuries (SCI). Most SCI cases are preventable since they are caused by trauma, such as falls, car accidents, or violent crimes.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.49 Billion |

| Market Size in 2024 | USD 2.09 Billion |

| Market Size in 2025 | USD 2.20 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.23% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising incidence of spinal disorders

Since osteoporosis and arthritis cause degenerative changes in the spine over time, older people are more vulnerable to spinal problems. Advanced imaging methods are frequently needed for spinal diseases to accurately diagnose, plan, and monitor treatment. Imaging techniques such as MRI, CT, and X-rays are essential for observing the spine's structure and identifying anomalies. Access to cutting-edge imaging technologies has improved in emerging economies due to increased investments in healthcare infrastructure.

Limited sensitivity of MRI to bone abnormalities

Soft tissues like ligaments, muscles, intervertebral discs, and nerves are very well-imaged by MRI. However, compared to imaging modalities like CT (Computerized Tomography) scans or X-rays, it is less sensitive to the fine structural details of bone. The usefulness of MRI is limited because conditions that impact bone density and integrity, like Paget's disease, are better observed using CT or bone-specific imaging techniques. In diagnostic processes, CT and X-rays frequently substitute or enhance MRI due to their limitations in bone imaging. In some spinal disorders, this lowers the necessity for MRI.

Degenerative illnesses (such as spondylosis and ruptured discs), congenital abnormalities, infections, trauma, and malignancies are all included in the wide range of spinal disorders. The need for different imaging methods and procedures for each kind makes it more difficult to standardize imaging solutions. Specialized radiologists with musculoskeletal and spinal imaging knowledge are needed to interpret spinal imaging. The usefulness of spinal imaging technology is limited in many areas by a lack of such specialists.

Advancements in imaging technology

High-field magnetic resonance imaging (MRI) and multi-detector computed tomography (MDCT), two contemporary imaging technologies, offer incredibly detailed pictures of the spinal components. This makes it possible to identify minute anomalies such as disc herniations, microfractures, and early indicators of degenerative illnesses. The use of advanced ultrasound imaging in spinal assessments has been made possible, especially when it comes to directing minimally invasive operations like nerve block placements and epidural injections.

The MRI segment has the largest share in the spinal imaging market in 2023. Since magnetic resonance imaging (MRI) produces high-resolution, detailed images without exposing users to radiation, it is the recommended technique for spinal imaging. The body's soft tissues, such as the spinal cord, nerves, muscles, ligaments, and tendons, are especially well-suited for MRI imaging. When assessing spinal injuries, MRI is incredibly helpful. When a physical examination reveals muscle weakness or paralysis, it aids in diagnosing or excluding acute spinal cord compression. Subtle alterations in the spinal column that could be an early indication of an infection or tumor can be found with MRI. MRI is more sensitive than CT scanning when assessing tumors, abscesses, and other soft tissue masses close to the spinal cord.

The CT segment is observed to be the fastest growing in the spinal imaging market during the forecast period. Since computed tomography (CT) scans are an effective method for identifying and treating spine disorders, they are in high demand for spinal imaging. When other forms of examination, like X-rays or physical examinations, are inconclusive, a CT scan of the spine may be used to check for a herniated disk, tumors, and other lesions, the extent of injuries, structural anomalies like spina bifida, blood vessel malformations, or other conditions. Additionally, a CT scan of the spine can be used to assess the results of spinal treatments like surgery or other therapies.

The spinal cord and nerve compressions segment has the largest share in the spinal imaging market in 2023. Around the world, spinal cord and nerve compression conditions such as sciatica, spinal stenosis, and ruptured discs are very common. Due to their increased risk of degenerative spinal disorders, these problems are particularly prevalent in older populations. In addition to diagnosis, imaging is essential for preoperative planning and postoperative assessment of procedures such as spinal fusion and decompression surgery. The need for imaging technologies that target spinal cord and nerve compressions has increased due to the rise in spine procedures performed worldwide.

The spinal infection segment is observed to be the fastest growing in the spinal imaging market during the forecast period. The danger of post-operative infections is increased by the rising frequency of invasive procedures and spinal surgeries, necessitating accurate imaging for diagnosis and follow-up. Spinal disorders are more common in patients with weakened immune systems, such as those with HIV/AIDS, cancer, or receiving chemotherapy. The need for diagnostic imaging is rising as this demographic expands. The frequency of imaging referrals has increased due to awareness initiatives and medical education that highlight the significance of early detection of spinal infections.

The hospital segment held the largest share in the spinal imaging market in 2023. Every day, hospitals handle a sizable patient population, including referrals from primary care centers and smaller clinics and emergency cases. Hospitals commonly undertake spinal imaging because of their accessibility and wide range of care offers, especially in situations of spinal cord injuries, degenerative disorders, and trauma. Numerous hospitals' clinical research activities facilitate the adoption of cutting-edge imaging technology. Hospitals have strengthened their position in the market by expanding their spinal imaging capabilities through technologies like 3D imaging and functional MRI.

Spinal conditions, including scoliosis, ruptured discs, and spinal stenosis have become more common as the population ages and lifestyles change. Millions of people worldwide suffer from back pain, which increases the need for accurate diagnostic tools to enable efficient treatment. Diagnostic imaging facilities are becoming increasingly dependent on high-quality imaging necessary for early detection and individualized treatment strategies. Several governments are supporting diagnostic centers as part of larger healthcare programs to increase access to cutting-edge diagnostic techniques. More people are seeking aging services due to public awareness initiatives on spinal health and the value of early diagnosis.

Our in-depth research and expertise highlight the transformative growth potential of the spinal imaging market. With the rising prevalence of spinal disorders such as herniated discs, degenerative diseases, and spinal injuries, the demand for precise and innovative imaging solutions is growing exponentially.

Through our in-depth analysis, we observe that advancements in AI-driven imaging systems, 3D visualization, and portable imaging technologies are revolutionizing diagnostics and patient care. These technologies not only improve diagnostic accuracy but also enable healthcare providers to adopt minimally invasive and more effective treatment approaches.

Our research also underscores significant opportunities in emerging markets, particularly in the Asia-Pacific region, where improving healthcare infrastructure and increased investments are creating fertile ground for market expansion. As industry leaders, we believe collaborations between technology developers, healthcare providers, and policymakers will further drive accessibility and innovation in this sector.

By Product

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

September 2024

January 2025

January 2025