August 2024

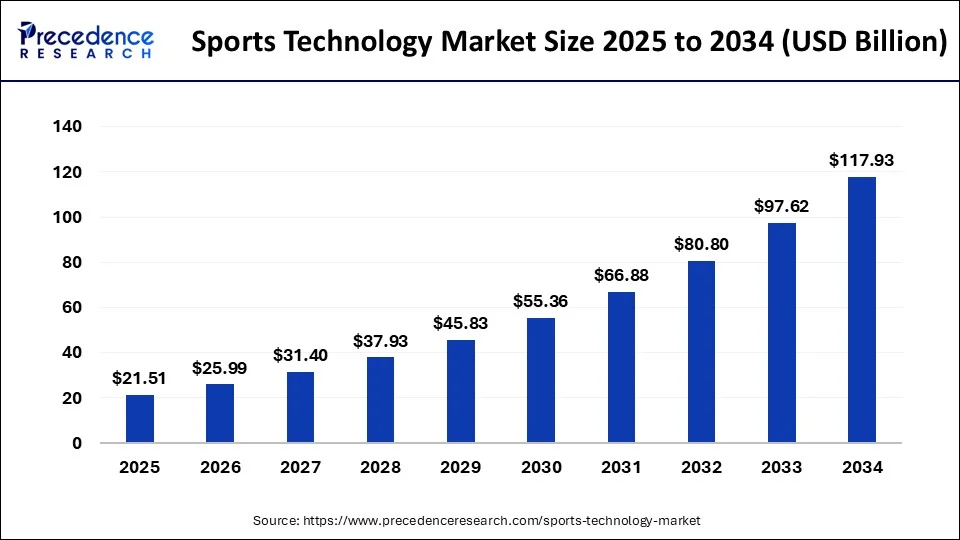

The global sports technology market size was USD 14.74 billion in 2023, calculated at USD 17.81 billion in 2024 and is expected to be worth around USD 117.93 billion by 2034. The market is slated to expand at 20.81% CAGR from 2024 to 2034.

The global sports technology market size is expected to worth USD 17.81 billion in 2024 and is anticipated to reach around USD 117.93 billion by 2034, growing at a solid CAGR of 20.81% over the forecast period 2024 to 2034. The rise in audience engagement in sports and increasing competition among athletes are the driving factors of the sports technology market.

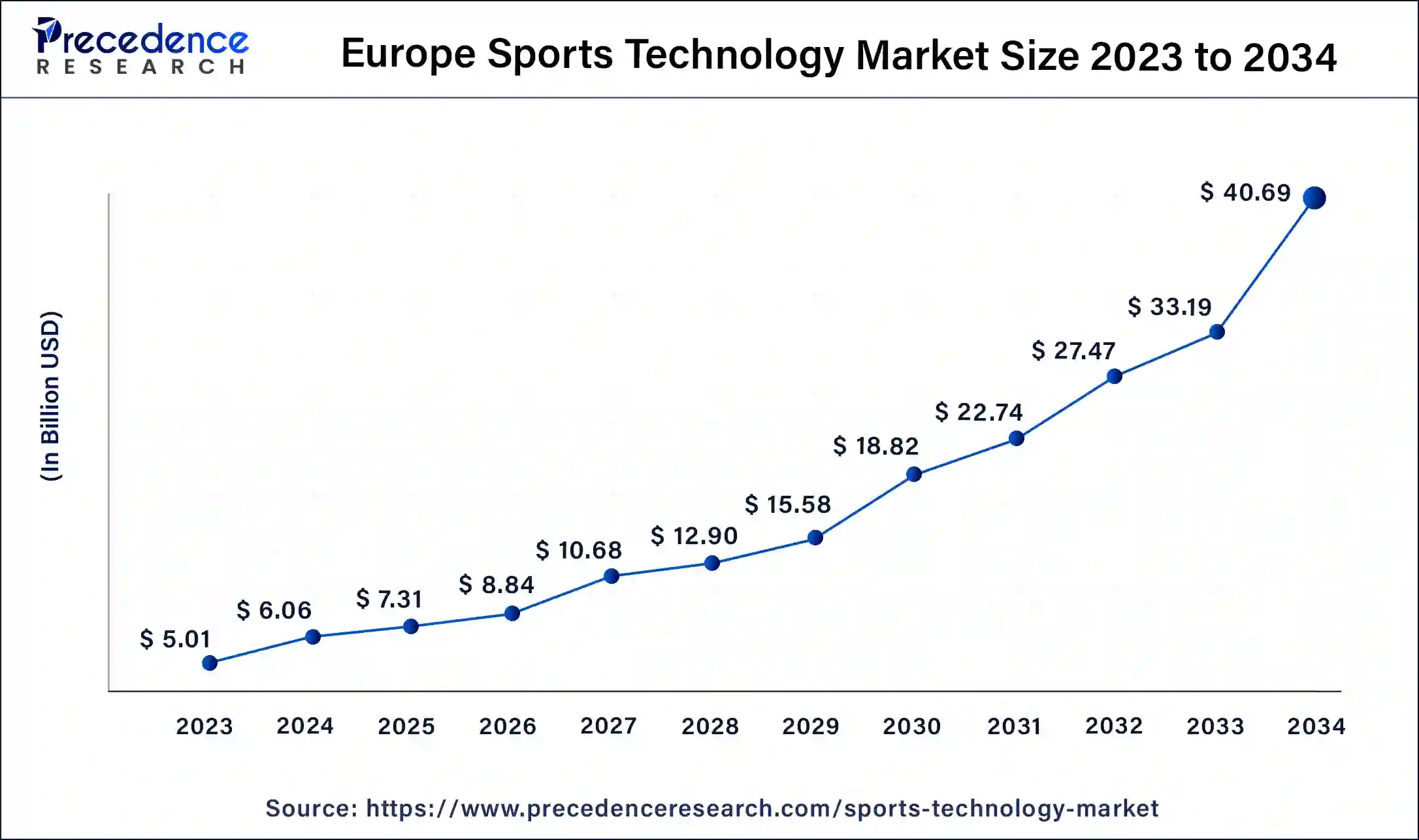

The Europe sports technology market size was exhibited at USD 5.01 billion in 2023 and is projected to be worth around USD 40.69 billion by 2034, poised to grow at a CAGR of 20.97% from 2024 to 2034.

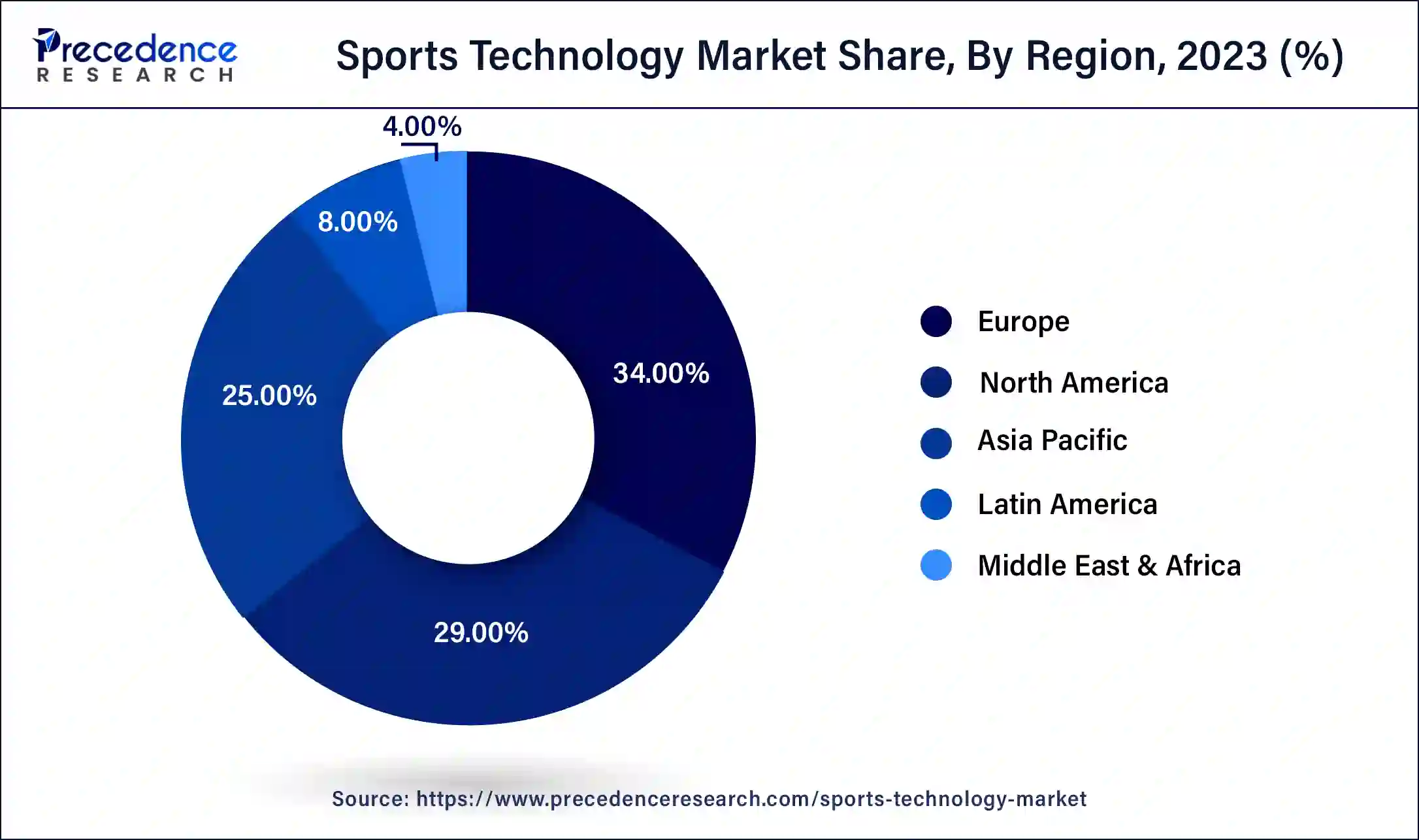

Europe dominated the sports technology market in 2023. The rising fans’ engagement, increasing collaborations and investments, and advancements in technology augment the market in the region. Another factor driving the market is the presence of key players. The leading tech giants like Meta, Apple, and Google are heavily investing in sports technology.

European governments support innovation in sports through funding and infrastructure development, fostering a strong ecosystem for sports technology startups and research institutions. Countries like Germany, France, and the UK have invested in smart stadiums and digital fan engagement tools, contributing to market growth.

The increasing collaborations, emerging startups, presence of key players, state-of-the-art sports infrastructure, growing demand in eSports, and technological advancements drive the market growth. The European government is also at the forefront of promoting sports technology through funding and various sports policies.

Asia Pacific has the capacity to expand rapidly in the sports technology market over the forecast period. The market is driven by advancements in technology, the conduction of major sporting events, increased collaborations, and rising competition among athletes. Countries like China, Korea, Japan, Malaysia, India, and Australia are at the forefront of sports technology in the region. The Chinese government has made significant infrastructural and sports development investments as it recognizes the role that sports play in promoting an active and healthy community.

Sports Technology Market: Revolutionizing Sports

The sports technology market involves the design, development, and utilization of devices, equipment, systems, and software specifically for athletic purpose. The market is rapidly evolving with increasing engagement of audience, improving athlete performance, managing sports teams, and analyzing on and off field activities. The sports technology sector is the origin of cutting-edge and innovative methods to boost athletic performance, avoid injuries, captivate spectators, and enhance the whole professional sports event experience.

Some common sports technology products include wearable technology, sports injury prevention, data tracking and data collection, event scheduling, and goal-line technology. It enhances the viewers’ experience by providing real-time data analytics and eases the umpire’s decision with replay options and goal-line technologies. It can also help prevent and diagnose injuries, monitor heart rate and oxygen levels, and monitor calorie intake. Furthermore, strategic business ventures by key players in the sports technology market have been observed in recent years.

SportsTechX’s Report on the Sports Technology Industry

Asia Pacific dominated the mergers and acquisition deal, accounting for 44% of the market share in 2023, followed by North America with 33% and Europe with 23%. In addition, approximately 45.1% of investment in North America and 68.2% of investment in Europe was made to improve the activity and performance of athletes, while 73.7% of investment was made in the fans and content in Asia Pacific. All these data highlight the demand for sports technology at a global level.

How AR and VR are Shaping the Future of Sports?

Augmented Reality and Virtual Reality augment the way sports are played, watched, and experienced by enhancing performance, safety, and engagement. These technological innovations can assist coaches and athletes in uplifting their game through specialized techniques. They enable visual feed of the athletes’ form and technique with precision metrics such as angles, distances, and speed, allowing for minute adjustments. It empowers a larger audience and generates additional revenue for the teams and organizations.

AR VR can enhance viewership by amplifying the entertainment level and information value of its sports broadcasting. They also enable referees or umpires to make informed decisions on and off the field by utilizing technologies such as optical tracking, vision processing, and creative graphic technologies like Hawk-Eye. They can also provide new opportunities for sponsors and advertisers by creating virtual ads and displays during a match.

| Report Coverage | Details |

| Market Size by 2034 | USD 117.93 Billion |

| Market Size in 2023 | USD 14.74 Billion |

| Market Size in 2024 | USD 17.81 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 20.81% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Sports, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing viewership

The increase in the number of viewers in the past few decades has played a vital role in uplifting the sports technology market. As technology advances at a rapid pace, modern sports organizations have a chance to connect with their supporters faster and easier, broadening their appeal and worldwide reach. The increasing popularity of sports encourages organizations and clubs to uncover a competitive edge by promoting advancements in technology.

The enhanced streaming services are estimated to reach USD 80 billion by 2028.

The digitization of sports and fan experience can strengthen engagement, build brand value, and drive new avenues of growth. The viewers can watch their favorite game from any location with multiple camera angles and better quality. Additionally, the mobile apps provide detailed player information and also enable live commentary in their language. Modern technologies like AR and VR further augment the viewership experience. Hence, emerging technologies play a major role in sports, enabling companies to invest in and capitalize on the growing demand for their use among consumers.

Cyber security and live viewership

It is now necessary for the sports industry to embrace technology to help achieve better sporting and financial results. However, there are several challenges that need to be overcome in this digital era. One of the major challenges of sports technology is the risk of cyber threats. Technology helps in recording an athlete’s performance analysis, health, etc. data, which can be hacked and can invade privacy.

The adoption of the sports technology market services reduces the number of viewers in the stadium for a live match. Advanced technology offers a better viewing experience for people watching the match on TVs or mobile phones. Additionally, the availability of technology to all clubs and training centers is difficult due to higher costs. The higher cost thereby makes sports exclusive to wealthy people.

State-of-the-art research and development facilities

The increasing demand for sports technology encourages state-of-the-art research and development in the field. Today’s digital science research offers an arsenal of tools and techniques, from real-time data collection to advanced performance analysis and the generation of prediction models that are revolutionizing the training and performance enhancement of elite athletes. The increasing investments also support more research and innovation in the sports sector. Numerous sports and tech brands are developing their own sports research labs using computational technology to fill the gap in sports technology.

The smart stadium segment led the global sports technology market in 2023. The advancements in technology and changing consumer behavior are driving a dramatic transition in fan involvement in the fast-changing sports industry. In light of today’s sophisticated home entertainment systems and the most recent statistics and updates available on mobile phones, stadium managers and operators are coming up with innovative strategies to keep spectators entertained and secure at the stadium.

They integrate technologies like sensors, cameras, and 5G to keep the audience engaged within the stadium. The 5G Wi-Fi connectivity offers innovative technologies, fan engagement opportunities, and promotional activities. The mobile application enables parking location, ticket booking, selecting seats at the stadium, real-time statistics, and much more.

The analytics & statistics segment is projected to grow at the fastest rate in the sports technology market during the forecast period. Sports analytics and statistics enable real-time data to improve the performance of the athletes. The rising competition among athletes demands the need for efficient analysis and statistics governing support staff to make effective decisions.

The analytics in the sports field can be of two types: on-field analytics and off-field analytics. The on-field data analytics gives data about in-game strategies, player records, nutritional data, etc., whereas the off-field data analytics helps in ticket sales, merchandise sales, fan engagement, etc.

The soccer segment held the largest share of the sports technology market in 2023. Soccer is the most watched sport worldwide. Sports technology is not only useful for on-field decisions but also for off-field training of the players. FIFA World Cup first used the Video Assistant Referee (VAR) in 2018 to assist with referee decisions. Another technology, semi-automated offside technology (SAOT), was first used on soccer grounds in Qatar in 2022 to calculate the exact position of the players and the ball in real-time if offside has occurred.

Smart technologies like touch trainers and smart targets enable players to enhance their technical skills. Similarly, training regimens are also available for players, such as data tracking, to enable coaches to design training sessions and sensors to monitor heart rate and physical stress.

The cricket segment will expand rapidly in the sports technology market during the forecast period. After soccer, cricket is the most viewed sport with the highest viewership in countries like India, UK, and Australia. Advanced technologies like Hawk-Eye, Virtual Eye, and Ultra-Edge have made on-field decisions for umpires easier. Additionally, technologies like high-speed cameras monitor a player’s movements and provide real-time feedback, GPS trackers monitor a player’s fitness levels and workload, and much more provide a deeper insight into a player’s performance.

The sports leagues segment dominated the sports technology market in 2023. A sports league is a professional body that governs the competition among teams of different countries or different franchises. The use of AI by teams has enabled them to extract more information from in-game data, thereby expanding their understanding. The massive investments of sports leagues in AI have encouraged teams and athletes to reach new heights of innovation in performance analysis and tactical decision-making. Sports leagues like the National Football League, Major League Baseball, and National Basketball Association are among the highest revenue-generating leagues globally.

The sports club segment is expected to grow rapidly in the sports technology market over the forecast period. A sports club is an association of players who play different sports. The increase in collaboration and investments to adopt advanced technology boosts the sports club segment. The adoption of technology helps improve the player’s performance by providing more accurate data and assisting in decision-making.

Segments coverd in the Report

By Type

By Sports

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

April 2025

February 2025

April 2025