March 2025

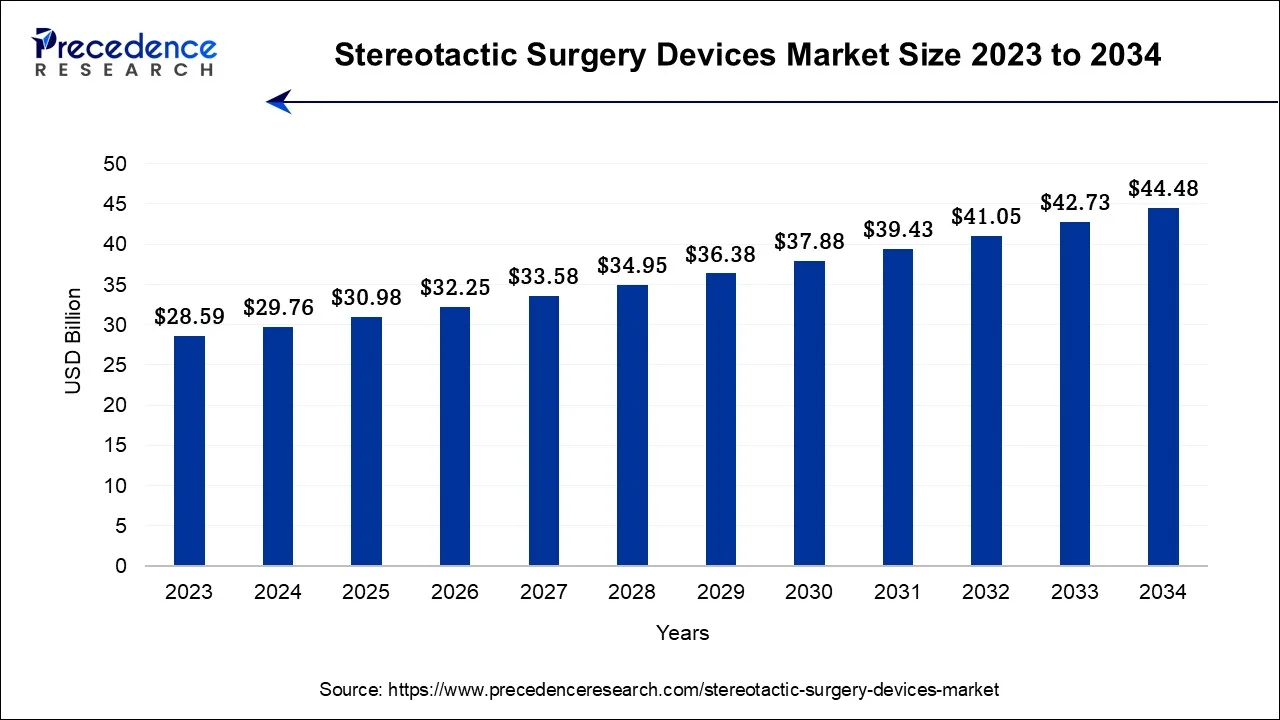

The global stereotactic surgery devices market size accounted for USD 29.76 billion in 2024, grew to USD 30.98 billion in 2025 and is projected to surpass around USD 44.48 billion by 2034, representing a healthy CAGR of 4.10% between 2024 and 2034. The North America stereotactic surgery devices market size is worth around USD 13.69 billion in 2024 and is expected to grow at a fastest CAGR of 4.21% during the forecast period.

The global stereotactic surgery devices market size is calculated at USD 29.76 billion in 2024 and it is estimated to hit around USD 44.48 billion by 2034, growing at a CAGR of 4.10% from 2024 to 2034.

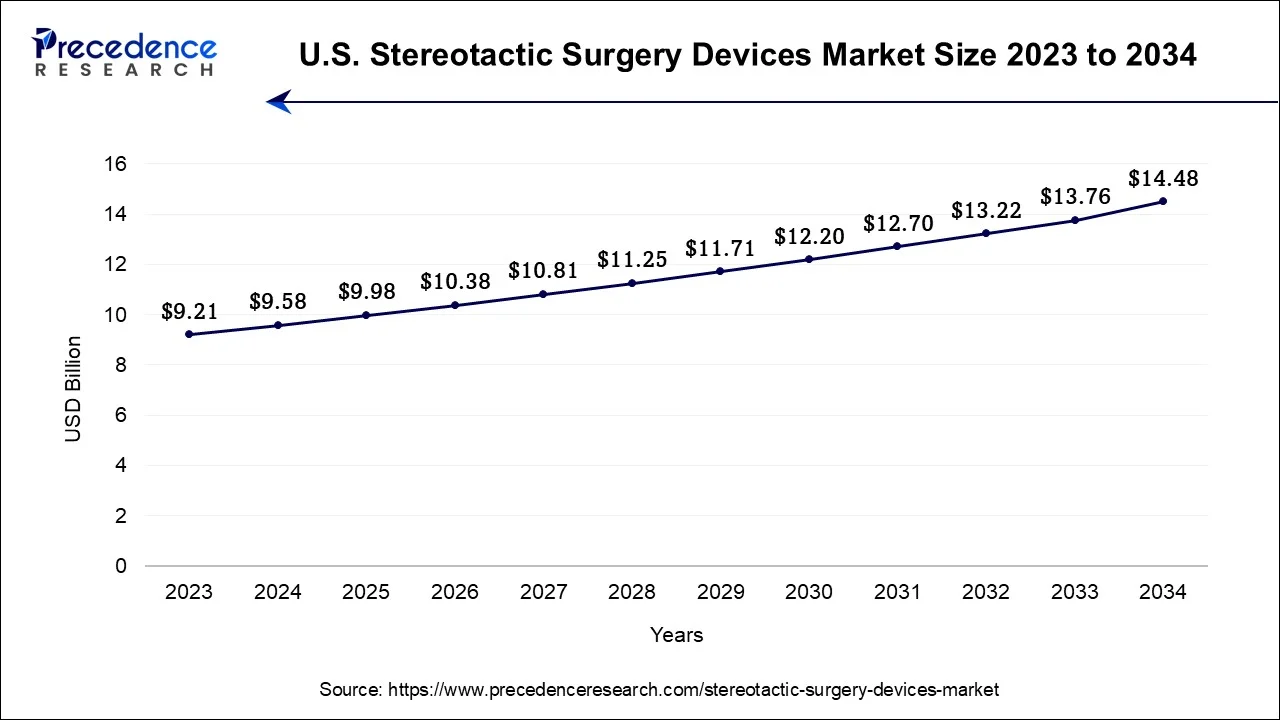

The U.S. stereotactic surgery devices market size accounted for USD 9.58 billion in 2024 and is estimated to reach around USD 14.48 billion by 2034, growing at a CAGR of 4.22% from 2024 to 2034.

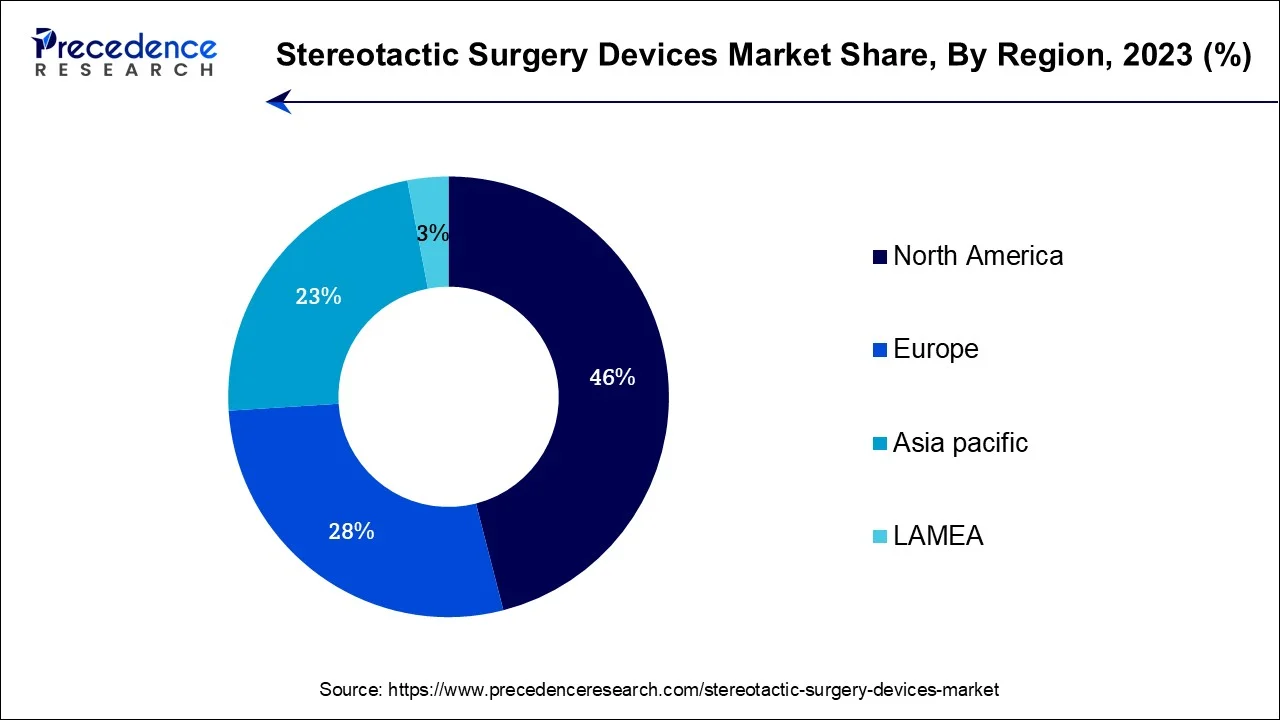

North America has held the largest revenue share 46% in 2023. In North America, the stereotactic surgery devices market has witnessed several notable trends. The region has seen a growing adoption of advanced stereotactic surgery technologies, driven by a robust healthcare infrastructure and high healthcare spending. There's an increasing emphasis on minimally invasive procedures, with surgeons utilizing stereotactic devices for precision and reduced patient trauma. Telemedicine integration has also gained prominence, especially in remote areas, expanding access to these devices.

Additionally, ongoing research and development activities, as well as collaborations between medical institutions and manufacturers, continue to drive innovation in the North American market, ensuring its position at the forefront of stereotactic surgery device adoption.

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the stereotactic surgery devices market is experiencing notable trends. With a rapidly aging population and increasing prevalence of neurological disorders, there is a growing demand for precise and minimally invasive treatment options, driving the adoption of stereotactic surgery devices. Technological advancements and improving healthcare infrastructure in countries like China and India are further propelling market growth. Additionally, collaborations between regional healthcare providers and global medical device manufacturers are fostering innovation and expanding the availability of these devices. The Asia-Pacific region is poised to become a significant player in the global market, offering both challenges and opportunities for industry stakeholders.

| Report Coverage | Details |

| Market Size by 2024 | USD 29.76 Billion |

| Market Size in 2034 | USD 44.48 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.10% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The escalating prevalence of neurological disorders is a pivotal factor driving the demand for stereotactic surgery devices. As neurological conditions like Parkinson's disease, brain tumors, and epilepsy become more widespread, the need for precise and minimally invasive treatment options grows. Stereotactic surgery devices offer a tailored approach for addressing these disorders, enabling surgeons to target affected areas with exceptional precision. This rising demand is propelling market growth, as healthcare providers and patients increasingly recognize the effectiveness of stereotactic surgery in improving outcomes and quality of life for individuals grappling with neurological disorders.

Moreover, the minimally invasive surgery trend is significantly surging the demand for stereotactic surgery devices industry. Patients and healthcare providers increasingly favor minimally invasive techniques for their reduced post-operative complications, faster recovery times, and improved patient outcomes. Stereotactic surgery devices play a pivotal role in this trend, enabling precise and minimally invasive interventions in conditions like brain tumors and neurological disorders. As the demand for less invasive procedures continues to rise, the market for stereotactic surgery devices is expanding, with a growing number of healthcare facilities incorporating these advanced technologies into their surgical practices to meet patient preferences and improve clinical outcomes.

The high cost associated with stereotactic surgery devices presents a significant restraint on market demand. These devices require substantial capital investment not only for their purchase but also for ongoing maintenance and operational expenses. This financial burden can deter healthcare facilities, particularly those with limited budgets, from adopting these advanced technologies. Additionally, it can limit patient access to these precise and minimally invasive surgical options. To mitigate this restraint, manufacturers and healthcare institutions must explore cost-effective solutions and financing options to make stereotactic surgery devices more accessible and affordable, ultimately stimulating market demand.

Moreover, Complexity and training requirements present significant constraints on the market demand for stereotactic surgery devices. These highly specialized devices necessitate skilled healthcare professionals trained in their operation. The scarcity of trained personnel can limit the adoption of stereotactic surgery techniques, especially in underserved areas. The time and resources required for comprehensive training can also deter medical institutions from investing in these technologies. This constraint underscores the importance of developing effective training programs and expanding the pool of qualified professionals to unlock the full potential of stereotactic surgery devices and make them more accessible to patients worldwide.

Technological advancements play a pivotal role in surging the market demand for stereotactic surgery devices. These innovations continually enhance the precision, safety, and efficacy of procedures, making them more attractive to both healthcare providers and patients. Advanced imaging technologies enable better visualization, while robotic-assisted systems offer greater surgical dexterity. Real-time monitoring and data analytics further improve surgical outcomes. As these technologies evolve, they instill confidence in healthcare professionals, boost patient satisfaction, and drive the adoption of stereotactic surgery devices. Consequently, the market experiences increased demand as the industry stays at the forefront of cutting-edge medical innovations.

Moreover, Telemedicine integration can significantly boost the market demand for stereotactic surgery devices by expanding their reach and accessibility. By incorporating these devices into telemedicine platforms, healthcare providers can offer remote consultations, guidance, and even surgical procedures. This integration enhances access to specialized care, especially in underserved or remote areas, driving demand for stereotactic surgery devices. It not only facilitates real-time communication between surgeons and patients but also enables collaboration among medical professionals, ultimately increasing the utilization of these devices for precise and minimally invasive procedures, further fueling market growth.

The PBRT segment has held 86.1% revenue share in 2023. PBRT (Proton Beam Radiation Therapy) is a specialized technology used in the stereotactic surgery devices market. It employs proton beams to precisely target and irradiate cancerous tumors, minimizing damage to surrounding healthy tissues. This technology has gained prominence due to its ability to deliver highly focused radiation, reducing side effects and improving treatment outcomes.

In recent trends, PBRT (Proton Beam Radiation Therapy) has witnessed growing adoption within the field of stereotactic surgery, specifically for addressing intricate and deeply located tumors in the brain and other areas of the body. The increased demand for PBRT is attributed to its exceptional precision and reduced toxicity when compared to conventional radiation therapy methods. This development signifies a significant advancement in the realm of stereotactic surgery, promising improved treatment outcomes and minimize side effects for patients.

The cyberKnife segment is anticipated to expand at a significantly CAGR of 6.8% during the projected period. CyberKnife is a cutting-edge stereotactic surgery device used for non-invasive, precise, and targeted radiation therapy. It combines robotics and advanced imaging to deliver high doses of radiation to specific targets within the body, minimizing damage to surrounding healthy tissue. In the stereotactic surgery devices market, the CyberKnife system represents a growing trend towards advanced, image-guided, and minimally invasive treatments.

Its increasing adoption is driven by its ability to treat various conditions, including cancerous and non-cancerous tumors, with pinpoint accuracy, reduced treatment duration, and fewer side effects, making it a key player in the evolving landscape of stereotactic surgery.

The breast segment is anticipated to hold the largest market share of 28.5% in 2023. In the field of breast surgery, stereotactic surgery devices market are utilized for minimally invasive procedures like breast biopsies and wire-localization procedures. These devices enable precise targeting of breast lesions, ensuring accurate tissue sampling and guiding surgical interventions. Trends in this sector include an increasing emphasis on early breast cancer detection, prompting the demand for stereotactic surgery devices in breast screening programs.

Additionally, advancements in imaging and navigation technologies have enhanced the accuracy of breast procedures, reduced patient discomfort and improving diagnostic outcomes. The integration of artificial intelligence and 3D imaging further augments the capabilities of these devices, positioning them as essential tools in modern breast surgery and diagnosis.

The lung segment is projected to grow at the fastest rate over the projected period. Lung stereotactic surgery involves the precise, image-guided treatment of lung tumors, often using minimally invasive techniques. This approach allows for highly targeted radiation therapy or surgical interventions, minimizing damage to surrounding healthy tissue. In recent trends, the stereotactic surgery devices market has seen a notable increase in lung applications.

The rising incidence of lung cancer, coupled with advancements in imaging and robotics, has fueled demand. Stereotactic surgery devices for lung applications enable quicker recovery, reduced side effects, and improved outcomes, making them an increasingly preferred choice for both patients and healthcare providers. This trend is expected to continue as early lung cancer detection and minimally invasive treatment options gain prominence in the healthcare landscape.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

December 2024

December 2024