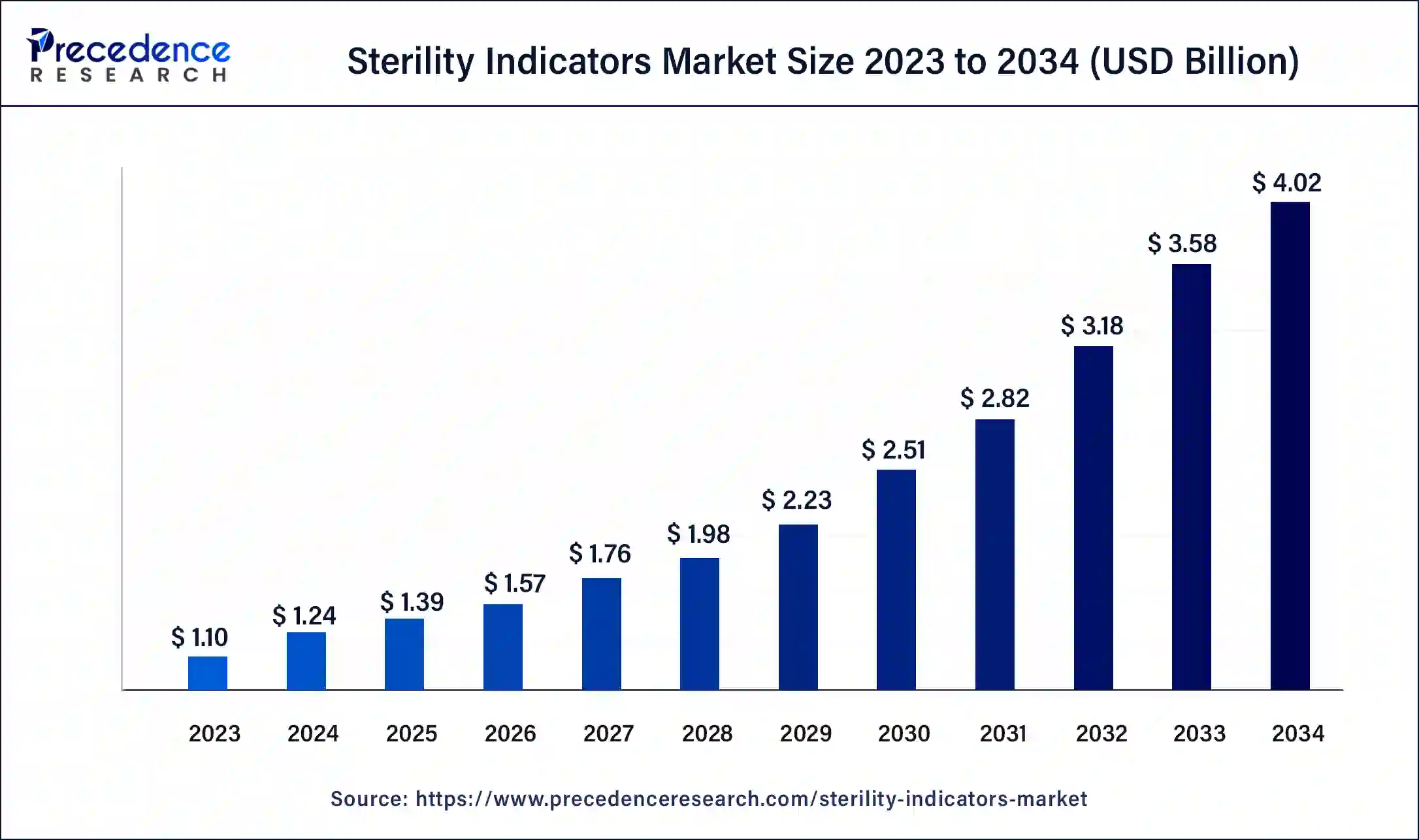

The global sterility indicators market size was USD 1.10 billion in 2023, calculated at USD 1.24 billion in 2024 and is expected to be worth around USD 4.02 billion by 2034. The market is slated to expand at 12.51% CAGR from 2024 to 2034.

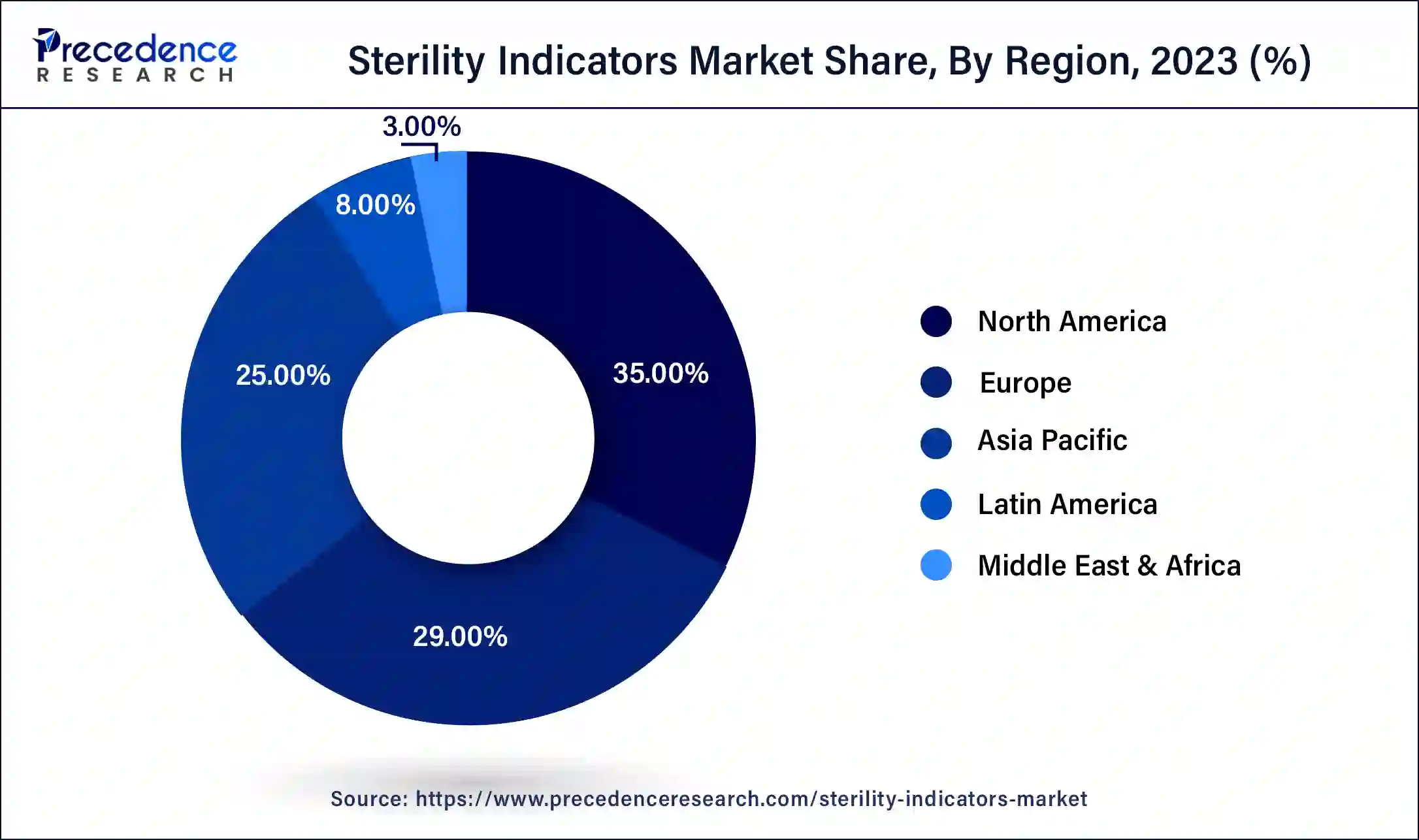

The global sterility indicators market size is expected to worth USD 1.24 billion in 2024 and is anticipated to reach around USD 4.02 billion by 2034, growing at a solid CAGR of 12.51% over the forecast period 2024 to 2034. The North America sterility indicators market size reached USD 390 million in 2023. The sterility indicators market is increasing due to enhancements in healthcare organizations, the growth and development of the medical device industry, increased awareness for infection control, and government regulations.

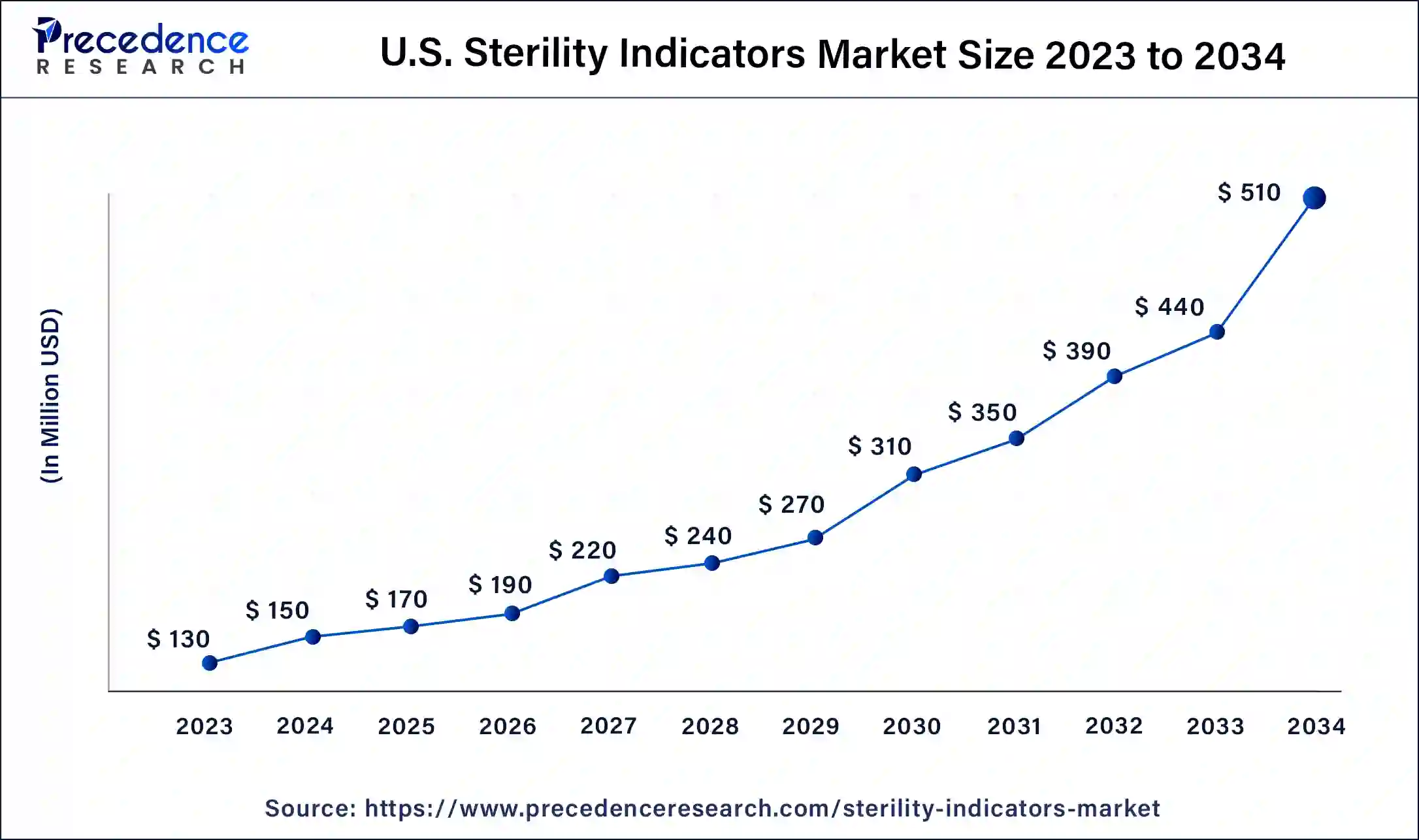

The U.S. sterility indicators market size was exhibited at USD 130 million in 2023 and is projected to be worth around USD 510 million by 2034, poised to grow at a CAGR of 13.23% from 2024 to 2034.

North America led the global sterility indicators market in 2023, owing to the high standards for medical device sterilization and the well-developed healthcare industry. The United States and Canada have the availability of well-developed healthcare facilities, and the concern towards the spread of healthcare-associated infections increases the need for accurate sterility indicators. Also, the advancements in technology and a greater focus on patient care are other factors that drive the market growth continuously.

Asia Pacific is anticipated to grow notably in the sterility indicators market during the forecast period due to factors such as an increase in the number of newly constructed hospitals and clinics, which has increased the need for proper sterilization and sterility control methods. Countries, including China, India, and Japan, are expected to have a large share due to improved economic status, improved investment in health facilities, and enhanced sterilization technologies.

Sterilization is a procedure of destruction of microorganisms, including spores and other forms, and is achieved by many physical and chemical means. Sterility indicators are used to monitor and evaluate the effectiveness of sterilization processes. They can reveal whether or not microbial growth was present after the process or if the sterilization. Sterilization indicators, such as spore strips and indicator tape, enable routine monitoring, qualification, and load monitoring of the sterilization process. There are several types of sterility indicators, like biological and chemical.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.02 Billion |

| Market Size in 2023 | USD 1.10 Billion |

| Market Size in 2024 | USD 1.24 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 12.51% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Technique, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing number of Hospital Acquired infections (HAIs)

The increasing number of hospital-acquired infections caused by viral, bacterial, and fungal pathogens is anticipated to drive the sterility indicators market. The most common types are bloodstream infections. An infection can be acquired in various clinical settings such as hospitals, nursing homes, and outpatient clinics. Infection is spread to susceptible patients in the healthcare setting, which has boosted the need for sterility indicators in hospital facilities.

Safety concerns related to ethylene oxide sterilization

The risks and challenges related to the ethylene oxide (EtO) sterilization process are restraints for the sterility indicators market. EtO is a highly toxic gas that is flammable and explosive and used in the sterilization of various medical requirements such as equipment, drugs, and any other products.

The use of such chemicals causes several safety problems like chronic toxicity, Irritation (skin, eyes, nose, throat, and lungs), possible harm to the brain, nervous system as well as reproductive system. These safety issues can result in increased regulation and decreased utilization of EtO sterilization, thus affecting sterility indicators demand.

Expansion of healthcare facilities

The expansion of healthcare facilities and infrastructure development is projected to boost the demand for the sterility indicators market. Sterilization proposes medical devices free from infectious agents, thus reducing the risk of patient harm and cross-contamination. As a hospital is established, effective sterility monitoring is needed to ensure the safety and efficiency of medical devices and equipment. Additionally, awareness of infection control is rising across the healthcare sector.

The biological indicators segment accounted for the biggest share of the sterility indicators market in 2023. A biological indicator or BI is a test system used to assess the efficacy of sterilization processes or procedures. They consist of living organisms, mostly bacterial spores, which are very hard to eliminate by sterilization procedures. Biological indicators, depending on the specific type, can be used for various sterilization processes using steam, hydrogen peroxide gas, ethylene oxide, and more. These are most often strips, discs (metal or paper), or threads that are inoculated with a predetermined organism at a controlled resistance.

The chemical indicators segment is expected to witness significant growth in the sterility indicators market during the forecast period. Chemical indicators monitor whether the parameters to achieve sterilization have been met for a specific sterilization process, such as steam or vaporized hydrogen peroxide sterilization. Chemical indicators change their properties due to critical parameters such as temperature, time, or the type of sterility indicator being used in the process, and these changes can be easily viewed by the human eye. Chemical monitors are intended to alter one or more of the physical conditions present in the sterilizing chamber. These indicators employ temperature-sensitive solutions or chemicals that turn color when sterilization is complete.

Class of Chemical Indicators

| Class 1 Process Indicators |

Class 1 chemical indicators are designed to monitor the thermal sterilization process and are intended to provide visible indicators of the sterilization process. |

| Class 2 Specific-Use Indicators |

These indicators contain two components: a heat-sensitive indicator which changes color when exposed to the steam and a moisture-sensitive indicator which changes color when exposed to moisture. |

| Class 3 Single-Variable Indicators |

These indicators change color when exposed to their respective chemical reagents and can be a useful tool for ensuring that a load has been adequately treated. |

| Class 4 Multi-Variable indicators |

They can be used for steam, ethylene oxide, and hydrogen peroxide sterilization processes and should be employed whenever precise dosimetry of these chemicals or radiation is essential. |

| Class 5 Integrating Indicators (Integrators) |

They change color when exposed to a given parameter of their respective sterilization process, even in the presence of a competing chemical or process parameter. These indicators are especially useful for double-check monitoring of the sterilization process. |

| Class 6 Emulating Indicators (Cycle Verification Indicators) |

These are typically used to measure the actual presence of viable organisms in the load after treatment and are essential for determining the actual effectiveness of the sterilization process. |

The heat sterilization segment generated the biggest share of the sterility indicators market in 2023. Heat sterilization is the traditional type of sterilization which is widely used. Such prospects are due to the effectiveness and convenience of this method. These methods include autoclaving, pasteurization, and fractional sterilization methods. Heat sterilization is generally the most efficient method of sterilization in which the killing of microbes is done through the destruction of the cell constituents and enzymes. In the recent past, moist sterilization techniques have grown in popularity because they have been used in the dairy and pharmaceutical industries as well as in research and development institutions.

The low-temperature sterilization segment is expected to grow significantly in the sterility indicators market during the forecast period. Low-temperature sterilization is a process that entails sterilization of tools or equipment using gases or chemicals. It is useful in reprocessing devices that are temperature and moisture-sensitive and cannot withstand full sterilization through autoclave sterilization. In addition, the use of expensive, complex, and delicate instruments for medical practice that are hard to sterilize promotes the development of low-temperature sterilization methods.

The hospital segment dominated the sterility indicators market in 2023. The sterility indicators are used to detect the sterilization process of medical devices performed they are free from the microbes. Good manufacturing practices are performed on products that are directed to supporting human health, sterility testing is critical to ensure the products are free from contaminating microorganisms. In the hospital, the medical instruments, equipment, and articles are reused it is necessary to perform sterilization.

The pharmaceutical companies segment is estimated to grow significantly in the sterility indicators market during the forecast period. Pharmaceutical sterilization is a process that removes or kills microorganisms, such as bacteria, fungi, and spores, from pharmaceutical products and equipment. Sterilization is one of the effective ways of maintaining the quality and safety of pharmaceutical products because the products are regulated and standardized. Sterility indicators are employed by pharmaceutical companies as well as other companies to measure and check sterilization processes. They can indicate whether sterilization was effective.

Segments Covered in the Report

By Type

By Technique

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client