April 2025

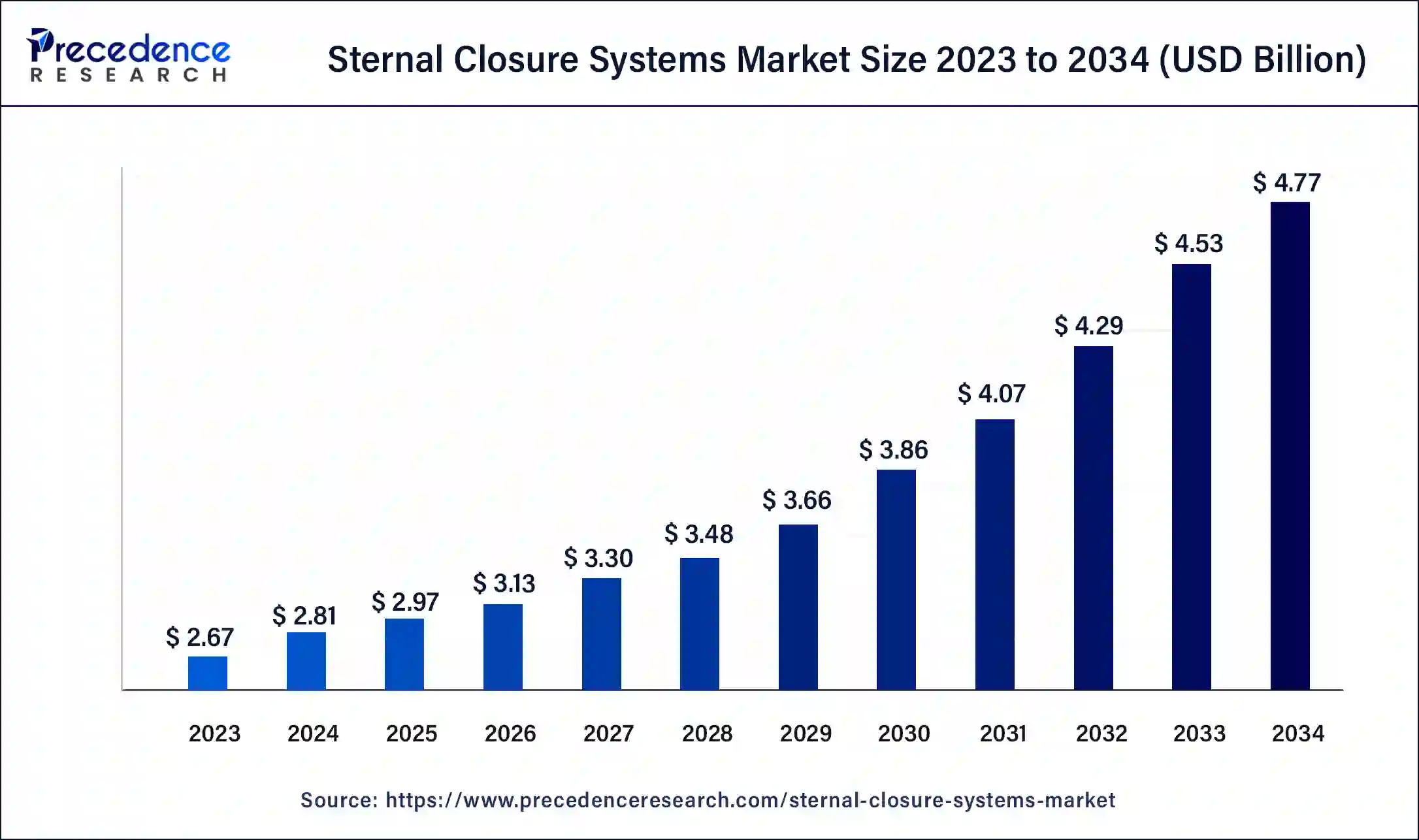

The global sternal closure systems market size surpassed USD 2.67 billion in 2023 and is estimated to increase from USD 2.81 billion in 2024 to approximately USD 4.77 billion by 2034. It is projected to grow at a CAGR of 5.42% from 2024 to 2034.

The global sternal closure systems market size is worth around USD 2.81 billion in 2024 and is anticipated to reach around USD 4.77 billion by 2034, growing at a solid CAGR of 5.42% over the forecast period 2024 to 2034. The North America sternal closure systems market size reached USD 910 million in 2023. Increasing cardiovascular diseases across the globe are turning into fatal conditions that need to be treated precisely; along with that, accidental injuries to the sterna affecting the quality of patients' lives after surgeries are the major cause driving the sternal closure systems market globally.

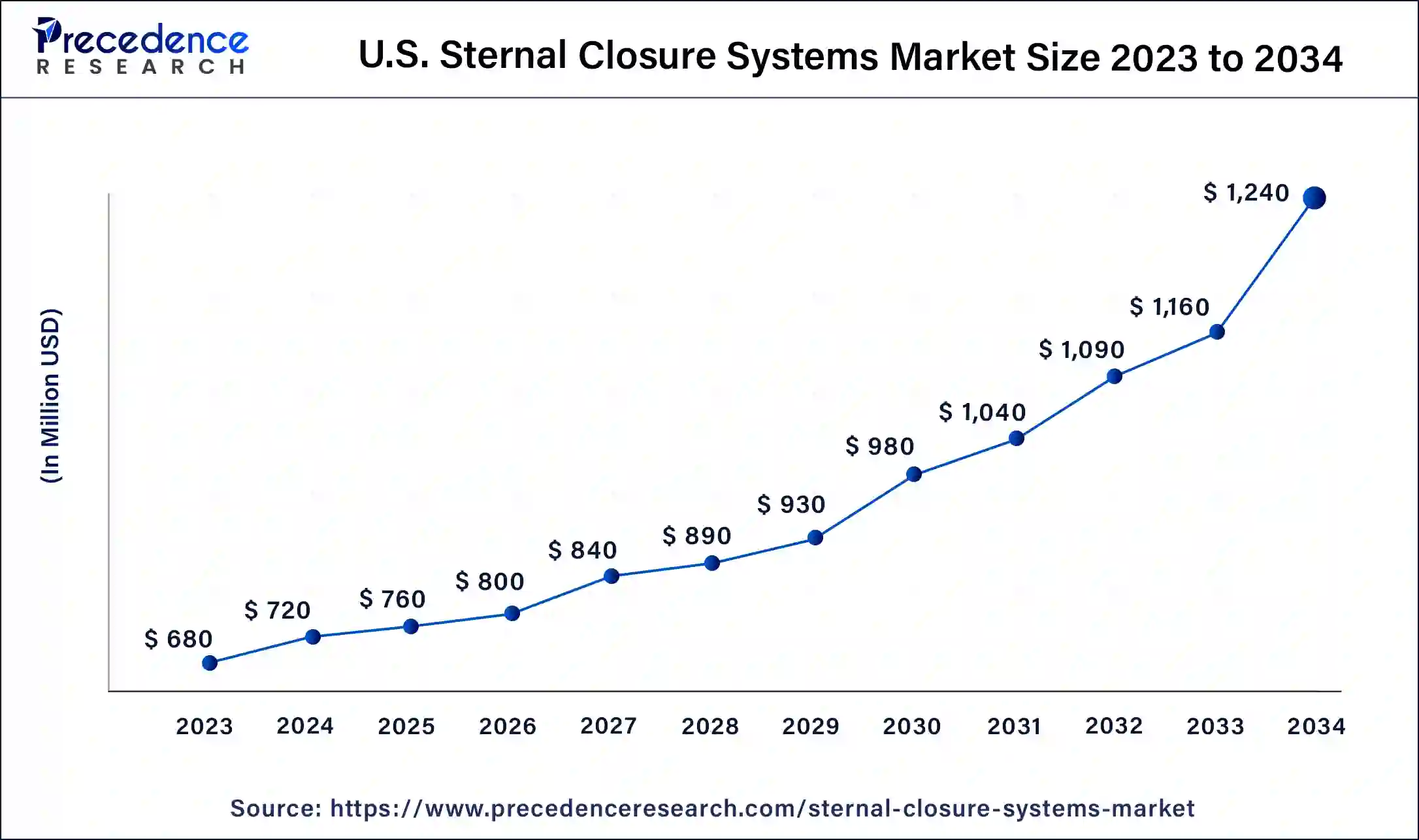

The U.S. sternal closure systems market size was exhibited at USD 680 million in 2023 and is projected to be worth around USD 1,240 million by 2034, poised to grow at a CAGR of 5.61% from 2024 to 2034.

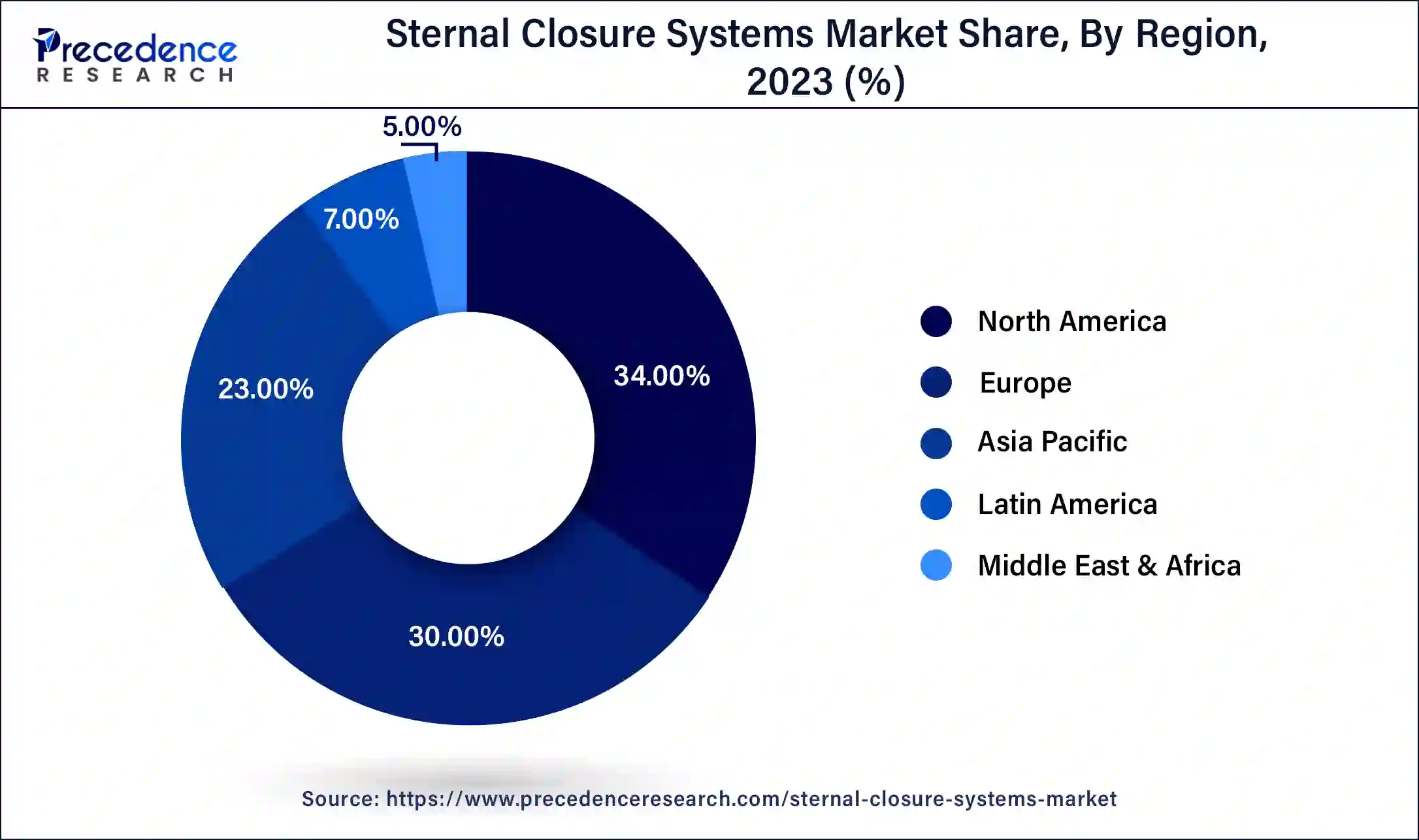

North America accounted for the largest share of the sternal closure systems market in 2023. The growth of this region is due to the presence of major market players in the U.S. and their active involvement. Moreover, the burden of cardiovascular diseases is increasing and creating a sense of fear among the masses, leading to awareness about surgeries for a healthy heart and overall health since the heart is the key organ of the human system.

Asia Pacific is expected to witness the fastest growth in the sternal closure systems market during the forecasted years. Growth of the region is due to the increasing rate of the geriatric population and investment in robust healthcare infrastructure with well-equipped, technically sound structures to treat various diseases, including chronic ones and CVDs as well. The market is expanding due to evolving countries like India, Japan, and China and their active participation in the advancement of the medical sector.

In India, the sternal closure systems market is witnessing exponential growth owing to factors like rising geriatric population rates, cardiovascular diseases, and chronic diseases. To treat this, technological advancement in the medical sector is further fuelling the market in India.

In China, the sternal closure systems market is fuelling due to the increasing healthcare expenditure annually along with numerous initiatives taken by major key players in the country to offer the best healthcare facilities to improve the results of surgeries like open heart surgery, which is crucial one among the surgeries proceeding in the medical sector.

The sternal closure systems market is expected to showcase a significant growth rate during the forecasted years owing to the increasing rate of cardiovascular diseases globally. Sternal closure devices refer to orthopedic devices that are used for the fixation of the sternum after a sternotomy and stabilize it properly with natural alignment. Sternotomy is basically a medical procedure where the chest cavity is opened with the help of surgical tools, done by highly skilled medical professionals to access the organs beneath the breastbone of the human body.

Cardiovascular diseases are frequent these days due to the sedentary lifestyle with contaminated foods, especially foods grown inorganically with harmful pesticides, which is one of the prime reasons for health decline. Cardiovascular injury is another reason why sternotomy is done to treat the damaged part of the chest area, which majorly happens due to accidents. These two reasons led to the increasing number of heart surgeries worldwide, fuelling the sternal closure systems market prominently on a wider scale and aiding in rising demand for sternal closure devices.

AI Impact on the market

Artificial Intelligence (AI) is significantly impacting the market growth of sternal closure systems for various reasons, like enhancing surgical procedures and improving precision by analyzing data with the help of machine learning algorithms. Due to the accuracy, intricate surgeries can become more sophisticated and data-driven, leading to reduced complications and faster recovery with a positive impact on the health of the patients.

Moreover, AI-driven imaging and diagnostics help in preoperative decisions and personalized planning for the treatment of individuals for better outcomes and faster recovery time. After operating on the patient, the AI-based tools can be used to measure medical terms like heart rate, blood pressure, and HB level after sugar, which are crucial factors that can affect patients' health prominently. AI tools developed for medical procedures further fuel the global sternal closure systems market.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.77 Billion |

| Market Size in 2024 | USD 2.81 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.42% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Procedure, Material, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The increasing rate of open-heart surgeries due to medical complications

A significant growth factor for the proliferation of the sternal closure systems market is increasing health-related complications, leading to open heart surgeries globally. The global market is driven by various prominent factors, including increasing instances of cardiovascular diseases due to unhealthy habits, a sedentary working culture, and wrong eating practices. The subsequent rise in open heart surgeries has increased the demand for sternal closure system devices for the precise outcomes of delicate practices like open heart surgeries.

The inclination toward minimally invasive surgery

A major restraining factor that hinders the sternal closure systems market growth is the inclination of individuals for minimally invasive surgeries across the globe. Chronic diseases like diabetes, thyroid, and CVDs can be optimally managed with the help of minimally invasive and non-invasive treatments, hindering the market growth further. This is due to the ongoing scientific advancements in the medical sector, which have led to the development of technically well-structured devices that help in precise surgeries without operating on the human system.

Approval of technologically innovative orthopedic/ sternal products.

A major opportunity that the sternal closure systems market holds is the approval of technologically advanced sternal products by authorities like the FDA and others. Major key players in the market are striving for opportunities to merge and acquire developing companies in the market to expand their portfolios and strengthen their roots.

The Sternal Talon launched by KLS Martin Group. which is a lightweight titanium closure device designed to encircle the sternum, helps in precisely yielding a stable closure by effectively distributing the strength of closure over the entire length of the sternotomy. After multiple strength tests performed by professionals, its superiority over wires is accepted widely, and tests have confirmed its ease of placement.

The closure devices segment accounted for largest sternal closure systems market share in 2023. The growth of this segment is attributed to the increasing launching rate of innovative medical devices, which is exponentially increasing, contributing to the growth of the market further. These devices are affordable and convenient for medical professionals since they help speed up recovery after intricate, deep surgeries.

The bone cement segment is anticipated to grow rapidly in the sternal closure systems market during the forecasted years. This segment is growing due to the ongoing studies showing its effect on the patients who have gone through surgeries, which showcased a noticeable positive and healing change in the bone structure. The sternal reconstruction in patients is a crucial aspect of the surgeries since it enables individuals to live normal routines again; due to this, many key players are introducing new devices for medical professionals to use for intricate surgeries of bones.

The median sternotomy segment accounted for the largest share of the sternal closure systems market in 2023. The medical process known as osteotomies is mostly performed across the world since this process allows deep access to the lungs, heart, and area around the heart to treat precisely. This is performed mostly with valve replacement surgery for the heart. Similarly, median sternotomy helps lower the complications and infections involved after surgery, fuelling this segment's growth.

The bilateral thoracosternotomy segment is anticipated to have the fastest growth rate in the sternal closure systems market during the forecasted years. The growth of this segment is due to the increasing prevalence of cardiac surgeries across the globe, owing to the huge number of people suffering from cardiovascular diseases with other health complications.

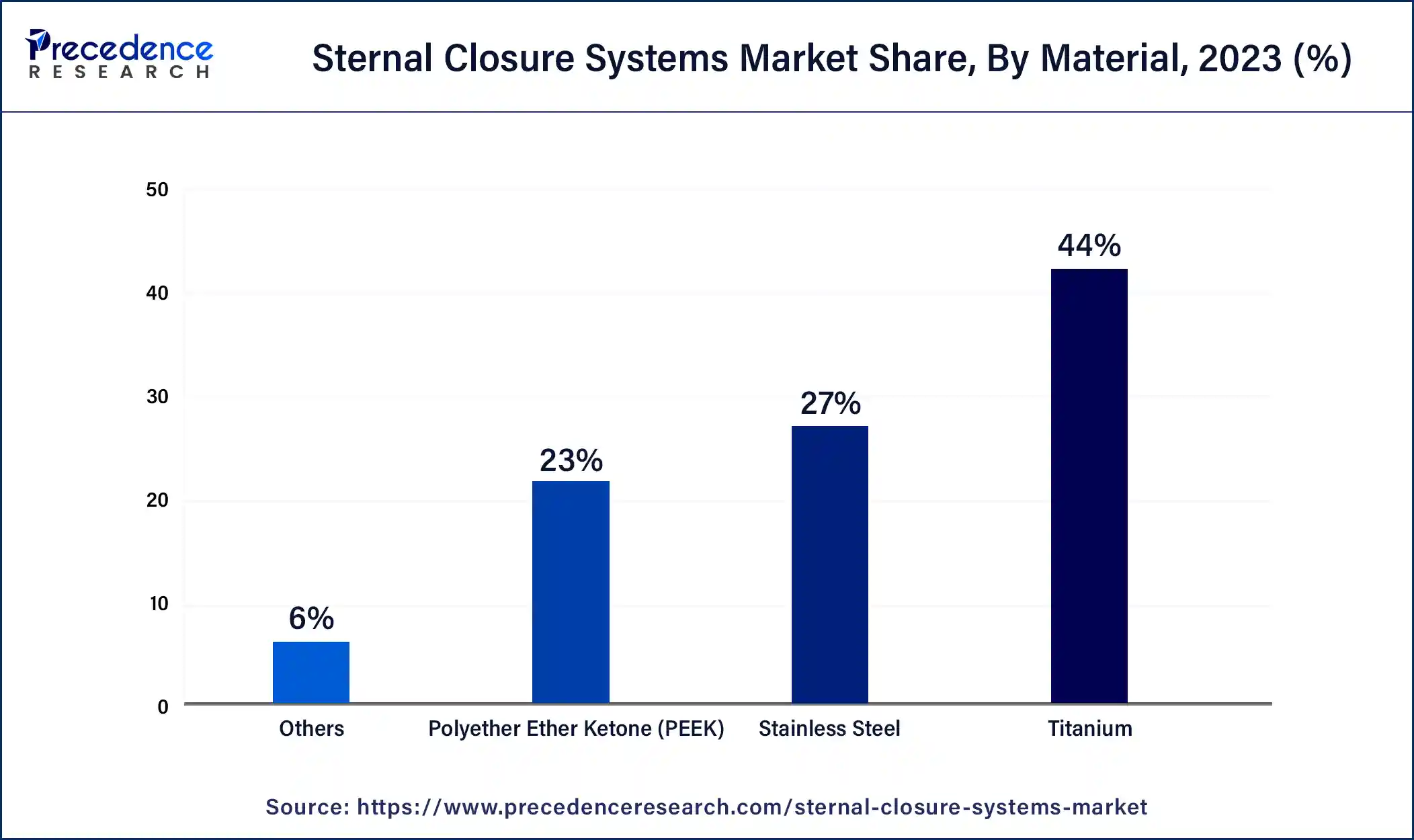

The titanium segment dominated the global sternal closure systems market in 2023. The growth of this segment is due to the benefits offered by titanium, such as the ability to join human bone structures accurately since titanium is a bio-compatible and non-toxic material with affordable prices. It also provides resistance to corrosive possibilities, leading it to be the most demanding material for medical procedures.

The PEEK segment is anticipated to witness the fastest growth in the sternal closure systems market during the forecasted years. The growth of this segment is attributed to various factors like increasing investments in R&D by major key players in the market and technological advancements in medical products, including properties like biocompatibility of the material. Many products are made with the help of PEEK material.

Segments Covered in the Report

By Type

By Procedure

By Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

March 2025

January 2025

March 2024