September 2024

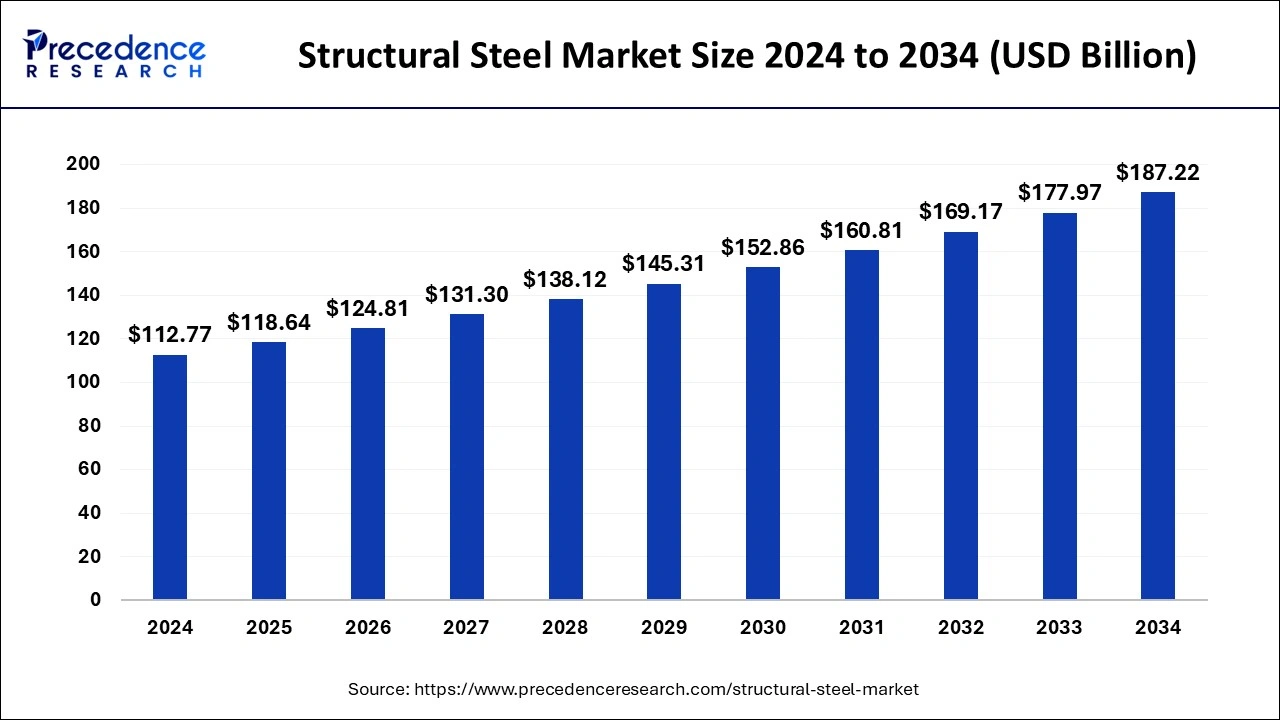

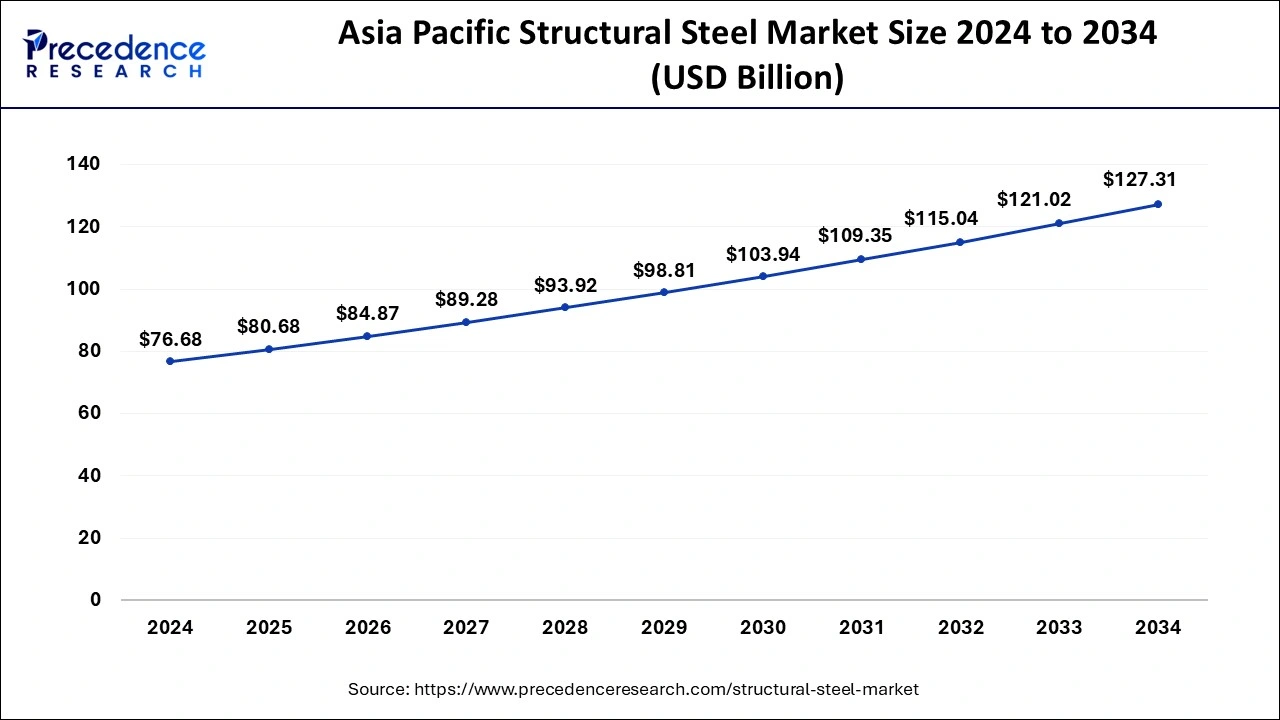

The global structural steel market size calculated at USD 118.64 billion in 2025 and is projected to surpass around USD 187.22 billion by 2034, expanding at a CAGR of 5.20% from 2025 to 2034. The Asia Pacific structural steel market size is estimated at USD 80.68 billion in 2025 and is expanding at a CAGR of 5.40% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global structural steel market size accounted for USD 112.77 billion in 2024 and is expected to be worth around USD 187.22 billion by 2034, at a CAGR of 5.20% from 2025 to 2034.

The Asia Pacific structural steel market size was estimated at USD 76.68 billion in 2024 and is predicted to be worth around USD 127.31 billion by 2034, at a CAGR of 5.40% from 2025 to 2034.

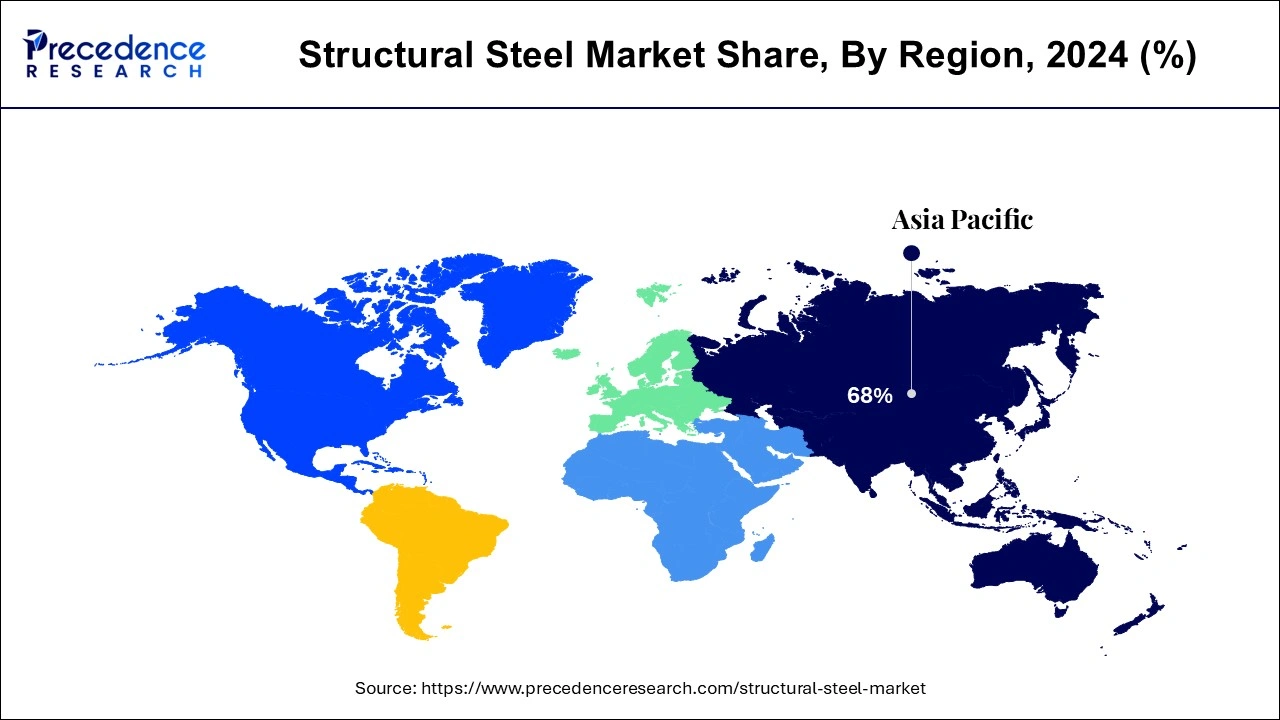

Asia Pacific dominated the market with the largest share in 2024. The Asia-Pacific’s growing population is responsible for the expansion of the structural steel market in the region. The governments in Asian countries are developing housing policies and building smart cities in order to address the region’s growing population. Moreover, the increased construction of non-residential buildings, such as commercial buildings for corporate and government offices, contributed to the regional market growth. Additionally, rapid urbanization and industrialization boosted the market in Asia Pacific.

The market in North America is expected to expand at the highest CAGR during the forecast period. The COVID-19 epidemic caused significant economic losses in North America, particularly in the U.S. and Mexico. However, during the second quarter of 2020, the building and construction business in this region recovered exponentially. The rising infrastructural development in the region is expected to be the major factor for regional market growth.

The structural steel market deals with the most commonly used building material across all areas of construction. Structural steel has various benefits over other materials, such as masonry, wood, and concrete, and it can be fabricated into various sizes and shapes. The rising advancement in engineering technology, strong growth of the construction industry, increasing industrialization in emerging countries, growing housing needs, increasing demand for sustainable construction materials, and strict regulations on carbon emissions and waste reduction in construction and energy conservation are anticipated to boost the growth of the market during the forecast period.

| Report Coverage | Details |

| Market Size in 2024 | USD 112.77 Billion |

| Market Size in 2025 | USD 118.64 Billion |

| Market Size by 2034 | USD 187.22 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.20% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Easy recyclability and increasing usage in construction

Structural steel is one of the most reused materials globally, as it is 100% recyclable. Carbon steel, high-strength low-alloy steel, high-treated carbon steel, and high-treated constructional alloy steel are among the several types of structural steel available in the market. Structural steel can get embrittled as a result of thermal deterioration and exhaustion, as well as corrosion damage when exposed to factors such as pressure, temperature, radiation, cyclic loads, and environment.

Structural steel is a shear-strength material. It has high strength, making it suitable for use in the construction of load-bearing structures. Unlike other building materials, steel parts will be small and lightweight regardless of the entire structure's size. Structural steel can be easily made and mass-produce in large quantities. The structural steel components can be manufactured off-site and then assembled on-site. This saves time and improves the overall construction process' efficiency.

Structural steel, known for its cost-effectiveness, is an extremely adaptable material. It can be molded into any shape without losing its qualities, making it a versatile choice for construction. Whether it's sheets or wires, structural steel can be designed to fit the project's needs. In comparison to other building materials, structural steel is relatively inexpensive. It's also a long-lasting material, with a well-maintained building expected to survive up to 30 years.

One of the primary factors driving the growth of the structural steel market is the increase in building and construction expenditure around the world. The structural steel market is expected to grow due to increased adoption of the product due to several benefits such as lightweight, elasticity, ease of fabrication, uniformity, toughness, high strength, and recyclability. Moreover, the increase in residential and non-residential construction projects boosts the market.

The structural steel market is also influenced by increased demand for flat products, such as cold and hot-rolled coil and stainless steel, in the manufacturing industry and its significant utilization in construction. Furthermore, rising consumer awareness, fast industrialization and urbanization, and rising high-sectional steel building construction all benefit the structural steel market's growth.

The demand for structural steel is expected to be driven by infrastructure developments in both developing and developed regions. One of the primary factors driving product demand is the increased housing needs resulting from global population growth.

Due to its great strength, structural steel is commonly utilized in industrial structures and buildings, which is useful for structural integrity and reducing the possible impact of repairs. Because of its high durability and outstanding strength-to-weight ratio, it is also ideal for constructing big bridges that can handle the weight of vehicles.

Insufficient resistance to natural environments and the high cost of material

The insufficient resistance to natural environments to withstand the rigor of nature is the major factor restraining the market growth. This can create problems if it comes in contact with insects or animals and is exposed to extreme weather conditions, depending on where the steel structure is located. In addition, structural steel is more expensive than other construction materials, such as concrete and engineered wood, which limit its adoption in construction.

Rising demand for sustainable materials

Structural steel can be recycled and reused, which is a major advantage of using structural steel in construction. As a result, no new material can be required to build the structure and make it an environmentally friendly way to build buildings. Steel does not decompose when left in the ground for a long period of time, making it ideal for use in outdoor structures, including towers and bridges. This eco-friendly material is easy to fabricate and can be shaped into any desired shape and structure, enabling architects to design structures they can't with other materials. Moreover, key players are making efforts to boost the production of green steel products and stay competitive in the market. For instance,

Based on the product, the high sectional steel dominates the structural steel market during the forecast period. The high sectional steel is hot rolled long products. This type of structural steel is used in the construction of highways, buildings, bridges, and public utilities.

On the other hand, the light sectional steel is expected to grow at rapid pace during the forecast period. The increased product usage of light sectional steel will result from an increase in smart city projects sponsored by government and private entities funding.

The non-residential segment dominated the market with the highest market share in 2024. This is primarily due to the rising development of non-residential structures, such as commercial, industrial, and institutional buildings. Furthermore, the demand for structural steel is being driven by increased investments in the creation of smart cities and is likely to support market growth during the forecast period.

On the other hand, the residential segment is fastest growing segment in the structural steel market. Due to light weight and high strength qualities, structural steel is widely used in housing and residential constructions, reducing the foundation load and sub-structure expenses.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2024

November 2024

January 2025