January 2025

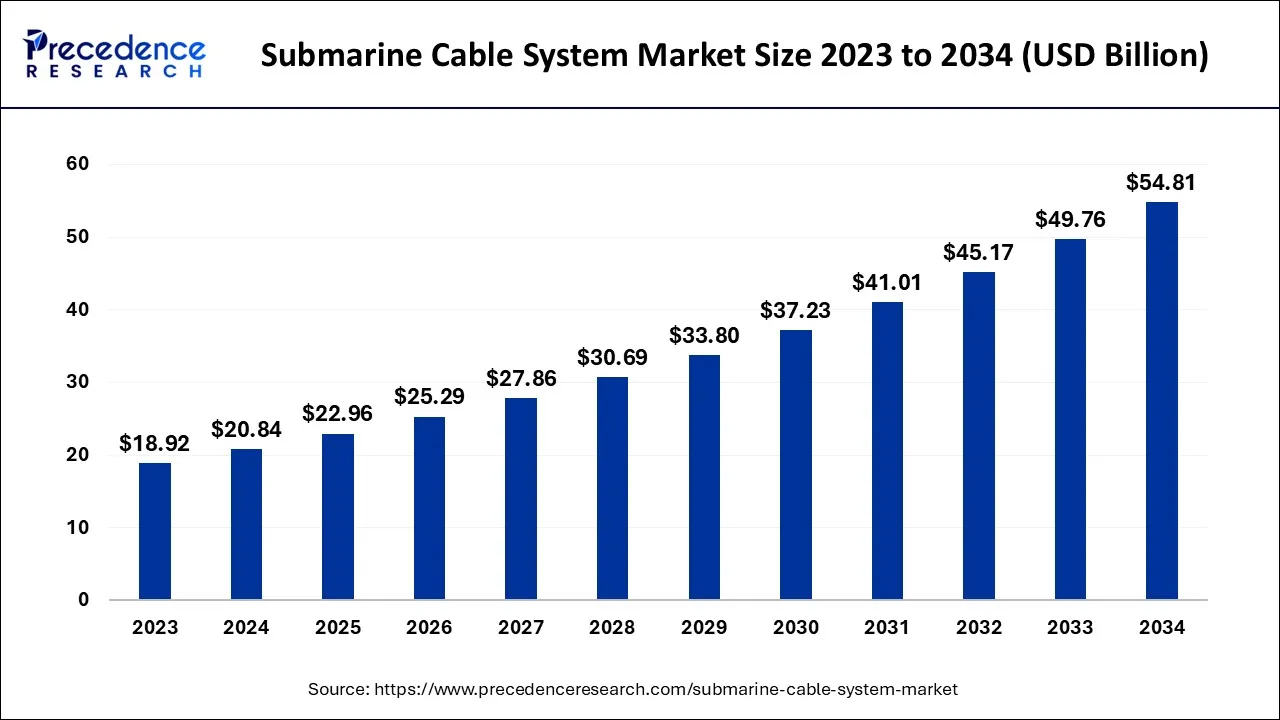

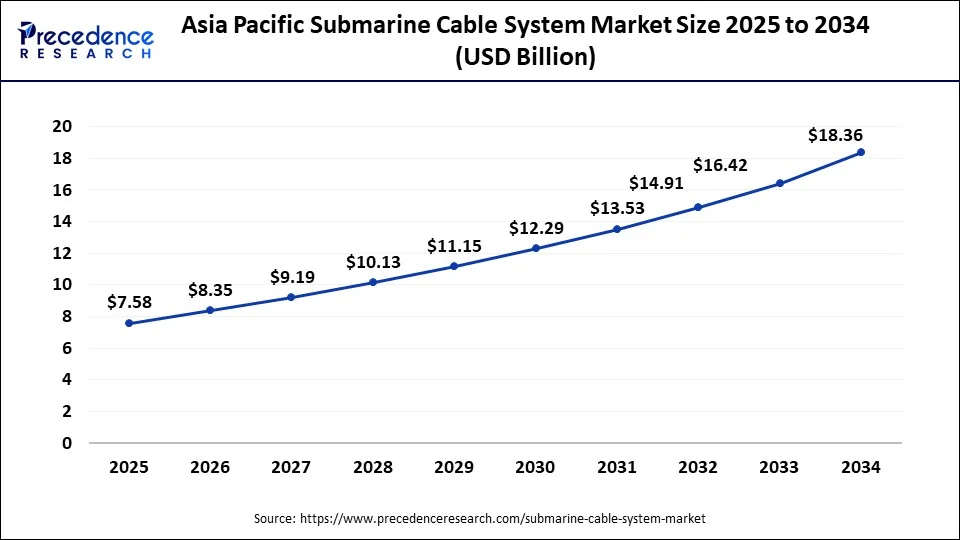

The global submarine cable system market size accounted for USD 20.84 billion in 2024, grew to USD 22.96 billion in 2025, and is expected to be worth around USD 54.81 billion by 2034, poised to grow at a CAGR of 10.15% between 2024 and 2034. The Asia Pacific submarine cable system market size is predicted to increase from USD 6.88 billion in 2024 and is estimated to grow at the fastest CAGR of 10.32% during the forecast year.

The global submarine cable system market size is expected to be valued at USD 20.84 billion in 2024 and is anticipated to reach around USD 54.81 billion by 2034, expanding at a CAGR of 10.15% over the forecast period from 2024 to 2034. Emerging investments in offshore wind management projects across the globe are driving the growth of the global submarine cable system market.

The Asia Pacific submarine cable system market size is exhibited at USD 6.88 billion in 2024 and is projected to be worth around USD 18.36 billion by 2034, growing at a CAGR of 10.32% from 2024 to 2034.

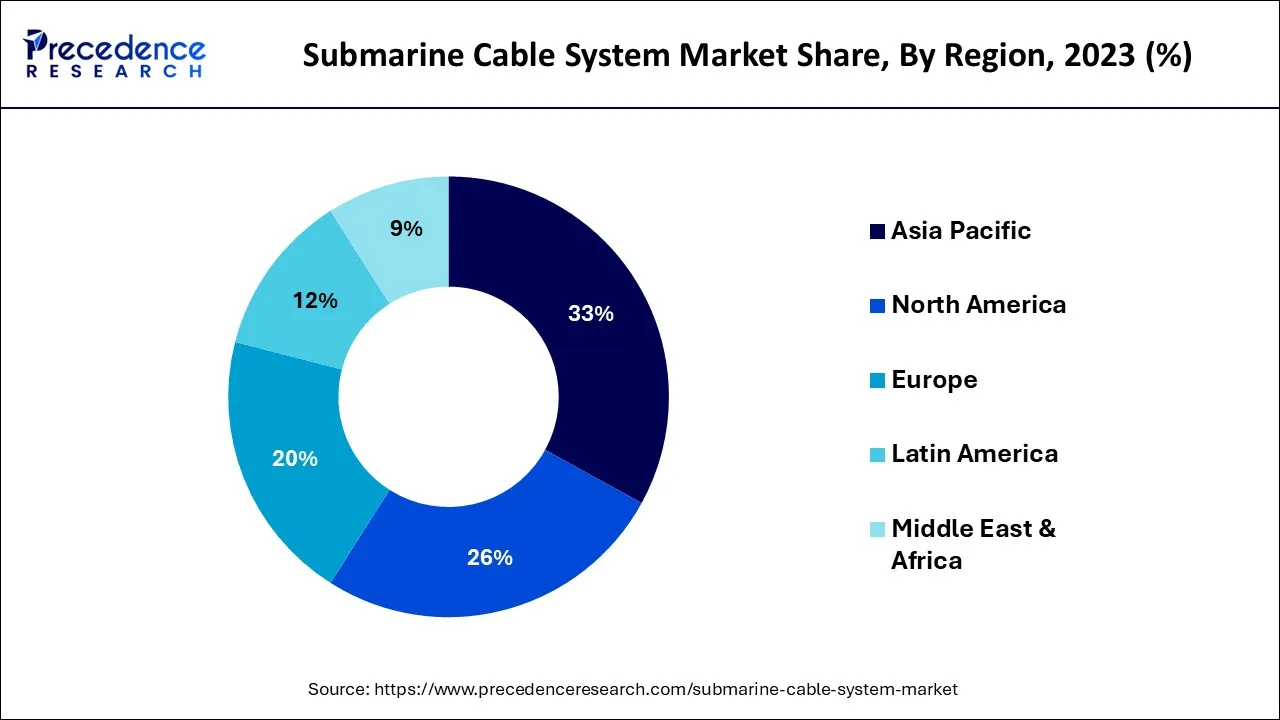

Geographically, Asia Pacific dominates the global submarine cable system market. Increased planned wind energy projects in major countries such as India, China and Japan. China is the largest contributor to the market. Whereas Japan is anticipated to dominate during the forecast period owing to the rising industrial expenditure. The presence of major key players in Asia Pacific contributes to the growth of the market.

North America is expected to boost at a noticeable rate during the forecast period. Rapid adoption to cloud-based services is helping the market in North America to grow. Moreover, the deployment of smart submarine cable systems is another driving factor for the growth of the market in North America.

Europe is witnessing significant growth owing to the rising demand for faster internet connection in the region. The UK is considered the largest contributor to the growth of the market. Ongoing submarine cable installation projects in various parts of the region are fueling the growth of the market.

The developing infrastructure of the telecom industry and the rising deployment of advanced technologies such as cloud-based services in submarine cable systems have propelled the growth of the market in the Middle East. The submarine cable system market in the Middle East and Africa is expected to grow during the estimated period.

A submarine cable system is laid in the ocean/sea to transfer telecommunication signals. Almost 98% of international data is transmitted through cables situated at the bottom of the ocean. Such cables are referred to as submarine communication cables. These cables are capable of sharing large data faster between two or more selected points.

Installing submarine cables for carrying massive internet traffic has become a captivating business in recent years. Such cables are layered with high-quality steel and tar to help them stand against the unpredictable ocean environment. The process of installing submarine cables includes the participation of specialists such as geologists, oceanographers and geophysicists.

Oceans valleys, undersea coral reefs and rocks are taken into consideration before installing the submarine cable systems. A typical life span of submarine cables is approximately 25 years, in the total life span; these cables undergo multiple maintenance sessions and repairs to boost the data run.

The global submarine cable system market is fragmented, with numerous key players all around the world. Some companies in the market provide raw materials for the cables, and some focus on manufacturing. Whereas only some players work on the installation process. The need to transmit significant data traffic primarily fuels the demand for submarine cables across the globe.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 10.15% |

| Market Size in 2024 | USD 20.84 Billion |

| Market Size by 2034 | USD 54.81 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Voltage, By System, By Transmission, By Service, By Cables Type, By Fiber Class, By Depth and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The global submarine cable system market is predicted to grow during the estimated period. The rapid deployment of 5G internet services in developing countries is estimated to boost the market's growth in the upcoming years. Other factors, including emerging offshore renewable energy generation projects, rising use of the internet, entry of competitive players in the market, increasing investments for wind power projects and emerging economies, are driving the submarine cable system market growth.

Moreover, the rising need for efficient power transmission across the globe is propelling the development of the market. The constant growth of the market is attributed to the upgradation in maintenance service and the deployment of advanced technologies in the installation of submarine cables.

However, the high-cost cable limits the installation of submarine cables system, which acts as a restraining factor for the market's growth. Complex maintenance and repair services of submarine cable systems hinder the growth of the global submarine cable system market. Furthermore, improper installation and lousy design of submarine cables may result in a potential risk for submarine cables.

Unpredictable natural threats such as tsunamis and cyclones are prone to hamper the submarine cable system market growth. Moreover, in upcoming years, the adoption of satellite-based communication is considered to restrain the growth of the submarine cable system market. In conclusion, risks (natural or manmade) associated with submarine cables are non-negligible; however, proper risk management methods are likely to minimize the restraining factors of the market.

The high voltage segment dominates the market and is expected to maintain growth during the forecast period. High-voltage cables are used for distributing power, and they range above 33kV. High-voltage cables preserve the capacity of transferring electric power over long distances.

Rising need for efficient power transmission across the globe with increased communication traffic, the demand for high voltage cable segments will boost in upcoming years. Extra-high voltage cables can transfer power from 35kV – 800 kV. Furthermore, the medium voltage segment is expected to increase during the forecast period significantly.

The dry plant segment accounts for the largest revenue share in the worldwide submarine cable system market. Recent advancements in the dry plant, such as increased aluminum conductors and deployment of smart cables, have fueled the growth of the dry plant segment. The dry plant segment comprises land cables, power feeding equipment, and submarine line terminal equipment.

The wet plant segment is predicted to register a significant increase during the estimated period of 2024-2034. The wet plant lies between beach utility holes. This segment comprises the gain equalizer, repeater, and transmission line amplifier.

The communication signals segment is expected to dominate the submarine cable system market during the forecast period. The growth of the communication signals segment is attributed to the rising demand for transmitting telecommunication signals.

The constant growth of the communication signals segment is driven by seawater's easy absorption of radio waves and the reliability of transmitting a larger capacity of international data. Rising offshore wind energy generation projects across the globe are predicted to boost the electric power transmission segment in upcoming years.

The installation service segment leads the global submarine cable system market and is anticipated to maintain growth during the forecast period. The rising demand for the installation of submarine cables, the upgradation is cable installation services, and the deployment of automated control systems have propelled the segment's growth.

The installation segment is witnessing noticeable growth due to a surge in submarine cable system projects worldwide. This emerging segment of services comprises trenching, plowing, and jetting for installation purposes. The service includes laying submarine cables at the bottom with anchors or covers.

The maintenance segment is predicted to grow significantly during the forecast period with advancements in repairing services for enhancing the life span of submarine cables and preventing potential damage. The maintenance segment comprises a survey of cables, checking tears or wear and replacing cables. Rising potential hazards to the submarine cables (natural and man-made) have forced the market to adopt advanced maintenance services methods in recent years.

The offshore wind power generation industry dominates the global submarine cable system market. The segment is predicted to carry the growth during the estimated period owing to the surge in offshore wind power generation projects across the globe.

The offshore wind power generation plants are generally located over a shallow water source or ocean. The rising awareness for renewable energy is predicted to grow the investments in offshore wind power energy generation projects in upcoming years. Submarine cables system is capable of transmitting electric power generated at the offshore plant to the land.

However, the rising demand for connecting islands with compelling power and telecommunication services is fueling the growth of the intercountry & island connection segment. The segment is estimated to account for significant growth in the upcoming years. Moreover, the offshore oil & gas industry will witness a considerable increase due to increased investments in offshore oil and gas projects by South Africa and gulf countries in the Middle East.

By Voltage

By System

By Transmission

By Service

By Cables Type

By Fiber Class

By Depth

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

March 2025

January 2025