September 2024

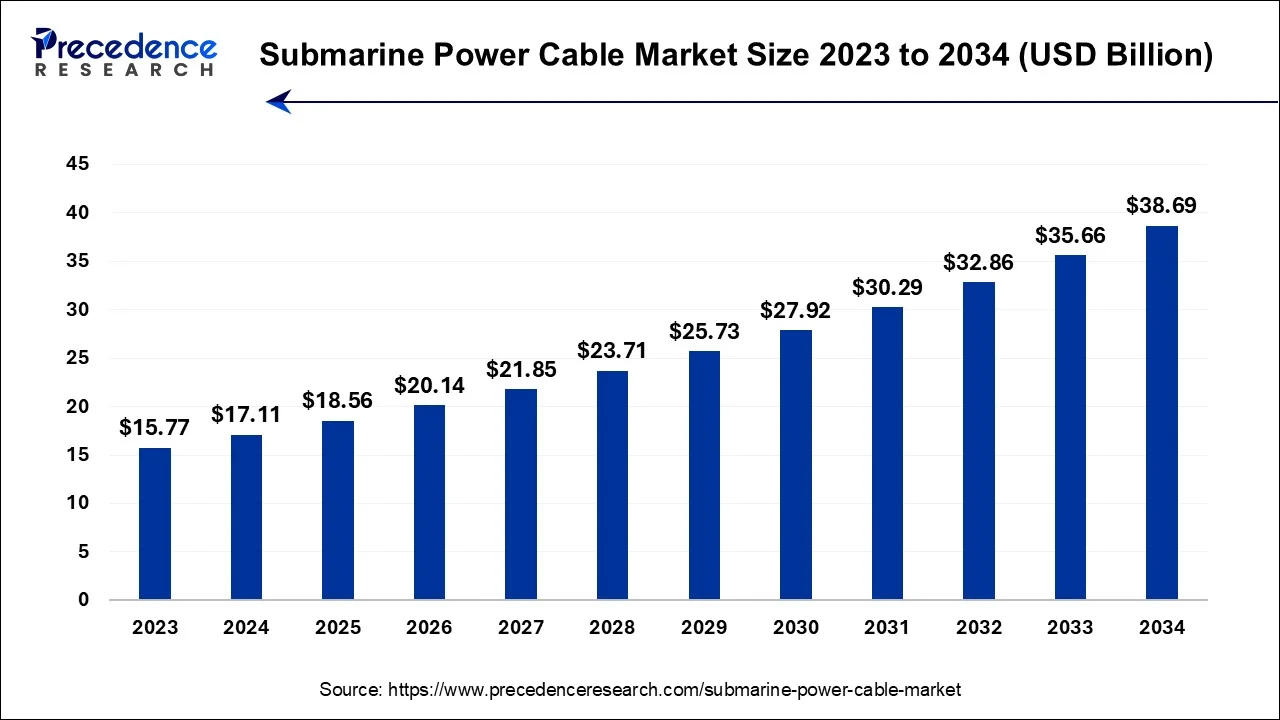

The global submarine power cable market size is estimated at USD 17.11 billion in 2024 and is anticipated to reach around USD 38.69 billion by 2034 growing at a CAGR of 8.50% between 2024 and 2034.

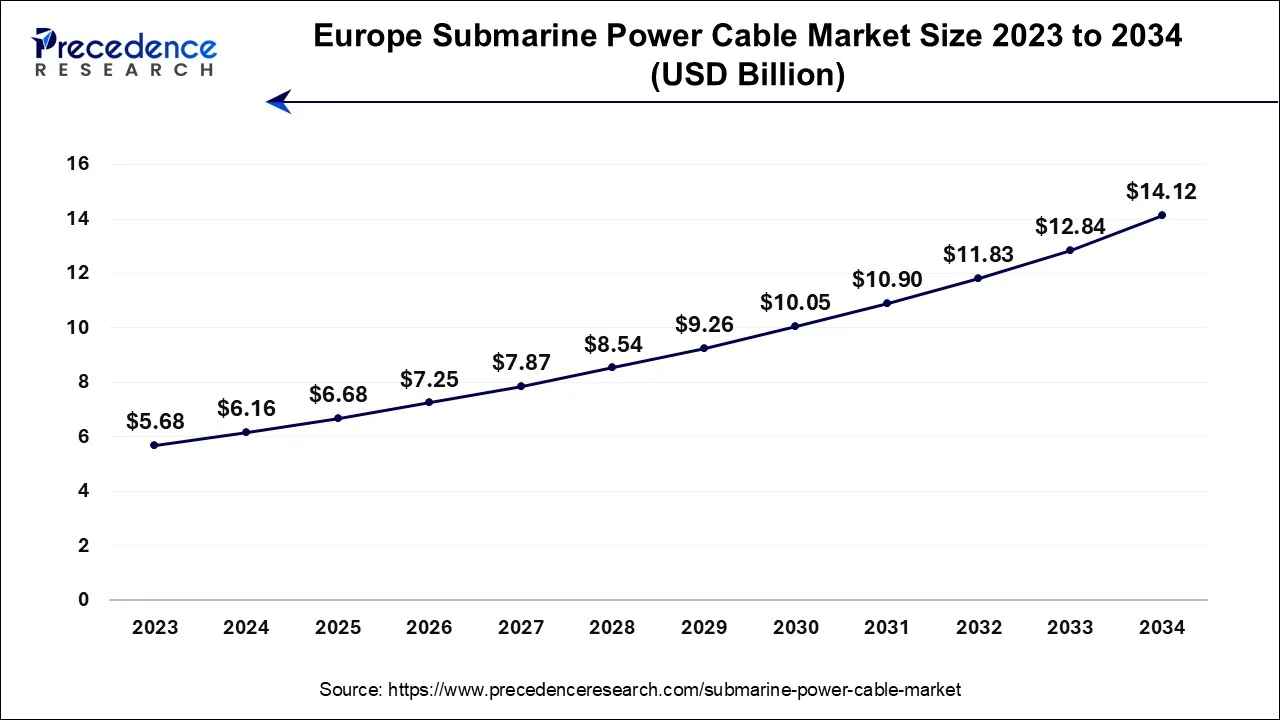

The Europe submarine power cable market size accounted for USD 6.16 billion in 2022 and is expected to be worth around USD 14.12 billion by 2034, growing at a CAGR of 8.64% from 2024 to 2034.

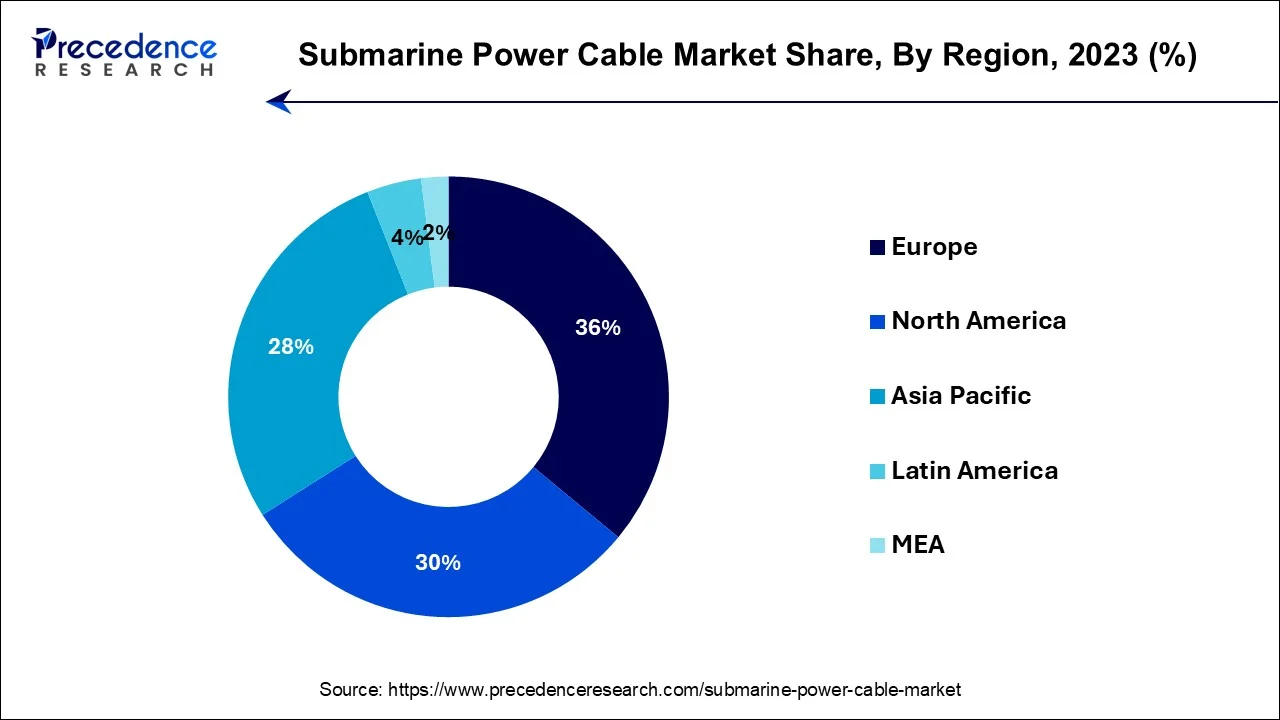

Europe held the largest revenue share 36% in 2023. Europe's submarine power cable market is witnessing robust growth, driven by the continent's ambitious renewable energy goals. Offshore wind farms, especially in the North Sea, require extensive cable infrastructure, propelling demand. Furthermore, interconnection projects between European nations enhance energy trading and grid stability. A growing trend is the adoption of high-voltage direct current (HVDC) cables for efficient long-distance transmission. Environmental sustainability is a key focus, leading to innovations in eco-friendly cable designs.

Asia-Pacific is estimated to observe the fastest expansion. In this region, there is a surge in demand for submarine power cables, driven by rapid urbanization and industrialization. Countries such as China, Japan, and India are making substantial investments in offshore wind projects and cross-border interconnection initiatives. Additionally, there's a shift toward HVDC cables for efficient cross-border energy transmission. Fiber optic integration for real-time monitoring is a prevalent trend. While the market shows significant growth potential, challenges like regulatory complexities and cost management are being addressed to facilitate sustainable expansion.

In North America, the submarine power cable market is expanding as the region embraces offshore renewable energy sources. The United States and Canada are investing in offshore wind farms along their coastlines, necessitating the deployment of submarine power cables for grid connection. Additionally, interregional power trading initiatives are gaining traction. A notable trend is the development of projects to transmit electricity from remote renewable energy-rich areas to population centers, underscoring the importance of submarine power cables in the continent's energy transition.

A submarine power cable is a specialized electrical transmission cable designed to carry electricity across bodies of water, typically beneath the seabed. These cables are essential for connecting offshore renewable energy sources, such as offshore wind farms and tidal energy installations, to onshore power grids. They are also used for interconnecting islands with mainland power systems and for international power transmission between neighboring countries.

Submarine power cables are engineered to withstand the harsh underwater environment, including water pressure, temperature variations, and potential damage from anchors or marine life, ensuring the reliable and efficient transfer of electrical energy across water bodies.

The submarine power cable market is experiencing substantial growth due to several key drivers. One significant factor is the increasing global shift towards renewable energy sources, particularly offshore wind farms. Submarine power cables play a pivotal role in transmitting clean energy generated offshore to onshore power grids. Additionally, interconnection projects between countries are gaining prominence, fostering the need for these cables to facilitate cross-border energy trading.

Furthermore, rising energy demand in remote and coastal areas is driving investments in submarine cables, addressing supply gaps and ensuring reliable electricity supply to these regions. Ongoing technological advancements in cable design, materials, and installation techniques are enhancing their efficiency, reliability, and lifespan, further fueling market growth.

Several industry trends are shaping the submarine power cable market. Environmental sustainability is also a growing concern, leading to the development of environmentally friendly cable designs that minimize ecological impact during installation and operation. However, the industry faces challenges, including the high installation costs associated with laying and maintaining submarine power cables, especially in deep-sea environments.

Regulatory hurdles and complex permitting processes can lead to project delays and increased costs. Additionally, the risk of cable damage from factors such as anchor strikes, fishing activities, and natural events poses a significant challenge to the reliability of submarine power cable systems.

Despite these challenges, numerous business opportunities abound in the submarine power cable market. The continued expansion of offshore renewable energy projects, including wind and tidal energy, offers substantial opportunities for cable manufacturers and installers. Moreover, modernizing existing power grids and expanding them into developing regions with untapped offshore energy resources represent promising avenues for growth in this dynamic industry.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 8.5% |

| Market Size in 2024 | USD 17.11 Billion |

| Market Size by 2034 | USD 38.69 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Core Type, Voltage, Conductor Material, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Renewable energy expansion and interconnection projects

Renewable energy expansion and interconnection projects are two key drivers significantly surging the demand for submarine power cables. The rapid expansion of renewable energy sources, particularly offshore wind farms and tidal energy installations, necessitates the use of submarine power cables to transmit the clean energy generated at sea to onshore grids. As countries worldwide embrace green energy solutions to combat climate change, the demand for these cables has soared. The reliability and efficiency of submarine power cables are critical in facilitating the integration of renewable energy into the existing power infrastructure.

Moreover, Interconnection Projects between countries are fostering a robust market for submarine power cables. These projects aim to create cross-border power networks, enabling efficient energy trading and resource sharing. Submarine cables serve as the backbone of these interconnections, allowing electricity to flow seamlessly between neighboring nations.

The desire for energy security, diversification of energy sources, and access to a broader market for surplus energy are driving governments and organizations to invest in such projects. This surge in cross-border energy connectivity is fueling the demand for submarine power cables, making them integral components of modern energy grids and contributing to a more sustainable and interconnected global energy landscape.

Technical challenges and cable damage

Technical challenges and cable damage pose significant restraints to the submarine power cable market. The high technical complexity involved in manufacturing, laying, and maintaining submarine power cables leads to considerable costs. Installing these cables in deep-sea environments is particularly challenging, requiring specialized vessels and equipment.

Additionally, the need to ensure proper insulation, waterproofing, and protection against marine life and corrosion adds to the complexity and cost. These technical challenges can deter potential investors and slow down the expansion of undersea power cable projects.

Moreover, cable damage is a critical concern. Submarine power cables are susceptible to damage from various sources, including anchor strikes, fishing activities, and natural events like underwater landslides or earthquakes. Such damage not only disrupts power transmission but also necessitates costly repairs and maintenance efforts.

The risk of cable damage can deter investments and increase operational costs, impacting the reliability and economic feasibility of undersea power cable systems. Addressing these technical challenges and enhancing cable durability is essential for the sustainable growth of the submarine power cable market and its role in facilitating offshore renewable energy and international grid connectivity.

Renewable energy expansion and cross-border power trading

Renewable energy expansion and cross-border Power trading are two interrelated factors that have significantly surged the demand for submarine power cables. The rapid expansion of renewable energy sources, such as offshore wind farms and tidal energy installations, is a key driver. These sources often locate far from onshore grids due to environmental considerations and space limitations. Submarine power cables bridge this gap, enabling the efficient transmission of clean energy from these offshore installations to the onshore grid. As countries worldwide embrace renewable energy to combat climate change, the demand for these cables has surged.

Cross-border power trading complements this growth by fostering international energy exchange. Countries are increasingly interconnected through power interconnection projects, which rely on submarine power cablesfor energy transmission across borders. This not only enhances energy security but also facilitates the sharing of surplus energy, promoting economic efficiency and grid stability.

As nations seek to diversify their energy sources and achieve renewable energy targets, the submarine power cable market continues to thrive as a critical component of the global energy infrastructure, supporting the growth of renewable energy and cross-border electricity trading.

Impact of COVID-19

The COVID-19 pandemic had a mixed impact on the submarine power cable market. In the initial stages, the market experienced disruptions due to supply chain interruptions, delays in project approvals, and workforce limitations caused by lockdowns and travel restrictions. These challenges led to project delays and increased costs, affecting the production and installation of submarine power cables.

However, as the pandemic progressed, the importance of reliable and resilient energy infrastructure became even more apparent. Governments and industries recognized the need to invest in critical infrastructure, including submarine power cables, to ensure a stable energy supply. This realization, coupled with stimulus packages and economic recovery efforts in various countries, led to a resurgence in demand for submarine power cables.

Furthermore, the ongoing push for renewable energy sources remained a key driver, with offshore wind projects continuing to expand. The submarine power cable market adapted to new safety protocols and remote work practices, demonstrating resilience and flexibility. In summary, while COVID-19 initially disrupted the market, the long-term outlook remains positive as the world focuses on building more sustainable and interconnected energy systems.

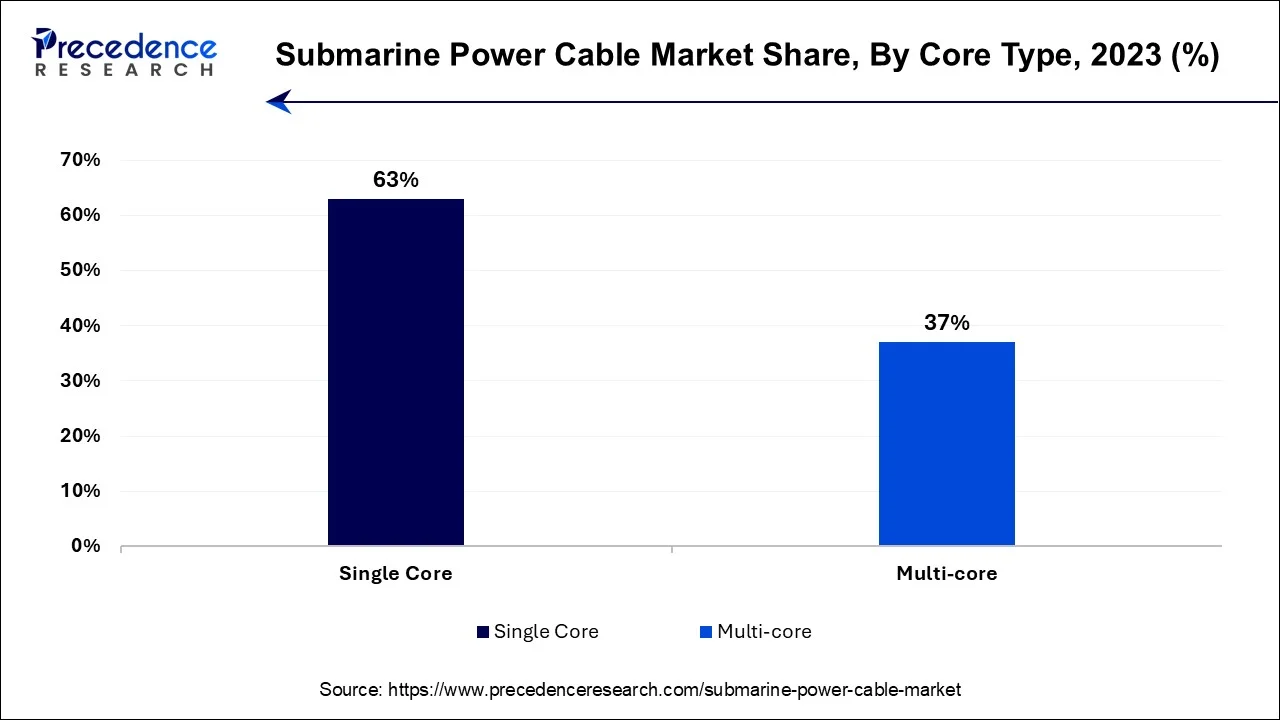

According to the core type, the single core has held 63% revenue share in 2023. Single-core submarine power cables are a type of underwater electrical transmission solution that comprises a solitary conductor enveloped by layers of insulation and protective materials. These cables are primarily designed for applications with lower voltage requirements and are particularly well-suited for relatively shorter transmission distances beneath bodies of water. One of the key characteristics of single-core submarine cables is their simplicity, which facilitates straightforward installation processes.

These cables play a crucial role in various underwater electrical connections, such as those in offshore energy projects and interconnecting islands with mainland power grids. Their ease of installation makes them a practical choice for scenarios where efficiency and cost-effectiveness are essential considerations. Single-core submarine power cables continue to find applications in a variety of underwater electrical projects, contributing to the reliable transmission of electricity across aquatic environments.

The Multi-core submarine power cables segment is anticipated to expand at a significant CAGR of 13.8% during the projected period. Multi-core submarine power cables have multiple conductors, often bundled together within a single cable structure. These cables are employed for higher voltage and more complex power transmission needs, especially over longer distances. Multi-core cables offer enhanced capacity and versatility, making them suitable for various applications in the submarine power cable market.

In recent trends, there has been a growing preference for multi-core submarine power cables, primarily due to the increasing demand for higher capacity and the expansion of offshore wind farms. Multi-core cables can efficiently transmit larger amounts of electricity over longer distances, aligning with the need for interconnecting renewable energy sources with onshore grids. They also support the development of interconnection projects between countries, promoting cross-border power trading.

Additionally, advancements in materials and insulation technologies have improved the performance and reliability of multi-core submarine power cables, making them increasingly attractive for modern energy infrastructure projects.

Based on the voltage, high-voltage segment held the largest market share of 59% in 2023. High-voltage submarine power cables are designed to transmit electricity at voltages typically exceeding 100 kV. They are crucial for efficiently transferring large quantities of electricity over long distances, making them ideal for interconnecting offshore renewable energy installations with onshore grids.

A trend in the submarine power cable market is the increasing adoption of high-voltage cables, driven by the need to minimize power loss during transmission, especially for offshore wind farms and interconnection projects. These cables facilitate the efficient and long-distance transfer of renewable energy, supporting the global transition to clean power sources.

On the other hand, the medium-voltage segment is projected to grow at the fastest rate over the projected period. Medium-voltage submarine power cables typically operate at voltages between 10 kV and 100 kV. They are commonly used for shorter-distance connections, such as island-to-mainland links and within coastal regions.

A trend in the submarine power cable market is the versatility and adaptability of medium-voltage cables for various applications, including grid integration of smaller-scale renewable energy projects and providing reliable power supply to coastal communities. Their flexibility makes them a cost-effective choice for regional energy distribution and interconnections in scenarios where high-voltage transmission may not be necessary or practical.

In 2023, the copper segment had the highest market share of 57% on the basis of the conductor materials. Submarine power cables traditionally employ copper conductors due to their excellent electrical conductivity, reliability, and resistance to corrosion. Copper offers low electrical resistance, ensuring efficient power transmission over long distances underwater. Despite its advantages, copper cables tend to be heavier and more expensive than their aluminum counterparts, making them less attractive for some projects aiming to reduce costs and cable weight.

The aluminum segment is anticipated to expand at the fastest rate over the projected period. Aluminum conductors have gained traction in the submarine power cable market due to their lighter weight and lower material cost compared to copper. While aluminum's electrical conductivity is lower, advances in cable design and insulation technologies have made it a viable alternative for certain applications. The trend towards aluminum conductors is driven by cost-conscious projects seeking to optimize cable weight and reduce overall installation expenses while maintaining acceptable electrical performance and reliability.

The Offshore wind segment held the largest revenue share of 35% in 2023. Submarine power cables play a pivotal role in connecting offshore wind farms to onshore grids. The offshore wind sector relies heavily on these cables to transmit electricity generated by wind turbines at sea. A notable trend in the submarine power cable market for offshore wind is the increasing capacity and distance requirements, necessitating high-voltage, long-distance cables. Additionally, advancements in cable design and installation techniques are enhancing reliability and efficiency, aligning with the rapid expansion of offshore wind projects worldwide.

The offshore oil and gas segment is anticipated to grow at a significantly faster rate, registering a CAGR of 15.6% over the predicted period. In the offshore oil and gas industry, submarine power cables are utilized for various applications, including powering offshore drilling platforms, and transmitting data from subsea equipment. A trend in this sector is the growing demand for more robust and durable cables that can withstand harsh marine environments.

Additionally, the integration of advanced communication and control technologies within these cables is becoming increasingly important for efficient offshore oil and gas operations, driving innovation in the submarine power cable market for this end-use.

Segments Covered in the Report

By Core Type

By Voltage

By Conductor Material

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

June 2025

June 2025