January 2025

The global substation automation Market size was USD 56.82 billion in 2023, estimated at USD 60.45 billion in 2024 and is anticipated to reach around USD 110.92 billion by 2034, expanding at a CAGR of 6.26% from 2024 to 2034.

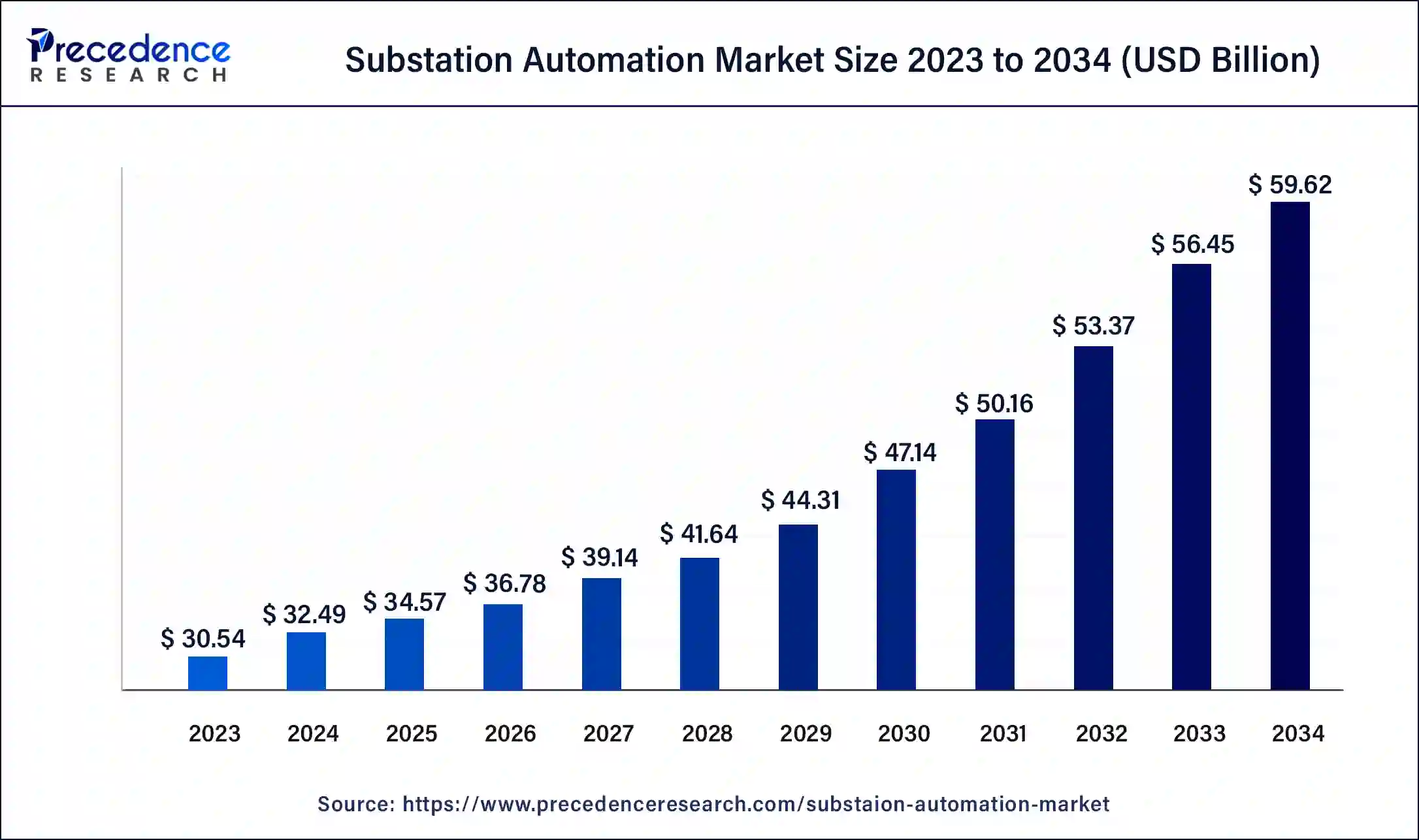

The global substation automation Market size accounted for USD 32.49 billion in 2024 and is predicted to reach around USD 59.62 billion by 2034, growing at a CAGR of 6.26% from 2024 to 2034.

Substation automation is a crucial element of the electrical system for the generation, transmission, and distribution of power. Substations are used to change the properties of electric forces, such as voltage and frequency, among other things. Substations are used to take high-voltage energy from transmission lines and reduce it to the proper level so that it can be used for initial distribution.

| Report Coverage | Details |

| Market Size in 2023 | USD 30.54 Billion |

| Market Size in 2024 | USD 32.49 Billion |

| Market Size by 2034 | USD 59.62 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.4% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 To 2034 |

| Segments Covered | Module, Offering, Type, Installation Type, End-user, Component, Communication Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for electricity

The market for substation automation is significantly influenced by the rising demand for power. Factors like population increase, urbanization, and industrialization are the main drivers of this need. The demand for power increases tremendously as more people move to metropolitan areas and as industry grow. By guaranteeing effective power generation, transmission, and distribution, substation automation is essential in addressing this expanding demand. The transfer of high-voltage electricity from power plants into lower voltage levels suited for distribution to end consumers is facilitated by substations, which serve as important nodes in the electrical grid. Power utilities can improve the system's operating efficiency by using automation technologies in substations. Automated systems make it possible to more effectively monitor, regulate, and optimize the flow of power, ensuring that electricity is delivered dependably and effectively.

Additionally, they enable remote monitoring and diagnosis, which lessens the need for in-person inspections and enhances maintenance procedures. Substation automation also aids utilities in efficiently managing peak load needs. Automation systems can automatically modify voltage levels, switch capacitor banks, and control reactive power to guarantee a steady and uninterrupted power supply during periods of high electrical demand. This capability is crucial in urban and industrial regions where there is a strong demand for electricity.

Top five countries by electricity consumption (2021)

| Sr. No | Location | Consumption (GWh/yr) | Consumption per capita (kWH/yr) | Consumption per capita (Watts) |

| 1 | China | 7,806,000 | 5,474 | 624 |

| 2 | U.S. | 3,979,000 | 11,267 | 1,285 |

| 3 | India | 1,443,000 | 1,025 | 117 |

| 4 | Russia | 996,000 | 6,864 | 783 |

| 5 | Japan | 913,000 | 7,327 | 836 |

Cybersecurity concerns in substation automation

The growing worry over cybersecurity is one of the major obstacles the substation automation business must overcome. The stability and security of the electricity system are under risk as substations become increasingly digitized and networked, making them possible targets for cyberattacks. Systems for automating substations rely on a variety of hardware components, software programs, and communication networks. These systems are susceptible to a variety of cyberthreats, such as denial-of-service (DoS) assaults, malware infections, unauthorized access, and data breaches. A successful cyber-attack on a substation might have devastating repercussions, including power disruptions, equipment damage, and even potential danger to the general public.

Strong security mechanisms must be deployed across the substation automation infrastructure in order to solve these cybersecurity threats. This entails protecting control systems, and communication networks, and putting in place strict access controls. In order to protect against cyber-attacks, security methods including firewalls, intrusion detection systems, and constant monitoring are used. Additionally, to address any known vulnerabilities, regular updates and patches must be applied to the software and firmware of substation automation systems. This necessitates a proactive approach to cybersecurity, keeping up with new threats, and promptly deploying any security updates that are required. User education and awareness is another important component. Employees who are in charge of operating and maintaining substation automation systems must receive training on system security best practices as well as information on potential cybersecurity hazards. This involves being aware of questionable activity and reporting it, maintaining proper password hygiene, and following security standards.

There are difficulties in dealing with cybersecurity issues in substation automation, nevertheless. Cyber dangers are always changing, necessitating ongoing monitoring and the capacity to adjust to new attack vectors. The automation projects may also become more complex and expensive to complete if strong cybersecurity measures are implemented and maintained. In order to address these issues, utilities and vendors devote enough resources, including purchasing security tools, employing cybersecurity experts, and continuing employee training.

Enhanced grid security

In order to improve grid security, substation automation is essential, especially in light of the changing cybersecurity threats. The risk of cyberattacks on vital infrastructure, particularly substations, has greatly increased as the energy sector becomes more digitalized and networked. Automation systems for substations offer cutting-edge security features and capabilities to reduce these threats. Real-time monitoring is one of the most important components of substation automation. Data from numerous sensors and equipment inside the substation are continuously collected and analysed by sophisticated monitoring systems.

This data may contain specifics like voltage levels, current flow, the condition of the equipment, and other things. Any unusual behavior or potential security breaches can be quickly found by closely monitoring these parameters. Early defect detection is also made possible via substation automation. Automated systems are able to swiftly spot anomalous behavior, flaws, or unauthorized entry attempts inside the substation. This early identification gives operators the opportunity to react quickly and take the required steps to stop or lessen any security hazards. Substation automation systems can also include quick reaction mechanisms, enabling operators to quickly identify problematic sections and put in place corrective actions.

Substation automation incorporates strong security standards and steps to address cybersecurity threats. These may include firewalls, intrusion detection systems, encryption methods, and authentication procedures. Substations can guard against unauthorized access, data breaches, and other cyber dangers by putting in place such security measures. Additionally, remote monitoring and control systems are frequently integrated into substation automation processes. This reduces the need for physical intervention and improves overall security by allowing operators to access and administer substations from a centralized control centre. Usually, secure virtual private networks (VPNs) or other secure communication protocols are used to protect remote access.

Impact of COVID-19:

The market for substation automation products and solutions from national grid projects is projected to fall during COVID-19 as governments around the world cut spending in several industries to concentrate more on improving healthcare infrastructure. Furthermore, power consumption declined dramatically in 2020 and 2021 as a result of commercial areas working at significantly reduced capacity in the majority of the world, which could delay the modernization of the grid infrastructure for electric utilities. It is anticipated that each of these factors will negatively affect the market for substation automation.

The communication networks segment dominated the market in 2023. The growth of the segment is attributed to the heightened use of communication networks to connect devices, such as actuators, sensors, and control systems. These networks transfer control signals, which further allow operators to control the substation from remote locations. The extensive adoption of communication networks in substations is because of their capability to enhance the electrical power grid's reliability, efficiency, and safety.

The SCADA segment is expected to grow at a significant rate in the near future owing to its ability to monitor processes and equipment in a substation in real-time. Moreover, SCADA allows for the quick identification and resolution of problems, improving the system's overall effectiveness.

The intelligent electronic devices (IEDs) segment is anticipated to grow rapidly due to the increasing need for high voltage across industries and buildings to operate machines and the deployment of IEDs in the power sector. As smart grid adoption and demand increase from the renewable energy industry, so does the demand for intelligent electronic devices, thereby boosting the segment.

The hardware segment led the market in 2023. The growth of the segment is mainly attributed to the growing usage of substation automation devices, like programmable logic controllers, digital relays, and intelligent electronic devices. These devices play an important role in offering smooth and efficient operation of power distribution and transmission networks.

The service segment is expected to grow at the fastest rate over the forecast period. The need for advanced services solutions in substation automation is the key factor driving the segment's growth. Furthermore, services offer numerous benefits such as reduced energy consumption, improved efficiency, and increased reliability to control substation equipment in real-time.

The distributed substation segment is anticipated to grow at the fastest rate during the projected period. Distribution substations are smaller units spread across various locations within a power grid. These substations control and monitor power flow and voltage levels. They also convert high-voltage electricity into low-voltage electricity, which is required for homes and businesses. Apart from voltage transformation, they detect faults in the grid.

The Ethernet segment led the market in 2023 with the largest market share. Ethernet is an extensively used communication technology that plays an important role in substation automation. It has high-speed data transmission capabilities. Moreover, Ethernet offers a fast and reliable communication network, enabling smooth data exchange between different processes in the substation automation system.

The new installation segment dominated the market in 2023. The dominance of the segment is primarily attributed to the increasing demand for smart grids and the rapid increase in the development of power stations in different locations. Additionally, new installations provide greater operational safety and reliability and require low maintenance, thus boosting the segment further.

The utilities segment dominated the market in 2023 and is projected to grow at the fastest rate over the studied period. This segment growth is attributed to the increasing electricity demand coupled with the growing focus on enhancing the efficiency and reliability of the power grid. Moreover, the rising investments to modernize power grids and growing emphasis on renewable energy sources further boost the segment.

Asia pacific dominated the market in 2023, owing to the increasing urbanization, industrialization, and the growing demand for continuous power supply. Electricity is one of the crucial commodities. China is the largest producer of electricity, followed by India. Moreover, the rising government focus toward electrification of rural areas, adoption of smart grid technologies, and the rapid expansion of the power industry contributed to the regional market growth.

The market in North America is projected to grow at a significant pace in the coming years due to the increasing usage of sophisticated intelligent electronic devices and communication technologies in the power sector. Moreover, the growing demand for smart grid and the increasing investments in grid modernization contribute to the regional market growth.

Segments Covered in the Report:

By Module

By Offering

By Type

By Installation Type

By End-user

By Component

By Communication Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

January 2025

August 2024