May 2025

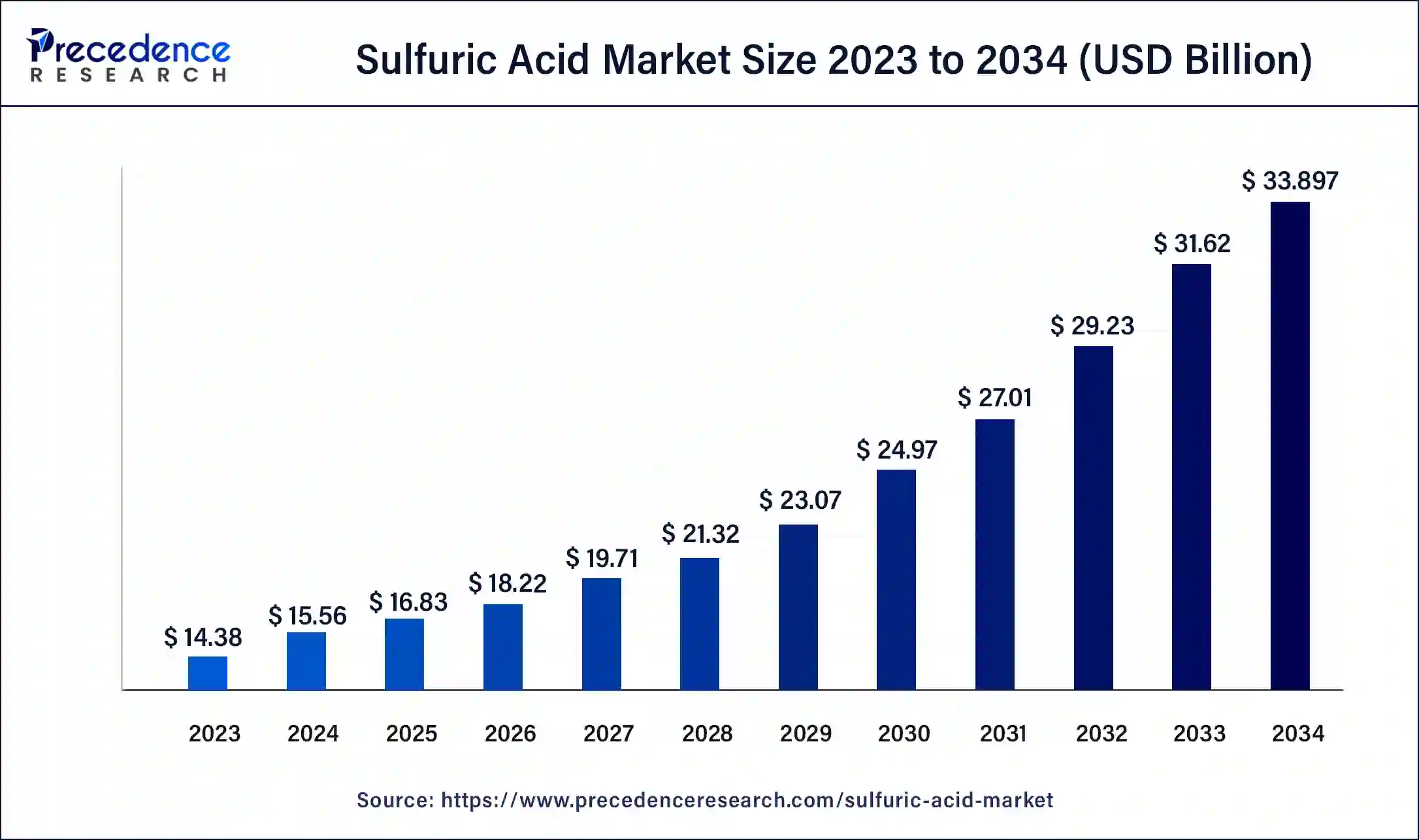

The global sulfuric acid market size was USD 14.38 billion in 2023, calculated at USD 15.56 billion in 2024 and is projected to surpass around USD 33.90 billion by 2034, expanding at a CAGR of 8.1% from 2024 to 2034.

The global sulfuric acid market size accounted for USD 15.56 billion in 2024 and is expected to be worth around USD 33.90 billion by 2034, at a CAGR of 8.1% from 2024 to 2034.

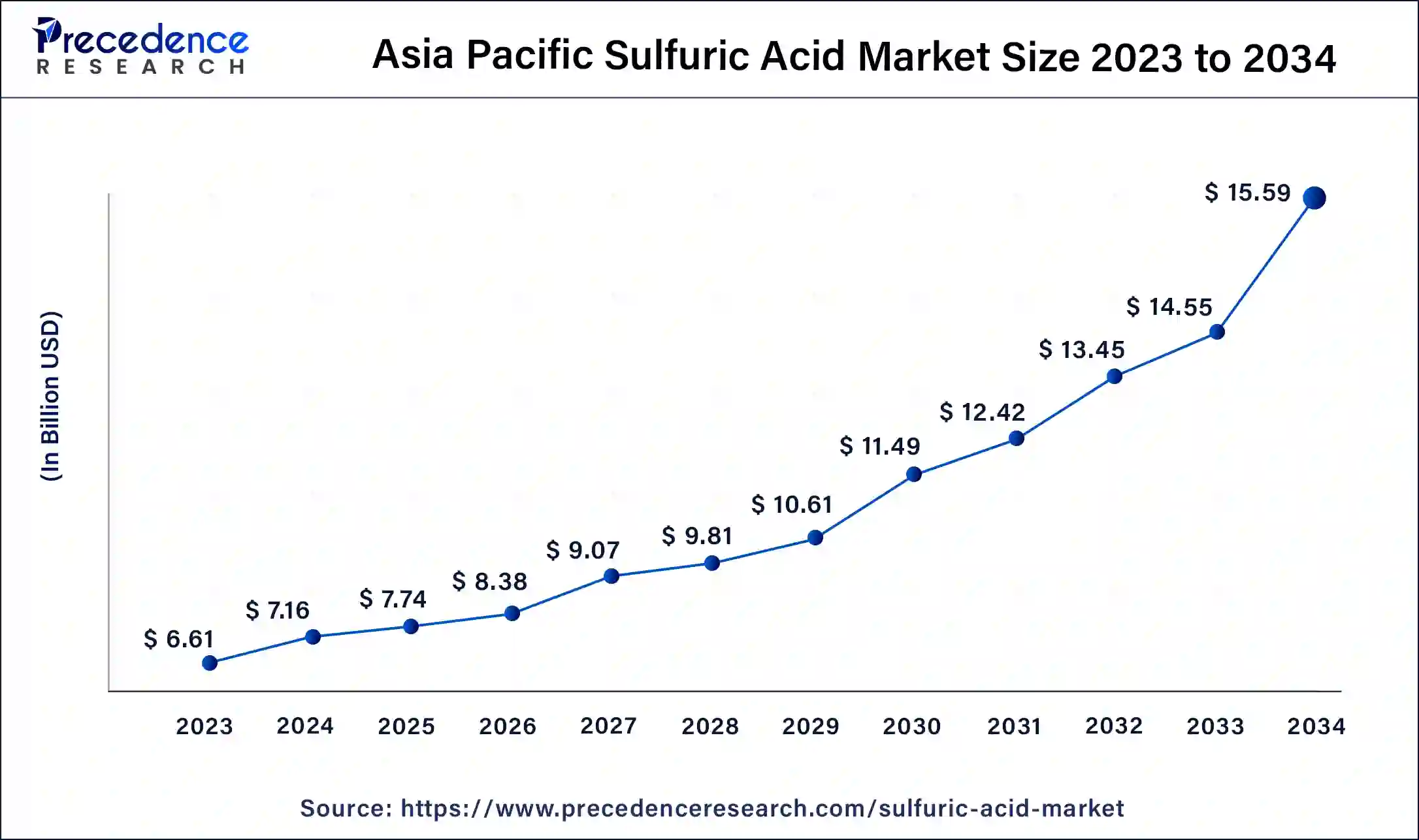

The Asia Pacific sulfuric acid market size was estimated at USD 6.61 billion in 2023 and is predicted to be worth around USD 15.59 billion by 2034, at a CAGR of 8.3% from 2024 to 2034.

Sulfuric acid market with increased demand and development across various regions. Asia Pacific region with increased market share with increased developments in increased utilization of sulfuric acid in various industries widely accepted by the industrial sector by the farmers for increasing the growth of the crops using fertilizers for increasing the productivity of the crops and fulfilling the needs of the consumers. Also contributes for rising the sulfuric acid usage which createss less pollution than other raw materials.

The rapid utilization of sulfuric acid in fertilizers, chemical industries, the automobile industry, and many more drives the market of sulfuric acid. Sulfuric acid is basically known as vitriol it contains components such as sulfur, oxygen, and hydrogen. Sulfuric acid molecular formula id H2SO4. Sulfuric acid is colorless, odorless, and viscous in nature it is miscible with water and soluble. Sulfuric acid pure is not available in nature because sulfuric acid is attracted to the water vapors. Being hygroscopic in nature, and absorption of water from the air. Increased corrosion of sulfuric acid towards some of the materials such as rock to metal.

One of the major properties of sulfuric acid is its dehydrating nature. Mixing water with sulfuric acid the gas fumes are released with the bubbles. Sulfuric acid is hazardous and can be harmful in contact with the body and may cause burns. Dilute sulfuric acid is comparatively less hazardous, having dehydrating properties. Production of sulfuric acid is done by various processes with increased utilization. Sulfuric acid is basically the raw material used during the processing or manufacturing or production the new chemical synthesis, drugs, and fertilizers. Sulfuric acid contains nutrients such as phosphorous, potassium, and nitrogen which are the main components for increasing the crops with improved quality.

Impact of Covid-19 on the sulfuric acid market with increased rules and regulations imposed by the government due to widespread of coronavirus across the region. This led to the lockdown in many regions which halt the growth, due to the shutdown of the industries, and ceased transportation which decreased the market size of sulfuric acid. Post pandemic situation of the sulfuric acid market extended the market growth with increased demands from the agriculture sector during the forecast period.

Utilization of sulfuric acid in chemical industries for increasing the synthesis of the chemical and producing and developing new drugs in the pharmaceutical industries with increased production and manufacturing of the medications. Enhanced utilization in the automobile industry is majorly utilized in batteries which helps to store the energy which fuels the market of sulfuric acid with increased usage of sulfuric acid.

Increased research and development in chemical synthesis and increased usage of fertilizers with increasing the output with increased performance of sulfuric acid drive the market to enhance during the forecast period. The key market players involved sulfuric acid which supports to increase in the development of sulfuric acid and increased investment for introducing new fertilizers and chemicals boosts the market development of sulfuric acid to a larger extent.

| Report Coverage | Details |

| Market Size in 2023 | USD 14.38 Billion |

| Market Size in 2024 | USD 15.56 Billion |

| Market Size by 2034 | USD 33.90 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8.1% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Raw Material, Form, Manufacturing Process, Distribution Channel, Applications, and Purity Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Raw materials elemental sulfur to gain the largest market in sulfuric acid with the increased utilization of sulfur in producing sulfuric acid having less pollution characteristics than that of pyrite ores, oil and petroleum refining industries and base metal smelters. Increased rapid adoption of the sulfuric acid in various sectors drives the market growth of sulfuric acid. Elemental sulfuric acid to be the processing material involved in chemical synthesis wide characteristics of sulfuric acid with increased production of drugs in pharmaceutical industries boost the market development.

Utilization of sulfuric acid in producing fertilizers for yielding the crops with increased quality and quantity of the crops using fertilizers with improved nutrients. Increasing demands for the fertilizers drives the growth of the sulfuric acid market with increased production of the crops required for daily life. Fulfilling the needs of the consumers with enhance growth of the crops lack of fertilizers in the field may not give the required productivity.

Mixing of the fertilizers with the soil which empowers the soil with increased nutrients in the soil with high efficacy and continuous research and development of fertilizers with increased demands from the farmer that is agriculture sector enhanced the market of sulfuric acid with wide applications in various sector. In chemical industry also with significant rise of the market with improved chemical synthesis and drug development.

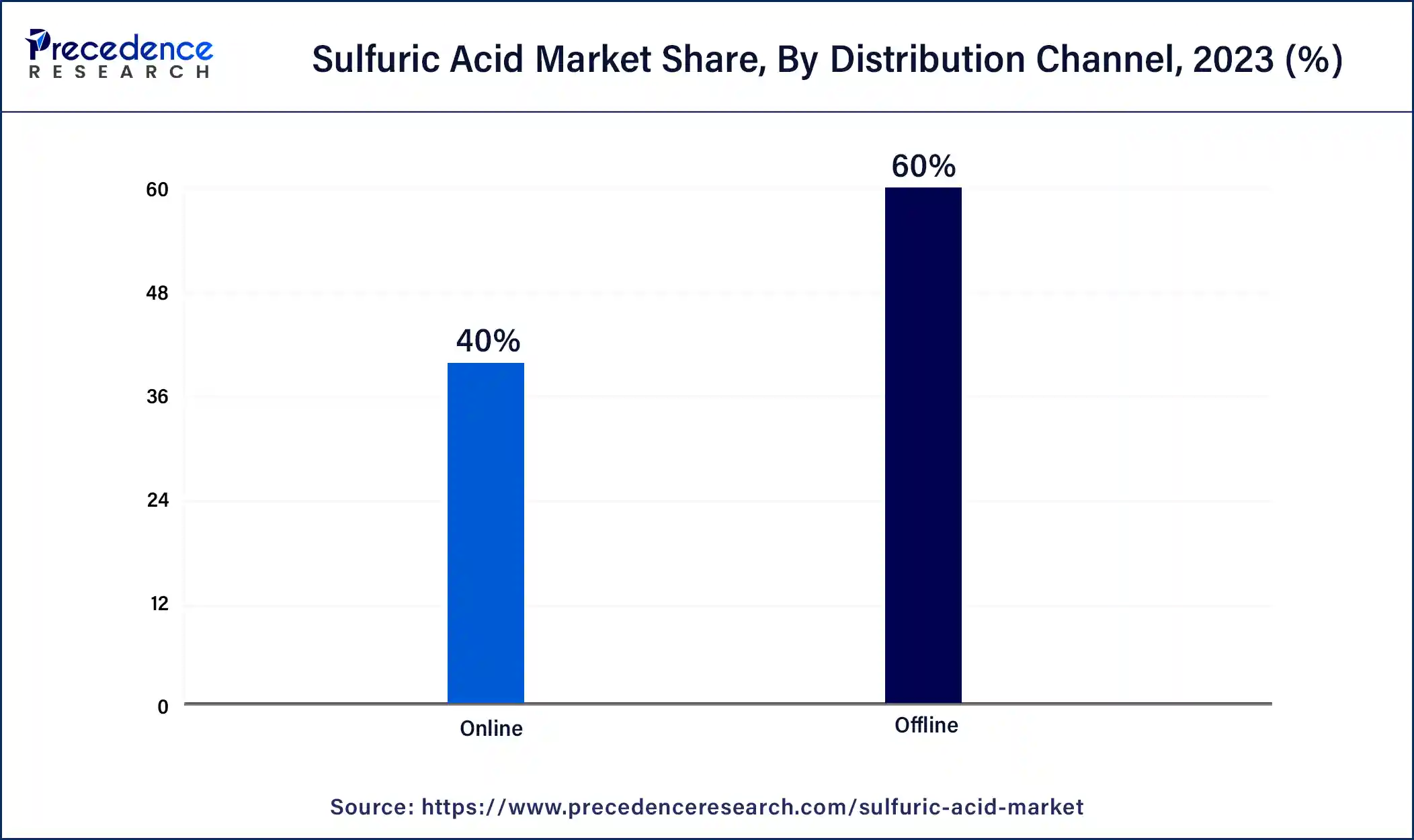

On the basis of distribution channel, offline category with increased market share with increased transportation of bulk due to increased demands from the consumers with increased rules and regulation regarding handling of the sulfuric acid being hygroscopic and exothermic in nature.

Segments Covered in the Report

By Raw Material

By Form

By Manufacturing Process

By Distribution Channel

By Applications

By Purity Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

March 2025

December 2024

August 2024