September 2024

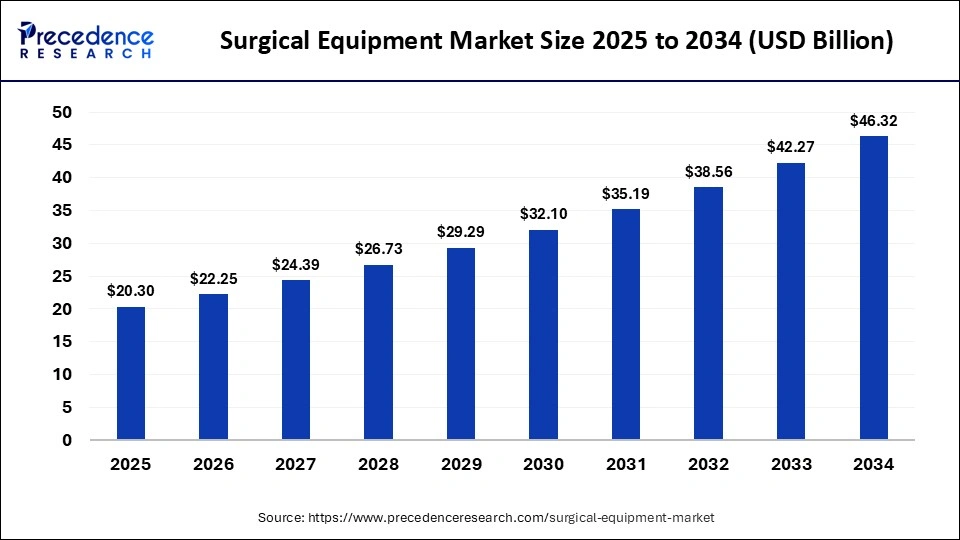

The global surgical equipment market size calculated at USD 20.30 billion in 2025 and is projected to surpass around USD 46.32 billion by 2034, expanding at a CAGR of 9.60% from 2025 to 2034. The North America surgical equipment market size was estimated at USD 8.33 billion in 2024 and is expanding at a CAGR of 9.64% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global surgical equipment market size accounted for USD 18.52 billion in 2024 and is expected to be worth around USD 46.32 billion by 2034, at a CAGR of 9.60% from 2025 to 2034.

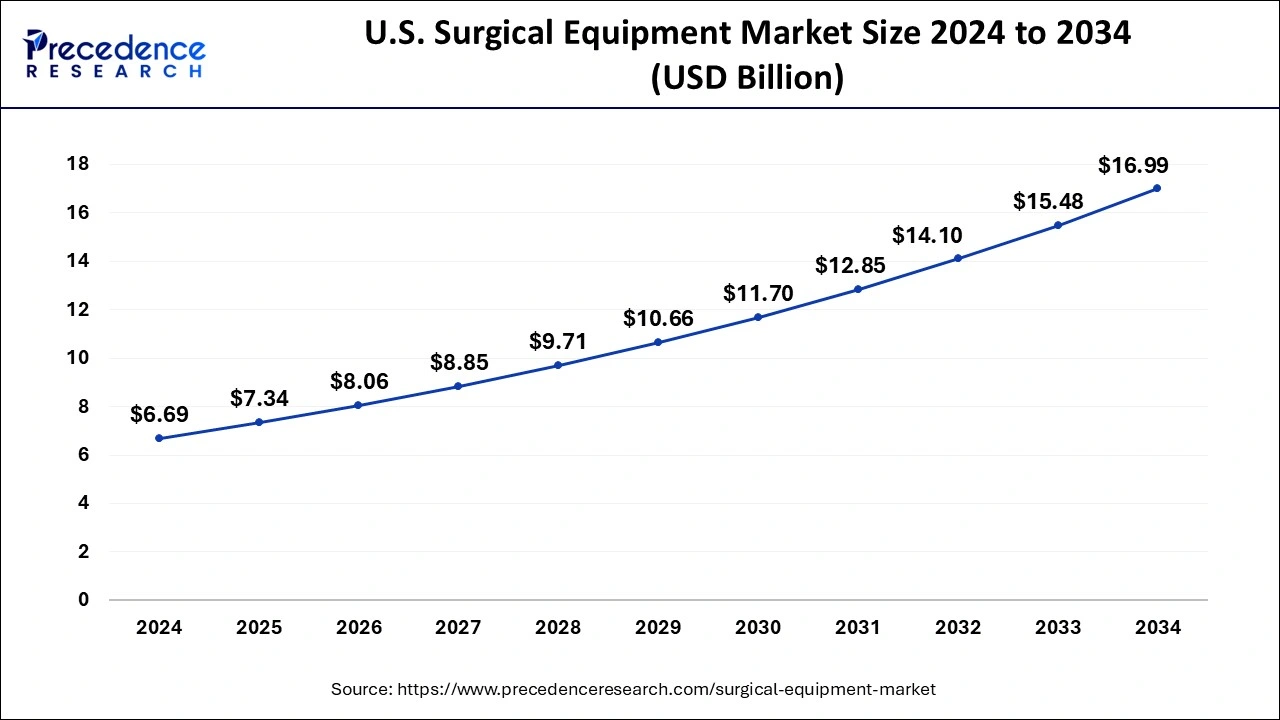

The U.S. surgical equipment market size was estimated at USD 6.69 billion in 2024 and is predicted to be worth around USD 16.99 billion by 2034, at a CAGR of 9.80% from 2025 to 2034.

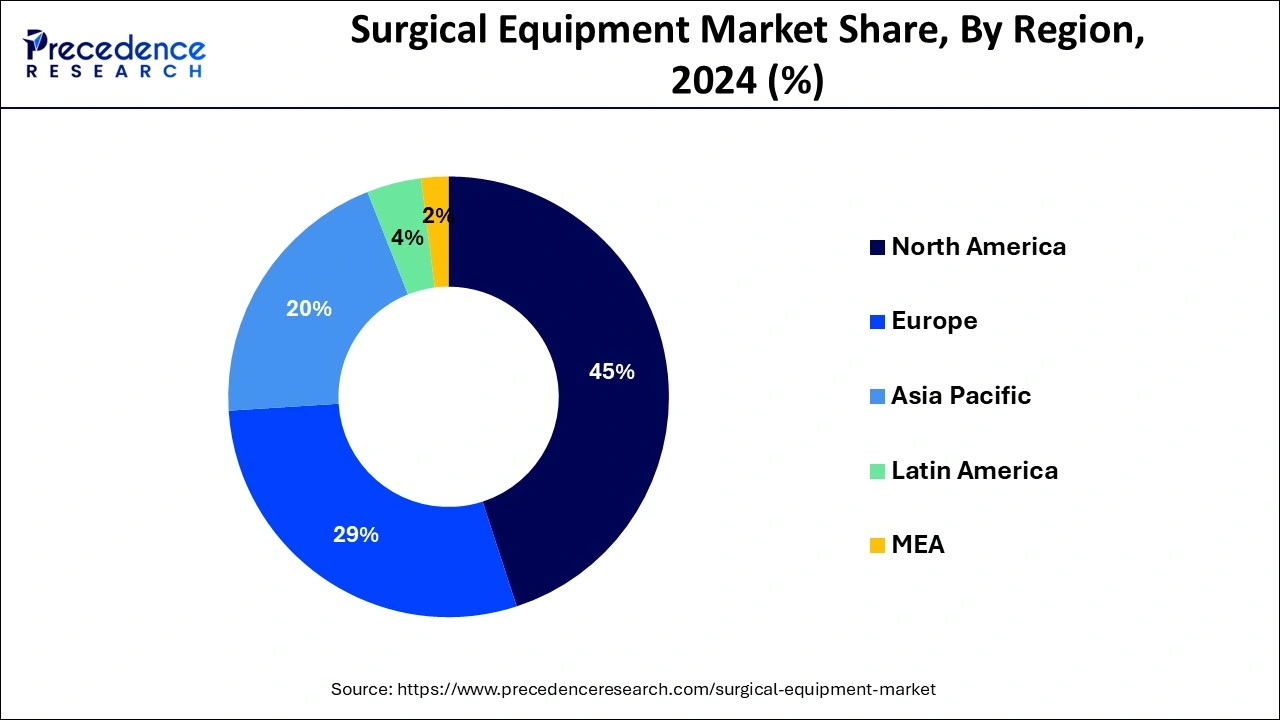

North America dominated the global surgical equipment market with share of 45% in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. North America is characterized by increased prevalence of chronic diseases and growing geriatric population. The increased awareness regarding the benefits of the surgical treatments and rising demand for the minimally invasive surgeries across the region is fostering the market growth. Moreover, the presence of strong and developed healthcare infrastructure in the region benefits the market owing to the increased penetration of hospitals, clinics, and ambulatory services. Furthermore, the increased disposable income, increased health awareness, and rising consumer expenditure on healthcare is expected to drive the growth of the market.

Asia Pacific is expected to be the most opportunistic market during the forecast period. This is attributed to the rising penetration of healthcare facilities in the region, rapid urbanization, growing number of hospitals, presence of huge population, and rising prevalence of chronic diseases. Moreover, the increased number of road traffic accidents is boosting the growth of the surgical equipment market. According to the World Health Organization, around 93% of the global road accidents occur in low and middle income countries, and it is one of the major causes of death among the children and young adults.

The global surgical equipment market is primarily driven by the growing prevalence of chronic diseases, growing geriatric population, and rising number of road accident cases across the globe. According to the Unite Nations, there were around 382 million old age people, aged 60 years or above, across the globe in 2017 ad this number is expected 2.1 billion by 2050. The old age people are prone to the chronic diseases and may boost the demand for various surgery treatments, thereby boosting the demand for the surgical equipment. Moreover, the increasing awareness regarding the non-invasive surgeries among the population is boosting the demand for the surgeries, which is boosting the growth of the global surgical equipment market. The rising awareness regarding the cost benefits associated with the early surgical intervention is also one of the important factors that drives the demand for the surgeries among the patients. The technological advancements in the surgery equipment and rising investments by the market players is expected to provide growth opportunities in the foreseeable future. The demand for the advanced and innovative surgical equipment is rising across the healthcare sector.

The rising government investments for the development of healthcare infrastructure and favorable policies to attract FDIs in the developing regions is boosting the growth of the surgical equipment. The rising number of injuries such as sports injury, road accident injury, and rising number of cardiac surgeries is propelling the consumption of surgical equipment. According to the World Health Organization, around 32% of the global deaths were directly linked to the cardiovascular diseases in 2019. Therefore, the rising incidences of the cardiovascular diseases is expected to drive the growth of the global surgical equipment market. According to the Orthopedic Journal of Sports Medicine, the athletes in China showed higher rate of injuries as compared to the American athletes. Hence, the rising number of sports injuries is fueling the demand for the surgical equipment market.

| Report Highlights | Details |

| Market Size in 2024 | USD 18.52 Billion |

| Market Size in 2024 | USD 20.30 Billion |

| Market Size by 2034 | USD 46.32 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.60% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

The surgical sutures & staplers segment accounted for around 46% of the market share in 2024 and is projected to remain its dominance. The extensive usage of surgical sutures & staplers in the wound closure application has increased the consumption and created the dominance of this segment. Staplers involves low risk of infections and facilitates quick wound healing, which further fuels the growth of this segment.

On the other hand, the electrosurgical devices is estimated to be the most opportunistic segment during the forecast period. This is attributed to the emergence of minimal-invasive surgery and its rapidly growing popularity among the population. The minimally-invasive surgeries offers quick healing and reduces the time of hospital stay for the patients. The technological advancements and development of various electrosurgical equipment is expected to rapidly boost the growth of this segment.

The obstetrics & gynecology segment accounted for more than 22% of the market share in 2024. This is attributed to the increasing number of baby births. Moreover, various complications related to pregnancy owing to the increasing prevalence of women reproductive organ disorder among the female population has increased the number of gynecological surgeries. Moreover, the rising number of cesarean deliveries is also expected to boost the growth of this segment.

On the other hand, neurosurgery segment is expected to register highest growth rate during the forecast period. This is due the increasing demand for the neurological surgeries among the population owing to the rising cases of neurological disorders. The technological advancements in the surgical equipment field resulted in the development of efficient and minimally invasive surgical equipment, which is expected to drive the growth of this segment during the forecast period.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In September 2019, Medtronic introduced Hugo RAS, which is a robot-assisted system for surgeries.

The various developmental strategies like new product launches, acquisition, partnerships, mergers, and government policies fosters market growth and offers lucrative growth opportunities to the market players.

By Product

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

March 2025