September 2024

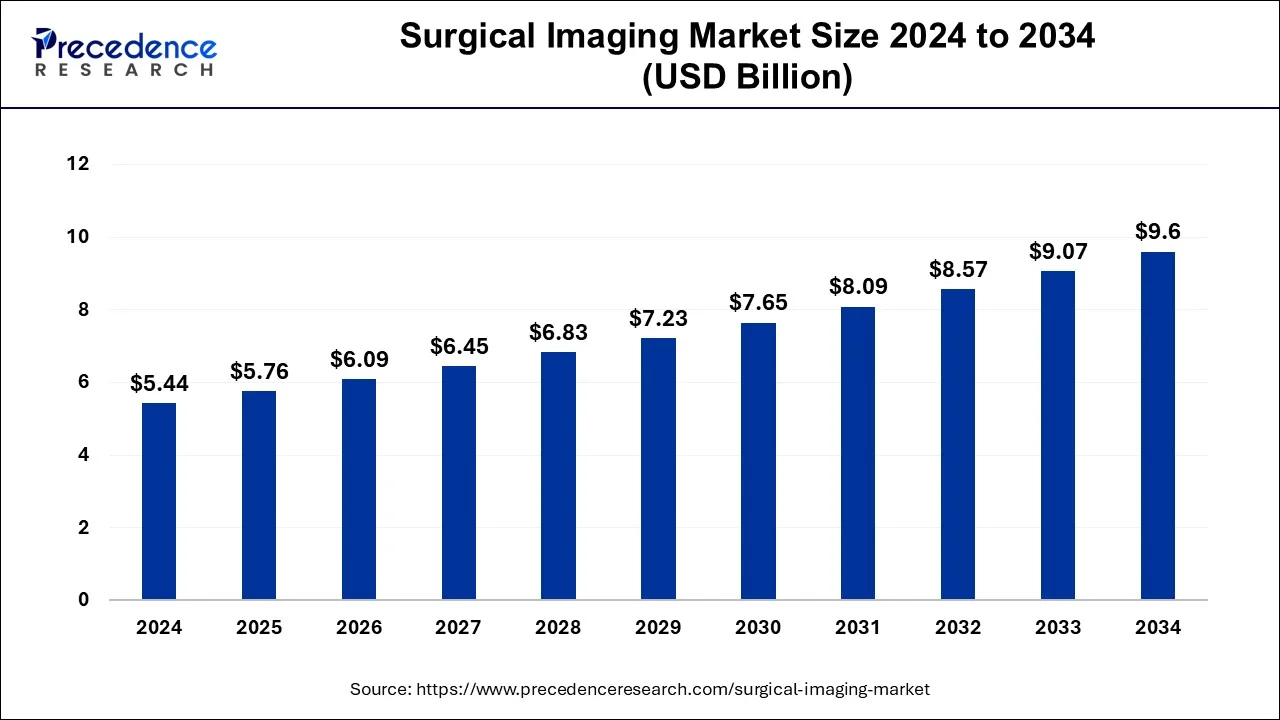

The global surgical imaging market size is accounted at USD 5.76 billion in 2025 and is forecasted to hit around USD 9.60 billion by 2034, representing a CAGR of 5.84% from 2025 to 2034. The North America market size was estimated at USD 1.90 billion in 2024 and is expanding at a CAGR of 6.02% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global surgical imaging market size was calculated at USD 5.44 billion in 2024 and is predicted to reach around USD 9.60 billion by 2034, expanding at a CAGR of 5.84% from 2025 to 2034. The global surgical imaging market growth is attributed to the growing geriatric population and rising prevalence of chronic diseases during the forecast period.

To revolutionize the surgical imaging industry, the integration of artificial intelligence into the surgical imaging market provides immense potential. AI technologies can automate certain aspects of imaging, such as segmenting tissues or identifying anomalies, assist in real-time decision-making, and enhance imaging quality. In addition, AI algorithms also reduce the burden on surgeons and improve diagnostic accuracy, enabling more precise and efficient procedures. AI-generated surgical imaging technologies are opening new growth avenues for the market and are anticipated to drive the adoption of advanced systems. Leading to innovations that enhance both surgical efficiency and patient outcomes, its application in surgical imaging is expected to expand as AI continues to evolve.

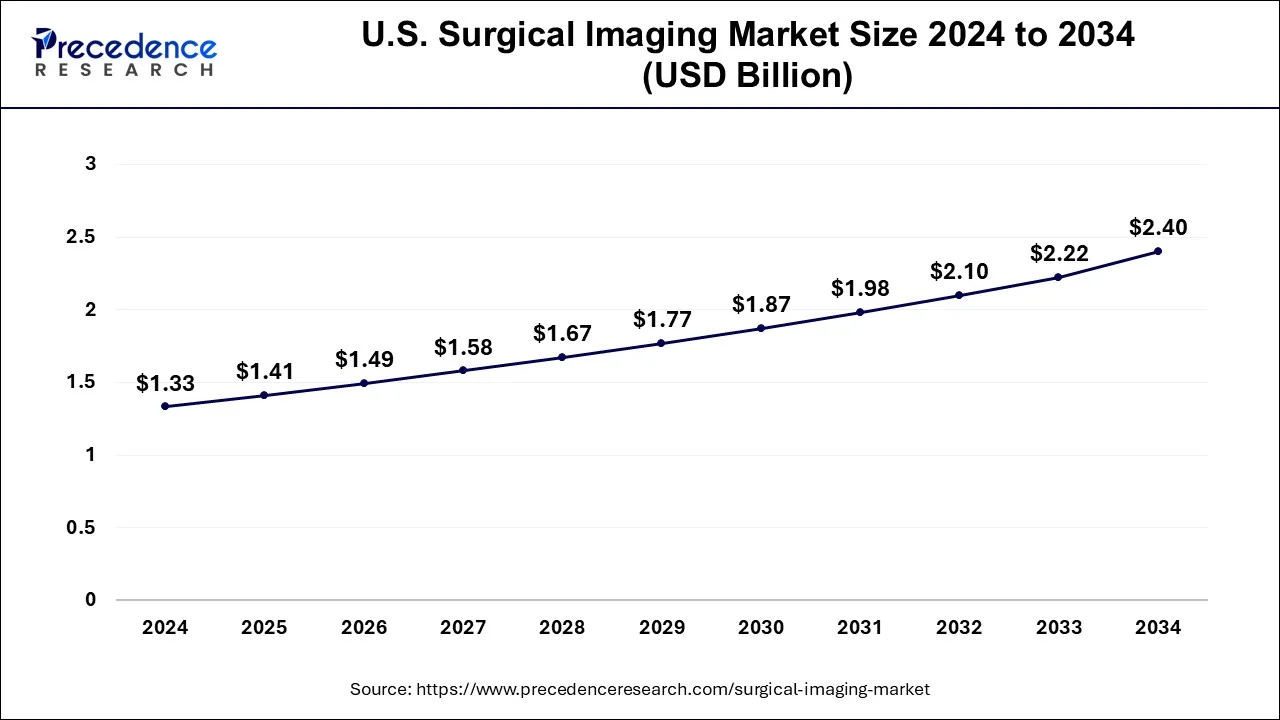

The U.S. surgical imaging market size was evaluated at USD 1.33 billion in 2024 and is projected to be worth around USD 2.40 billion by 2034, growing at a CAGR of 6.08% from 2025 to 2034.

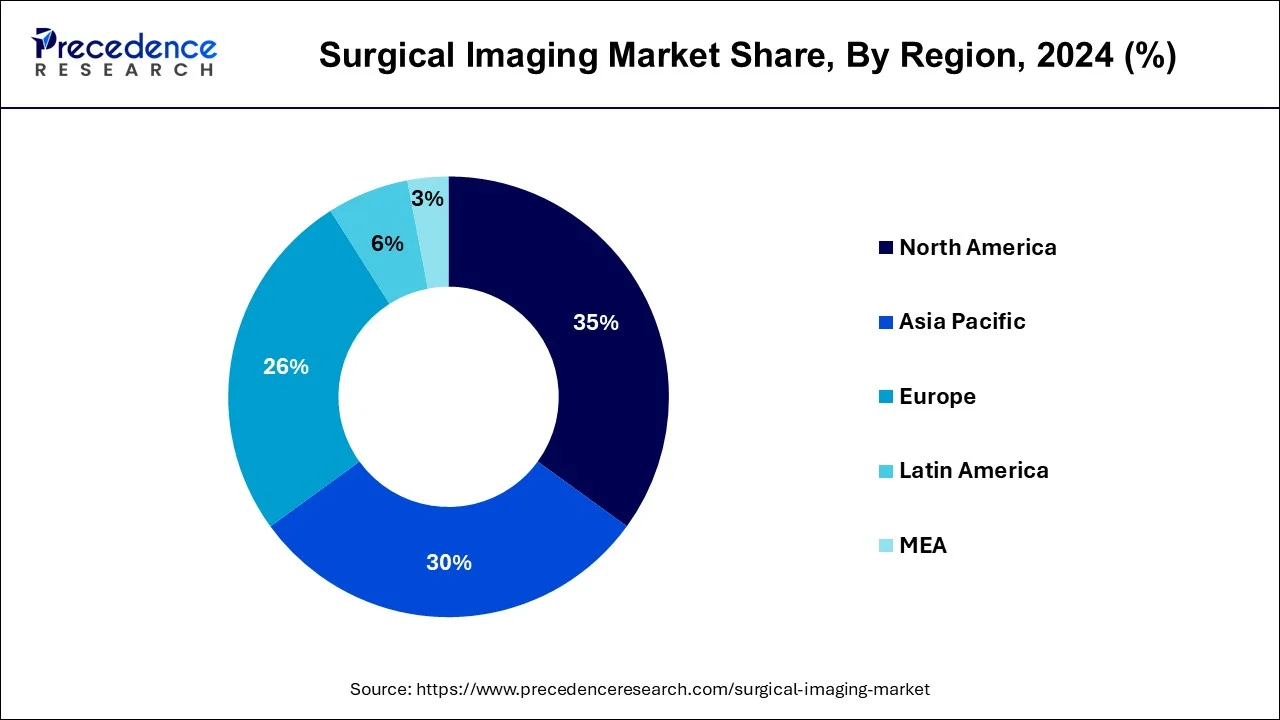

North America dominated the surgical imaging market in 2024. The market growth in the region is attributed to factors such as the increasing presence of high healthcare expenditure in countries with sufficient reimbursement policies, improved accessibility, and increasing adoption of surgical imaging technology in prime care industries. In addition, the increasing prevalence of chronic diseases such as neurological diseases, cardiovascular diseases, and breast cancer and rising technological innovations are further anticipated to drive the growth of the market in the region. The U.S. and Canada are the major countries that dominate the market.

The surgical imaging market growth in the U.S. is attributed to the increasing prevalence of chronic and pain-related diseases and increasing demand for healthcare equipment. In addition, evolving epidemiological patterns, changing patient care strategies, and rising advancing technologies are further anticipated to drive the growth of the market in the U.S.

Asia Pacific is expected to grow rapidly in the market during the forecast period. The surgical imaging market growth in the region is attributed to the increasing research and development activities and the rapid growth of the population. In addition, the increasingly high demand for advanced and traditional devices is expected to drive market growth in the region. China, India, Japan, and South Korea are the fastest-growing countries.

India's surgical imaging market is expected to grow fastest during the forecast period. Leading to a favorable significant population and regulatory climate, surgical imaging manufacturers are getting included in creating innovative manufacturing facilities. India has various clinics, doctors, and advanced technologies, which will significantly accelerate the demand for surgical imaging.

The surgical imaging market deals with the use of advanced imaging equipment and technologies during surgical processes to visualize internal structures of the body in real-time monitoring. Surgical imaging provides detailed and high-quality images that help surgeons make precise decisions during operations and reduce the need for invasive exploration. The increasing demand for minimally invasive surgeries, growing adoption of hybrid operating rooms, and rising development of compact and portable imaging devices.

In addition, the rising prevalence of age-related diseases requiring surgical interventions has significantly increased the demand for surgical imaging technologies. These diseases include neurological ailments, orthopedic diseases, cancer, and cardiovascular diseases. Furthermore, due to the need for research and development, mergers and acquisitions in the surgical imaging industry are rapidly growing.

| Report Coverage | Details |

| Market Size by 2024 | USD 5.44 Billion |

| Market Size in 2025 | USD 5.76 Billion |

| Market Size in 2034 | USD 9.60 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Modality, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The increasing demand for minimally invasive surgeries

The major driver boosting the surgical imaging market growth is the growing demand for minimally invasive surgeries. These processes offer various advantages, such as fewer complications, shorter hospital stays, and reduced recovery times. Surgical imaging systems, like intraoperative ultrasound and C-arms, allow surgeons to avoid unnecessary tissue damage, navigate with precision, and provide real-time visualization during these procedures. The increasing need for advanced imaging solutions that support these processes is anticipated to grow as the demand for minimally invasive techniques continues to rise.

Lack of skilled professionals

The shortage of skilled professionals in surgical imaging systems creates major challenges for the surgical imaging market. In emerging markets, there is a shortage of trained professionals able to use these technologies efficiently. As healthcare facilities may struggle to find qualified staff to maintain and operate the equipment, this lack of skilled professionals can restrain the adoption of surgical imaging systems. The advantages of these technologies, such as improved patient outcomes and surgical accuracy, may not be fully realized without proper expertise. The shortage of skilled professionals creates major challenges to the market in both developing and developed regions.

Development of compact and portable imaging devices

The increasing demand for compact and portable surgical imaging devices, particularly in smaller output settings and healthcare facilities, is the major opportunity in the surgical imaging market. These portable devices provide the flexibility to be used in less complex surgical environments and move between operating rooms, making them a convenient option for clinics. Portable ultrasound machines and mobile C-arms are compact devices that offer high-quality imaging while being more convenient and affordable. In addition, the increasing need for space-saving and accessible solutions creates a notable opportunity for manufacturers to develop and innovate portable imaging systems.

The C-arms segment accounted for the largest surgical imaging market share in 2024. Leading to improved patient outcomes, these mobile fluoroscopy units offer surgeons guidance and visualization and provide real-time imaging during surgeries. The segment growth is attributed to the rising prevalence of minimally invasive processes equipped with technological advancements such as 3D imaging capabilities and flat-panel detectors. These advanced technologies enhanced the adoption of C-arm systems across various specialties, such as trauma surgery, cardiology, and orthopedics. In addition, developing compact and portable C-arm systems increased their accessibility in smaller healthcare facilities and ambulatory surgical centers.

The X-ray segment is expected to grow at the fastest rate in the surgical imaging market during the forecast period. The segment growth is attributed to the increasing use of digital X-ray machines equipped with high-technology features. In addition, the laser scanner of the imaging device consists of phosphor and cassette plates and does not use film.

The orthopedic and trauma segment accounted for the largest surgical imaging market share in 2024. Orthopedic imaging techniques such as Magnetic Resonance Imaging (MRI), computed tomography (CT) scans, and X-rays play an important role in diagnosing degenerative diseases, joint injuries, and fractures. To enhance market penetration, market players are involved in the continuous development of novel products. This system improves the effectiveness and speed of spinal procedures, and it is unique for its machine-vision technologies and camera-based technology.

The cardiovascular surgeries segment is expected to grow rapidly in the surgical imaging market during the forecast period. The segment growth is attributed to the increasing number of cardiovascular diseases, such as cardiac arrest, and growing cardiovascular surgical cases. In addition, it is expected to drive the demand for cardiovascular surgeries across the globe, which indirectly enhances the demand for surgical imaging equipment such as C-arms, ultrasounds, and CTs.

The hospitals segment accounted for the largest surgical imaging market share in 2024. The segment growth is attributed to the growing population of patients affected with various diseases, such as cancer, cataracts, arteriovenous malformation, traumatic brain injury, brain aneurysm, and ischemic and hemorrhagic stroke. In addition, the rising advanced technological products and the increasing number of hospital admissions.

The ambulatory surgical centers segment is expected to grow significantly in the surgical imaging market during the forecast period. The segment growth is attributed to the rising demand for minimally invasive surgeries and rising advancements in cost-effective and portable imaging technologies. The ambulatory surgical centers are the major facilities of procedure-centric healthcare in the U.S.

By Modality

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

January 2025