September 2024

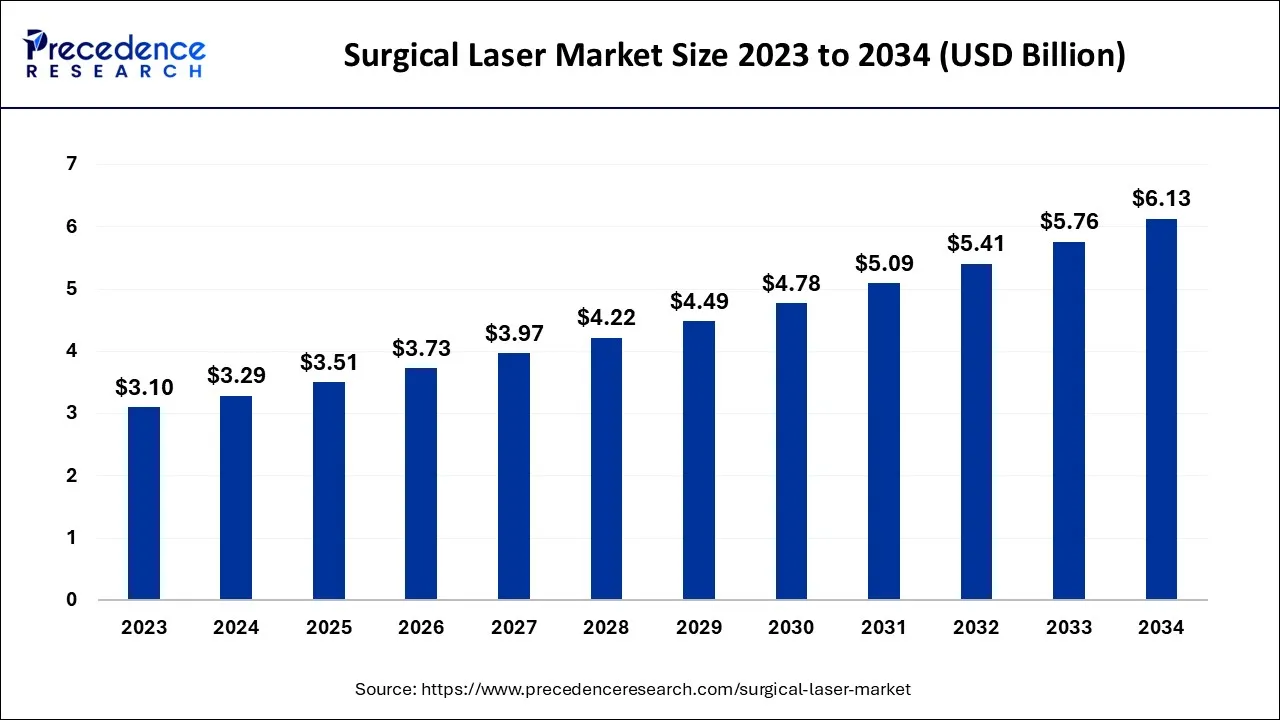

The global surgical laser market size accounted for USD 3.29 billion in 2024, grew to USD 3.51 billion in 2025, and is expected to be worth around USD 6.13 billion by 2034, poised to grow at a CAGR of 6.42% between 2024 and 2034. The North America surgical laser market size is predicted to increase from USD 1.38 billion in 2024 and is estimated to grow at the fastest CAGR of 6.55% during the forecast year.

The global surgical laser market size is expected to be valued at USD 3.29 billion in 2024 and is anticipated to reach around USD 6.13 billion by 2034, expanding at a CAGR of 6.42% over the forecast period from 2024 to 2034.

The rising prevalence of chronic diseases is the key factor driving market growth. Also, the increasing preference for minimally invasive surgeries coupled with the technological advancements in laser systems can fuel market growth further.

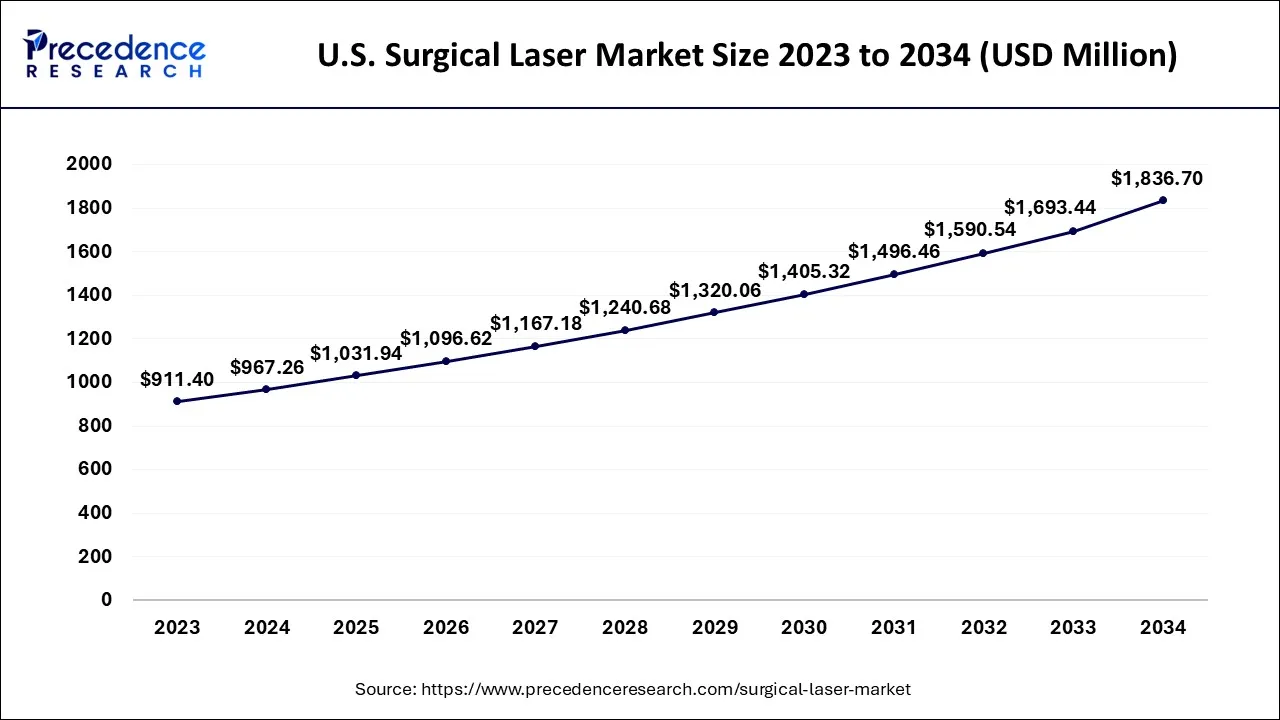

The U.S. surgical laser market size is exhibited at USD 967.26 million in 2024 and is projected to be worth around USD 1,836.70 million by 2034, growing at a CAGR of 6.62% from 2024 to 2034.

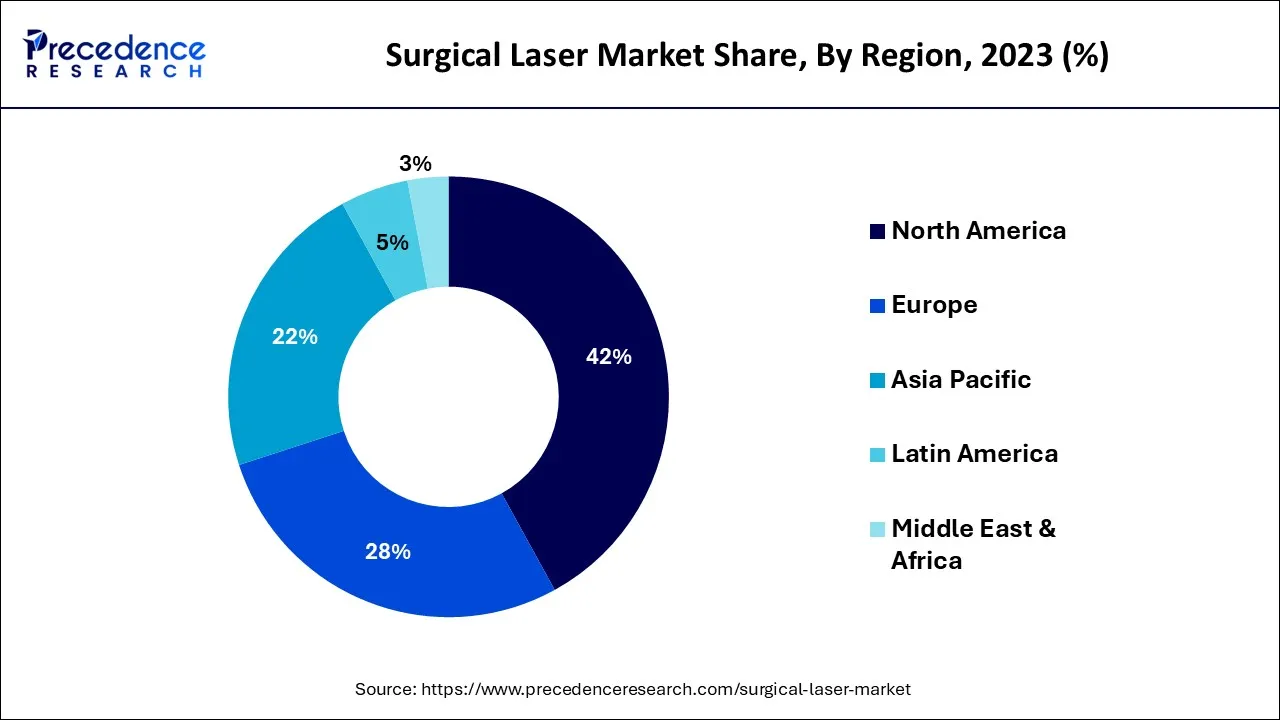

North America, Latin America, Europe, Asia Pacific, the Middle East, and Africa are the regional divisions of the surgical lasers market. North America generated the most revenue in 2023, and it is anticipated that it will hold this position throughout the projected period. This dominance is attributable to the established healthcare system, widespread use of technologically sophisticated aesthetic laser technologies, and rising demand for aesthetic and cosmetic procedures in North America.

Furthermore, it is projected that the local presence of large firms and their ongoing strategic endeavors will further improve the market environment. During the projection period, surgical lasers are anticipated to have brisk growth in the Asia Pacific region. In order to increase the visibility of its surgical laser devices and to obtain a competitive edge, a number of significant firms are implementing a variety of growth methods.

Furthermore, new key developments, such as product launches and approval by key players, are also anticipated to provide growth opportunities. For instance, in order to support the care of more people with heart failure, Abbott acquired expanded indication approval from the US Food and Drug Administration (FDA) in February 2022 for the CardioMEMS HF System. A paperclip-sized sensor known as the CardioMEMS HF System is inserted into a patient's pulmonary artery using a catheter.

Asia Pacific region is expected to witness the fastest growth over the forecast period. The growth of the region can be driven by ongoing developments in healthcare infrastructure and rising access to innovative surgery technologies. Also, there is a surge in healthcare standards in developing economies like China and India. In addition, an increasing shift toward minimally invasive surgeries can shorten recovery times.

Surgical lasers are devices that treat or cut tissue without the use of a scalpel by using light. When performing eye surgery, a surgical laser is frequently utilized to reshape the cornea or correct vision. The device can also be used to get rid of tattoos, birthmarks, and wrinkles. Since there is no physical touch during laser surgery, there is no chance of infection, making it safer than traditional surgery.

The market has been transformed by high growth potential in developing nations and growing interest in minimally invasive procedures. The market for surgical lasers is being driven by the expansion of the medical tourism sector as a result of the globalization of the healthcare system. People have been steadily increasing in number in recent years who travel abroad for medical care.

To draw patients, many nations have positioned themselves as having top-notch healthcare facilities and cutting-edge technology. The developing world is now taking advantage of the increased demand for medical care by meeting it with better facilities and at lower costs due to the high cost of surgeries and treatments in the industrialized world.

Furthermore, the rising prevalence of vision impairment and the quick development of laser technology will drive the worldwide surgical lasers market trends through 2030. Over 2.2 billion people worldwide have a distance or near visual impairment, according to the WHO. This element might increase demand for LASIK eye surgery, which makes up 90%–95% of all laser vision correction procedures. The development of laser technology to treat critical illnesses like cancer will also spur industrial growth.

Furthermore, Heriot-Watt University in Edinburgh received a $1.6 million grant from the Engineering and Physical Sciences Research Council in 2021 for the creation of a new laser device that would assist surgeons in identifying and removing cancer cells without causing damage to neighboring tissues. Such significant investments in the management of specific diseases will also encourage

The implementation of Artificial Intelligence (AI) technology in the market is substantially changing the market. AI algorithms enable precise diagnostics and accurate treatment planning during laser procedures. Furthermore, AI and ML technologies optimize overall operational efficiencies by decreasing human error and enhancing processes.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.29 Billion |

| Market Size by 2034 | USD 6.13 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.42% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type, By Application and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising interest in minimally invasive procedures - Minimally invasive surgery typically results in less discomfort, a shorter hospital stay, and fewer complications. Furthermore, the demand for minimally invasive or non-invasive operations is rising, and patients are favoring shorter hospital stays, which is driving manufacturers to create items and equipment with cutting-edge technology and quick recovery times.

Minimally invasive surgery typically results in less discomfort, a shorter hospital stay, and fewer complications. Furthermore, the demand for minimally invasive or non-invasive operations is rising, and patients are favoring shorter hospital stays, which is driving manufacturers to create items and equipment with cutting-edge technology and quick recovery times.

As a result of the aforementioned variables, it is projected that the market under study will expand during the course of the investigation. However, the substantial procedural costs linked to laser surgery will probably restrain market expansion.

Increase in key developments - The Spectranetics Corporation (Philips Holding USA Inc.), IPG Photonics Corporation, Carl Zeiss Meditec, Inc., BISON MEDICAL Co., Ltd., Biolitec AG (BioMed Technology Holdings Ltd.), Alma Lasers (Sisram Med), Abbott Laboratories, Lumenis, Cynosure, and Boston Scientific Corporation are just a few of the major companies operating in the market.

These businesses are employing a variety of techniques, such as new product releases and partnerships, to increase their market share in the cutthroat industry. For instance, Boston Scientific and a BPEA affiliate signed a contract in March 2021. (Baring Private Equity Asia). With this agreement, Lumenis' surgical division, comprising its top-tier laser systems, will be acquired.

Lack of knowledge regarding specialized training - Over the forecast period, challenges such as surgeons' specialized training, stringent safety regulations, and the high cost of laser therapy are anticipated to have a negative impact on the growth of the surgical laser market. Additionally, laser therapy's effects might not persist as long in other conditions, like cancer, so doctors might need to repeat the procedure to get better outcomes.

Furthermore, the high cost of laser procedures, the absence of practical medical reimbursement mechanisms, and stringent guidelines guiding the approval of surgical lasers are anticipated to also be market restraints.

Acceptance of surgical lasers in developed and undeveloped countries – Players in the surgical laser market have a lot of room to grow in emerging markets like India, China, Brazil, and Mexico. The aging of the population, the incidence of lifestyle illnesses, and rising investments by major companies in these nations are all contributing to growth in these regions.

Furthermore, growing acceptance and demand for sophisticated cosmetic operations worldwide, in both established and emerging nations, are largely due to growing awareness of advanced aesthetic techniques. The use of surgical laser technology in aesthetic operations has significantly increased during the past several years. According to the American Society of Plastic Surgeons (ASPS), the South Atlantic has 3.8 million (25%) of the country's cosmetic treatments were conducted there in 2020.

Acceptance of surgical lasers in developed and undeveloped countries – Players in the surgical laser market have a lot of room to grow in emerging markets like India, China, Brazil, and Mexico. The aging of the population, the incidence of lifestyle illnesses, and rising investments by major companies in these nations are all contributing to growth in these regions.

Furthermore, the growing acceptance and demand for sophisticated cosmetic operations worldwide, in both established and emerging nations, is largely due to growing awareness of advanced aesthetic techniques. The use of surgical laser technology in aesthetic operations has significantly increased during the past several years.

The surgical laser market is anticipated to have the greatest revenue share in solid-state laser systems in 2023. Erbium Yttrium Aluminum Garnet (Er: YAG), Neodymium Yttrium Aluminum Garnet (Nd: YAG), Holmium Yttrium Aluminum Garnet (Ho: YAG), Ruby laser systems, and other solid-state systems are further subdivided.

The use of Nd: YAG laser systems for cosmetic procedures has spread throughout the world as market participants introduce their goods and surgical laser systems in other regions. Additionally, improvements in Nd: YAG lasers along with their widespread use due to their effective results on practically all skin types are some of the key drivers boosting the segment's growth in the surgical lasers market.

Furthermore, with the low cost of these surgical laser systems and the precision of the procedures, carbon dioxide surgical lasers account for a sizeable portion of gas-laser systems. Due to the numerous benefits that these systems offer, market participants are concentrating on the introduction of CO2 lasers.

The diode laser systems segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be attributed to the growing use of diode lasers in a variety of applications such as dentistry, dermatology, and ophthalmology which makes them adaptable for various procedures. Additionally, ongoing development in diode laser technology can impact segment growth positively in the market.

The market for surgical lasers is divided into cosmetic, surgical, dental, and ophthalmic segments based on the application. Over the foreseeable period, it is expected that the aesthetics segment will continue to dominate.

An increasing number of FDA approvals that broaden dermatology applications such as skin rejuvenation, varicose vein treatment, acne, tattoo, and pigmented lesions support industry growth in the aesthetics sector.

The market for surgical lasers is divided into cosmetic, surgical, dental, and ophthalmic segments based on the application. Over the foreseeable period, aesthetics segment dominaed the market in 2024.

An increasing number of FDA approvals that broaden dermatology applications such as skin rejuvenation, varicose vein treatment, acne, tattoo, and pigmented lesions support industry growth in the aesthetics sector.

The dentistry segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the rising adoption of laser technology for an extensive range of dental procedures. Lasers provide numerous benefits in dentistry like reduced pain. Moreover, developments in laser technology including portable diodes can lead to market growth soon.

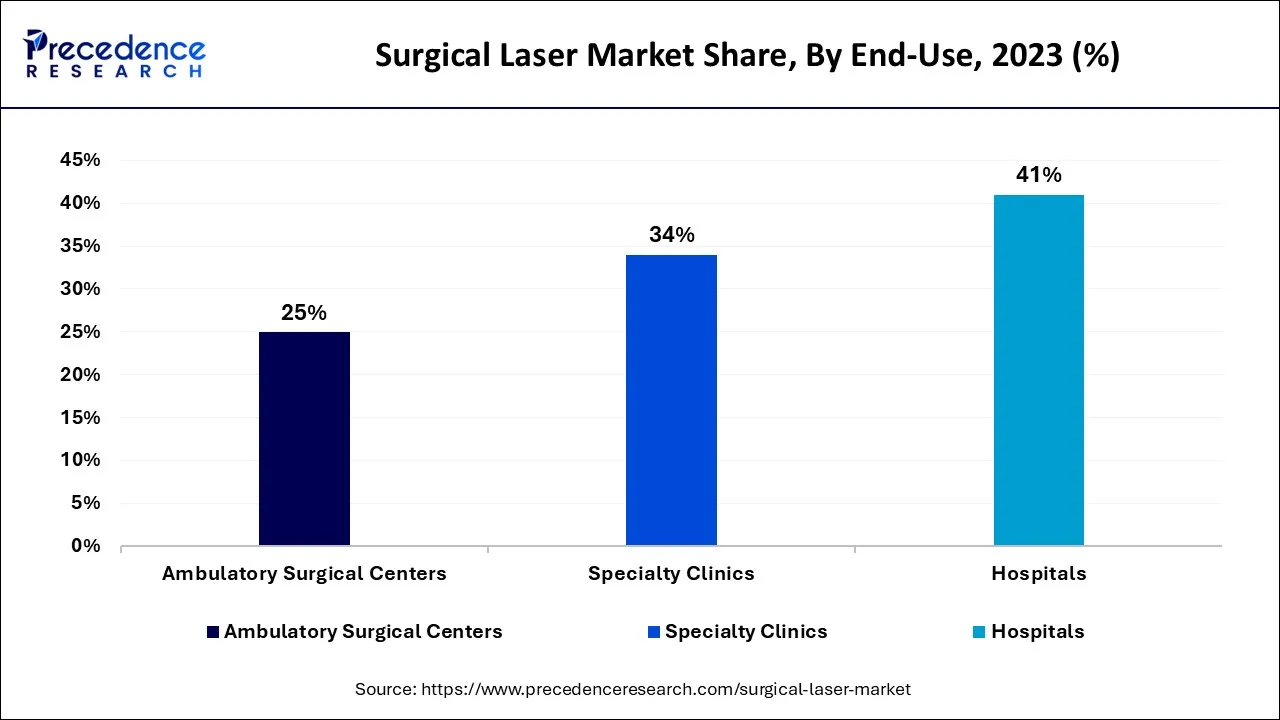

The surgical lasers market was dominated by the hospital sector. Over the projected period, the category is expected to continue to rule. The rise in aesthetic operations in hospitals in important markets including the U.S., Germany, and Japan is credited with the hospital segment's expansion.

Additionally, it is projected that growing consumer awareness of aesthetic and cosmetic procedures in developing nations like China and India will promote segment expansion.

The ambulatory surgical centers (ASCs) segment is estimated to show the fastest growth during the projected period. The growth of the segment can be credited to the rising demand for OPD procedures and the increasing preference for cost-effective treatments. Furthermore, ASCs are easier to reach than hospitals, good for patients searching for convenient and quick alternatives.

By Product Type

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

January 2025