September 2024

Surgical Robot Accessories Market (By Application: Orthopedics, Neurology, Urology, Gynecology, Others; By End-use: Inpatient, Outpatient) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

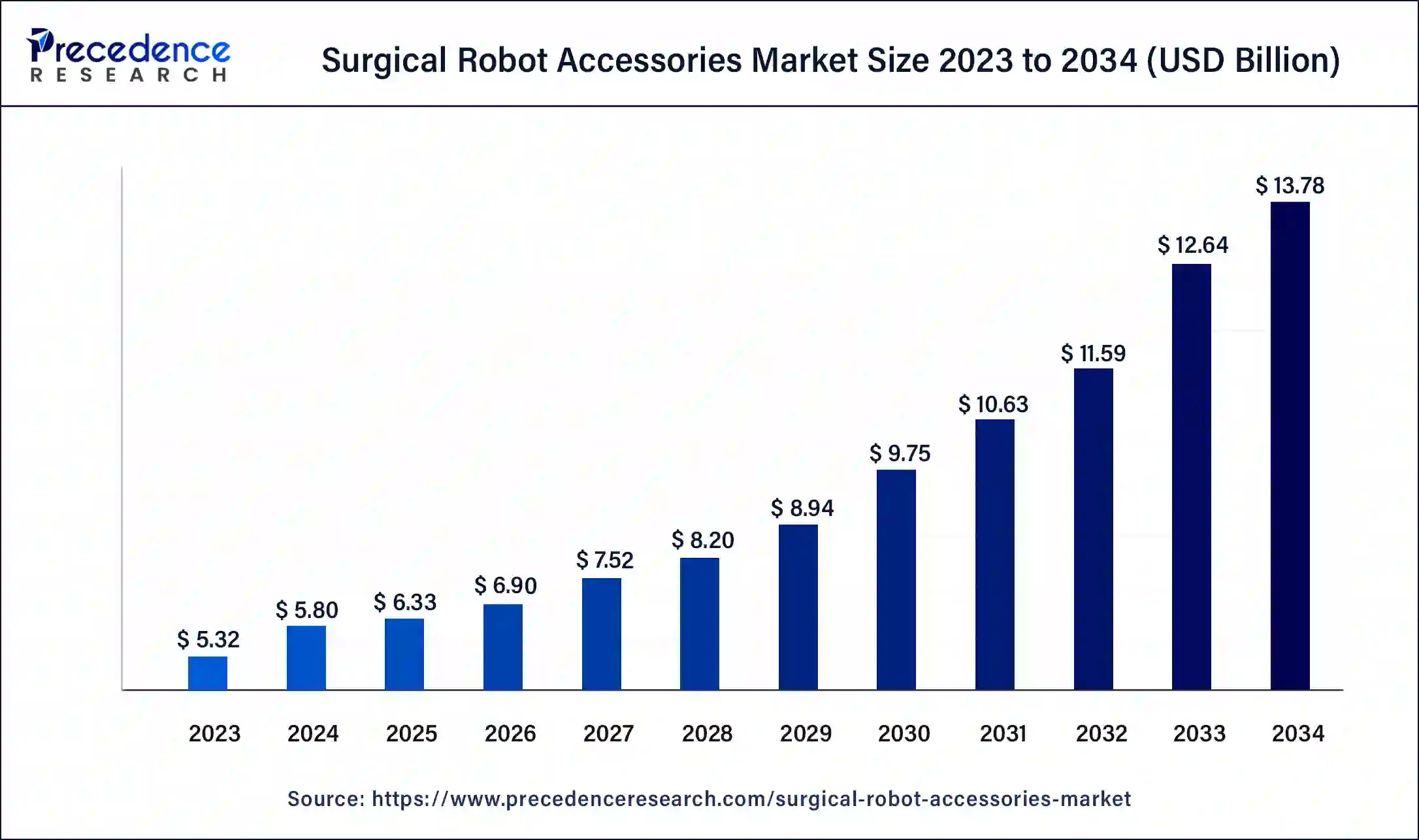

The global surgical robot accessories market size was USD 5.32 billion in 2023, calculated at USD 5.80 billion in 2024 and is expected to reach around USD 13.78 billion by 2034. The market is expanding at a solid CAGR of 9.03% over the forecast period 2024 to 2034. The robust growth in healthcare infrastructure to boost the expansion of the market in the coming years.

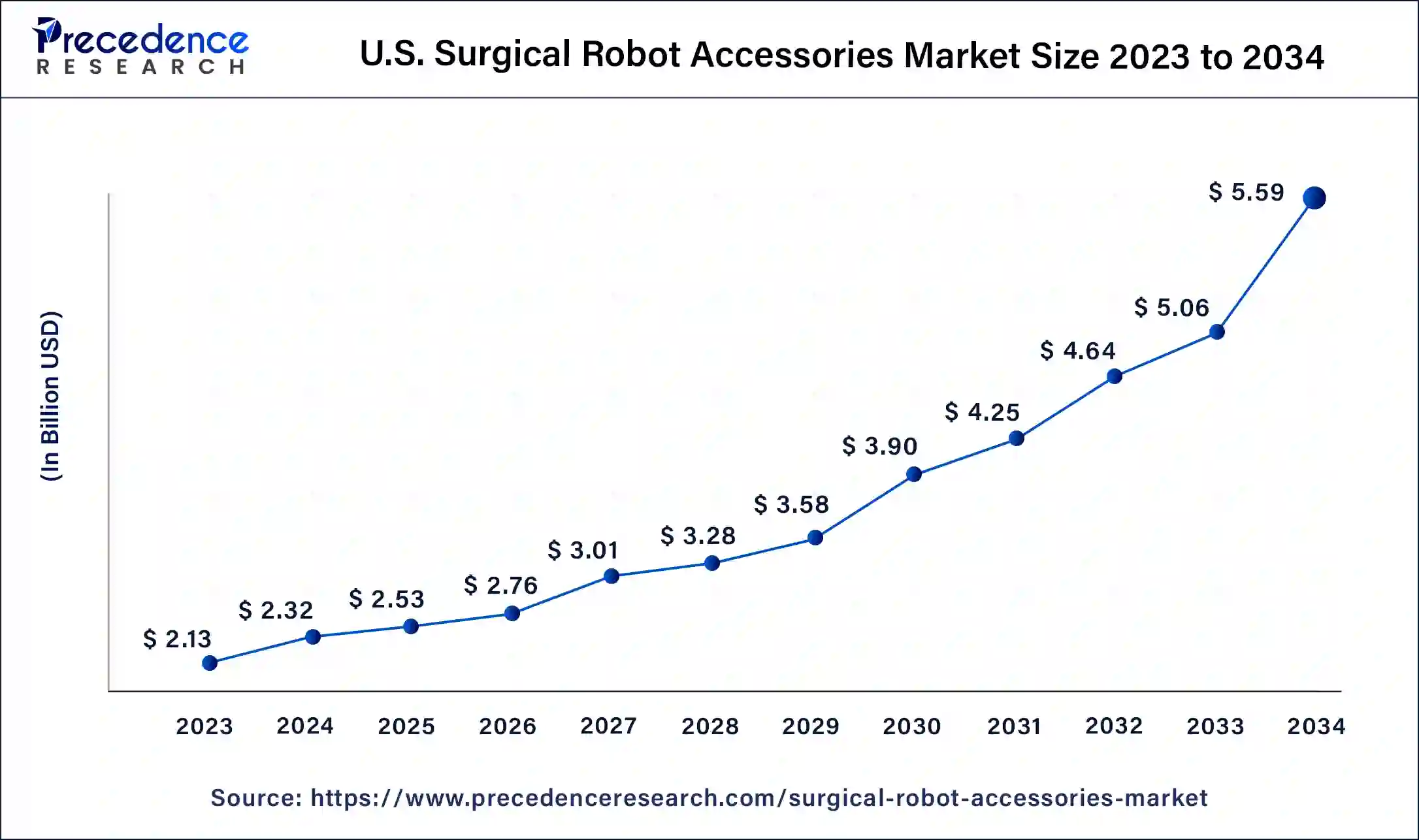

The U.S. surgical robot accessories market size was exhibited at USD 2.13 billion in 2023 and is projected to be worth around USD 5.59 billion by 2034, poised to grow at a CAGR of 9.16% from 2024 to 2034.

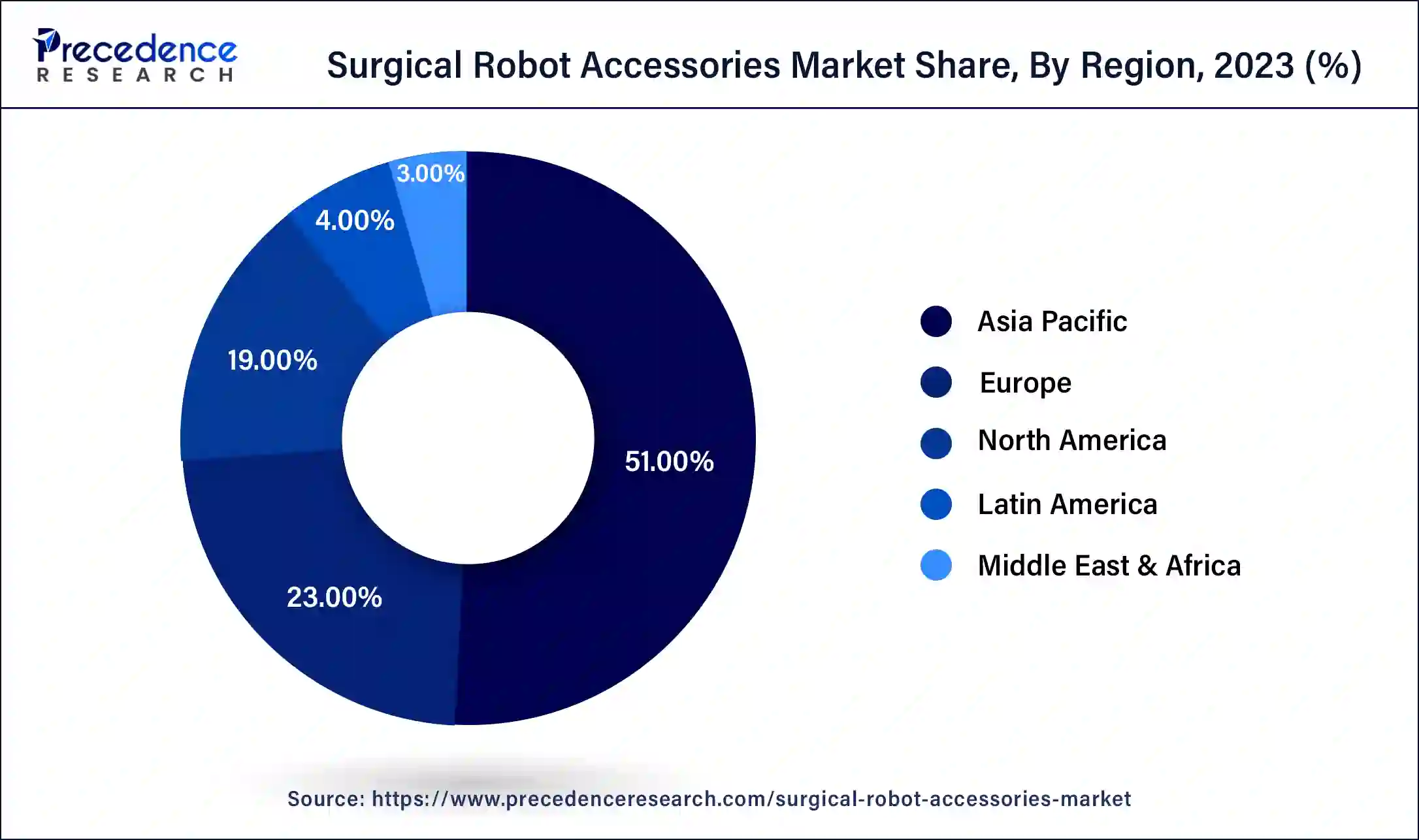

North America led the surgical robot accessories market in 2023 and the region is observed to continue the position during the forecast period. The region's sophisticated healthcare infrastructure and substantial investment in healthcare technology provide a solid foundation for robotic-assisted surgeries. Robotic surgery plays a pivotal role in the region's remarkable advancement of medical technology. The region has witnessed the increasing prevalence of chronic diseases, increasing the use of surgical robots to aid surgeons in performing complex procedures related to Urology, Colorectal, General Surgery, Gynecology, Oncology, and Gastrointestinal surgeries more precisely in less time.

The United States is the major contributor to the market due to the rising adoption of cutting-edge technologies, the rising number of robot-assisted surgeries, the presence of well-established hospitals, the rising growth in medical tourism, and the surge in the number of patients with cardiovascular, orthopedic, gynecology, neurological, and others health conditions that call for surgeries. Moreover, rapid technological innovations, extensive R&D activities, supportive government policies, and a rise in healthcare expenditure are expected to support the integration of robotic systems into healthcare. Furthermore, the North American region also has a strong presence of prominent market players which drives the growth of the surgical robot accessories market in the region during the forecast period.

Asia Pacific is anticipated to grow at a notable growth rate in the surgical robot accessories market during the forecast period. Factors such as increasing adoption of surgical robots in hospitals and surgical centers, rising research & development activities, increasing surgical patient population, increasing deployment of advanced medical technologies, rising healthcare expenditure, cutting-edge technologies, increasing investment in healthcare infrastructure development, supportive government initiatives, and rising demand of da Vinci surgical system among surgeons is anticipated to boost the growth of the surgical robot accessories market in the Asia Pacific.

The rising dependence on surgical robots is a result of the increasing incidence of chronic diseases. Surgical Robots are designed to help surgeons in surgical procedures. More precise surgeries can be performed in less time through robot-assisted surgery. Additionally, the surgical robot accessories market in China, Japan, and India is experiencing growth in the rising number of chronic diseases that require surgical intervention, which further increases the need for surgical robots for minimally invasive surgeries and open surgical procedures to improve outcomes. Furthermore, collaborations or partnerships between healthcare institutions and technology providers are likely to accelerate the significant growth of the surgical robot accessories market in Asia Pacific. Therefore, these considerable factors increase the adoption of surgical robot accessories in the region during the forecast period.

With the use of robotic surgery, physicians perform several complex surgical procedures with greater flexibility, precision, and control. Various components constitute a surgical robot such as robotic arms, console, camera, surgical tools, computer software, and others. The excellent design and function of these components work together to enable surgical robots to play a pivotal role in various surgeries and improve the efficiency and precision of surgery. Robotic surgery is often performed through tiny incisions. This approach is widely known as minimally invasive surgery. The benefits of minimally invasive surgery include Less pain, reduced blood loss, quicker recovery, less noticeable scars, and risk of fewer complications.

| Report Coverage | Details |

| Market Size by 2034 | USD 13.78 Billion |

| Market Size in 2023 | USD 5.32 Billion |

| Market Size in 2024 | USD 5.80 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.03% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increase in the number of surgical procedures

The increasing number of surgical procedures is anticipated to boost the growth of the surgical robot accessories market during the forecast period. Surgical procedures have significantly increased due to the rise in chronic diseases that require surgeries. Surgeons are highly adopting robotic-assisted surgery systems to minimal post-operative complications, shorten hospital stays for patients, and reduce blood flow. Surgical robots have emerged as an advanced medical technology to assist surgeons in performing complex and delicate surgical procedures with high accuracy as compared to conventional methods. Surgical robot accessories play a pivotal role in surgical procedures to improve precision, flexibility, visualization, dexterity, and efficiency in minimally invasive surgeries (MIS).

These systems are widely used in a wide variety of surgical procedures, including orthopedic, general surgery, neurosurgery, cardiovascular, gynecology, laparoscopy, urology, oncology, pediatric surgery, and others. In recent years, the da Vinci surgical system has gained immense popularity and enables surgeons with an advanced set of instruments to use in performing robotic assisted minimally invasive surgery. The use of the da Vinci Xi is associated with less pain and quick recovery to improve the patient’s quality of life. Therefore, the rising number of surgical procedures is propelling the growth of the surgical robot accessories market.

High Cost

The high cost associated with surgical robot accessories is anticipated to hamper the market's growth. High cost is required for purchasing these advanced medical products. In addition, limited healthcare infrastructural facilities in middle and lower-income countries may restrict the expansion of the global surgical robot accessories market. In addition, such accessories are still newer to the industry that require a span to get adapted by healthcare providers. Thereby, the slow rate of adoption is also observed to create a hampering factor for the market.

Rising government initiatives and technological innovation

The rise of government initiatives along with technological innovation is projected to offer lucrative opportunities to the surgical robot accessories market during the forecast period. In recent years, the healthcare sector has achieved milestones. Government initiatives and funding are advancing and increasing the adoption of surgical robots in hospitals. Governments have recognized the potential of robotic surgery for revolutionizing the healthcare sector and are highly investing in R&D. Favorable policies of several Government policies are offering support to domestic manufacturers. Surgical robotics companies have sped up their go-to-market timelines through the approval pathway which accelerates regulatory approval for novel medical products.

Additionally, robust technological innovation is expected to drive the growth of the surgical robot accessories market. Several potential companies operating in the market are prioritizing the development of technologically advanced solutions including robotic microsurgery simulators. A robotic microsurgery simulator is designed to replicate the intricate procedures of microsurgery using robotic systems. Therefore, these factors are credited to the growth of the market.

The orthopedics segment accounted for the dominating share in the surgical robot accessories market. Surgical robots have significantly transformed many medical interventions, offered precision and improved minimally invasive operations in the orthopedics field. The segment growth is observed due to the rising demand for robotic-assisted surgeries in orthopedics. In addition, the growing adoption of minimally invasive techniques for orthopedic interventions coupled with rapid advancements in surgical robotics technology to improve overall patient care in orthopedic surgery. Orthopedic implants are a type of robotic surgery equipment designed to replace a bone or a joint in the body such as knee replacement, hip replacement, and others.

The neurology segment is observed to grow at the fastest during the forecast period owing to the increasing prevalence of neurological disorders. The neurosurgery field continues to advance with the advent of robotic surgery, marking a shift in the way complex and delicate procedures on the brain and spine. Robotic systems revolutionize neurology surgical careers by decreasing tremors, increasing accuracy, improving precision, and overall improving patient outcomes. The most often used robotic systems in neurosurgery include the Da Vinci Surgical System, ROSA Robot, and NeuRobot.

The inpatient segment held the largest share of the surgical robot accessories market in 2023, the segment is expected to sustain the position throughout the forecast period owing to the increasing number of surgeries conducted, offering lucrative opportunities for effectively utilizing surgical robots in diverse surgical interventions Inpatient facilities including hospitals have sophisticated infrastructure and resources to utilize surgical robots. It allows doctors to perform several complex procedures through small incisions. Hospitals often have dedicated surgical teams trained to perform surgical procedures with robotic assistance. Such factors are bolstering the segment’s growth.

The outpatient segment is expected to grow significantly during the forecast period. Outpatient facilities such as ambulatory surgical centers (ASCs) and specialized surgical centers are increasingly adopting surgical robots for minimally invasive surgeries. Patients often prefer outpatient settings for minor surgeries to avoid overnight stays as well as reduce expenses. Surgical robots are precise and less invasive procedures which increases the trend for the outpatient model. Thus, bolstering the growth of the segment.

Segments covered in the report

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

January 2025