February 2025

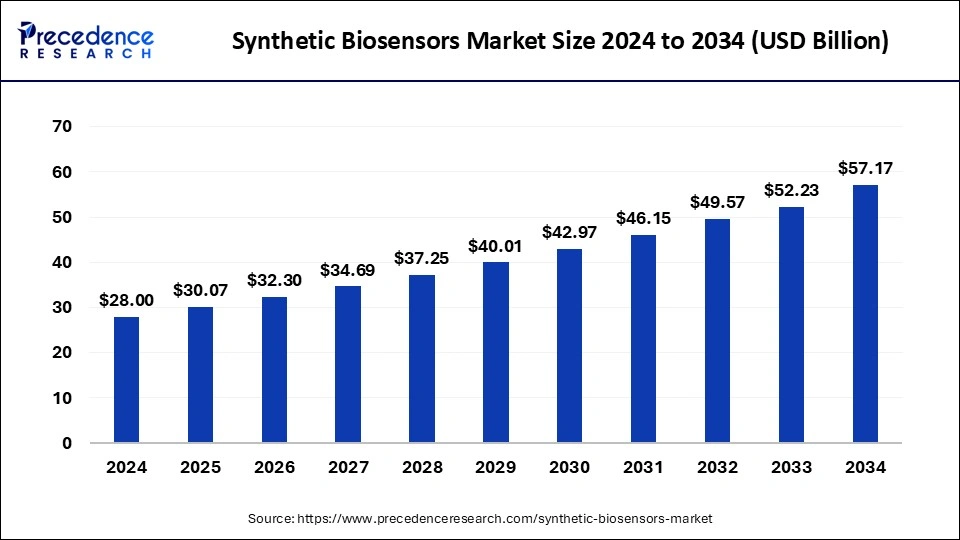

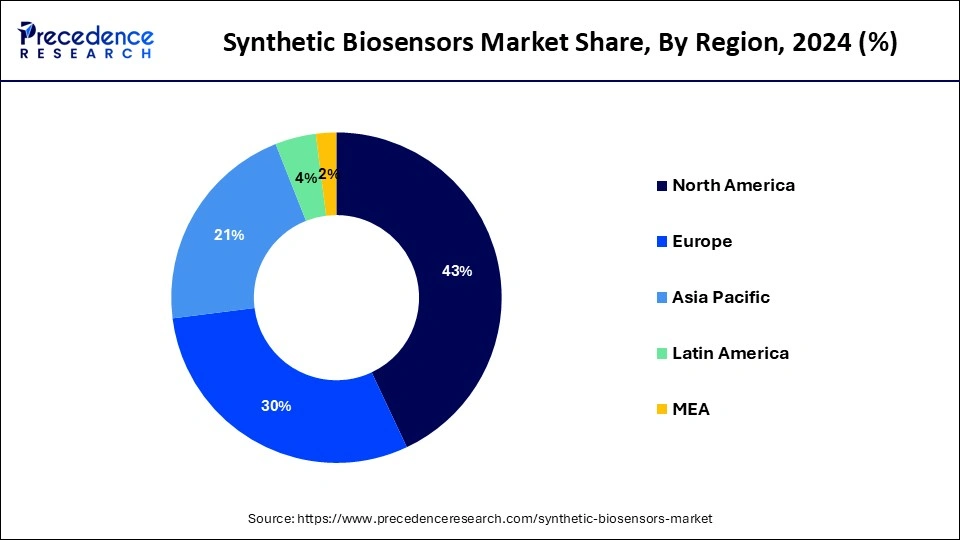

The global synthetic biosensors market size accounted for USD 30.07 billion in 2025 and is forecasted to hit around USD 57.17 billion by 2034, representing a CAGR of 7.30% from 2025 to 2034. The North America market size was estimated at USD 12.04 billion in 2024 and is expanding at a CAGR of 7.40% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global synthetic biosensors market size was calculated at USD 28.00 billion in 2024 and is predicted to increase from USD 30.07 billion in 2025 to approximately USD 57.17 billion by 2034, expanding at a CAGR of 7.30% from 2025 to 2034.

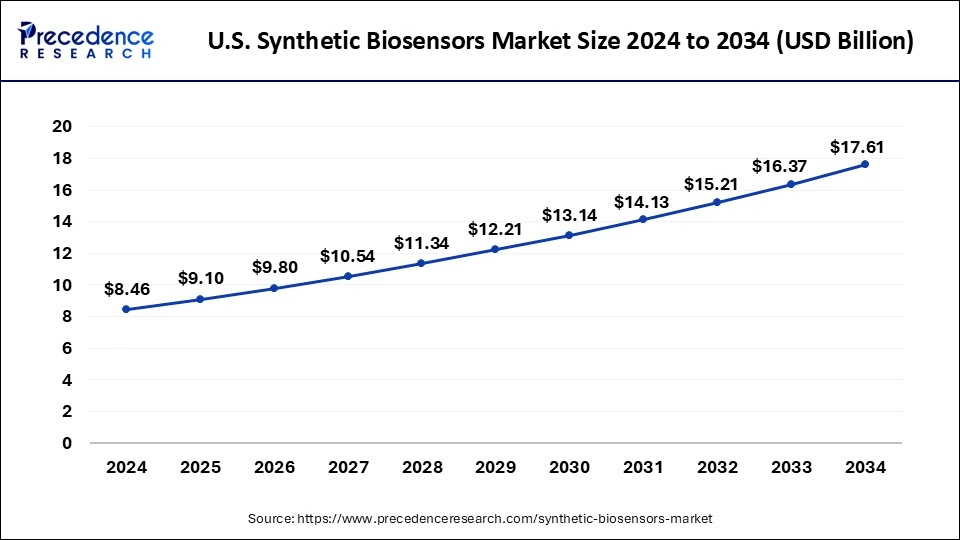

The U.S. synthetic biosensors market size was exhibited at USD 8.46 billion in 2024 and is projected to be worth around USD 17.61 billion by 2034, growing at a CAGR of 7.60% from 2025 to 2034.

North America is the dominating region in the synthetic biosensors market in the year 2024 owing to the growing prevalence of life-threatening diseases. The development and advancement of technology in the medical diagnostic industry a key factors driving the biosensor market in North America. The presence of medical institutes and pharmaceutical research and development organizations in North America is driving market growth in the region. The growing awareness of health problems, environmental hazards, and food toxicity in North America has driven demand for synthetic biosensors in the region. Technological developments and advancements in diagnostic devices in North America are driving the synthetic biosensors market.

Asia-Pacific is expected to be the largest synthetic biosensors market during the forecast period. The presence of a large population base and the increasing prevalence of lifestyle-related diseases are the key factors driving the market growth in the Asia-Pacific region. In 2019, new materials for vaccine production and medical facilities were added to the 2019 national incentive list. Asian countries like China are now encouraging investment in the health sector and creating infrastructure, opportunities for foreign investors to access preferential policies and tax rates. These policies are expected to attract several opportunities for the synthetic biosensor market in this region.

The global synthetic biosensors market is anticipated to witness potential growth opportunities due to an increase in applications in various industries such as pharmaceutical, healthcare, food, agriculture, environment, and others. The increase in government investment in the health and pharmaceutical industries, the incidence of cardiovascular diseases, diabetes, and the increasing trend of self-monitoring are the key factors driving the global synthetic biosensors market during the forecast period. The major market players operating in the global biosensor market are focused on the production of cost-effective biosensor devices for accurate measurements. Additionally, the market players have huge growth opportunities due to the increasing applications of synthetic biosensors amid the global pandemic. Technological advancements in synthetic biosensors and developments in the field of nanotechnology are driving the expansion of the global synthetic biosensors market during the forecast period.

The main driving factors for the synthetic biosensor market include significant technological advancements in recent years, the emergence of nanotechnology-based synthetic biosensors, the rising usage of synthetic biosensors, the increase in the use of synthetic biosensors to monitor blood sugar levels in diabetic consumers, growing demand for home care devices during the COVID19 Pandemic, and increasing government initiatives towards diagnostics.

| Report Coverage | Details |

| Market Size in 2025 | USD 30.07 Billion |

| Market Size in 2024 | USD 28.00 Billion |

| Market Size by 2034 | USD 57.17 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.30% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, Technology, Application, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

By type, the embedded device segment is a major revenue-generating segment in the synthetic biosensors market and is expected to dominate during the forecast period. These devices are widely used in a wide range of applications such as point of care, home diagnostics, food and beverage, research laboratories, environmental monitoring, and bioremediation. With the rise of the Internet of Things (IoT) devices, there has been a massive shift in connected healthcare applications. IoT enables real-time alerting, tracking, and monitoring, enabling convenient treatment, greater accuracy, appropriate physician intervention, and better holistic patient care. Many medical facilities have started to adopt integrated solutions for IoT-enabled medical devices to solve the shortage of doctors in remote areas.

Depending on the product, the market is divided into wearable and non-wearable. The wearable synthetic biosensors segment is predicted to show the highest growth rate during the forecast period. Wearable synthetic biosensors have attracted considerable attention due to their potential to change conventional medical diagnoses and concepts of continuous health monitoring. Wearable biosensor applications aim to transform centralized hospital care systems into personalized home medicine and reduce healthcare costs and diagnostic times. Today, wearable synthetic biosensors are bringing a wave of innovation to society. The availability of this real-time data enables better clinical decisions and translates into better health outcomes and more efficient use of the health system. Wearable synthetic biosensors can help detect health events early and avoid hospitalization. Such events are expected to accelerate the growth of the wearable biosensor market.

Depending on the application, the market is divided into food & beverages, POC, research lab, home diagnostics, environmental monitoring, and biodefense. The home diagnostics segment is predicted to show the highest growth rate during the forecast period. The growth of the market is attributed to the growing development of the healthcare industry, the high adoption rate of new diagnostic methods, and the convenience of using medical devices at home. As a result, manufacturers in the domestic diagnostic market are expanding their production capacity. In addition, with the growing demand in the wearables segment and as lifestyle-related diseases increase in prevalence, there is huge potential for the biosensor market in the home diagnostics segment.

Depending on the technology, the electrochemical synthetic biosensors accounted for the largest market share in the year 2021. Electrochemical synthetic biosensors are increasingly being used in non-medical applications, such as environmental monitoring; and also used in food and beverage quality inspection. Indirect monitoring via electrochemical synthetic biosensors can be performed for the analysis of organic pesticides or inorganic substances that interfere with the biocatalytic properties of the sensor.

By Type

By Product

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

March 2025

March 2024

November 2024