January 2025

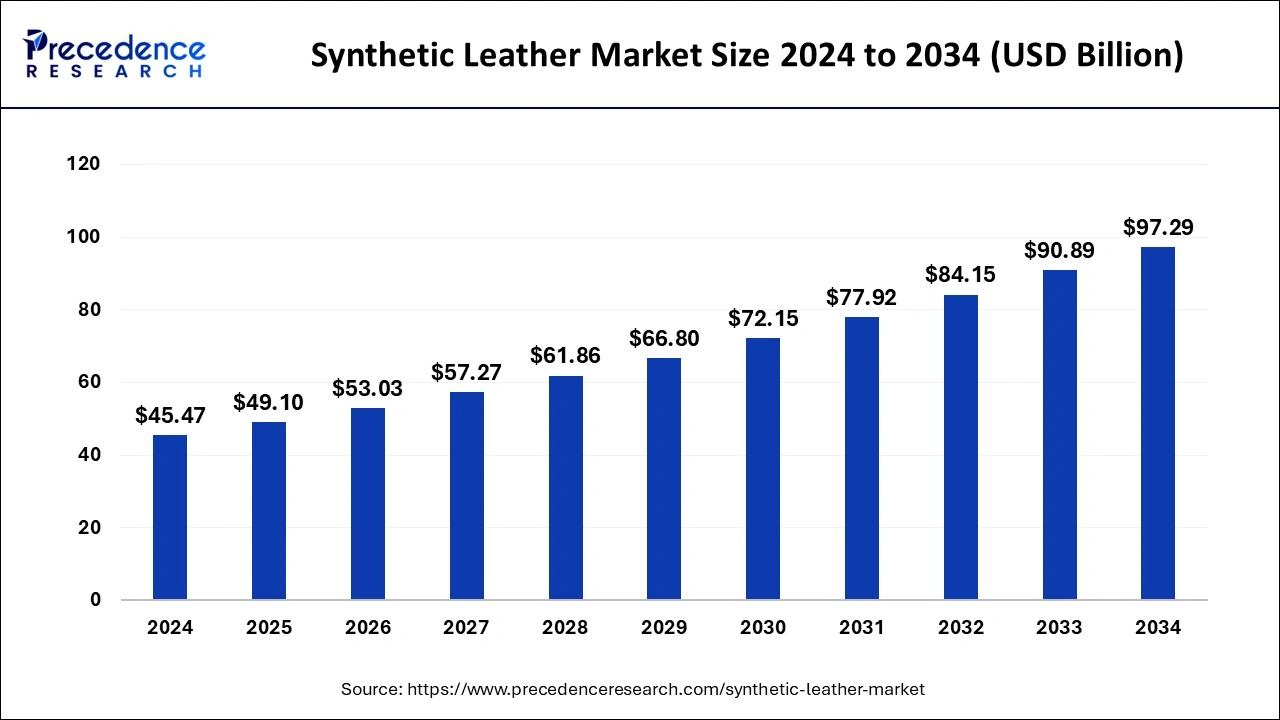

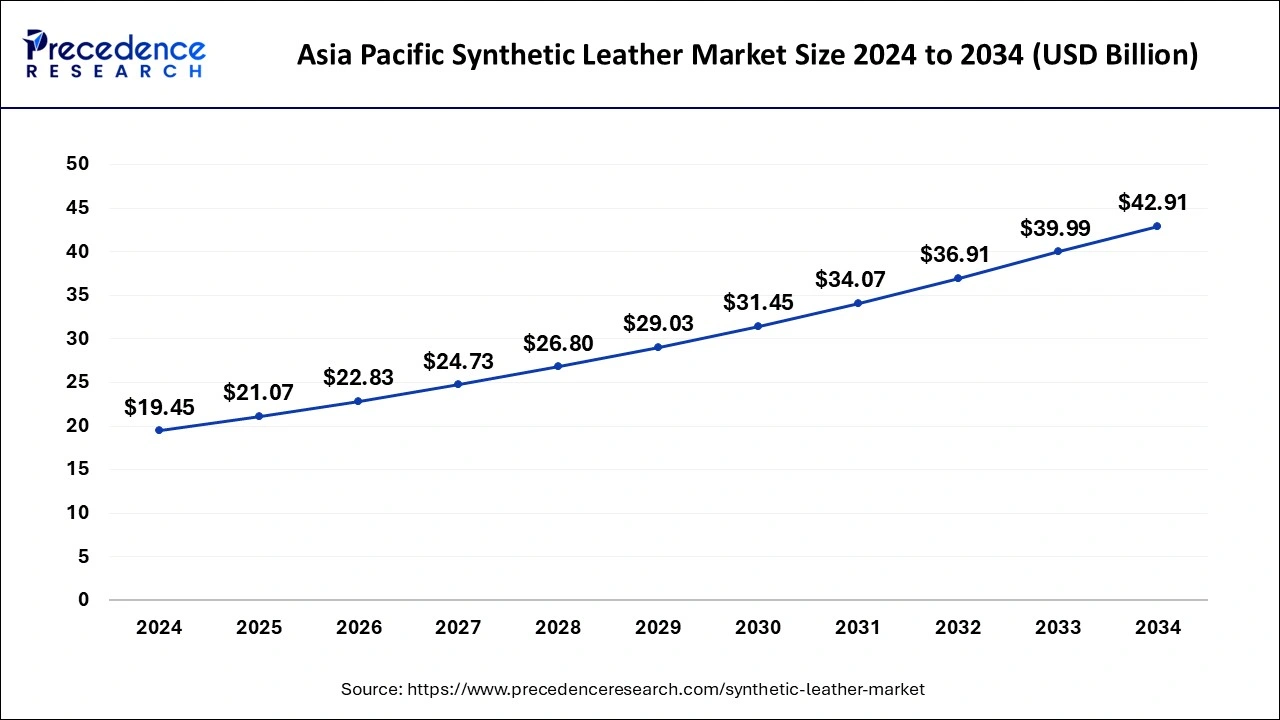

The global synthetic leather market size is calculated at USD 49.10 billion in 2025 and is forecasted to reach around USD 97.29 billion by 2034, accelerating at a CAGR of 7.9% from 2025 to 2034. The Asia Pacific synthetic leather market size surpassed USD 19.45 billion in 2024 and is expanding at a CAGR of 8.23% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global synthetic leather market size was valued at USD 45.47 billion in 2024 and is anticipated to reach around USD 97.29 billion by 2034, growing at a CAGR of 7.9% from 2025 to 2034.

The Asia Pacific synthetic leather market size was estimated at USD 19.45 billion in 2024 and is predicted to be worth around USD 42.91 billion by 2034, at a CAGR of 8.23% from 2025 to 2034.

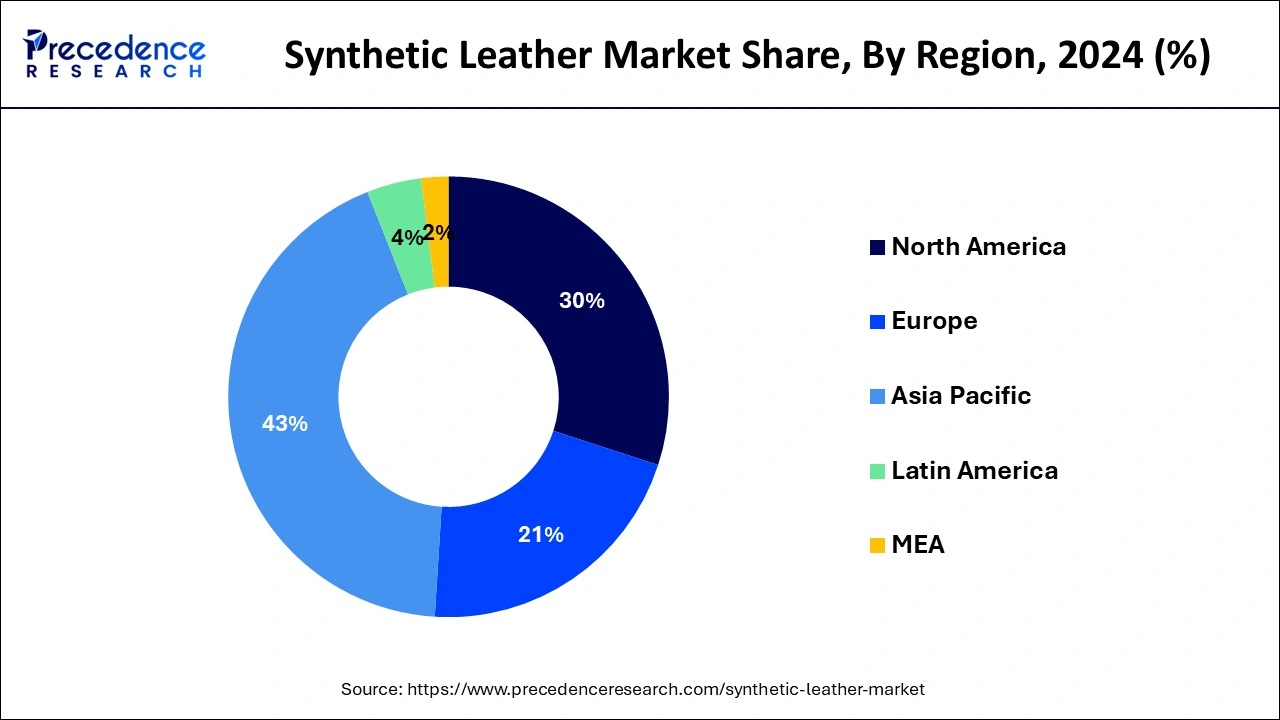

The Asia Pacific encountered the largest value share of more than 43% in the year 2024 and expected to maintain the same trend over the analysis period. India, China, and South Korea are the major countries that drive the growth of the market in the region. Further, increasing disposable income along with rising population across the region offers numerous opportunities for the market growth.

North America and Europe witness sluggish growth owing to the maturity of the market. In addition, the ongoing trade war between China and the U.S. along with drastic decline in the cross-border trade with the spread of the coronavirus pandemic that originated in Wuhan, China, has initiated trust issues between the two countries that further expected to negatively impact market growth in the upcoming years.

The synthetic leather market is expected to grow significantly over the forecast period owing to the rising demand for synthetic leather in footwear and automotive applications. Synthetic leathers are blends of polyurethane and polyvinyl chloride. At present, several market players are also engaged in the introduction of bio based materials for leather. Increasing demand for synthetic leather in the footwear industry owing to cheaper prices is expected to fuel the market growth over the forecast period. However, the outbreak of the COVID-19 pandemic is expected to impact the demand for synthetic leather in applications such as automotive, footwear, furnishing, and others in the short-term.

Synthetic leather has been replacing genuine leather at a steady rate. The market is expected to gain considerable market share in the footwear segment in the coming years on account of rising usage of artificial leather grades in boots, sneakers, women’s sandals, and men’s formal shoes. Moreover, increasing per capita disposable income is expected to boost the demand for synthetic leather in various application segments.

Increasing market penetration of synthetic leather materials in automotive interior applications is expected to be a critical factor for growth. Car manufacturers are adopting synthetic leather materials owing to their high durability, wear resistance, and cost-effective production. Passenger vehicles targeted primarily at the middle income class consumer group are the major end user of faux leather in automotive segment. Faux leather is affordable and easier to maintain as compared to real leather, which aids in attracting a large number of consumers. Utilization of artificial leather reduces the overall cost of the vehicle, thereby assisting manufacturers in achieving stable economies of scale.

Increasing demand of footwear expected to be a major factor that propels the overall market growth for synthetic leather. Synthetic leather is a suitable alternative as it comprises of a cloth base that is coated with synthetic resins. Thus, synthetic leather completely serves the purpose of real leather by offering a leather-like finish, thereby anticipated to augment its demand across wide application area that includes footwear, fabrics, upholstery, clothing, and others. The production process of synthetic leather has evolved over the past few years to curb down the rate of hunting and protect the animal life.

The global demand for leather materials has seen a paradigm shift owing to its increasing application across automotive, furnishing, bags, clothing, and many others. Manufacturers have been focusing significantly to shit their sources for raw materials towards the Asian suppliers for example Vietnam and China because of low cost of labor & fright along with an abundance of raw material in the region. However, the recent spread of corona virus across the globe has drastically impacted the demand for synthetic leather because of several preventive measures undertaken by the governments of various regions to control the spread of the pandemic. This has resulted in sudden fall in the trade and demand of synthetic leather across the globe projected to have a negative impact on the growth of the market over the near future.

| Report Coverage | Details |

| Market Size in 2025 | USD 49.10 Billion |

| Market Size by 2034 | USD 97.29 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.9% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing Demand from Footwear Sector

Footwear was the largest application segment for synthetic leather in 2022. The footwear industry has witnessed a significant growth in recent years owing to the rising demand from emerging markets, as consumer spending in the U.S. and some countries in Europe has slowed down slightly owing to the global recession.

Increasing investment by foreign players will further propel industry penetration in emerging economies in the near future. Luxury brands have been among the first to respond to the shift in global consumer spending. In 2016, brands like Prada have opened 27 new stores in Asia Pacific, which amounts to approximately 35% of the total number of stores of the brand. Such initiatives are expected to play a crucial role in improving the market penetration of synthetic leather brands over the next few years.

International players also have to adjust their pricing strategies as per the local competition in developing economies. This will be a key challenge for multinational players. In addition, the influx of new customer groups will put some pressure on product development channels to meet diverse needs and preferences. Footwear brands have to take into consideration the rising middle class, which is expected to be the major growth driver for the overall market in the near future.

Viable Alternative to Natural Leather

Natural leather is obtained from animals, which has resulted in animal killings. There have been various guidelines and laws established by various countries in order to protect animal rights. Animal right laws have become a major hurdle for natural leather manufacturers in several countries. Manufacturing activities of natural leather, especially tanning, lead to pollution of the nearby surroundings. This is another major reason leading to the shift in preference toward synthetic leather. Stringent environmental laws and government regulations have been influential in promoting the demand for synthetic leather.

PVC leather is another crucial type of synthetic leather and has witnessed increased market penetration primarily on account of its wide range of applications, including shopping bags, wallets, cosmetic bags, wallets, suitcases, handbags, and travel bags. Several manufacturers have ramped up their production of PVC leather owing to its cost-effectiveness.

India is among the world’s top five producers of leather. However, the Central government of India has banned the slaughter of cows for meat and leather, which has adversely affected the leather industry in the country. Most of India’s leather and meat industry comprises unorganized players, owing to which a reduction in the annual production from these industries is not feasible to estimate. The market situation has widened the demand-supply gap of genuine leather, which is expected to supplement the India PU synthetic leather market’s growth over the forecast period.

Damaging Effects 0f pvc. and PU

PVC is derived from plastic sources and, like most plastics, it contains carcinogens and other toxic chemicals that can transfer to the user’s skin through contact. Furthermore, PVC has a very slow rate of biodegradation and therefore has a negative impact on the environment. Similar toxicity concerns do not apply to PU, as it is only toxic during its production and, once dried and sealed, does not represent a threat as with PVC.

The production of PU fabrics can be toxic for factory workers, as it releases harmful chemicals. The production process involves the use of solvents mostly used for painting the polyurethane in liquid form on a fabric backing. Solvents required in this process are highly toxic. However, new polyurethane versions use waterborne coatings, which do not have the same kind of damaging impact on the environment as exhibited by other grades. This is expected to be a key aspect in terms of overall product development and sustainability. In addition, synthetic leather made from PU or PVC cannot be remade into leather products, as it does not recycle very well and cannot be reused when it is worn out.

On account of the aforementioned harmful impact on the environment, the demand for PU synthetic leather is likely to be restrained over the forecast period. Most consumers prefer genuine leather owing to properties that enable it to age finely and make it more durable as compared to faux leather. Genuine leather is also biodegradable in nature, unlike PU leather. These advantages of genuine leather may pose a threat to the PU leather market’s growth over the forecast period.

Polyurethane (PU) synthetic leather segment captured the largest value share of more than 53% in the year 2023. Further, the segment witnesses promising growth over the upcoming years owing to the product quality, yield, and variety. PU is softer, waterproof, and lighter than real and other types of synthetic leather; in addition, it can be dry cleaned as well as torn easily than real hides. It also does not get affected from the sunlight. In addition, the product type does not emit dioxins that make it an eco-friendly substitute for the vinyl-based products. Collectively all the above-mentioned factors expected to further augment the product demand.

Besides this, the PVC product segment expected to register slow growth over the analysis period. It was the very first type of synthetic leather that was initially produced using carcinogenic chemicals. It was proved to be an ideal material for furnishing and household applications. PVC was unable to maintain the body heat as well as gave a sticky feel when touched; while PU proved to be beneficial in these terms. Hence, the market demand for PVC decreased particularly in bags and clothing sectors.

Bio-based product expected to witness prominent growth over the forthcoming years owing to presence of polyester polyol that has 70% to 75% renewable content. Further, it is softer as well as has better scratch resistance properties compared to PU and PVC.

Footwear accounted for the maximum revenue share of more than 31% in 2023. Increasing income levels along with economic growth, especially in the developing countries has fueled the demand for footwear. In addition, the segment is also driven by the changing climatic conditions of different regions that require different types of footwear.

Rising athleisure trend of including athletic shoes in daily lifestyle also projected to flourish the growth of the segment. Further, the price of faux leather footwear is three times less compared to ones made from animal hide that again boosts the growth of the segment. In addition, furnishing industry is also one of the prime applications of synthetic leather because of its lower price than animal hides. However, Polyurethane (PU) is widely used in the automotive sector because of its non-sticky and soft touch properties compared to other products.

Key Companies & Market Share Insights

The market players in the synthetic leather are mainly focused towards regional expansion along with new product development. For instance, Kuraray Europe GmbH introduced new solvent-free man-made leather at the Première Vision 2019 that possesses properties similar to the natural leathers. These properties make it very suitable for several fashion creations.

Segments Covered in the Report:

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

November 2024

February 2025