January 2025

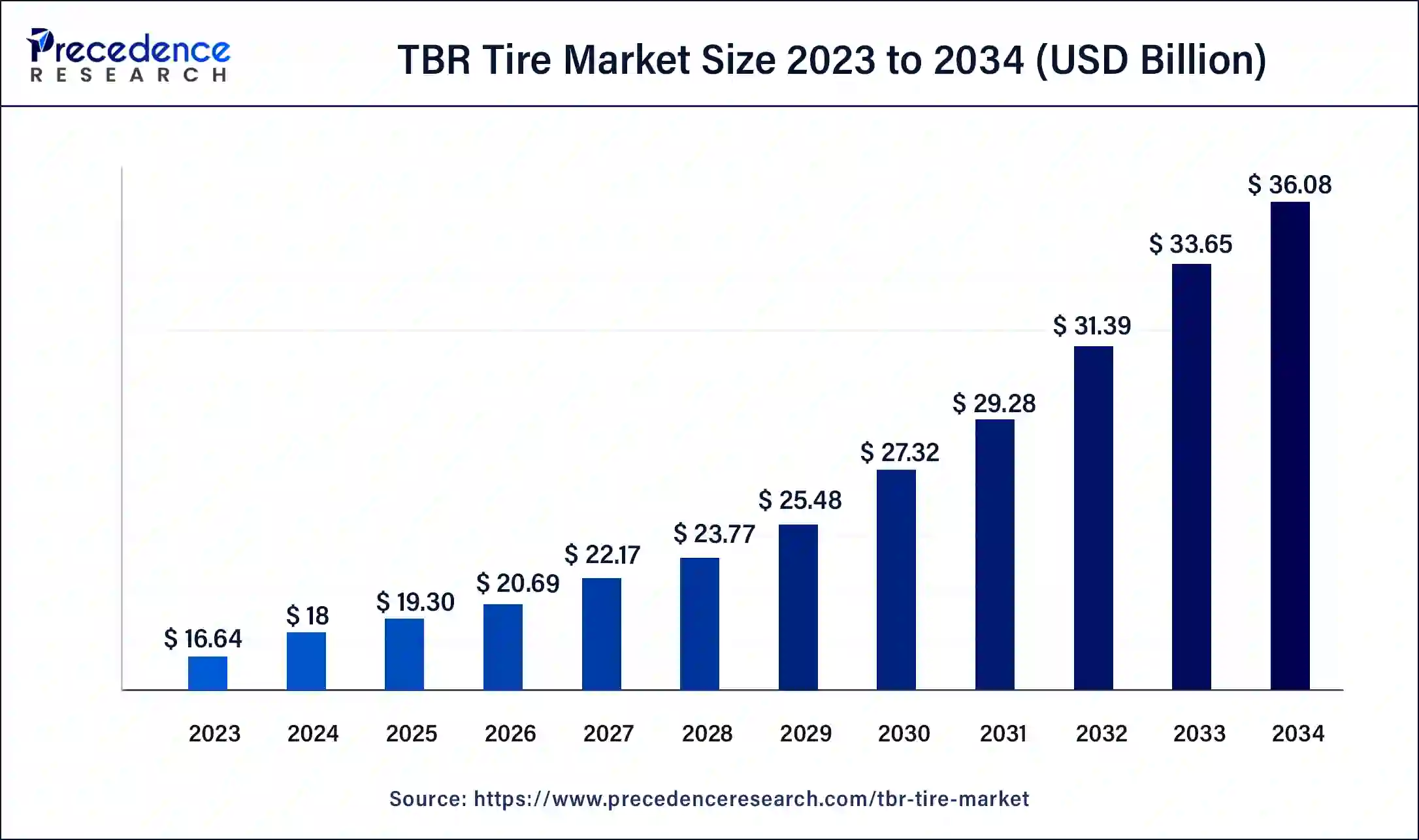

The global TBR tire market size was USD 16.64 billion in 2023, calculated at USD 18 billion in 2024 and is expected to reach around USD 36.08 billion by 2034, expanding at a CAGR of 7.2% from 2024 to 2034.

The global TBR tire market size was estimated at USD 18 billion in 2024 and is predicted to increase from USD 19.30 billion in 2025 to approximately USD 36.08 billion by 2034, expanding at a CAGR of 7.20% from 2025 to 2034.

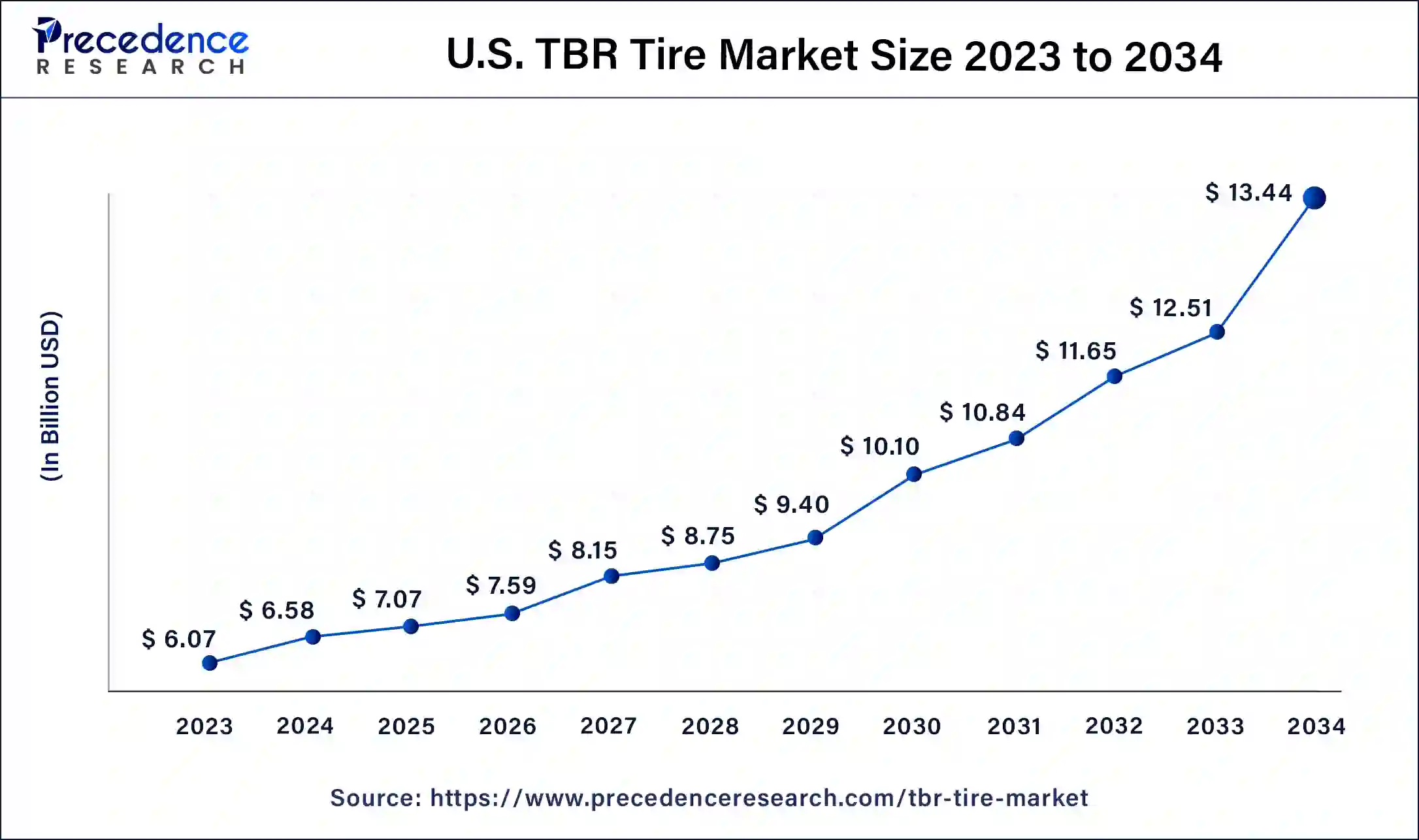

The U.S. TBR tire market size was estimated at USD 6.58 billion in 2024 and is predicted to be worth around USD 13.44 billion by 2034, at a CAGR of 7.40% from 2025 to 2034.

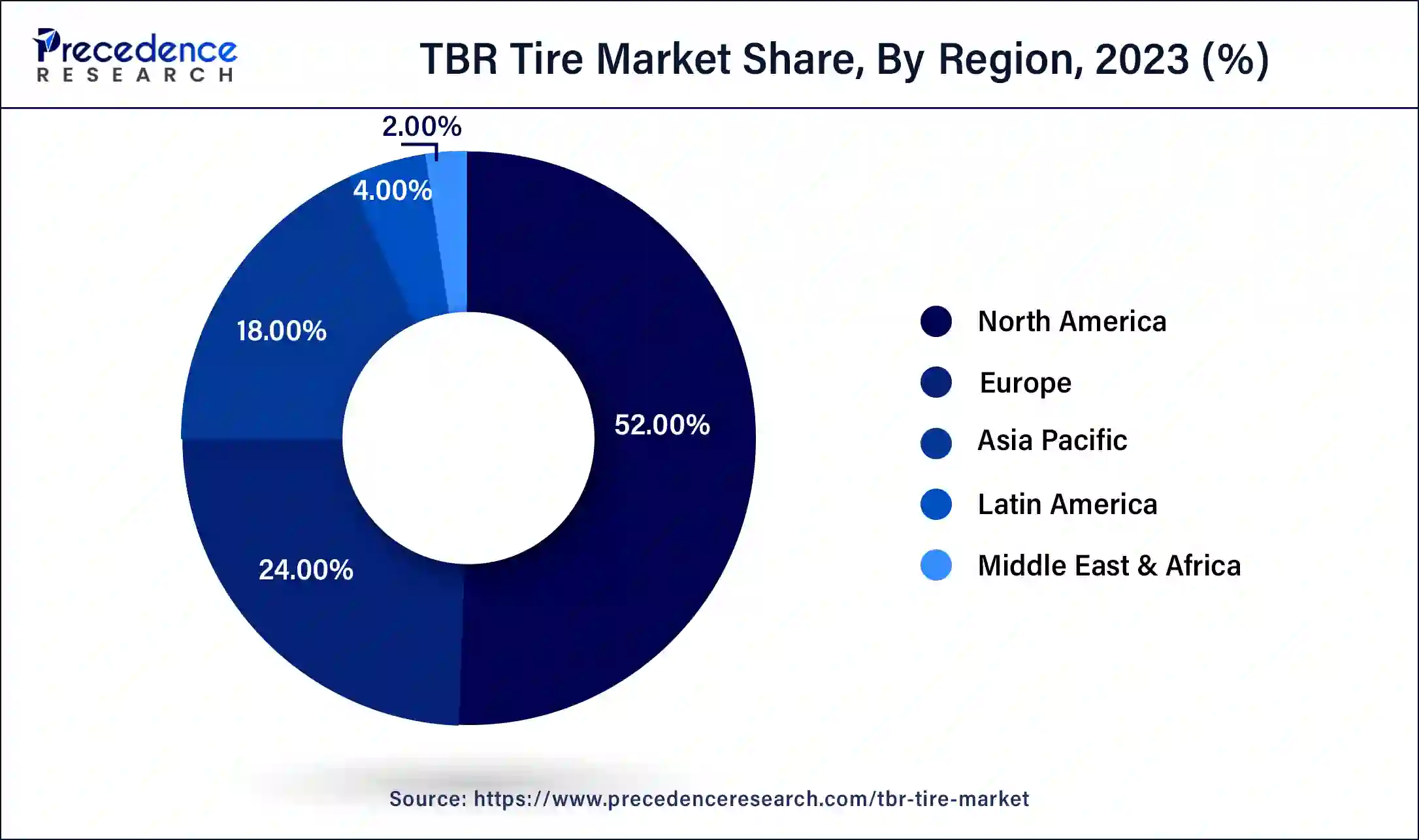

North America emerged as the global leader in the TBR tire industry in the year 2024 because of rapid development in the industrial sector along with shifting trend towards online purchasing likely to boost the logistics & transportation in the region. Further, the government has set mandatory standards for the maximum load carrying capacity of the goods carrier vehicles that impels the demand for commercial vehicles and in turn boosts the demand for TBR tire in the region. In addition, increasing penetration of electric and battery-powered vehicles expected to propel the market for TBR tires in the upcoming years. Electric vehicle is a boon in the transportation industry to control the rate of vehicle emission, thereby fuels the adoption of such vehicles during the forthcoming years.

On the contrary, the Asia Pacific exhibits the fastest growth in the overall TBR tire market owing to increasing sale of commercial vehicles in the region. Flourishing growth in the industrial sector spur the logistics and transportation of various types of goods and materials such as raw materials and finished goods that is the prime factor to boost the demand for commercial vehicles in the region thereby impel the growth of TBR tire.

Increasing industrialization because of which pollution rising at an alarming rate, this has triggered the necessity to design stringent regulations and norms in order to control the pollution rate. In the wake of same, governments of several regions have mandated fuel efficiency standards in the regions to curb the carbon emission form vehicle. For instance, the government of United States has issued a Vehicle Fuel Efficiency (VFE) policy, under which all the vehicles including passenger and commercial vehicle require to meet 18 Miles per gallon (mpg). However, the government has aimed to achieve a target of 54.5 mpg by the end of 2025. In support of the above stated policies and issues, TBR tire proved to be helpful as it effectively helps in enhancing the fuel performance of the vehicle.

TBR tires also offer certain benefits over other types of tires such as better auxiliary quality, better control over the handling, improved engine performance, and reduced weight & cost associated to the mishaps and accidents. In addition, the governments across various countries have implemented different norms related to the effective management of the maximum limit of goods that can be loaded in a commercial vehicle. For example, the Federal Motor Carrier Safety Administration (FMCSA)based in the United States was established to monitor and control the rate of injuries and fatalities that happen due to the commercial vehicles. In accordance to same, the regulatory body has set the maximum limit of goods that can be carried in such vehicles. This in turn, expected to flourish the sale of commercial vehicles, thereby propels the growth of TBR tire in the near future.

On the other hand, high cost of tires due to advanced materials used in the manufacturing expected to hamper the market growth. Because of the same, several Original Equipment manufacturers (OEMs) are reluctant to implement TBR tires into their vehicles. Though, improvement in the execution in terms of toughness, wear, and opposition to the movement of the vehicle are the key factors anticipated to boost the demand for TBR tires in the upcoming years.

| Report Highlights | Details |

| Market Size in 2024 | USD 18 Billion |

| Market Size in 2025 | USD 19.30 Billion |

| Market Size by 2034 | USD 36.08 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.20% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Based on application, the global TBR tire market is classified into public transportation services, trucking industry, and urban use. Among these, trucking industry held the major value share in the year 2023. Increasing implementation of TBR tires in the advanced and next-generation vehicles particularly those trucks and other types of vehicle that are used for the construction activity likely to contribute towards the profound growth of the segment. In addition, increase in construction activity across the globe along with spur in the demand for advanced trucks and goods carrying vehicle expected to impel the market growth of the segment over the forecast period.

Besides this, public transportation service is the other most important segment that estimated to execute significant growth rate over the coming years. The growth of the segment is mainly attributed to the rising investment for the development of public transportation in order to cater the increasing demand for the advanced transportation facility.

Key Companies Share Insights

The market players in the TBR tire industry are significantly focused on product advancement & development and for the same, they invest prominently in the Research & Development (R&D) activity. Apart from this, the market players are also adopting inorganic growth strategies that include merger & acquisition, partnership, collaboration, and joint venture to expand their product portfolio.

By Type

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

November 2024

April 2025