January 2025

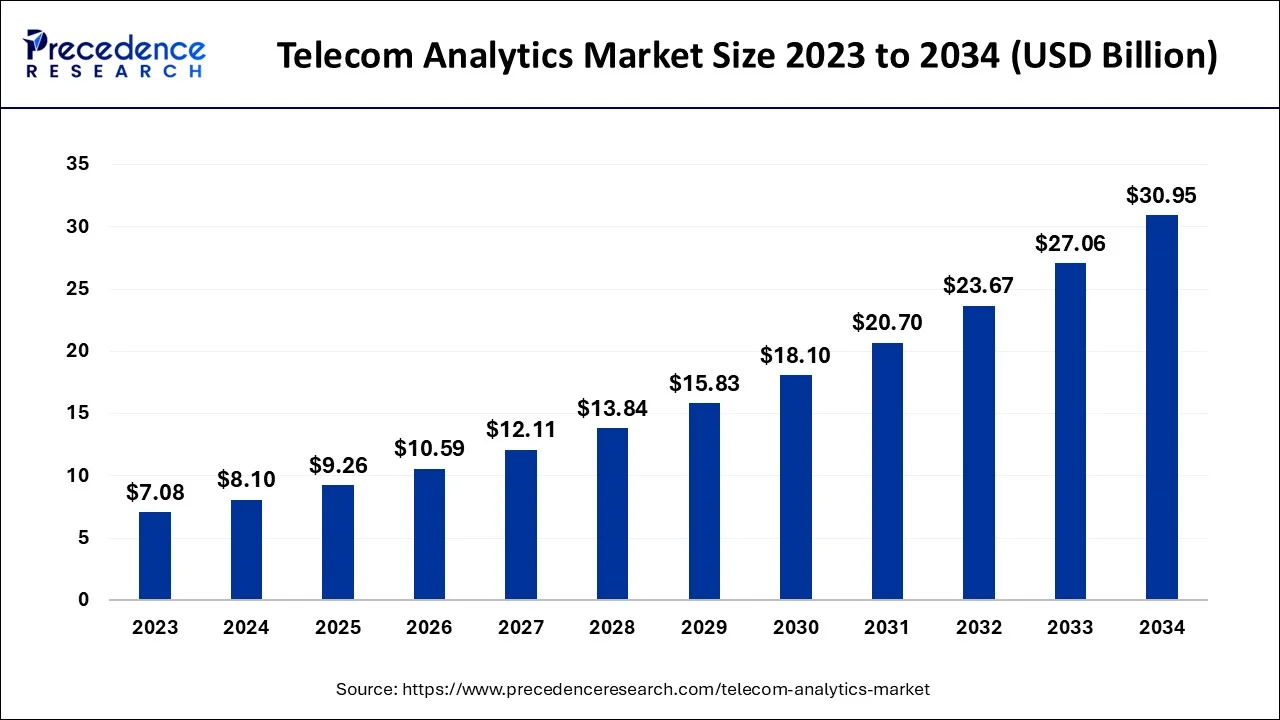

The global telecom analytics market size accounted for USD 8.1 billion in 2024, grew to USD 9.26 billion in 2025 and is projected to surpass around USD 30.95 billion by 2034, representing a healthy CAGR of 14.35% between 2024 and 2034. The North America telecom analytics market size is calculated at USD 3.32 billion in 2024 and is expected to grow at a fastest CAGR of 14.48% during the forecast year.

The global telecom analytics market size is estimated at USD 8.1 billion in 2024 and is anticipated to reach around USD 30.95 billion by 2034, expanding at a CAGR of 14.35% between 2024 and 2034.

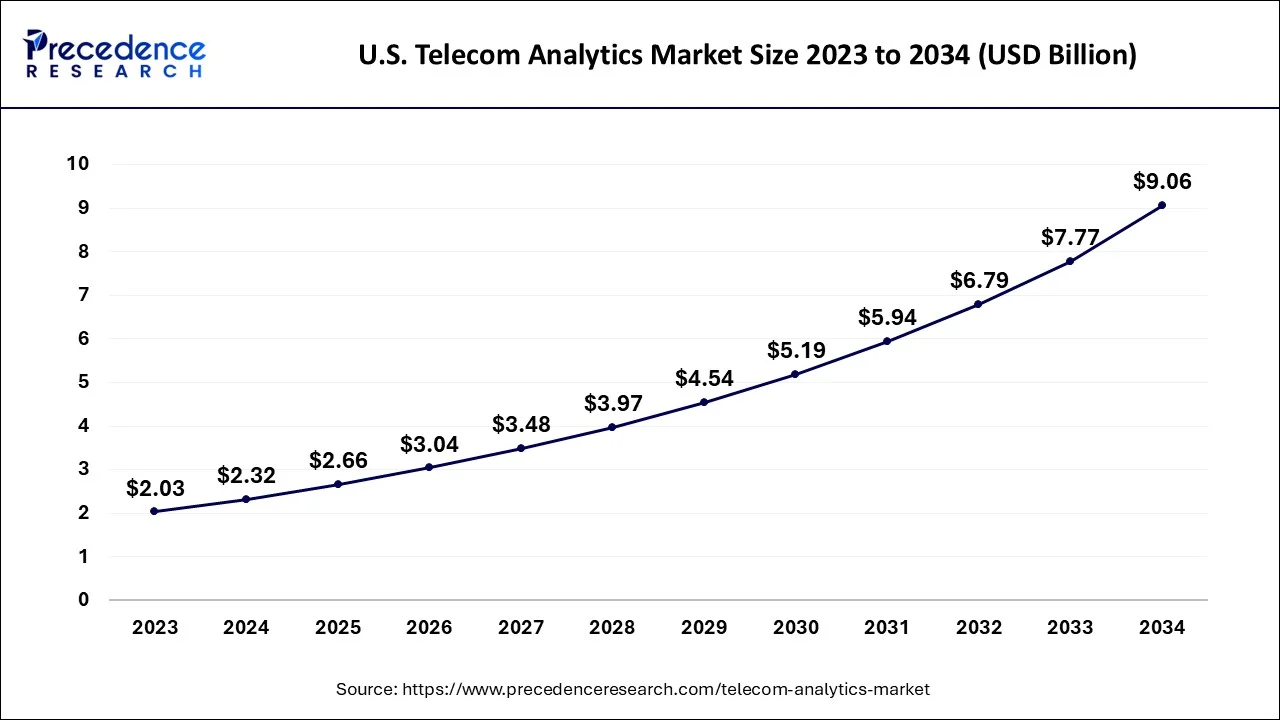

The global telecom analytics market size accounted for USD 2.32 billion in 2024 and is predicted to be worth around around USD 9.06 billion by 2034, growing at a CAGR of 14.59% between 2024 and 2034.

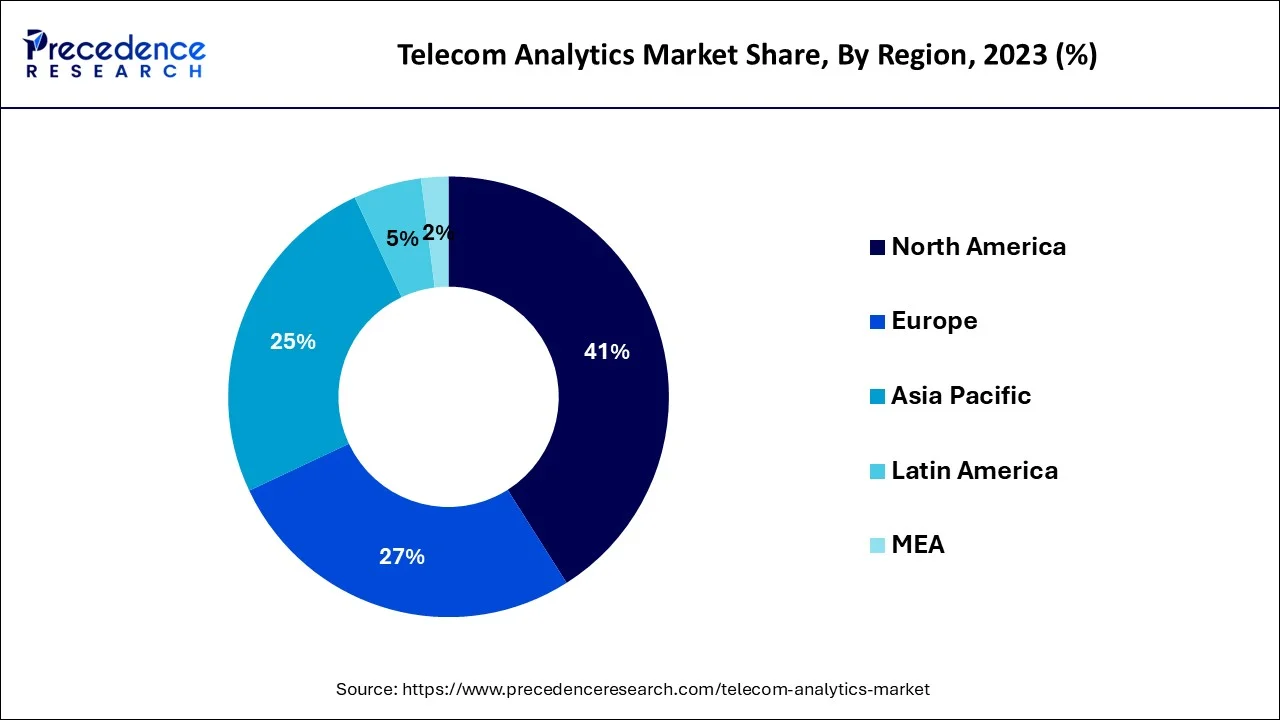

In North America, the telecom analytics market is witnessing an increasing adoption of analytics solutions driven by the demand for data-driven decision-making, advanced network optimization, and improved customer experiences. Cloud-based analytics solutions and the integration of AI and ML technologies are gaining momentum in the region. The drivers for telecom analytics in North America include the need to manage large volumes of data, optimize network performance, and deliver personalized customer experiences while complying with regulatory requirements. There are opportunities to provide comprehensive and scalable telecom analytics solutions in North America, offering advanced capabilities such as real-time network optimization and predictive maintenance. Partnerships with telecom service providers and data-driven organizations can unlock growth opportunities.

In Europe, there is a trend toward using analytics to improve network efficiency, comply with data protection regulations, and optimize pricing strategies. Drivers in the European market include the need for high-quality services, regulatory compliance, and gaining insights from diverse data sources. Opportunities lie in providing analytics solutions that address data privacy and compliance requirements, enhancing customer satisfaction, and collaborating with telecom operators and regulators. In the Asia Pacific region, telecom analytics is adopted to manage high data volumes, improve network performance, and support digital services. Opportunities include offering scalable and cost-effective solutions tailored for diverse markets, developing analytics capabilities for network optimization and fraud detection, and collaborating with telecom operators and technology providers.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.10 Billion |

| Market Size in 2025 | USD 9.26 Billion |

| Market Size by 2034 | USD 30.95 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 14.35% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Components, Deployment, Enterprise Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Focus on customer-centric strategies

Data privacy and security

Customer experience enhancement

The software segment of the telecom analytics market is witnessing trends such as the adoption of cloud-based analytics platforms, the integration of AI and ML technologies, and the development of advanced analytics tools. These trends are driven by the increasing need for real-time analytics, personalized customer experiences, and optimized network performance. Additionally, the proliferation of IoT devices generates massive volumes of data, creating opportunities for software solutions to analyze and derive insights. Opportunities in the software segment include the development of innovative and scalable analytics software tailored for the telecom industry and leveraging AI and ML for enhanced predictive analytics and real-time insights.

In the services segment, there is a growing demand for consulting and professional services to guide organizations in implementing and optimizing analytics solutions. Managed services, including data management and ongoing support, are also gaining traction. The drivers for services in telecom analytics include the complexity of data integration, shortage of skilled resources, and the need for expertise in analytics implementation. Service providers can capitalize on these opportunities by offering end-to-end consulting, implementation, and managed services to meet the analytics needs of telecom companies.

The hardware segment is witnessing trends such as the adoption of high-performance computing infrastructure to handle large-scale data processing. The drivers for hardware in telecom analytics stem from the need for robust infrastructure to support telecom data volume, velocity, and complexity. Opportunities lie in providing specialized hardware solutions optimized for telecom analytics workloads, including high-performance servers, storage systems, and networking equipment. Collaborations with software and service providers can create comprehensive solutions tailored for the specific needs of the telecom industry.

The telecom analytics market can be segmented by deployment type into on-premises and cloud-based deployments. In the on-premises segment, there is a trend towards hybrid models that combine on-premises infrastructure with cloud-based capabilities, allowing organizations to benefit from control and security while leveraging scalability and flexibility. On-premises deployments are driven by data privacy and security concerns, regulatory compliance requirements, and the need for full control over analytics infrastructure and data. This presents opportunities to provide robust and secure on-premises analytics solutions tailored for telecom companies. In the cloud-based segment, there is a strong trend towards cloud adoption, driven by scalability, cost optimization, rapid deployment, and the ability to access analytics capabilities from anywhere. Cloud-based deployments offer opportunities to provide scalable and secure analytics platforms, catered to telecom industry needs, and to offer cloud-based managed services and support for data integration and analytics operations. The trends and drivers in both deployment types reflect the demand for data privacy, scalability, real-time insights, and cost optimization in the telecom analytics market.

The telecom analytics market can be segmented by enterprise size into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are driven by the need to enhance operational efficiency, compete with larger players, and improve customer experiences. They seek cost-effective analytics solutions to optimize network performance, manage customer relationships, and comply with regulations. Cloud-based analytics platforms are trending among SMEs due to their affordability, scalability, and user-friendly interfaces. Opportunities in this segment include offering cost-effective and intuitive analytics solutions tailored to SMEs' needs, as well as providing consulting and support services to help them overcome implementation challenges.

On the other hand, large enterprises aim to gain a competitive edge and optimize customer experiences through advanced analytics capabilities. They invest in big data infrastructure, integrate AI and ML technologies, and leverage predictive analytics and real-time insights. Opportunities in the large enterprise segment involve providing comprehensive and scalable analytics solutions, developing AI-driven capabilities, and collaborating with industry leaders to address specific enterprise requirements. Understanding the drivers, trends, and opportunities in each enterprise size category enables solution providers to develop tailored offerings that cater to the distinct needs of SMEs and large enterprises in the telecom analytics market.

Segments Covered in the Report:

By Components

By Deployment

By Enterprise Size

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

January 2025