January 2025

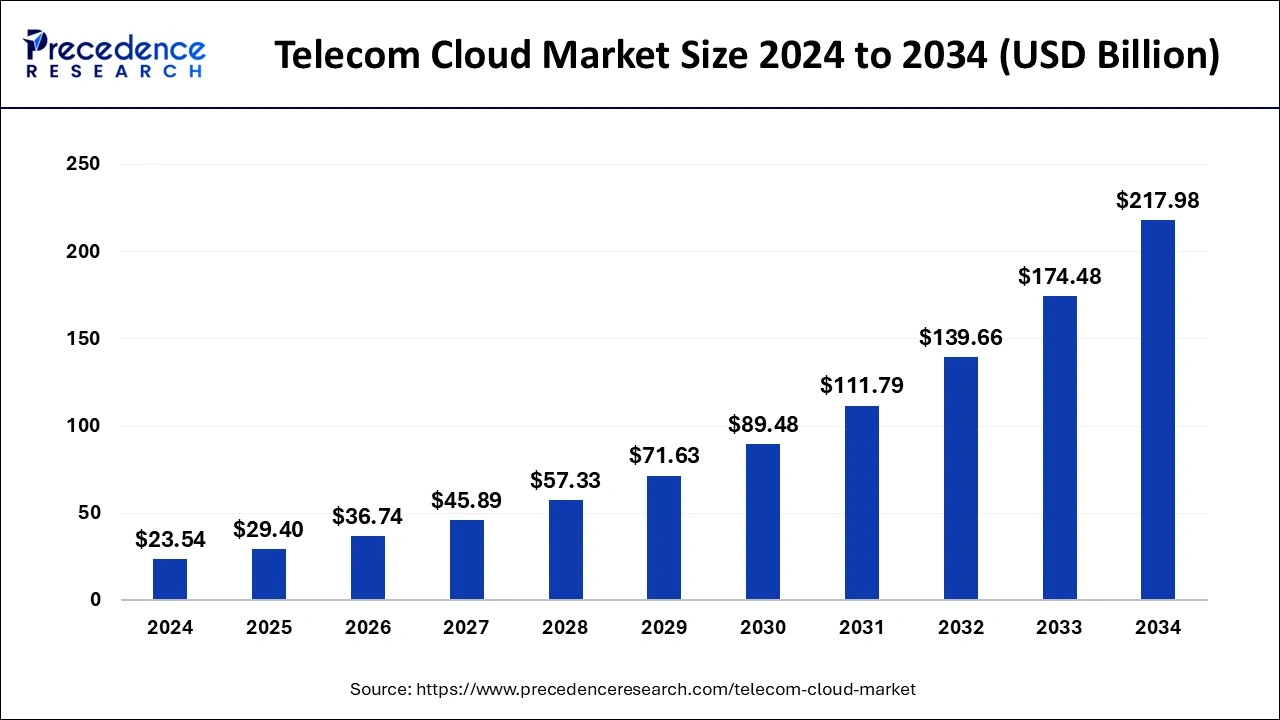

The global telecom cloud market size is accounted at USD 29.4 billion in 2025 and is forecasted to hit around USD 217.98 billion by 2034, representing a CAGR of 24.93% from 2025 to 2034. The North America telecom cloud market size was estimated at USD 8.95 billion in 2024 and is expanding at a CAGR of 25.08% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global telecom cloud market size accounted for USD 23.54 billion in 2024 and is anticipated to reach around USD 217.98 billion by 2034, growing at a CAGR of 24.93% from 2025 to 2034. The telecom cloud market is experiencing significant growth due to the increasing adoption of cloud solutions and the rapid expansion of telecom businesses worldwide.

AI is transforming various industries globally, and the telecom industry is no exception. Artificial intelligence helps the telecom cloud industry break down data silos across the ecosystem and within companies, build machine learning models, and help companies securely and easily access data in real time. AI also helps increase profitability, maximize operational efficiency, and improve customer experiences. AI technologies can identify threats and network traffic irregularities in real time. In addition, integrating AI in the telecom cloud optimizes network performance, improves customer service via personalized experiences, and enables predictive maintenance.

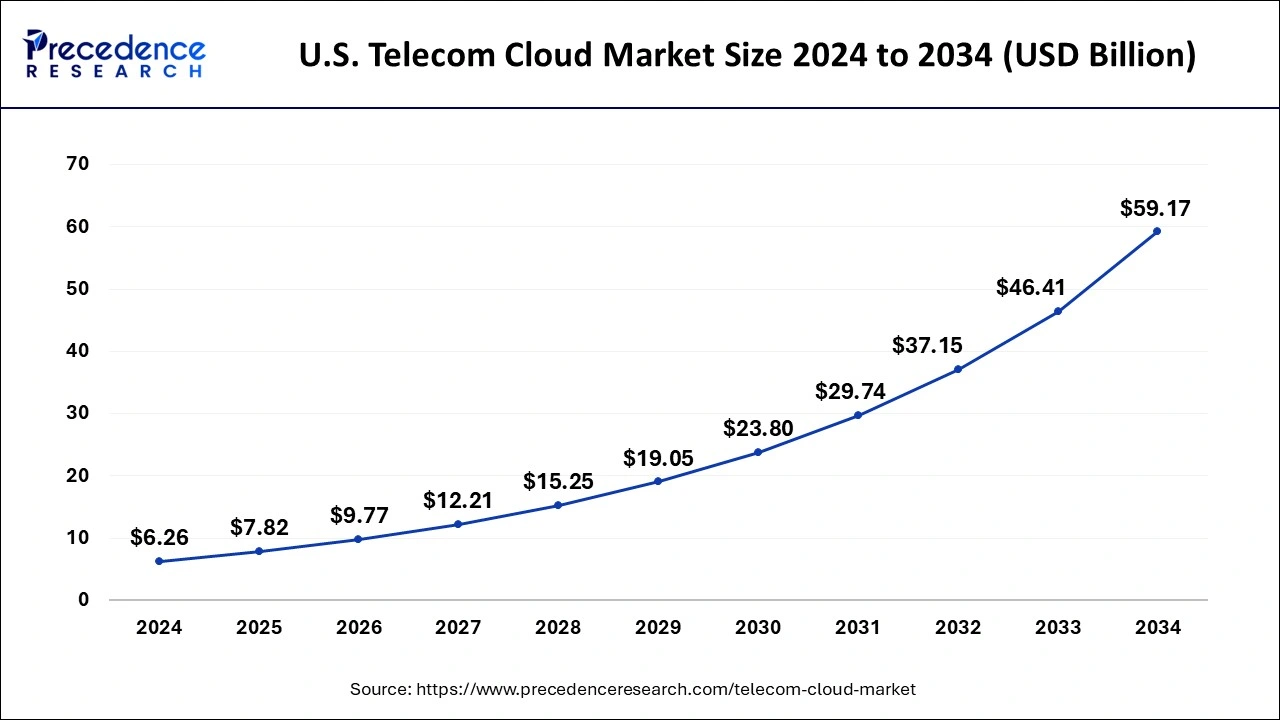

The U.S. telecom cloud market size was exhibited at USD 6.26 billion in 2024 and is projected to be worth around USD 59.17 billion by 2034, growing at a CAGR of 25.19% from 2025 to 2034.

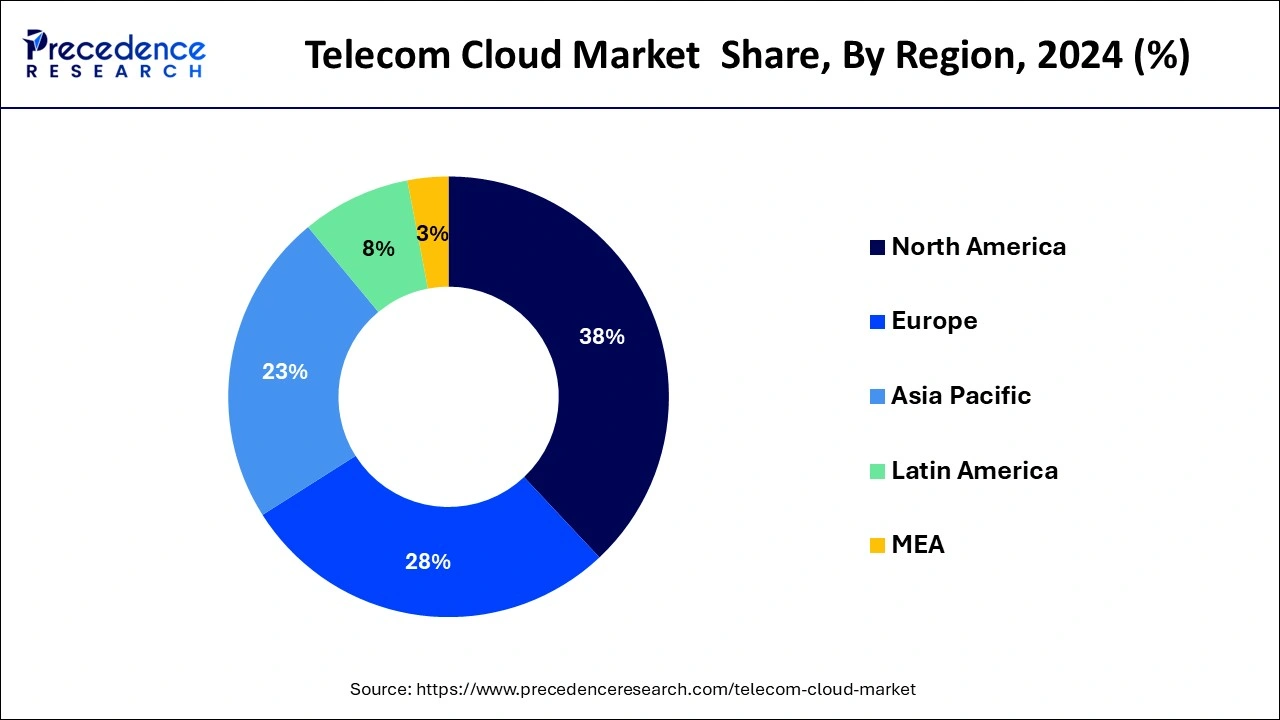

Asia-Pacific dominated the telecom cloud market in 2024. China and India dominated the telecom cloud market in Asia-Pacific region. The telecom cloud market in Asia-Pacific region is being driven by the adoption of latest and advanced technologies as well as growing deployment of 5G networks. The market players adopted innovative technologies such as internet of things, cloud computing, and artificial intelligence. The other factors such as driving the growth of Asia-Pacific telecom cloud market are growing healthcare expenditure, expansion of healthcare sector, and growing government initiatives.

North America, on the other hand, is expected to develop at the fastest rate during the forecast period. For better communication and connectivity, businesses in North America are fast acceptance and adoption of telecom cloud services. These companies’ personnel have good technical information and are eager to boost the use of telecom cloud services, allowing North America to dominate the telecom cloud industry. In addition, the growing fundings and investments in data centers are also driving the expansion of North America telecom cloud market.

| Report Coverage | Details |

| Market Size in 2025 | USD 29.4 Billion |

| Market Size by 2034 | USD 217.98 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 24.93% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Packaging Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Adoption of Cloud Computing

The telecom cloud market is expanding at a significant pace due to the widespread adoption of cloud computing across an array of industries. This trend is further accelerated by the rapid digital transformation businesses undergo to adapt to everyday demands. With the introduction of 5G technology, characterized by enhanced speeds, low latency, and increased connectivity, the demand for tele-cloud solutions is rising significantly for a highly scalable and flexible network infrastructure. Additionally, the rapid expansion of the Internet of Things (IoT), with devices becoming increasingly interconnected, necessitates advanced network capabilities that telecom cloud solutions can provide. As organizations strive to improve efficiency and enhance their service offerings, the reliance on cloud-based platforms continues to rise.

Data Security Concerns and Regulatory Landscape

Despite the enormous potential, integrating existing telecom infrastructure with cloud-based solutions presents notable challenges. This process can be complex and resource-intensive, often requiring a substantial investment in new technology and skilled expertise. Furthermore, telecom operators must navigate an intricate and constantly evolving regulatory landscape, particularly concerning data privacy and security issues. These regulatory challenges can create significant barriers, hindering the overall growth of the telecom cloud market as operators grapple with compliance while striving to innovate and implement new cloud technologies.

Demand for Hybrid Cloud Solutions

Rising demand for hybrid cloud solutions creates immense opportunities in the market. Adopting hybrid cloud solution provides companies with flexibility to use a combination of public and private clouds, thereby enhancing data security. Furthermore, the telecom cloud solutions market presents exciting avenues for new revenue streams. Operators can explore offerings such as platform as a service (PaaS) and tailored customer solutions, capitalizing on their existing infrastructure while meeting the diverse needs of their clientele. This strategic shift not only drives innovation but also positions operators to thrive in a competitive landscape.

The services segment dominated the telecom cloud market in 2022. Within the telecom cloud market, network services represented a considerable market share in the services segment. The telecom operators can reuse underutilized networking resources and capitalize on existing business partnerships due to the migration to cloud services. Due to the increasing requirement to sustain telecom infrastructure around the world, network services that include network virtualization in the telecom cloud market are seeing significant growth.

The solutions segment is projected to reach remarkable growth during the forecast period. The content delivery network sub segment is growing at a rapid pace in the solutions segment. The content delivery network adoption is predicted to increase among enterprises in both small and large sectors, since it enables scalability to match the demands of evolving technologies, saves money, and reduces network administration workload.

The IaaS segment dominated the telecom cloud market in 2022. Infrastructure as a service (IaaS) is highly automated and standardized product in which a service provider’s computer resources, together with networking and storage capabilities, are made available on demand to consumers. In few minutes, resources can be scaled and flexed, and usage is tracked. The customers have direct access to self service interfaces, which include graphical user interfaces and automated programming interfaces. The customer’s data center host multi-tenant or single tenant resources.

The SaaS segment is expected to witness significant growth during the forecast period. The software as a service (SaaS) is a software distribution paradigm in which a cloud provider hosts and makes applications available to end users via the internet. In this arrangement, an independent software vendor may hire a third-party cloud provider to host the application.

The BFSI segment dominated the telecom cloud market in 2022. The BFSI sector are outsourcing non-core activities in order to cut expenses and increase efficiency. As a result, directed content perceptions and precise banking data are required, which can be combined via telecom cloud solution. By providing greater communication choices, the alliances enable banking and financial service providers to give expanded amenities.

The transportation segment is expected to drive strong growth during the forecast period. Every day, the telecommunications business in the transportation sector generates massive amounts of data and information, necessitating extensive data management and storage services. As a result, the use of telecom cloud systems in this area is rapidly increasing.

By Deployment Mode

By Type

By Computing Service

By Organization Size

By Application

End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

October 2024