March 2025

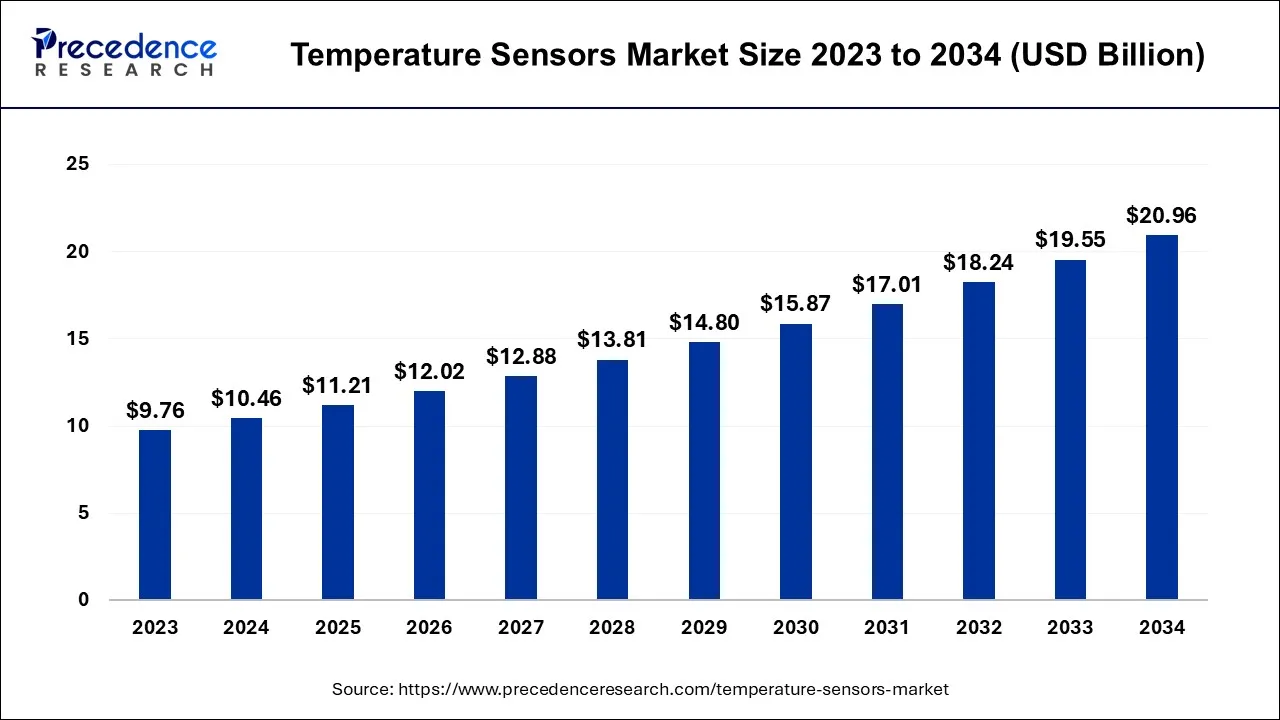

The global temperature sensors market size accounted for USD 10.46 billion in 2024, grew to USD 11.21 billion in 2025, and is projected to surpass around USD 20.96 billion by 2034, representing a healthy CAGR of 7.2% between 2024 and 2034. The North America temperature sensors market size is calculated at USD 3.42 billion in 2024 and is expected to grow at the fastest CAGR of 7.35% during the forecast year.

The global temperature sensors market size is expected to be valued at USD 10.46 billion in 2024 and is anticipated to reach around USD 20.96 billion by 2034, expanding at a CAGR of 7.2% over the forecast period 2024 to 2034.

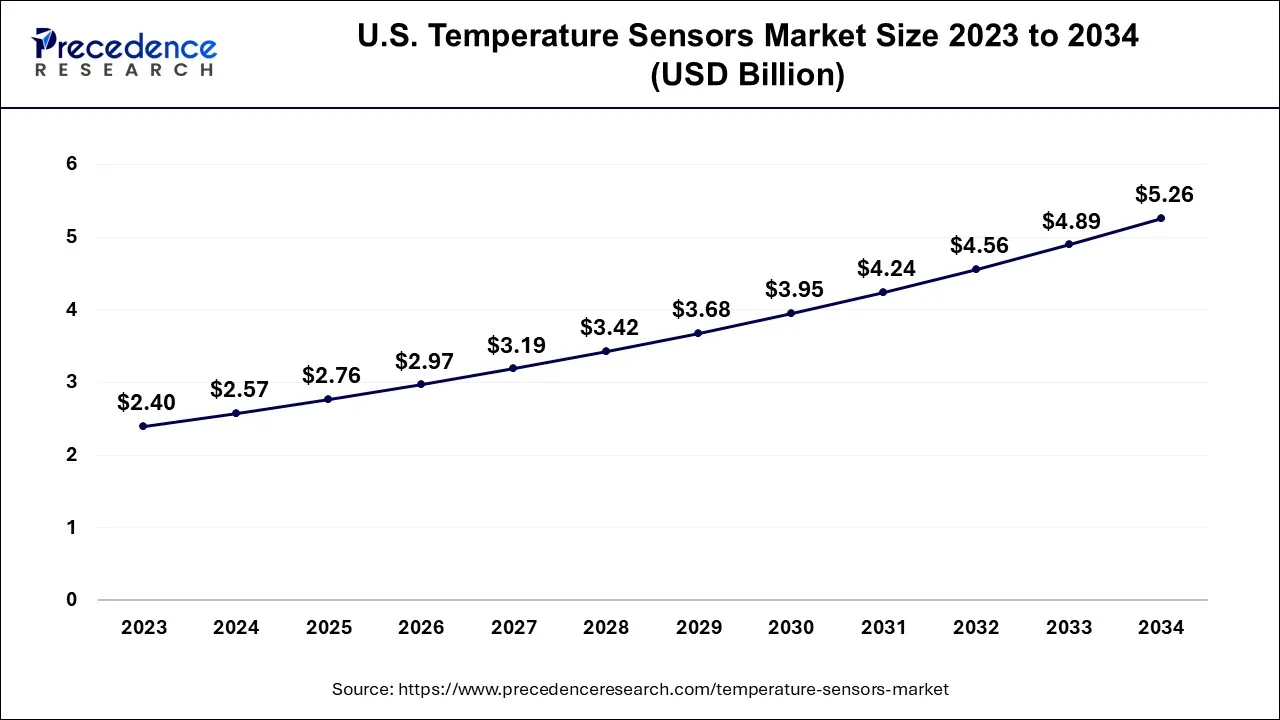

The U.S. temperature sensors market size is calculated at USD 2.57 billion in 2024 and is projected to be worth around USD 5.26 billion by 2034, poised to grow at a CAGR of 7.4% from 2024 to 2034.

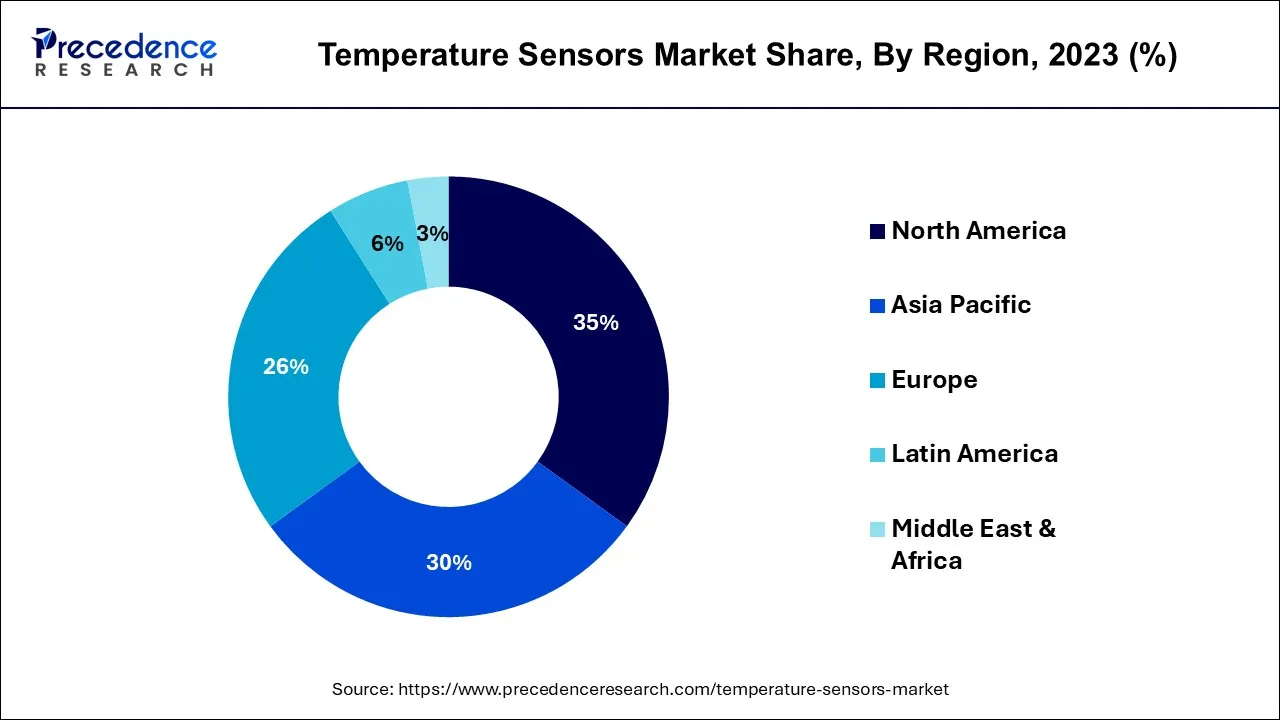

North America held the largest revenue share over 35% in 2023. In North America, the temperature sensors market has witnessed a growing demand for sensors in the healthcare sector, particularly for temperature monitoring during the COVID-19 pandemic. Additionally, the automotive industry in the region is embracing temperature sensors to enhance vehicle safety and performance. The trend toward electric vehicles has further fueled the adoption of temperature sensors for battery management.

Asia Pacific is estimated to observe the fastest expansion. In the region, the increasing industrialization and expansion of manufacturing facilities have driven the demand for temperature sensors to ensure efficient and safe production processes. Additionally, the region's focus on environmental monitoring and energy conservation has led to the adoption of temperature sensors in HVAC systems, further boosting market growth. The rise in smart manufacturing practices, coupled with government initiatives promoting energy efficiency, has contributed to the expanding role of temperature sensors in the Asia Pacific.

The temperature sensors market comprises a diverse range of devices designed to measure temperature accurately in various applications. These sensors are integral components in industries like manufacturing, automotive, healthcare, and consumer electronics. The market exhibits dynamic growth driven by technological advancements, increasing demand for IoT-enabled sensors, and their crucial role in ensuring product quality, safety, and efficiency. Temperature sensors can be contact-based (thermocouples, RTDs) or non-contact (infrared sensors) and play a vital role in monitoring and controlling temperature in a wide array of processes and products.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.2% |

| Market Size in 2024 | USD 10.46 Billion |

| Market Size by 2034 | USD 20.96 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Technology, and By End-user Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing industrial automation, IoT and connectivity

The temperature sensors market experiences significant growth driven by two interrelated factors, the expansion of industrial automation and the increasing integration of temperature sensors into IoT ecosystems. Industrial automation has become a cornerstone of modern manufacturing and process industries, relying heavily on precise temperature monitoring for quality control and process optimization. Temperature sensors play a pivotal role in this automation, ensuring that machinery and processes operate within specified temperature ranges. As industries continue to embrace automation for efficiency and precision, the demand for temperature sensors remains robust.

Simultaneously, the rise of internet of things (IoT) technology has revolutionized temperature sensing by enabling remote monitoring and control. IoT devices, often equipped with temperature sensors, collect and transmit real-time data to centralized systems or cloud platforms. This connectivity empowers industries to remotely monitor and manage temperature-sensitive assets and environments, making predictive maintenance and rapid responses to temperature fluctuations possible. Consequently, the synergy between industrial automation and IoT connectivity propels the demand for temperature sensors, as they serve as critical components in the digital transformation of various sectors, including manufacturing, logistics, healthcare, and agriculture. As industries continue to advance and embrace smart technologies, the temperature sensors market is poised for sustained growth.

Technical challenges

Technical challenges and compatibility issues pose significant restraints on the temperature sensors market. One key challenge is accuracy. Temperature sensors must provide precise readings to ensure the safety and reliability of critical systems, but factors like electromagnetic interference, self-heating, and sensor drift can affect accuracy. Another challenge is calibration and maintenance. Temperature sensors require regular calibration to maintain accuracy, which can be costly and time-consuming, especially when dealing with a large number of sensors in industrial settings.

Compatibility issues arise when integrating temperature sensors with existing systems and devices. Ensuring seamless communication and data exchange between sensors and control systems is crucial. Mismatched protocols, data formats, or interfaces can hinder integration efforts. Furthermore, issues related to power consumption and sensor size may limit their applicability in compact or battery-powered devices. These challenges necessitate ongoing research and development efforts to overcome technical limitations and improve sensor performance, reliability, and compatibility, thus unlocking the full potential of temperature sensors across various industries.

IoT integration and demand from automotive industry

The temperature sensors market is experiencing significant growth, driven in large part by the integration of IoT technology and heightened demand from the automotive industry. IoT integration has revolutionized temperature sensing by enabling real-time data collection and remote monitoring across various applications. Industries such as manufacturing, logistics, and healthcare now rely on IoT-connected temperature sensors to ensure precision, compliance, and operational efficiency. For instance, in the pharmaceutical sector, IoT-enabled temperature sensors monitor the storage and transportation of sensitive vaccines and medicines, ensuring they remain within specified temperature ranges, thus maintaining their efficacy.

The automotive industry is another key driver, with the growing popularity of electric vehicles (EVs) and advanced driver-assistance systems. Temperature sensors play a crucial role in EVs by monitoring battery temperature for safety and performance optimization. Additionally, ADAS systems rely on temperature data for accurate decision-making, enhancing vehicle safety. As automakers continue to invest in these technologies, the demand for temperature sensors is set to rise further, solidifying their position as a cornerstone of the modern automotive and IoT landscape.

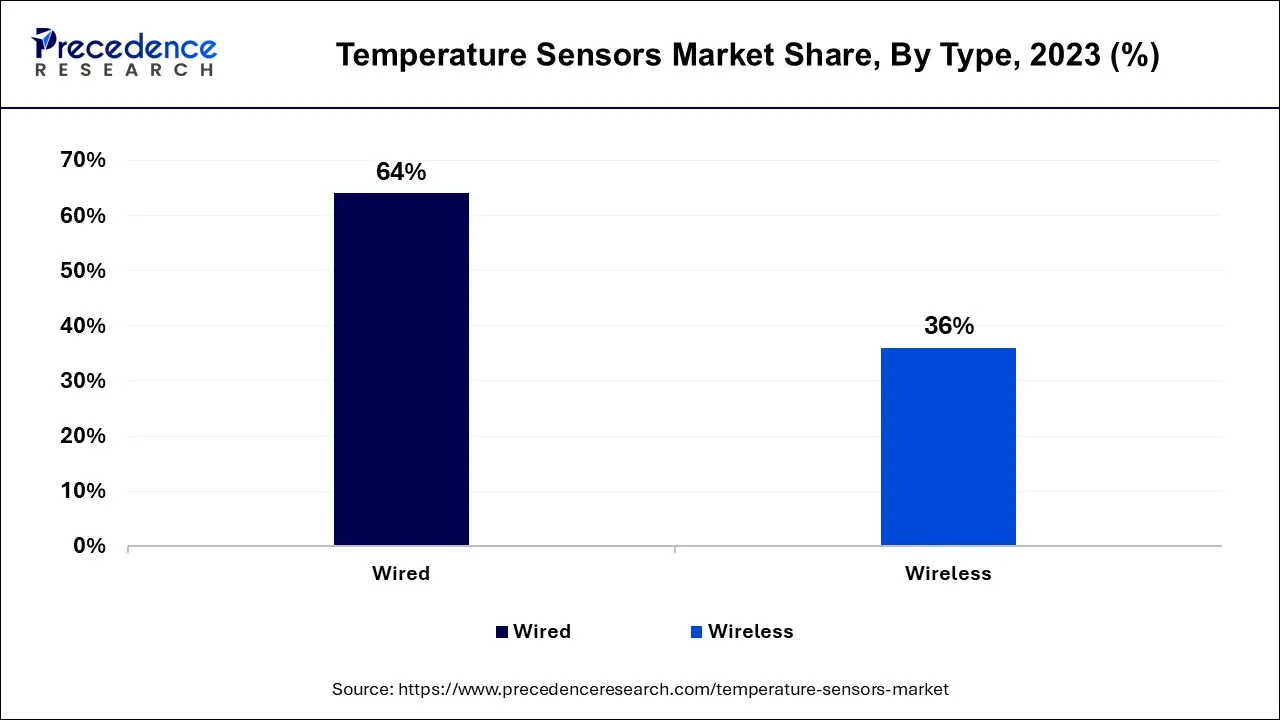

According to the type, the wired segment has held a 64% revenue share in 2023. The temperature sensors market offers both wired and wireless sensor solutions to meet diverse industry needs. Wired temperature sensors, characterized by their robustness and reliability, are preferred in critical applications such as industrial manufacturing and laboratory environments, where uninterrupted, real-time temperature monitoring is essential. These sensors are trending toward improved accuracy, durability, and compatibility with industrial automation systems.

The wireless segment is anticipated to expand at a significant CAGR of 10.8% during the projected period. Wireless temperature sensors have gained traction, owing to the growing demand for remote monitoring and IoT integration. These sensors offer flexibility and ease of installation, making them suitable for applications like smart homes, healthcare, and logistics. A trend in this segment is the development of low-power, long-range wireless sensors, enhancing their efficiency and extending their applicability in various industries. Both wired and wireless temperature sensors play pivotal roles in modern temperature monitoring solutions, catering to diverse requirements across industries.

Based on the technology, the Resistance Temperature Detectors (RTDs) segment is anticipated to hold the largest market share of 31% in 2023. Resistance temperature detectors (RTDs) and thermistors are two prevalent technologies in the temperature sensors market. RTDs are known for their high accuracy and stability, making them ideal for applications demanding precision, such as scientific research and industrial process control. They exhibit linear resistance-temperature relationships and are typically made of platinum, nickel, or copper. Industry trends show an increasing demand for RTDs due to their reliability and compatibility with IoT systems for real-time temperature monitoring.

On the other hand, the thermistors segment is projected to grow at the fastest rate over the projected period. Thermistors, known for their affordability and sensitivity, find applications in consumer electronics, automotive, and medical devices. These semiconductor-based sensors offer a non-linear resistance-temperature characteristic, making them suitable for temperature-compensation circuits. Trends indicate a growing market for thermistors, particularly in the automotive sector, where temperature-sensitive components require accurate thermal management for enhanced performance and efficiency.

In 2023, the chemical and petrochemical segment had the highest market share of 35% on the basis of the end user. In the chemical and petrochemical industry, temperature sensors play a critical role in ensuring the safe and efficient operation of processes. The trend in this sector is a growing emphasis on accuracy and reliability in temperature measurement. As chemical reactions are highly sensitive to temperature variations, precise monitoring is essential to prevent accidents and optimize production. Temperature sensors with advanced features like remote monitoring and self-diagnosis capabilities are gaining traction, enabling real-time data analysis and proactive maintenance.

The oil and gas segment is anticipated to expand at the fastest rate over the projected period. In the oil and gas industry, temperature sensors are utilized in various applications, including upstream drilling, refining, and transportation. The trend here is towards rugged and durable sensors that can withstand harsh environmental conditions, such as extreme temperatures and corrosive substances. Additionally, the industry is witnessing a shift towards wireless and IoT-enabled temperature sensors for remote monitoring of pipelines, storage tanks, and equipment, enhancing operational efficiency and safety while reducing maintenance costs.

Segments Covered in the Report

By Type

By Technology

By End-user Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

July 2024

January 2025

November 2024