April 2025

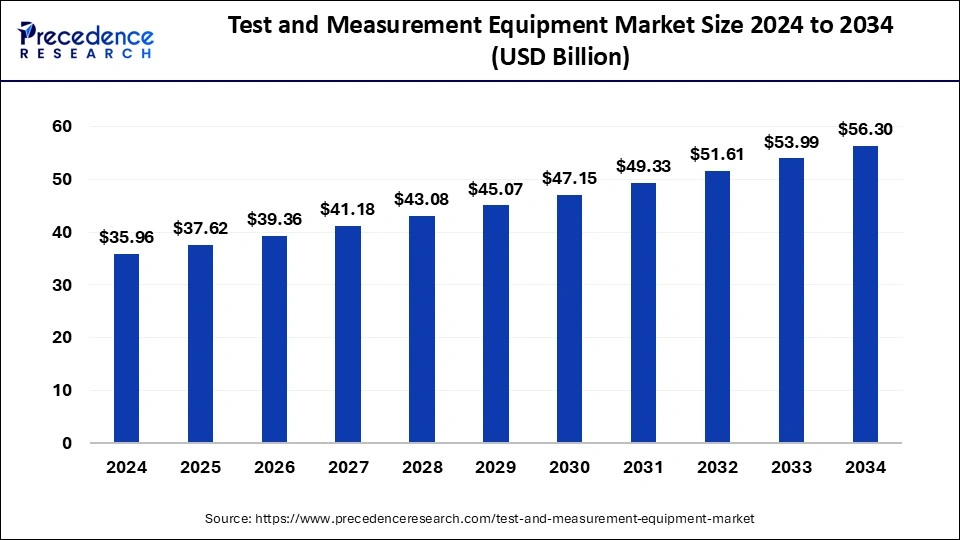

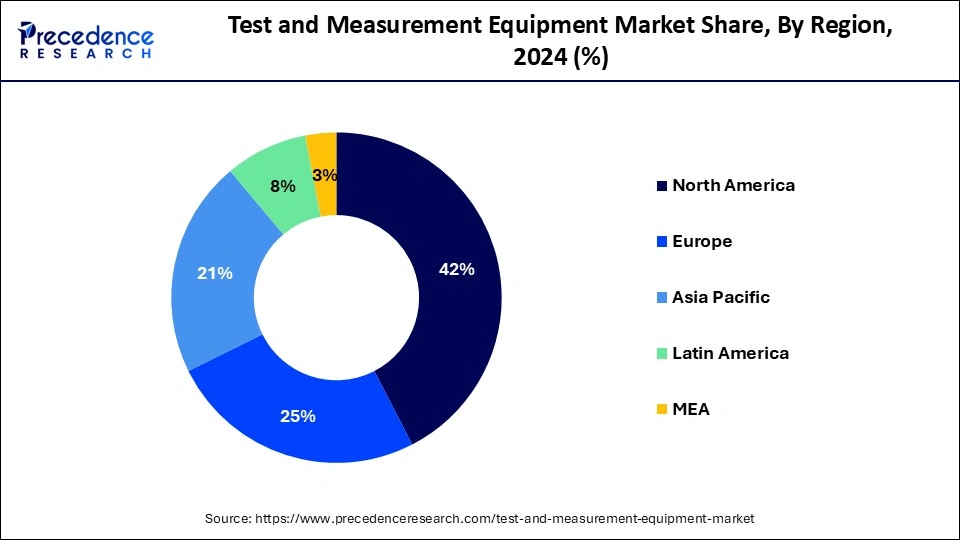

The global test and measurement equipment market size is calculated at USD 37.62 billion in 2025 and is forecasted to reach around USD 56.30 billion by 2034, accelerating at a CAGR of 4.58% from 2025 to 2034. The North America market size surpassed USD 15.10 billion in 2024 and is expanding at a CAGR of 4.59% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global test and measurement equipment market size accounted for USD 35.96 billion in 2024 and is predicted to increase from USD 37.62 billion in 2025 to approximately USD 56.30 billion by 2034, expanding at a CAGR of 4.58% from 2025 to 2034. Rising investment in industrial development drives the growth of the market.

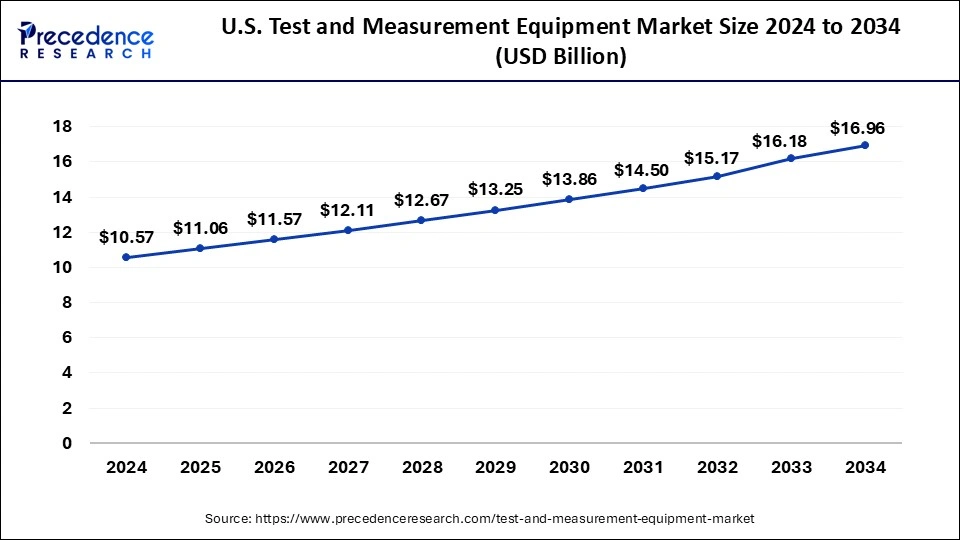

The U.S. test and measurement equipment market size was exhibited at USD 10.57 billion in 2024 and is projected to be worth around USD 16.96 billion by 2034, growing at a CAGR of 4.84% from 2025 to 2034.

North America dominated with the largest share of the market in 2024. The growth of the market is attributed to the availability of well-developed industrial infrastructure such as automotive, electronics, aerospace, and defense, as well as other industries that are contributing to the demand for test and measurement equipment for testing the mechanical properties of industrial devices or components. The rising investment in the infrastructural development of the electronic industry is driving the growth of the test and measurement equipment market. The ongoing research on the development and innovations of electronic products is further driving the expansion of the test and measurement equipment market.

Asia Pacific is expecting significant growth during the forecast period. The growth of the market in the region is attributed to the rising regional countries' population and the rising demand for industrialization in the region, which drives the demand for testing and optimizing the process of industries that will positively influence the growth of the market. The rising economic growth in the countries driving the expansion of industries like healthcare, automotive, electronics, telecommunication, aviation, and others are further driving the demand for the test and measurement process, which will drive the growth of the market. Additionally, the rising research and development activities for the expansion of technologies drive the growth of the market in the region.

Tests and measurements are important functions in testing industries' operations and manufacturing processes. It is used in a wide range of industrial applications like automotive, healthcare, consumer electronics, manufacturing, research labs, and others. Tests and measurements are essential in the electronic industry for utilizing quality control, product testing, and debugging of electronic components, PCBs (printed circuit boards), and electronic devices. There are different types of test and measurement equipment available, such as electronic industry, ohmmeters, voltmeters, capacitance meters, ammeters, digital pattern generators, frequency counters, oscilloscopes, and EMF meters. Some of the test and measurement equipment are used to produce signals and help in measuring the object being tested. There are several tests available to test the mechanical properties of products, such as friction, compression, impact, hardness, fatigue, torsion, fatigue, and others. The rising industrialization is driving the growth of the test and measurement equipment market.

| Report Coverage | Details |

| Market Size by 2034 | USD 56.30 Billion |

| Market Size in 2025 | USD 37.62 Billion |

| Market Size in 2024 | USD 35.96 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.58% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Service Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand from several industrial uses

The rising demand for test and measurement equipment from various end-use industries like automotive, healthcare, IT, telecommunications, electronics, aerospace and defense, and others increases efficiency in workflow and improves productivity and effectiveness. It helps in validating all electronic and electric devices in a wide range of industries. Test and measurement equipment plays an important role in the automotive industry; under the manufacturing and testing of driverless vehicles, connected cars, and autonomous driving cars, there is an increase in demand for test and measurement equipment for testing and optimizing the performance of the vehicles.

The demand for other testing, such as RF testing, is required to test wireless communication standards like Wi-Fi in traditional automotive applications and Long-Term Evolution (LTE). Test and measurement equipment is responsible for every standard testing in the automobile, including automotive radar, infotainment systems, collision avoidance, target simulation, and the new Wi-Fi standard 802.11p. Thus, the rising demand for the automotive industry worldwide is highly contributing to the growth of the test and measurement equipment market.

Stringent regulations

The handling of a number of regulations in a wide range of industries and the diverse quality and safety standards of industries like healthcare, pharmaceuticals, food and beverages, and chemicals are limiting the expansion of the test and measurement equipment market. Additionally, the higher cost of the test and measurement equipment is restraining the demand growth of the product, and major industries like electronics, aerospace and defense, automotive, and others industries are preferably choosing the test and measurement equipment on a rental basis, which limits the buying of test and measurement equipment are restraining the growth of the test and measurement equipment market.

Integration of modern technologies

The advancements and integration of the technologies in the test and measurement equipment are driving the opportunity for growth in the market. The test and measurement equipment has seen substantial growth in the industrial expansion of big data analytics, Internet of Things (IoT), and 5G technologies. Technological integration, like power applications, high-speed digital standards, and the evolution of software-as-a-service (SaaS), new software models, and cloud licensing, is driving the expansion of the test and measurement. The rising intervention of the market leader in technology and the ongoing research and development activities on the upgrade of software and product launches drive the growth opportunity in the test and measurement equipment market.

The general-purpose test equipment segment dominated the test and measurement equipment market and is expected to remain dominant during the forecast period. The general-purpose test equipment is used in the industries like automotive, healthcare, IT telecommunications, and others. There is a rising demand for general-purpose test equipment for testing and identifying equipment performance. The rising adoption of 5G technology and electronic industries are driving the growth of the segment. The general-purpose test equipment is used to detect and solve general electronic parameters like frequency, voltage, watts, and other electronic components. The PG3 digital pattern generator series is one of the important tools of the general-purpose test equipment that is used in a wide range of testing applications.

The mechanical testing equipment segment is expected to grow significantly in the market during the predicted period. The growth of the segment is attributed to the rising industrialization, and the increasing demand for quality assurance (QA) and quality control (QC) has been driven by the demand for mechanical testing equipment. There are several types of mechanical testing equipment used to run compression, adhesion, flexure, fatigue, shock, vibration, ductility, and shear tests. All these testing equipment are used to make sure the component will work in the appropriate way. Mechanical test equipment includes several types of equipment, such as hardness testing equipment, fatigue testers for fatigue resistance measurement, compression testers, tensile testers, and others. Mechanical testing equipment is used in different industries such as biomedical devices, material testing such as ceramic, rubber, metals, etc., automotive, manufacturing, construction, engineering, and others.

The calibration services segment dominated the test and measurement equipment market in 2024. The calibration equipment is used to detect the expected performance of the measuring test equipment. The calibration services for measuring tests include a calibrator, current clamp meter, data loggers, desktop multimeters, digital multimeters handheld, electrical testing instruments, modular measuring systems, oscilloscopes desktop and handheld, probes and accessories, special multimeters and measuring kits. The increasing adoption of calibration services by several end-user industries for improving the quality, efficiency, and safety of the products. Calibration helps reduce measurement errors and ensures precise measurement. There are some types of calibrators used in different industrial equipment measurements, such as electrical calibrators, dry block calibrators, calibration baths, pressure calibrators, deadweight testers, humidity calibrators, flow calibrators, and laser interferometers.

The healthcare segment dominated the test and measurement equipment market with the largest share in 2024. The growth of the segment is attributed to the rising implementation of tests and measurements in the healthcare sector to improve patient and treatment outcomes. Testing and measurement are used to simplify complex and efficient diagnostics to help with the treatment. It also helps in the testing of preventive vaccines and medications. The continuous research on the development and launch of the latest medical devices, personal emergency reporting systems, and patient monitoring systems drives the demand for testing and measurement in the healthcare industry. Additionally, the rising investment in the development of the healthcare industry is further driving the demand for test and measurement equipment in the segment.

The automotive and transportation segment is expecting significant growth in the market during the forecast period. The growth of the segment is owing to the rising demand for the automotive industry by the population due to the rising disposable income and the rising tendency to have their own transportation system, which is driving the growth of the automotive and transportation industry. Test and measurement equipment plays an important role in the automotive industry; it is used in every stage of automobile manufacturing, from development to production, quality checking and assurance, safety testing, conformity, workshops, and recycling. Furthermore, the rising advancements in automotive technologies, integration of smart features, and rising competition in the automobile industry are collectively contributing to the expansion of the test and measurement equipment market.

By Product

By Service Type

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

August 2024

March 2025

November 2024