January 2025

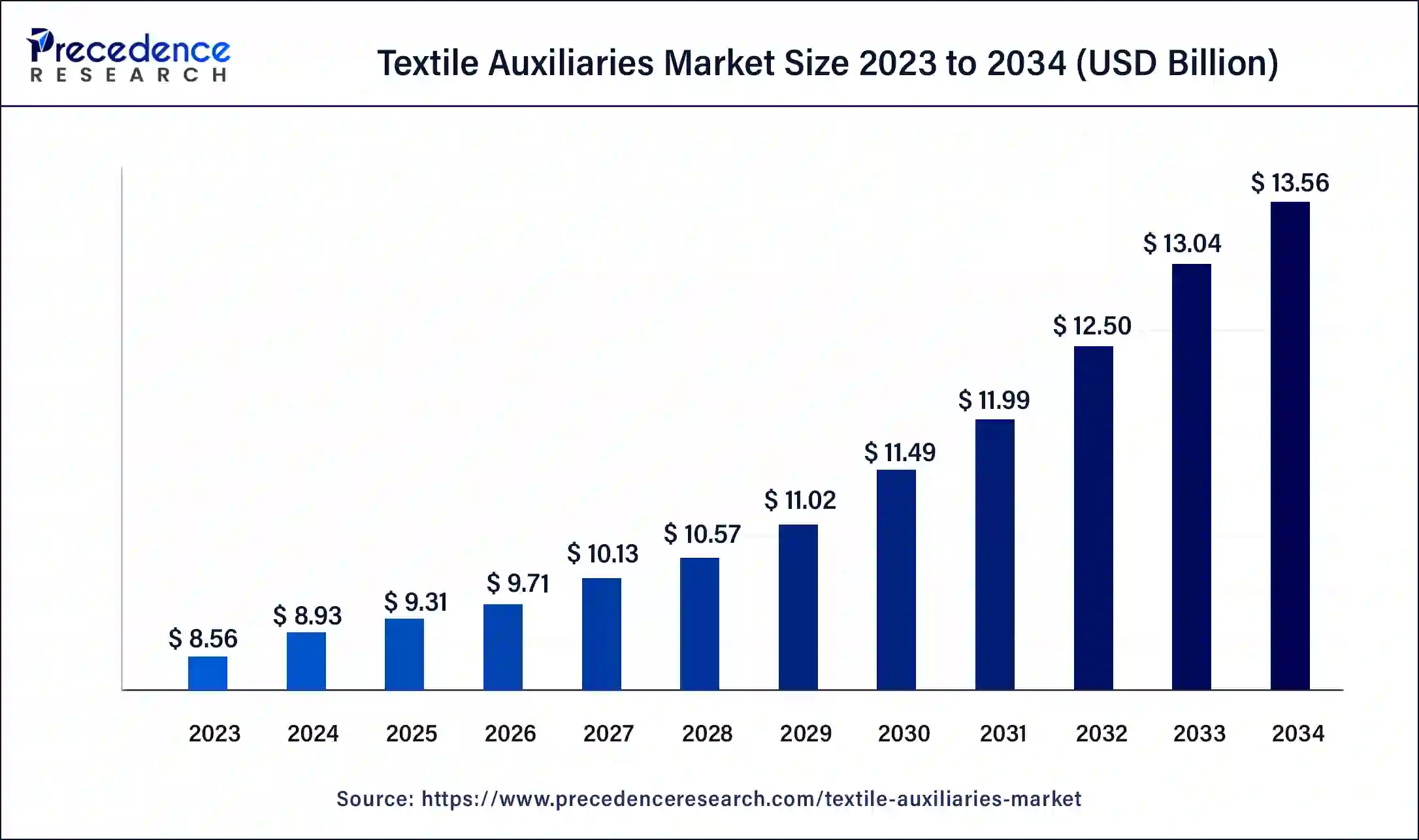

The global textile auxiliaries market size was USD 8.56 billion in 2023, estimated at USD 8.93 billion in 2024 and is anticipated to reach around USD 13.56 billion by 2034, expanding at a CAGR of 4.27% from 2024 to 2034.

The global textile auxiliaries market size accounted at USD 8.93 billion in 2024 and is predicted to reach around USD 13.56 billion by 2034, expanding at a CAGR of 4.27% from 2024 to 2034.

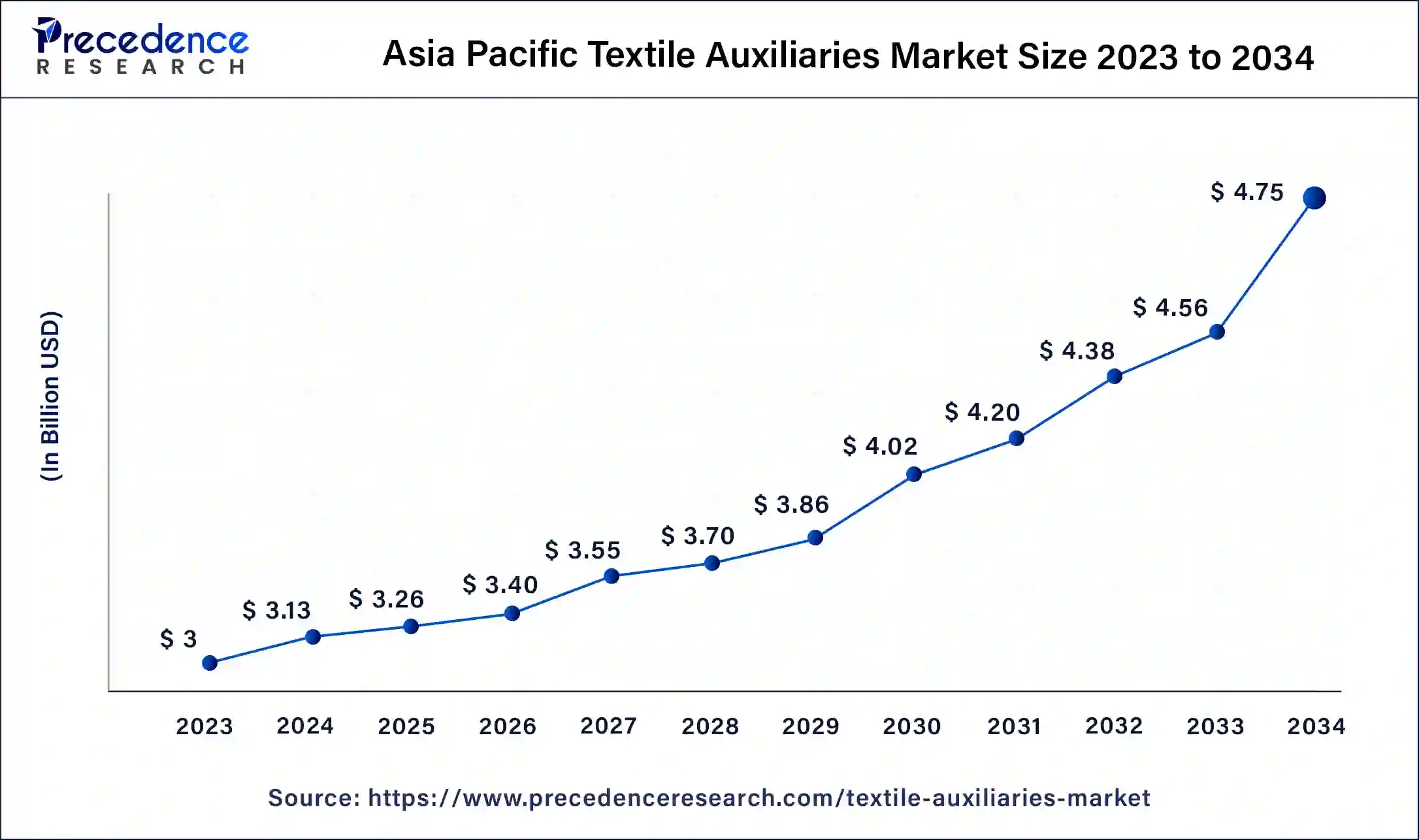

The Asia Pacific textile auxiliaries market size was valued at USD 3 billion in 2023 and is expected to reach USD 4.75 billion by 2032, growing at a CAGR of 5% from 2024 to 2034.

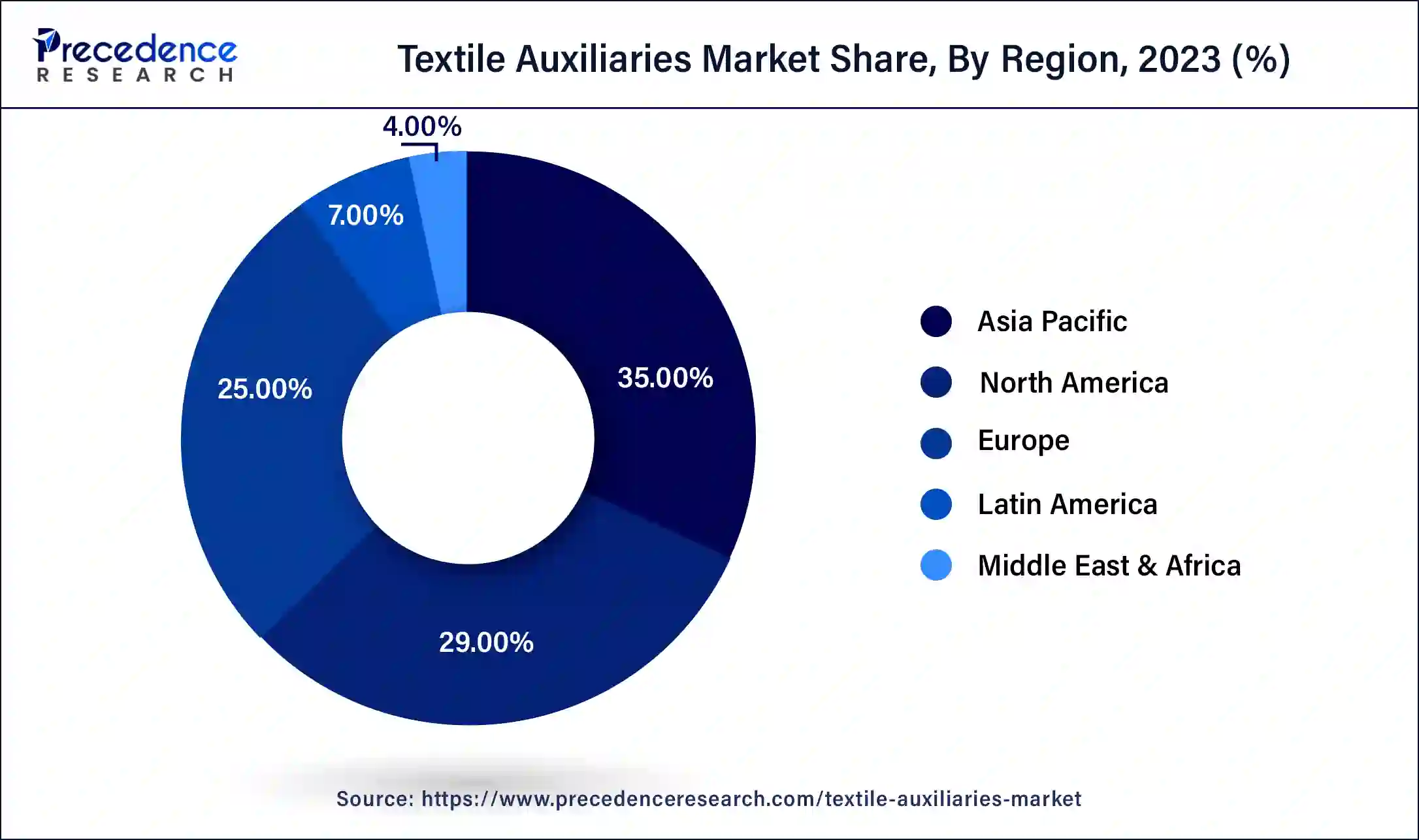

The research report covers crucial trends and predictions of textile auxiliaries products across several geographical regions such as North America, Asia-Pacific, Europe, Latin America, and the Middle East and Africa. Asia Pacific is anticipated to witness speedy growth in the global textile auxiliaries market in years to come due to the development of the textile sector in developing economies including India. As per, the India Brand Equity Foundation report on textiles and apparel, the Indian domestic textile sector grasped around USD 150 billion in 2017 from USD 137 billion in 2016. Furthermore, the Indian domestic textile sector is anticipated to reach about USD 223 billion by 2021. Consequently, the growth of the textile sector is anticipated to push demand for textile auxiliaries, which aids in refining the complete quality of the fabric, thus boosting the development of the textile auxiliaries market in the region.

The textile industry in China is the largest in the world in terms of exports and production. The Chinese textile industry is thriving with snowballing investments and government backing from the 13th 5-Year Plan. Venture in the country’s textile industry has been swelling on account of inexpensive electricity rates, inferior raw cotton prices, and transportation subsidies.

The usage of natural and environmentally safer textile auxiliaries is anticipated to boost market growth due to strict governmental regulations implemented on the practice of toxic chemicals in textiles. With textiles being progressively accepted for innumerable applications such as apparel, home furnishings, and others there has been an outbreak of activity in the bigger textile industry, and compliant growth in the textile auxiliaries market too. Apparel endures to be a foremost application segment in the textile auxiliaries marketplace on account of flourishing clothing commerce in both, established and emerging nations across the world.

One of the major influences propelling the market is the vigorous growth of the apparel market in emergent economies. Yet, pollution problems triggered by the finishing industry and textile dyeing are expected to confine the growth of the market to some extent.

Critical factors responsible for market growth are

| Report Highlights | Details |

| Market Size in 2023 | USD 8.56 Billion |

| Market Size in 2024 | USD 8.93 Billion |

| Market Size by 2034 | USD 13.56 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.27% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2023 to 2034 |

| Segments Covered | Type, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The Dyeing & Printing Agents Segment Captured Key Market Share in 2023

Different types of products involved in the global textile auxiliaries are pretreatment agents, finishing agents, dyeing & printing agents, knitting & weaving auxiliaries, and spin finishes. Among all, the dyeing & printing agents product segment garnered a significant market share in 2023 and it is predicted to mirror this trend throughout the forecast period. Dyeing auxiliaries are chemical articulated products that are most useful in dyeing and printing processes. These auxiliaries offer essential support to fabrics in dyeing and printing operations to accomplish the anticipated properties and textures.

Apparel Application is Projected to lead the Textile Auxiliaries Market Revenue

Depending on the application, the global textile auxiliaries market is classified into apparel, home furnishings, technical, and industrial textiles. The home furnishings segment has been further divided into furniture, carpets & rugs, and others. The apparel application segment comprises a large stake in the global textile auxiliaries market in 2022, and it is anticipated to develop even further throughout the estimated period. Apparel is widely used by a great number of customers around the world. Major usages comprise activewear and personal clothing including t-shirts, shirts, trousers, tops, blazers, sportswear, daily wear, and other garments.

In order to better recognize the current status of acceptance of Textile Auxiliaries, and policies adopted by the foremost countries, Precedence Research predicted the future evolution of the Textile Auxiliaries market. This research study bids qualitative and quantitative insights into the Textile Auxiliaries market and an assessment of the market size and growth trend for potential market segments.

Major Market Segments Covered

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

March 2025

February 2025