April 2025

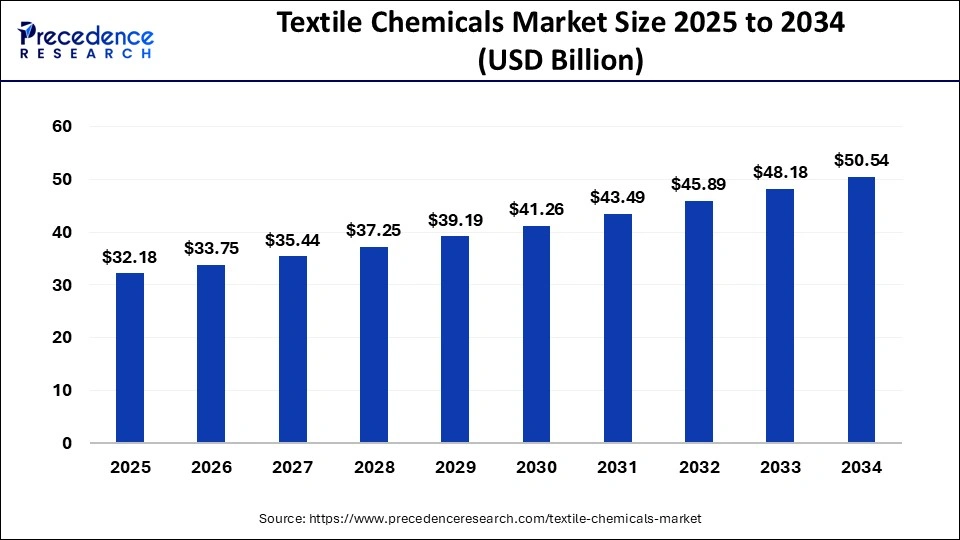

The global textile chemicals market size is accounted at USD 32.18 billion in 2025 and is forecasted to hit around USD 50.54 billion by 2034, representing a CAGR of 5.32% from 2025 to 2034. The Asia Pacific textile chemicals market size was estimated at USD 17.39 billion in 2024 and is expanding at a CAGR of 5.51% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global textile chemicals market size was accounted for USD 30.07 billion in 2024 and is anticipated to reach around USD 50.54 billion by 2034, growing at a CAGR of 5.32% from 2025 to 2034. The textile chemicals market growth is fueled by changing consumer preferences, technological advancement, and the rising interest of key players toward innovation.

The textile chemical industry can use artificial intelligence (AI) to dig deep into its vast databases to identify patterns and trends. Predictive maintenance, cutting waste streams, improving product quality controls, developing sustainability metrics for chemicals, and optimizing supply chains can all be achieved using AI. Identifying the different machinery and related equipment with great detail allows for anomaly detection, energy use reduction, and optimization of resource use. AI can ensure that any potential defect will be caught before an item leaves the line. AI can also look at existing chemical composition and find ways to create ecologically sustainable chemicals. This domain will witness an increasing boost as the textile industry gradually turns up toward A.I. to achieve maximum competition in terms of sustainable environmental conditions and efficiency.

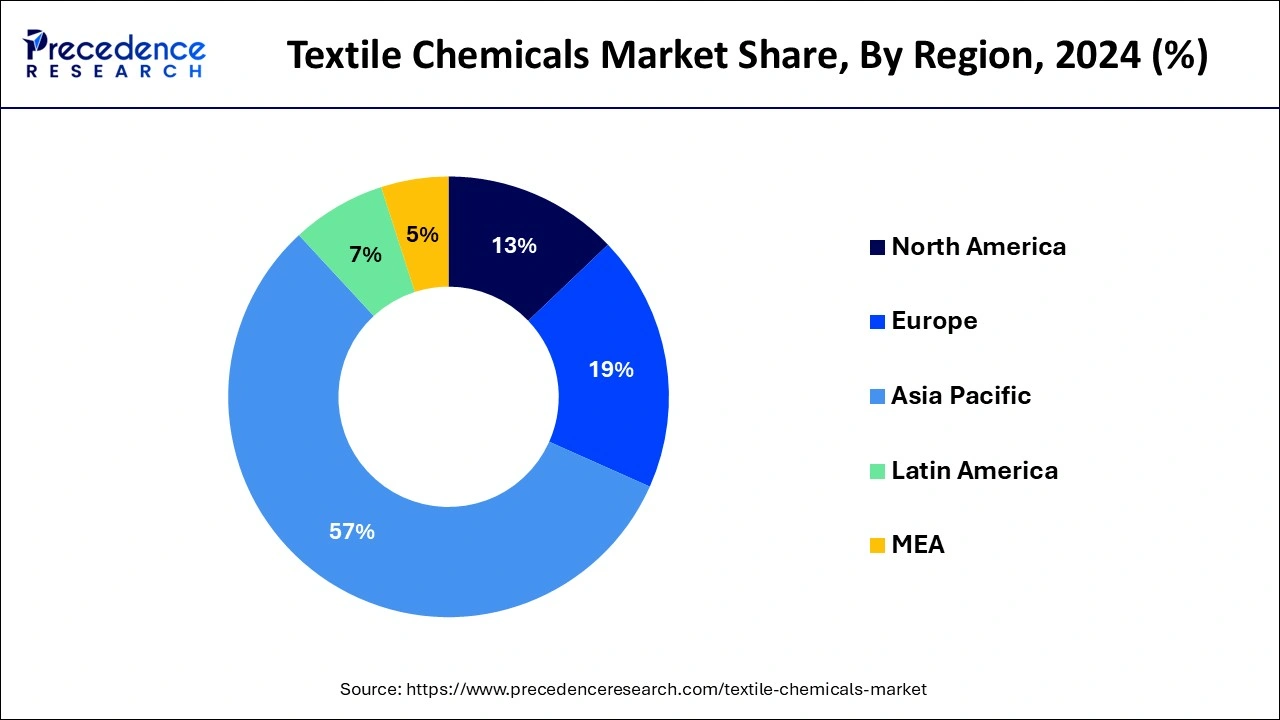

The Asia Pacific textile chemicals market size was exhibited at USD 17.39 billion in 2024 and is projected to be worth around USD 29.76 billion by 2034, growing at a CAGR of 5.51% from 2025 to 2034.

Being largest textile producer in the world, the Asia Pacific held attractive revenue share in the global textile chemicals market in 2023 and expected to offer substantial growth in the near future. China collective accounts for more than 60% of the regional share and nearly 35% of the global share. Prime factor attributed to the significant growth of the region is large production capacity of textiles. Total revenue conquered by China through textile export business was USD 206 Billion in 2016.

However, rising demand for apparels in North America expected to raise the consumption of textile chemicals during the forecast period. In addition, rising number of vehicle production along with increasing trend for advanced vehicles trigger the growth of automotive textiles in the region. The region is an industrial home for different types of industries that too promotes the use of technical textiles in the region.

Rapid growth of the apparel industry along with increasing penetration of online retail shops has bolstered the textile chemicals market growth. These chemicals are added in the fabric during its processing to impart specific characteristics to the apparel. Some of the specific features imparted by textile chemicals to the apparel include antimicrobial properties, sweat absorbent, stain resistance, wrinkle resistance, finish to the fabric, and desired texture.

However, release of harmful chemicals in the environment during the manufacturing process negatively impact human health, thereby restricts the market growth. Further, various regulations imposed by the government on the usage of textile chemicals expected to hinder the growth of the market. Nonetheless, a shifted focus of the manufacturing companies towards green chemicals i.e. bio-chemicals anticipated to open up new opportunities for the market growth in the coming years. These bio-chemicals are environmental-friendly as well as cost-efficient as they are made from plant and animal fat oil.

| Report Highlights | Details |

| Market Size in 2025 | USD 32.18 Billion |

| Market Size by 2034 | USD 50.54 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.32% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025to 2034 |

| Segments Covered | Process, Product, Fiber Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Coating & sizing chemicals dominated the global textile chemicals market in terms of revenue share in 2023 and projected to continue its dominance during the forecast period. Coatings materials are generally thermoplastic polymers that provide strength to the yarns and improve the abrasion resistance while weaving. This reduces the risk of breaking and fraying of yarn during weaving process. The aforementioned factors are the key contributors behind the significant growth of the segment.

On the other hand, rising preference for non-toxic dyes & dyestuffs anticipated to fuel the segment growth prominently during the forecast period. Apart from this, innovations and technological advancement in color production technique to develop eco-friendly colorants are the other major factors accelerating the market growth. Natural dyes are significantly used for coloring leather and fibers such as silk, cotton, and wool. Demand for eco-friendly dies anticipated to flourish in the near future owing to increased consumer preference for organic and non-allergic printed fabrics.

In 2023, apparel industry encountered significant revenue share in the global textile chemicals market and project stagnant growth of nearly 1% during the forecast period. Rising investments by the apparel industry participants to capture unique selling points (USPs) such as stain resistance, soft finish, wrinkle resistance, and antimicrobial properties for additional performance and comfort is the key factor that drives market growth. Besides this, improved standards of living, modernization of the apparel industry, rise in disposable income, and increase in population are some of the major factors projected to propel the apparel segment growth in the near future.

On the contrary, technical textile segment exhibits lucrative growth during the forecast period owing to rising demand for smart textiles. Smart textiles were introduced to produce products with dynamic functionalities, by integrating computing power and smart materials. Further, increasing application and innovations in automotive textiles, and other industrial textiles offer new business opportunities for the technical textile segment during the forecast period.

Segments Covered in the Report

By Process

By Product

By Fiber Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

March 2025

February 2025