January 2025

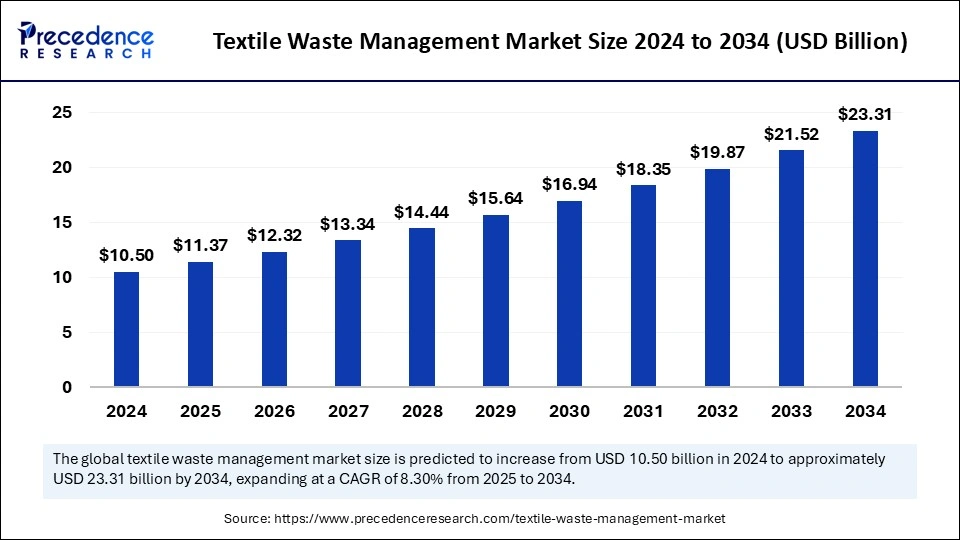

The global textile waste management market size is calculated at USD 11.37 billion in 2025 and is forecasted to reach around USD 23.31 billion by 2034, accelerating at a CAGR of 8.30% from 2025 to 2034. The Asia Pacific market size surpassed USD 3.05 billion in 2024 and is expanding at a CAGR of 8.47% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global textile waste management market size accounted for USD 10.50 billion in 2024 and is predicted to increase from USD 11.37 billion in 2025 to approximately USD 23.31 billion by 2034, expanding at a CAGR of 8.30% from 2025 to 2034.The growth of the textile waste management market is driven by the increasing awareness surrounding environmental sustainability. As consumers grow more cognizant of the effects of textile waste on the ecosystem, they are seeking more sustainable practices from both manufacturers and retailers. This change in consumer behavior is motivating companies to implement eco-friendly waste management methods.

Artificial Intelligence is transforming the textile waste management sector by enhancing waste collection, increasing sorting efficiency, improving recycling methods, and promoting sustainability efforts. As the global textile industry faces mounting pressure to lessen its environmental impact and embrace circular economy principles, AI-powered solutions are essential in reducing waste, optimizing material recovery, and facilitating sustainable textile production. A key application of AI in textile waste management is the automated sorting of textiles through computer vision and machine learning techniques. Conventional sorting approaches depend largely on manual labor, resulting in processes that are time-consuming, prone to errors, and inefficient.

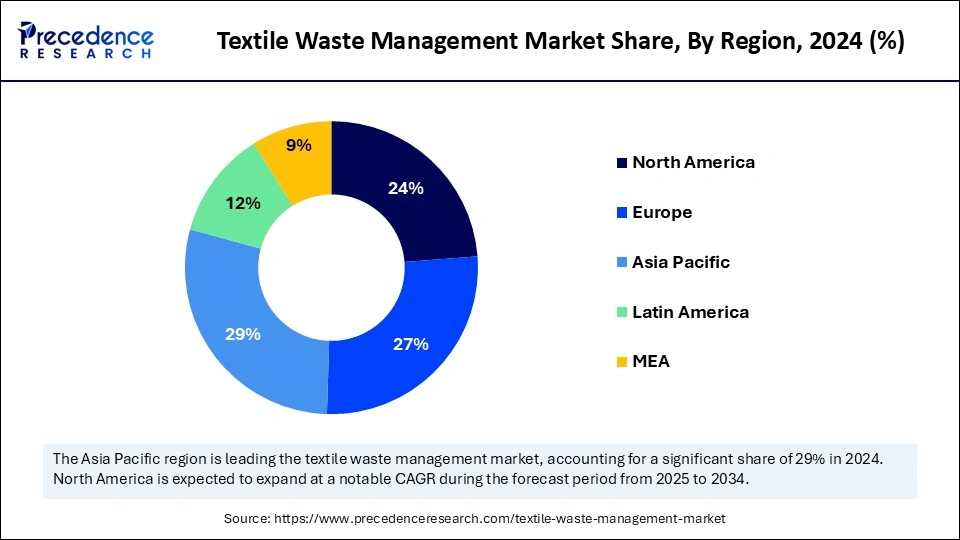

The Asia Pacfic textile waste management market size was exhibited at USD 3.05 billion in 2024 and is projected to be worth around USD 6.88 billion by 2034, growing at a CAGR of 8.47% from 2025 to 2034.

Asia Pacific dominated the textile waste management market with the largest market share, fueled by rapid industrial growth, escalating textile production, and an increase in government initiatives promoting sustainable waste management practices. The region is the base for some of the world’s leading textile-producing countries, including China, India, Bangladesh, and Vietnam, which generate vast quantities of pre-consumer (industrial) and post-consumer textile waste.

As the focus intensifies on environmental sustainability and circular economy models, nations across Asia-Pacific are channeling investments into textile recycling infrastructure, waste collection initiatives, and sustainable fashion projects to address the growing textile waste challenge. A key factor contributing to Asia-Pacific’s leadership is its extensive textile and garment manufacturing sector, which supplies products to international fashion brands

China Textile Waste Management Market Trends

As the largest textile producer and consumer globally, China generates millions of tons of textile waste each year, making waste management within the sector a crucial priority. In light of mounting environmental issues, the Chinese government has instituted regulations to restrict textile waste, promote circular fashion, and motivate manufacturers to incorporate recycled fibers in their production processes.

China is also committing substantial investments to advanced textile recycling technologies, such as chemical depolymerization of polyester and mechanical recycling of cotton, to lessen the reliance on virgin raw materials. The introduction of smart waste sorting systems and AI-driven recycling facilities is further enhancing the efficiency of China’s textile waste management industry.

Indian Textile Waste Management Sector: Trends & Potential

India plays a crucial role in the Asia Pacific textile waste management market, characterized by a thriving textile and garment sector that generates substantial amounts of both pre-consumer and post-consumer waste. The nation has a vibrant informal textile recycling industry, where numerous workers manually sort, process, and transform used fabrics into industrial rags, insulation materials, and second-hand apparel.

However, with the Indian government advocating for a more organized and extensive recycling infrastructure, new collaborations between public and private sectors, along with investments in textile waste processing facilities, are on the rise. The growing sustainable fashion movement in India, coupled with increased consumer engagement in clothing resale and rental services, is further bolstering the country’s textile waste management initiatives.

North America Market Trends

North America is the fastest growing market for the textile waste management, driven by escalating regulatory pressures, heightened consumer consciousness regarding textile sustainability, and the swift advancement of the circular fashion economy. The area has witnessed a notable transition towards responsible waste management, with governments, brands, and consumers actively participating in recycling initiatives, clothing take-back programs, and textile repurposing strategies.

A primary factor propelling the growth of textile waste management in North America is the introduction of Extended Producer Responsibility (EPR) policies that mandate fashion retailers and manufacturers to oversee the end-of-life processes for their products.

U.S. Textile Waste Management Industry Trends

The United States stands at the forefront of innovations in textile waste management, emphasizing recycling, upcycling, and sustainable fashion initiatives. The country produces over 17 million tons of textile waste each year, with a mere 15% being recycled, which creates substantial opportunities for market expansion. In response, both the U.S. government and environmental organizations are developing new policies and funding research on advanced textile recycling methods.

The rise of clothing resale platforms, second-hand fashion marketplaces, and rental clothing services is also aiding in waste reduction. Prominent U.S. brands, including Nike, Patagonia, and Levi’s, have initiated take-back programs, textile-to-textile recycling projects, and biodegradable fabric options, reinforcing North America’s leadership in sustainable textile waste management.

Europe Textile Waste Management Market Trends

Europe is considered to be a significantly growing area for the textile waste management market, fueled by rigorous environmental regulations, sustainability efforts, and advancements in recycling technologies for textiles. The region has been at the forefront of circular economy practices, with the European Union enacting laws that compel fashion brands to minimize textile waste, enhance recycling rates, and shift towards sustainable production methodologies.

A significant contributor to the growth of this market in Europe is the EU Strategy for Sustainable and Circular Textiles, which requires textile manufacturers to cover the expenses associated with waste management through Extended Producer Responsibility (EPR) systems. These regulations are motivating companies to invest in large-scale textile waste collection, sorting, and recycling operations.

U.K. Textile Waste Management Market Trends

The United Kingdom is witnessing notable growth in textile waste management, characterized by a rising adoption of circular fashion business models, textile repair movements, and sustainable production practices. Retailers in the UK are rolling out take-back initiatives, facilitating second-hand clothing sales, and implementing closed-loop recycling systems to curtail textile waste.

Government-led initiatives, such as WRAP’s Sustainable Clothing Action Plan (SCAP), have further motivated businesses to cut down on textile waste and enhance recycling efforts. Additionally, the UK is observing a surge in waste-to-energy applications for non-recyclable textiles, aiding in the reduction of reliance on landfills while also contributing to renewable energy generation.

The textile waste management market is experiencing significant growth driven by a growing awareness of sustainable practices and the environmental effects of textile waste. Consumers and businesses are increasingly acknowledging the necessity for efficient waste management solutions, especially as the fashion industry faces criticism for its role in pollution. Stringent regulations governing waste disposal and recycling are urging manufacturers to embrace innovative waste management approaches. This transition towards sustainability is fueled by a demand for circular economy practices, which involve reusing or recycling textile materials to reduce landfill contributions and conserve resources.

The rise of sustainable fashion is opening up new avenues for market growth, with businesses focused on recycling, upcycling textiles, and minimizing waste emerging to meet the growing need for more environmentally friendly solutions. Collaborative efforts between brands and waste management companies hold the promise of establishing solutions that are both profitable and environmentally sustainable. Additionally, the increasing popularity of clothing rental and second-hand markets is reshaping consumer attitudes toward textiles, creating opportunities for profitable ventures in textile waste management. Recently, there has been a trend toward the adoption of technologies that enhance the processing and recycling of waste. Innovations in recycling technologies and materials recovery processes are being implemented, boosting the efficiency of textile waste management.

| Report Coverage | Details |

| Market Size by 2034 | USD 23.31 Billion |

| Market Size by 2025 | USD 11.37 Billion |

| Market Size by 2024 | USD 10.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.30% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Waste Type, Processing Method, End User, Material Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing Government Regulations and Sustainability Efforts

A key driver of the textile waste management market is the increasing implementation of government regulations and sustainability initiatives aimed at alleviating textile waste and encouraging circular economy practices. Governments around the world are enacting tougher laws to address the environmental consequences of textile waste, which has rapidly become one of the largest waste streams globally.

For example, the European Union’s Strategy for Sustainable and Circular Textiles requires textile companies to assume responsibility for waste management, promoting recycling, reuse, and environmentally friendly material choices. Likewise, Extended Producer Responsibility (EPR) regulations in multiple countries stipulate that manufacturers and fashion brands must finance and engage in textile collection, sorting, and recycling efforts.

Beyond regulations, sustainability initiatives led by both public and private entities are catalyzing transformation across the industry. Initiatives like the Ellen MacArthur Foundation’s Circular Fashion Initiative and the United Nations Sustainable Development Goals (SDGs) are urging brands to minimize textile waste, utilize eco-friendly materials, and shift towards circular business practices.

Obstacles in Textile Recycling

Even with the increasing demand for methods to manage textile waste, one of the primary limitations in this market is the technical and financial hurdles linked to textile recycling. In contrast to materials such as plastic, glass, and paper, textiles form intricate waste streams composed of various natural and synthetic fibers, dyes, and chemical treatments, complicating efficient recycling processes. A significant number of garments consist of blended materials which necessitate advanced chemical separation technologies to decompose fibers while maintaining their quality. The substantial costs related to sorting, processing, and recycling textiles further restrict the growth of this market. Conventional mechanical recycling techniques often yield low-grade fibers unsuitable for high-quality applications, whereas chemical recycling technologies, despite their potential, remain costly and demand considerable infrastructure investments.

AI-Enhanced Smart Sorting and Digital Waste Monitoring

A significant opportunity within the textile waste management sector is the application of Artificial Intelligence and digital waste monitoring technologies, potentially transforming the manner in which textile waste is gathered, sorted, and recycled. Conventional methods of textile sorting are labor-intensive and ineffective, yet AI-powered computer vision and machine learning algorithms can autonomously identify fabric types, colors, and fiber compositions, enhancing sorting precision and recycling rates. Companies are pouring resources into AI-based waste management systems that utilize high-resolution cameras and spectroscopic sensors to recognize and separate textiles according to their material makeup, brand labels, and condition. This technology is being embraced in automated recycling facilities, facilitating quicker processing and minimizing contamination within recycling streams. AI-driven sorting can markedly boost the efficiency of fiber regeneration processes, enabling recyclers to generate higher-quality recycled textiles with fewer processing stages.

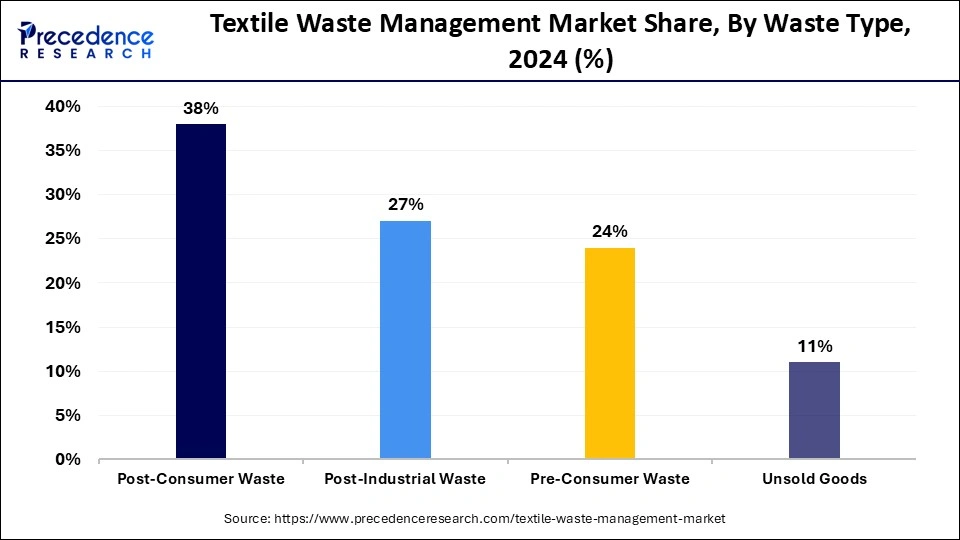

The post-consumer waste segment dominated the textile waste management market with the largest market share, fueled by the rising volume of discarded clothing, home textiles, and footwear from consumers globally. The advent of fast fashion, excessive consumption, and regular clothing disposal has resulted in a significant surge in textile waste, a large portion of which is directed toward landfills or incineration facilities. In reaction, governments and organizations are launching textile collection initiatives, take-back programs, and resale platforms to mitigate post-consumer waste and advance a circular economy.

The post-industrial waste segment is the fastest growing segment with a significant CAGR during the forecast period, as textile producers and manufacturing facilities aim to decrease production waste and enhance sustainability practices. Post-industrial waste includes remnants, cuttings, defective materials, and excess production resources generated during the processes of fabric creation, dyeing, and garment assembly.

The recycling sector dominated the market with the largest market share, driven by the rising demand for recycled textiles, circular fashion, and sustainable raw materials. Textile recycling encompasses mechanical and chemical processes that extract fibers from discarded textiles, turning them into new fabrics, insulation materials, industrial rags, and eco-friendly clothing. With brands increasingly pledging to use recycled fibers, companies are investing in cutting-edge textile recycling facilities, AI-enabled sorting technologies, and chemical depolymerization methods to enhance fiber recovery rates and the quality of recycled fabrics.

The waste-to-energy segment is the fastest growing segment with a significant CAGR during the forecast period, as textile waste that cannot be effectively recycled is increasingly converted into biofuels, synthetic gas, and thermal energy. As landfill restrictions become more stringent, waste-to-energy solutions present an alternative disposal method that aids in the reduction of textile waste pollution while producing renewable energy.

The textile manufacturers segment dominated the market with the largest market share, as factories and production units produce significant quantities of fabric waste during weaving, dyeing, printing, and garment assembly. Manufacturers face increasing pressure to lessen their environmental impact, with regulations mandating the reduction of production waste, adoption of sustainable sourcing, and implementation of closed-loop recycling systems.

The retailers segment is the fastest growing segment with a notable CAGR during the forecast period, as fashion brands, online platforms, and physical stores become more engaged in textile waste management through take-back initiatives, resale platforms, and sustainable supply chain strategies. The transition towards circular fashion business models is motivating retailers to collect, recycle, and repurpose discarded garments, providing consumers with options like clothing repair, resale, rentals, and upcycling services.

Additionally, the emergence of AI-driven resale platforms like ThredUp, The RealReal, and Depop is assisting retailers in extending the lifespan of garments and decreasing fashion waste, contributing to the rapid expansion of this segment.

The natural fibers segment dominated the market with the largest market share, as materials like cotton, wool, silk, and linen are commonly utilized in apparel and home textiles. Natural fibers break down more rapidly than synthetic options, facilitating their processing in organic waste recycling and composting systems. The rise in demand for sustainably sourced and organic natural fibers has prompted increased initiatives to recover and recycle cotton and wool waste. The mechanical recycling of natural fiber textiles enables the creation of new yarns, insulation products, and industrial fabrics, decreasing the dependence on virgin fiber production.

The synthetic fibers segment is the fastest growing segment for the foreseen period, as synthetic textiles like polyester, nylon, and acrylic constitute a significant part of global textile output and waste. Synthetic fibers present major environmental issues due to their non-biodegradable nature and the release of microplastics into the environment upon disposal. However, progress in chemical recycling and fiber regeneration technologies is fueling the growth of synthetic fiber recycling.

Companies such as Reju and Spinnova are pioneering innovative techniques to decompose polyester and nylon textiles into their fundamental chemical components, enabling them to be transformed into new, high-quality synthetic fibers.

By Waste Type

By Processing Method

By End User

By Material Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

September 2024

February 2025