November 2024

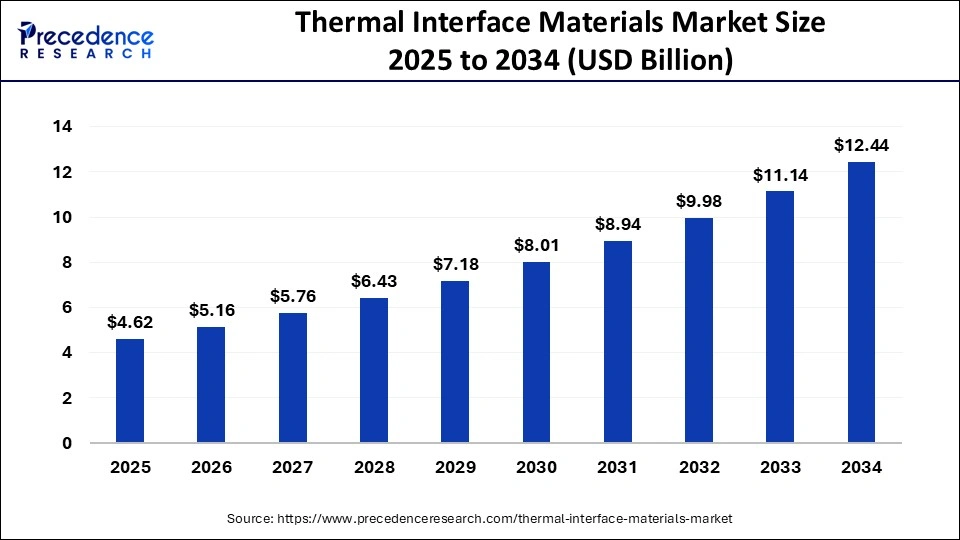

The global thermal interface materials market size is calculated at USD 2.06 billion in 2025 and is forecasted to reach around USD 4.97 billion by 2034, accelerating at a CAGR of 11% from 2025 to 2034. The Asia Pacific market size surpassed USD 1.86 billion in 2024 and is expanding at a CAGR of 11.40% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global thermal interface materials market size was estimated at USD 1.86 billion in 2024 and is predicted to increase from USD 2.06 billion in 2025 to approximately USD 4.97 billion by 2034, expanding at a CAGR of 11% from 2025 to 2034.

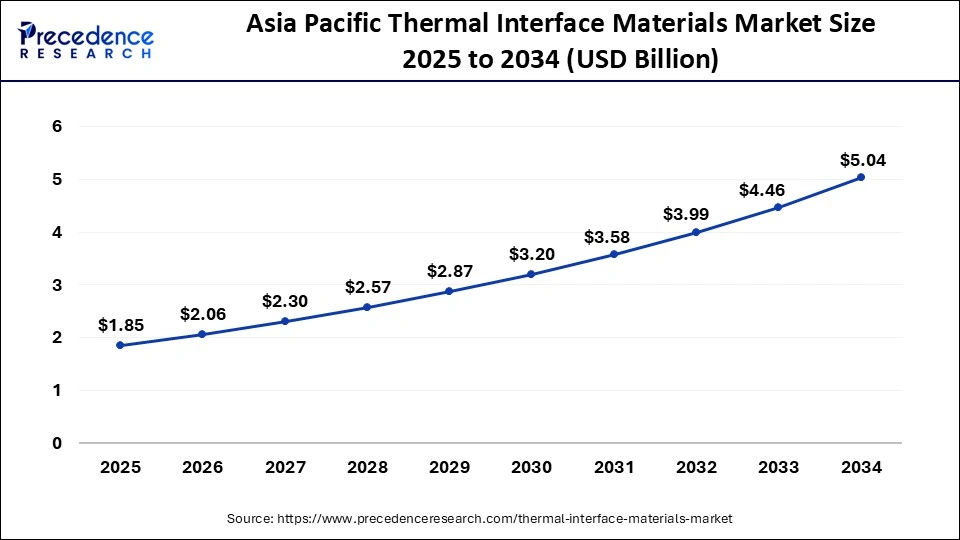

The Asia Pacific thermal interface materials market size was valued at USD 1.86 billion in 2024 and is expected to be worth USD 4.97 billion by 2034, with a notable CAGR of 11.40% from 2024 to 2034.

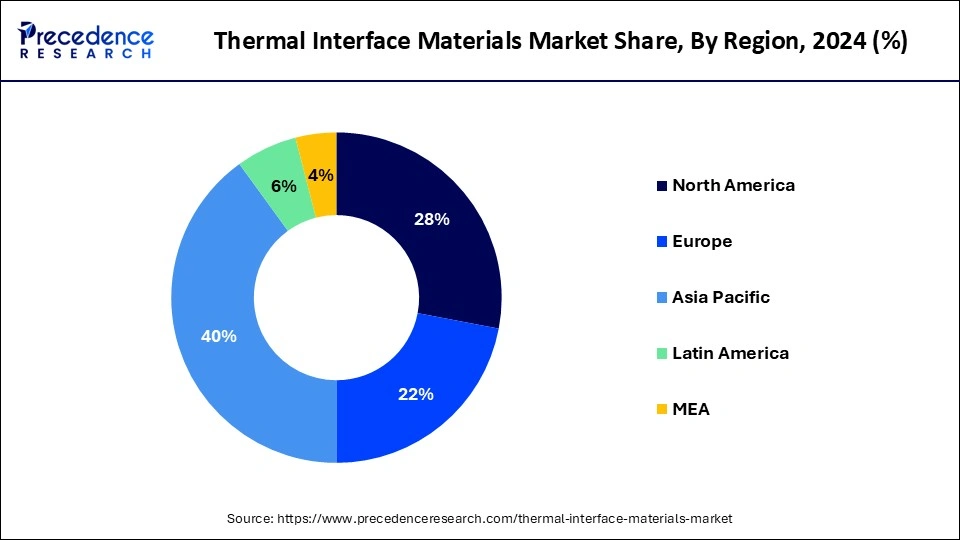

The Asia Pacific led the market with the highest revenue share of more than 40% in 2024 owing to the presence of large manufacturing base for various industries in the region. Apart from the manufacturing base, reduced corporate taxes, increase in household incomes, drop in Goods & Services Tax (GST), health awareness among consumers, favorable government policies, and changing lifestyle has potentially influenced the growth of the thermal interface materials industry in the region.

North America and Europe were the other most promising markets in the thermal interface material; however the sales in the region was deeply impacted with the outbreak of COVID-19 that has declined the share contribution of the region to the market, as most of the parts & components and products for medical devices and automotive industry were imported from China. Besides this, the healthcare sector in the region seems to have a promising future, thereby impel the market growth for the thermal interface materials in the regions.

Increasing consumer dependence on electronic items like tablets, smartphones, the advent of advanced electronics for the automotive industry, and rising affluence among the middle-class population expected to prosper significant demand for the product among various manufacturers across the globe.

In addition, the thermal interface materials are known to offer effective heat management solutions that are essential in improving the overall performance of a device, this in turn expected to fuel the growth of the industry over the forecast time period.

| Report Highlights | Details |

| Market Size in 2034 | USD 4.97 Billion |

| Market Size in 2025 | USD 2.06 Billion |

| Market Size by 2024 | USD 1.85 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 11% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2033 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Thermal greases & adhesives led the global thermal interface materials market accounting for a value share of more than 39.13% in the year 2024 because of its significant application in consumer products along with high thermal resistance property of the product. To ensure smooth working of an electronic devices greases & adhesives are largely used to maintain the internal working temperature of the device. This has been encountered that several electronic devices get heated while running for a longer time period such as computers, industry machinery, and automotive electronics, among others.

The elastomeric pads expected to possess significant value share in the market for thermal interface materials on the basis of its easy assembly compared to greases & adhesives. In addition, with the implementation of elastomeric pads, handling mechanism of the device improved as well as there is less chance of degrading interface resistance. Henceforth, the segment anticipated to witness prominent growth over the upcoming years. Besides this, high unit costs coupled with limited application scope of the product projected to hinder the market growth during the estimated timeframe.

On the other hand, phase change product exhibits the fastest growth rate in the thermal interface materials market during the analysis period. This is mainly attributed to the major application of phase changer in construction activity because the demand for temperature maintenance inside residential as well as commercial buildings. The thermal interface materials acts as a heat storage where heat gets absorbed during summer season and the retained heat can be further used during the winter times to manage and control the temperature difference.

The computer application accounted for the maximum market share of more than 27% in 2024 because of its increasing utilization in offices. Further, the affordable prices of desktops have impelled the demand as well as supply of the product. Further, rising globalization along with increasing penetration of internet particularly in the developing regions such as India, China, and Korea further expected to propel the demand for the computers worldwide. Moreover, the post-pandemic times did not hamper the market for computers; rather with the rise in the number of people opting working from home, the sales, upgradation, and installation of computers have risen prominently over the past few months.

On the contrary, the telecom application expected to witness remarkable demand during the upcoming time period mainly due to the rising preference for a cashless and digital economy. The banks, utilities, e-commerce, and media are dependent on the telecom sector for its operations and telecom seems to be their lifeline. Hence, the growth in the above-mentioned industries likely to support the growth of telecom sector over the analysis timeframe.

This research study comprises complete assessment of the market by means of far-reaching qualitative and quantitative perceptions, and predictions regarding the market. This report delivers classification of marketplace into impending and niche sectors. Further, this research study calculates market size and its development drift at global, regional, and country from 2021 to 2033. This report contains market breakdown and its revenue estimation by classifying it on the basis of product, application, and region:

By Product

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2025

January 2025

September 2024