What is the Thermal Management Market Size?

The global thermal management market size was calculated at USD 16.82 billion in 2025 and is predicted to increase from USD 18.51 billion in 2026 to approximately USD 43.42 billion by 2035, expanding at a CAGR of 9.95% from 2026 to 2035.

Thermal Management Market Key Takeaways

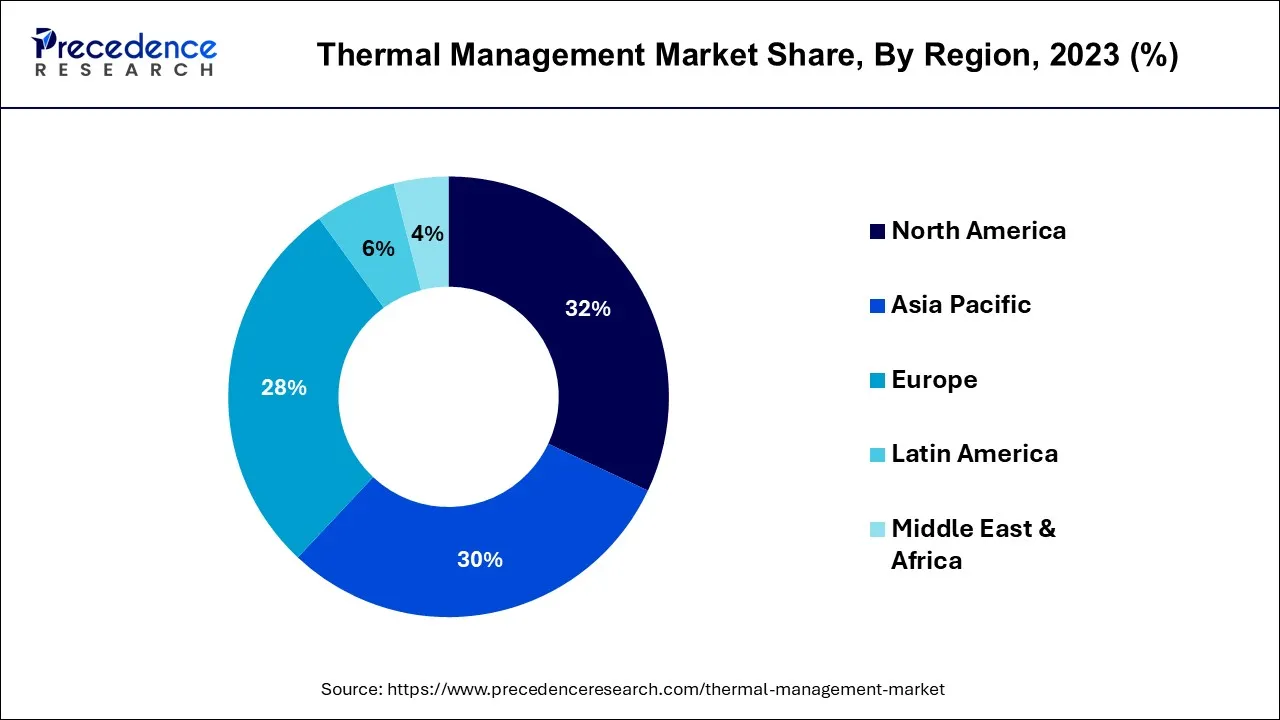

- North America contributed more than 32% of the revenue share in 2025.

- Asia-Pacific is expected to expand at the fastest CAGR during the forecast period.

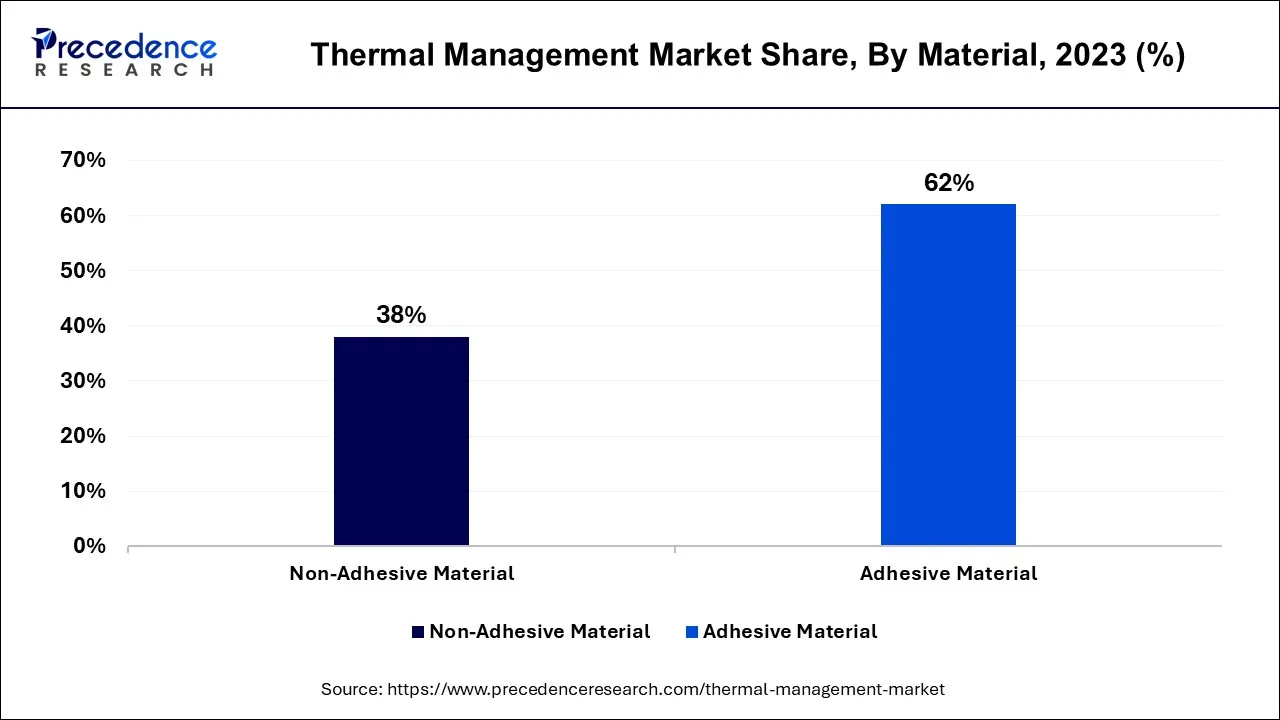

- By Material, the adhesive material sector segment has held the largest revenue share of 62% in 2025.

- By Material, the Non-adhesive materials segment is anticipated to grow at the fastest CAGR of 7.8% during the projected period.

- By Device, the Conduction cooling devices segment had the largest market share of 31% in 2025.

- By Device, the Convection cooling devices are expected to expand at the fastest rate over the projected period.

- By Service, the Installation and calibration services had the biggest market share of 56.8% in 2025.

- By Service, the Optimization and post-sales Service is projected to grow at the fastest rate over the projected period.

- By End User, the consumer electronics segment captured the highest revenue share of 34.9% in 2025.

- By End User, the Automotive segment is anticipated to expand at a significant CAGR of 8.6% over the predicted period.

Market Overview

Thermal management refers to the strategies and technologies employed to regulate and dissipate heat generated by electronic components, machinery, or industrial processes. The primary goal is to maintain optimal operating temperatures to ensure equipment reliability, longevity, and performance. This involves utilizing methods such as heat sinks, fans, thermal interface materials , and liquid cooling systems to efficiently transfer or disperse heat away from critical components. Effective thermal management is crucial in various sectors including electronics, automotive, and aerospace to prevent issues like overheating, component failures, and performance degradation due to excessive heat. By maintaining optimal temperatures, thermal management enhances overall efficiency and extends the operational lifespan of devices and systems.

Thermal Management Market Growth Factors

Industry trends encompass the adoption of advanced materials such as phase-change materials and graphene-based solutions, which offer superior thermal conductivity. Additionally, liquid cooling systems and AI-driven thermal management are gaining prominence for their efficiency and adaptability.

Key growth drivers include the rapid advancement of technology, leading to the development of more powerful yet compact electronic devices. These advancements necessitate effective thermal management solutions to maintain optimal operating temperatures. Moreover, the automotive industry's shift towards electric vehicles (EVs) and the aerospace sector's quest for lightweight, high-performance materials have further fueled the demand for innovative thermal management solutions. However, the market faces challenges related to environmental concerns and the push for more sustainable solutions. The disposal of electronic waste and the environmental impact of certain thermal management materials are areas of growing scrutiny.

The thermal management market, while facing challenges, offers substantial business opportunities. Companies stand to benefit from the increasing demand for effective cooling solutions, particularly in sectors like data centers , automotive, and electronics. Furthermore, the market holds promise for those investing in sustainable and eco-friendly thermal management technologies, aligning with the global emphasis on environmental sustainability. These factors underscore the potential for growth and innovation within the thermal management industry, as it continues to play a crucial role in maintaining the performance and longevity of various devices and systems.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 9.95% |

| Market Size in 2025 | USD 16.82 Billion |

| Market Size in 2026 | USD 18.51 Billion |

| Market Size by 2035 | USD 43.42 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Material, By Device, By Service, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising electronics, IT infrastructure, and automotive electrification

The thermal management market experiences surging demand due to the expanding electronics and IT infrastructure, as well as the electrification of the automotive industry. The thermal management market experiences rising demand due to the growing prevalence of electronic devices, data centers, and the Internet of Things (IoT). Efficient cooling solutions are essential to maintain these systems' optimal performance and prevent overheating. This trend is further accelerated by the increasing adoption of advanced electronics in daily life, spanning smartphones, laptops, and connected appliances.

Automotive electrification, driven by the shift towards electric vehicles (EVs), presents another major growth driver. The increasing complexity of automotive electronics and the demand for extended battery life necessitate advanced thermal management systems. Efficient cooling is essential to ensure safe operating temperatures for EV batteries and components. As the automotive industry pivots towards sustainable and electric mobility solutions, the thermal management market finds itself at the forefront, poised for substantial expansion.

Restraints

Limited cooling efficiency and reliability issues

Limited cooling efficiency and reliability issues are significant restraints in the thermal management market. Inadequate cooling solutions pose a critical challenge in industries like data centers, where even a minor disruption due to overheating can lead to significant financial losses and operational disruptions. Thermal management inefficiencies result in electronic components and systems overheating, causing reduced performance and potentially premature failures. To mitigate these issues, there is a growing demand for more efficient and reliable cooling solutions in various sectors, driving innovation in the thermal management market.

Reliability concerns are particularly pronounced in applications like automotive and aerospace, where extreme operating conditions demand robust thermal management systems. The failure of these systems can lead to safety risks, which are unacceptable in these sectors. Additionally, limited cooling efficiency can result in increased energy consumption, negating efforts to achieve energy efficiency and sustainability goals. These restraints underscore the need for continuous innovation in thermal management technologies. Addressing cooling inefficiencies and enhancing reliability is crucial to unlocking the full potential of various industries that rely on advanced electronics and systems. Manufacturers must prioritize research and development efforts to overcome these challenges and ensure that thermal management solutions keep pace with the evolving demands of modern technology.

Opportunities

Advanced cooling solutions and sustainability energy efficiency

Advanced cooling solutions are revolutionizing the thermal management market by addressing the increasing heat dissipation challenges in various industries. As electronic devices become more compact and powerful, conventional cooling methods often fall short. Advanced cooling solutions, such as liquid cooling systems, phase change materials, and innovative heat sinks, are enabling more efficient heat transfer and dissipation. These technologies offer higher thermal conductivity and better temperature control, ensuring that critical components operate within safe temperature limits. As a result, industries like data centers, automotive, and aerospace can achieve higher performance levels, longer component lifespans, and improved overall reliability.

Moreover, sustainability and energy efficiency are becoming paramount in the thermal management market. Innovative technologies that recycle waste heat, harness renewable energy sources for cooling, and employ more efficient cooling methods are gaining prominence. Businesses and industries recognize the dual benefits of cost savings and environmental responsibility offered by sustainable thermal management solutions. Consequently, the thermal management market is experiencing a surge in demand driven by the imperative to reduce energy consumption and minimize the carbon footprint across various sectors.

Segment Insights

Material Insights

The adhesive material sector held a 62% revenue share in 2025. Adhesive materials in the thermal management market typically refer to thermally conductive adhesives or compounds. These materials are designed to bond electronic components or heat sinks to dissipate heat effectively. A trend in adhesive materials is the development of high-performance, low-thermal-resistance adhesives that enable efficient heat transfer while maintaining strong bonds.

The Non-adhesive materials segment is anticipated to expand at a significant CAGR of 7.8% during the projected period. Non-adhesive materials in thermal management encompass substances like phase change materials (PCMs) and thermal interface materials (TIMs). PCMs absorb and release heat during phase transitions, providing efficient cooling. TIMs enhance heat transfer between components and heat sinks. Trends in non-adhesive materials include the integration of advanced PCMs with high thermal conductivity and the development of TIMs with excellent thermal stability and low thermal resistance, improving overall thermal management efficiency.

Device Insights

Conduction cooling devices held the largest market share of 31% in 2025. Conduction cooling devices are components or systems that transfer heat through direct physical contact, typically utilizing materials with high thermal conductivity like copper or aluminum. These devices are crucial for efficiently dissipating heat from electronic components such as microprocessors . A trend in the thermal management market is the development of advanced conduction cooling solutions that offer improved thermal conductivity, reduced form factors, and enhanced reliability, catering to the ever-increasing demand for high-performance and miniaturized electronics.

The Convection cooling devices are projected to grow at the fastest rate over the projected period. Convection cooling devices, on the other hand, rely on fluid dynamics, such as natural or forced airflow, to carry away heat. The market trend for convection cooling devices involves the integration of smart and energy-efficient cooling solutions, leveraging innovations like variable-speed fans, optimized airflow designs, and intelligent thermal management systems to maintain optimal temperatures in various applications, from data centers to electric vehicles.

Service Insights

In2025, the Installation & Calibration services had the highest market share of 56.8% on the basis of the service. Installation & Calibration services in the thermal management market involve the initial setup and fine-tuning of cooling systems, ensuring they operate at optimal performance levels. A key trend in this segment is the growing demand for turnkey solutions that offer hassle-free installation and precise calibration, reducing downtime and enhancing system efficiency.

The Optimization and post-sales Service is anticipated to expand at the fastest rate over the projected period. Optimization & Post-sales Service encompasses ongoing maintenance, monitoring, and upgrades to maximize the lifespan and efficiency of thermal management systems. This trend is driven by the increasing focus on predictive maintenance, where data analytics and remote monitoring are used to proactively identify potential issues and optimize performance, ultimately reducing operational costs and ensuring uninterrupted operation.

End User Insights

The consumer electronics segment held the largest revenue share of 34.9% in2025. Growing demand for smaller, more powerful devices with efficient cooling solutions. This trend is driven by the continuous miniaturization of electronics and the need to dissipate heat generated by high-performance components like processors and GPUs. Thermal management solutions for consumer electronics are increasingly focused on compact, high-performance heat sinks and advanced materials to ensure effective heat dissipation while maintaining sleek and slim device designs.

The Automotive segment is anticipated to grow at a significantly faster rate, registering a CAGR of 8.6% over the predicted period. Electrification of vehicles. Electric vehicles (EVs) require efficient thermal management systems to maintain battery temperature and overall vehicle performance. Key trends include the development of advanced cooling systems, such as liquid cooling and innovative materials, to optimize EV battery efficiency and extend their lifespan. Additionally, the integration of smart thermal management systems that adapt to driving conditions and maximize energy efficiency is becoming more prevalent in the automotive sector.

Regional Insights

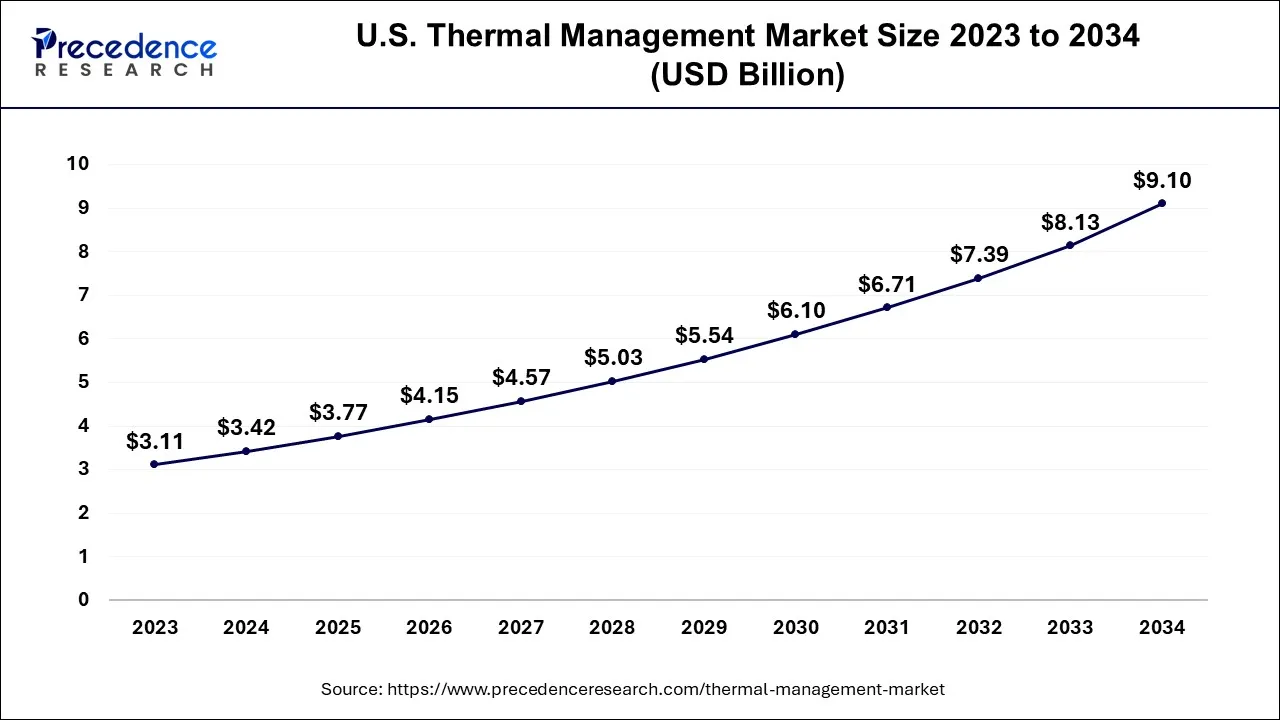

U.S. Thermal Management Market Size and Growth 2026 to 2035

The U.S. thermal management market size was accounted at USD 3.77 billion in 2025 and is projected to be worth around USD 9.92 billion by 2035, poised to grow at a CAGR of 10.16% from 2026 to 2035.

North America has held the largest revenue share 32% in 2025. In North America, the thermal management market is witnessing robust growth driven by the increasing adoption of advanced cooling solutions in data centers, automotive, and aerospace industries. There's a growing trend towards more efficient and eco-friendly thermal management technologies to meet sustainability goals. Additionally, the region places significant emphasis on innovations in electric vehicle (EV) thermal management to support the burgeoning EV market.

U.S. Thermal Management Market Analysis

The market in the U.S. is growing due to rising demand for efficient heat dissipation in data centers, electric vehicles, consumer electronics, and advanced manufacturing. Rapid adoption of high-performance computing, 5G infrastructure , and power-dense electronic systems is increasing the need for advanced cooling solutions. Additionally, strict energy efficiency regulations and strong R&D investments are accelerating innovation and market expansion.

Why is Asia Pacific Considered the Fastest-Growing Region in the Thermal Management Market?

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region is experiencing rapid industrialization and urbanization, driving the demand for efficient thermal management solutions. In this dynamic market, there's a growing focus on data center cooling and automotive thermal management, aligning with the region's technological advancements. The push for sustainability and energy efficiency is also promoting the adoption of eco-friendly thermal management technologies across various industries, making Asia-Pacific a key player in the global thermal management market.

India Thermal Management Market Analysis

India is a major contributor to the market within Asia Pacific. The market in India is growing rapidly due to government regulations surrounding energy efficiency and the adoption of advanced thermal systems across industries. Moreover, there is a strong focus on reducing emissions, contributing to the market growth.

What Influences the Market within Europe?

In Europe, the thermal management market is characterized by a focus on sustainability and energy efficiency. The region is at the forefront of adopting green thermal management technologies in response to stringent environmental regulations. Thermal management solutions for renewable energy systems and electric vehicles are gaining traction. The European market showcases a strong commitment to reducing carbon emissions through efficient cooling and heating processes across industries.

How is the Opportunistic Rise of Latin America in the Thermal Management Market?

Latin America is expected to experience lucrative growth in the market due to increasing industrialization, growing adoption of electric vehicles, and expansion of data centers and telecommunications infrastructure. Countries such as Brazil and Mexico are investing in advanced electronics, renewable energy, and manufacturing upgrades, which are driving demand for efficient cooling and heat dissipation solutions.

- In June 2025, Brazil, Italy, and the UN Environment Program (UNEP) announced a new funding initiative on cooling action to address extreme heat through sustainable cooling.

What Opportunities Exist in the Middle East & Africa for the Thermal Management Market?

The Middle East & Africa (MEA) offers immense opportunities for the market, driven by rapid industrialization, growing data center deployments, and increased adoption of electric vehicles. Investments in renewable energy, power generation, and advanced electronics are boosting demand for efficient cooling and heat dissipation solutions. Additionally, government initiatives supporting infrastructure development and smart city projects are encouraging the use of innovative thermal management technologies across the region.

Thermal Management Market Companies

- Aavid Thermalloy, LLC

- Advanced Cooling Technologies, Inc.

- Boyd Corporation

- Delta Electronics, Inc.

- Fujikura Ltd.

- Gentherm Incorporated

- Honeywell International Inc.

- Laird Thermal Systems

- Master Bond Inc.

- Paker Hannifin Corporation

- Siemens AG

- STMicroelectronics

- Thermacore, Inc.

- Vertiv Holdings Co

- Wakefield-Vette, Inc.

Recent Developments

- In November 2025, Boyd Corporation announced the sale of its thermal business to Eaton for $9.5 billion to boost its engineered materials business with opportunities in rapidly growing markets. (Source: boydcorp.com )

- In October 2025, Trane Technologies launched the industry's first comprehensive thermal management system reference design for NVIDIA Omniverse DSX, targeting gigawatt-scale AI data centers. The solution delivers high performance, scalability, and rapid deployment to support the most demanding AI infrastructure. (Source: investors.tranetechnologies.com )

- In September 2025, Fujikura Ltd. announced the investment in Commonwealth Fusion Systems LLC to drive the commercialization of fusion energy reactors. (Source: fujikura.co.jp )

- In 2022, Intel's Mobileye strengthened its partnerships with Ford and Volkswagen (VW), introducing the new EyeQ chip. Ford will incorporate Mobileye's REM mapping technology into its hands-free driving system, BlueCruise. This expansion signifies Mobileye's commitment to advancing autonomous driving technology with key automotive industry players.

- In 2021,Qualcomm acquired NUVIA, enhancing its technology roadmap for computing performance. This move aims to accelerate partnerships with operating system providers and empower Samsung and the mobile ecosystem to redefine premium performance in smartphones, marking a significant step forward in the computing industry.

Segments Covered in the Report

By Material

- Adhesive Material

- Non-Adhesive Material

By Device

- Conduction Cooling Device

- Convection Cooling Device

- Advance Cooling Device

- Others

By Service

- Installation & Calibration

- Optimization & Post sales Service

By End User

- Consumers Electronics

- Service & Data Centers

- Automotive

- Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting