January 2025

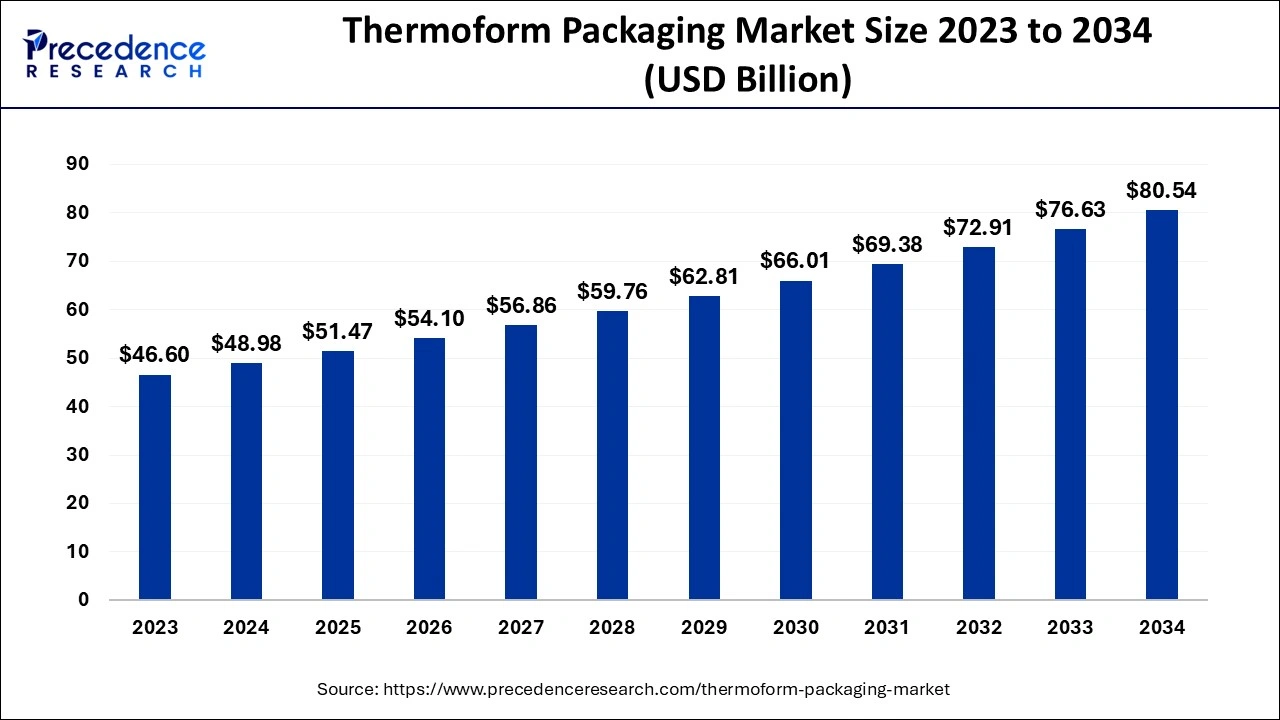

The global thermoform packaging market size accounted for USD 48.98 billion in 2024, grew to USD 51.47 billion in 2025 and is predicted to surpass around USD 80.54 billion by 2034, representing a healthy CAGR of 5.10% between 2024 and 2034. The North America thermoform packaging market size is calculated at USD 13.71 billion in 2024 and is expected to grow at a fastest CAGR of 5.27% during the forecast year.

The global thermoform packaging market size is estimated at USD 48.98 billion in 2024 and is anticipated to reach around USD 80.54 billion by 2034, expanding at a CAGR of 5.10% from 2024 to 2034.

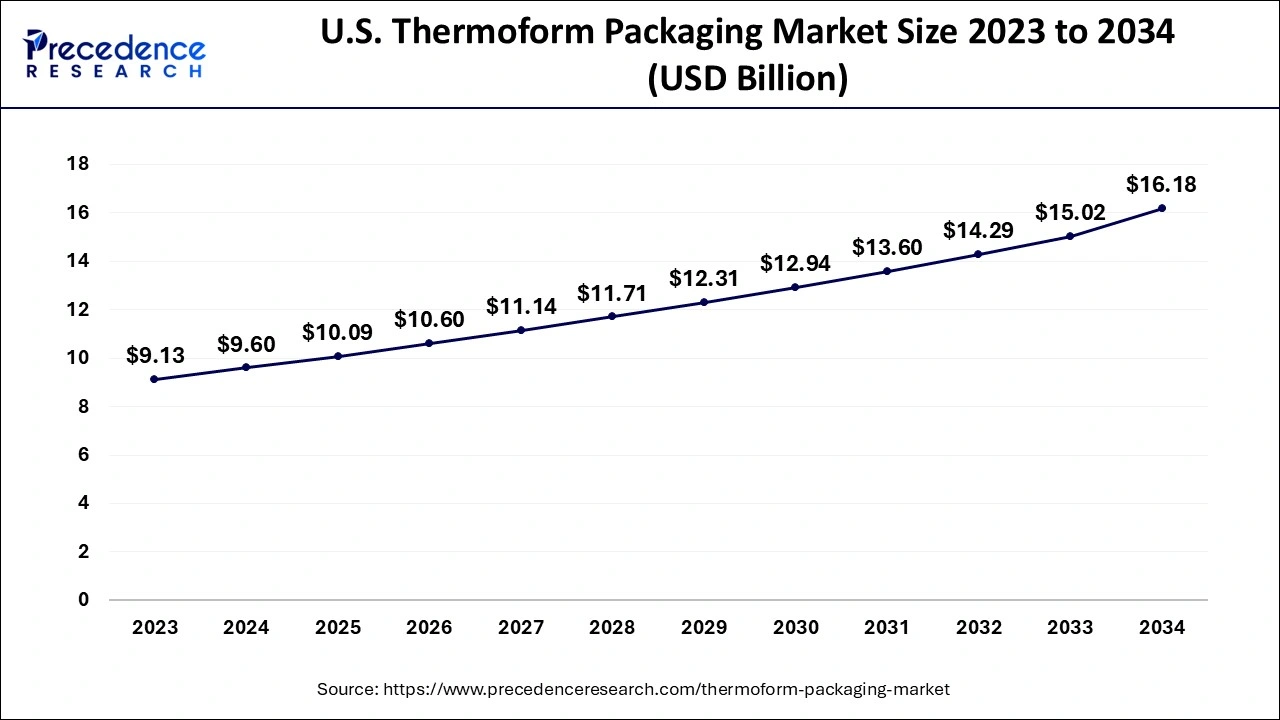

The U.S. thermoform packaging market size is evaluated at USD 9.60 billion in 2024 and is predicted to be worth around USD 16.18 billion by 2034, rising at a CAGR of 5.34% from 2024 to 2034.

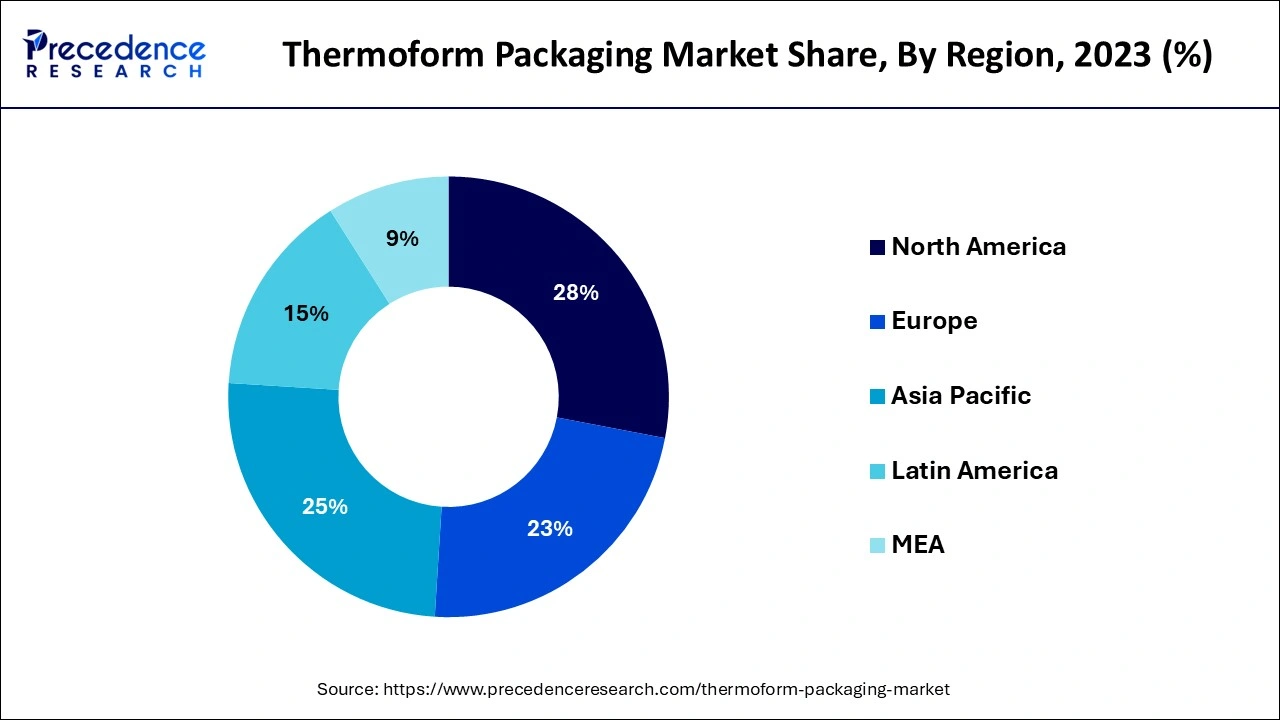

North America dominated the market in 2023. The extensive presence of large-sized packaged food firms, as well as the great penetration of organized retail, led to the region's high market share in 2023. Furthermore, the existence of large-scale thermoform packaging producers that aspire for a larger market share by offering innovative products aided the region's growth. High use of frozen meat and packaged bread items also contributed to the area market.

Asia Pacific, on the other hand, is expected to be the largest and fastest-growing regional market from 2024 to 2034. The primary drivers driving the regional market include an increase in nuclear households, which raises demand for single-serve packaging, an increasing elderly population, and increased penetration of organized retail in countries such as China and India. Europe is predicted to develop slowly during the projection period due to severe controls on the use of plastic goods and increased awareness about sustainability, which is paving the way for paper- and pulp-based packaging and stifling market growth.

Thermoforming is the plastic moulding technology that manufactures a wide range of extremely useful items. Thin plastic sheeting are heated throughout this process of manufacturing them easier to manipulate. A sheet is created over a male or female mould once it has reached a malleable temperature. The completed product is trimmed after it has been cooled to a final shape in order to maximize its usage. The major kinds of thermoforming are vacuum forming and pressure forming. Heat and pressure are used to pull plastic sheets into their final arrangement during vacuum forming. After heating a sheet and placing it over a mould, a vacuum is used to mold it into the required form. Pressure forming is comparable to vacuum forming, but with the extra advantage of more pressure. This pressure allows for more detail and structure, making it an excellent choice when aesthetic is important.

Increased supply for prepared foods, particularly ready meals and boxed meat and fish items, is expected to drive market growth during the projected period, as will worldwide expansion of organised and e-retail channels. During the thermoforming process, the thermoplastic sheets is heated to soften temperature and then moulded into the desired shape using castings. To create the finished items, these sheets are often subjected to heat, suction, and pressure. Thin-gauge thermoforming & thick-gauge thermoforming are the two main forms of thermoforming.

Furthermore, the cost - effectiveness and convenience of shipping of blisters entice producers to use the product. Thin-gauge thermoforming & thick-gauge thermoforming are the two main forms of thermoforming. Trays blister, and containers made of thin-gauge thermoformed materials are extensively used during packaging of food, medications, electronic parts, and home care items. The pharmaceutical industry in the United States has experienced a shift away from traditional bottle and more towards blister packaging for the packing of oral solid doses. This shift is partly owing to blisters & improved moisture and oxygen resistance for individual solid doses. Furthermore, the low cost and ease of transportation of blisters are enticing pharmaceutical makers to employ the product. Because thermoform packaging products are inexpensive, lightweight, and have a high visual appeal, they are commonly used by packaged food makers.

Furthermore, the growing popularity of Modified Atmosphere Packaging (MAP) for food items, in which a regulated gaseous mixture is used within thermoform containers to improve food product shelf life, is likely to drive market expansion in the coming years. Rising demand for single-serve packaging as a result of rising on-the-go food consumption is likely to be a key driver of market expansion. However, growing interest in sustainable packaging is encouraging end-user manufacturers to use flexible packaging that requires fewer raw materials and can be transported and handled more effectively. This factor is projected to stifle market expansion throughout the forecast period.

Thermoform packaging is a moulded product generated using the thermoforming process, which includes heating and applying pressure to mould plastic into the required shape. It is very less complicated and also less expensive relatively with other plastic moulding and forming procedure. Thermoplastic sheets are heated up to malleable point, and then moulded until cools to manufacture final product. Thermoforming packaging is protection, lightweight, reusability, and cost-effectiveness. It is widely used in variety of the industries including electronics, food and beverage, pharmaceuticals, personal care, and the automotive industry. Rising demand for the thermoform packaging in food and beverage, pharmaceutical industries for packaging of the products drives the market growth the forecast period.

Thermoforming technology has advanced to enable customized packaging alternatives that attract customers and increase the possibility of acquisition at the point of sale. Prototyped of new packaging items in a short period of time. Furthermore, rising need for lightweight packaging drives the growth of thermoform packaging market in the forecast period. To tackle cost challenges all through the value chain, some manufacturers have started to adopt lightweight packing goods. Furthermore, sustainable, bio-derived, and reusable polymers are preferred over traditional petroleum-based polymers. As a result, widespread concern about the discharge of plastic products and packaging, as well as stringent government regulations on plastic products and packaging, are projected to impede global market growth. Despite the fact that polyethylene terephthalate (PET) is recyclable, the application of strong adhesive stickers on the surface of PET packaging renders its non-recyclable.

The use of multiple resins in plastics manufacture boosts the expense of recycling thermoform packing. However, advancements in thermoforming technologies and packaging design and implementation are projected to give appealing opportunities for the global thermoform manufacturing market to thrive.

| Report Coverage | Details |

| Market Size in 2024 | USD 48.98 Billion |

| Market Size by 2034 | USD 80.54 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.10% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Product, Heat Seal Coating, End User and Geography |

The PET segment dominated the market in 2023. PET materials features such as high tensile strength, light weight, and recyclability drive demand, resulting in expansion. Furthermore, PET absorbs little water and therefore does not interact with food or beverages. Because of these properties, it is a good choice for packing consumable commodities. PET grades such as R-PET, C-PET, and A-PET are used to make thermoform packaging. Amorphous Polyethylene Terephthalate (A-PET) is a translucent polymer that is ideal for manufacturing containers for displaying various commodities, such as confectionery products. Crystalline polyethylene terephthalate or C-PET can withstand high temperatures, making it an ideal for oven-ready and frozen food packaging.

End-use firms increasingly prefer recycled polyethylene terephthalate, or R-PET, due to the increased need for ecofriendly and viable solutions. Polyvinyl chloride (PVC) is expected to boost at a substantial CAGR during analysis period owing to strong barrier qualities, is the shatter-resistant, lightweight, with having less expensive cost than the High-Density Polyethylene (HDPE) and also Polypropylene (PP). Polypropylene (PP) is another prominent market material, owing to its toughness. Furthermore, its high temperature tolerance makes it perfect for microwavable food product applications. Furthermore, PP helps to keep food fresh, which is why it is often utilized in food and beverage applications.

In 2023, the containers product type category led the global market with a highest revenue share. The widespread use of the thermoformed containers in a foodservice industry had contributed significantly to the segments high share. Due to rapid rising penetration of the food delivery services, particularly in emerging nations, the category will continue to grow at a stable rate in the future years. Another prominent product that is frequently used in the personal care, pharmaceutical, and electronics sectors is the blister. A blister pack is made up of a pocket or hollow into which the product to be packed is inserted, which is then sealed with paperboards or other many more materials like the aluminium foil or even the plastic.

From 2024 to 2034, the clamshell product sector is expected to grow at the quickest rate. Clamshells' high visual appeal promotes their demand in the retail industry. A clamshell is a container made up of two halves linked by a hinge that helps the container close. Clamshells are most often used in the food and beverage and technology sectors. Thermoformed trays are commonly used in the food business, particularly in supermarkets, to showcase a variety of items such as meat, fruits, and vegetables. The expanding penetration of cold chain and organized retail networks in emerging nations is expected to boost the expansion of the trays product type sector throughout the projected period.

In 2023, the food and beverage end-user industry category had the greatest revenue share. The extensive use of different items, such as containers, trays, and clamshells, by packaged food makers and foodservice outlets led to this segment's larger share. Increasing demand for convenience or packaged food items as a result of changing lifestyles is expected to enhance thermoform product penetration in the food & beverage end-use sector segment over the projected period. However, the segment's growth is projected to be hampered by the shifting demand for sustainable packaging options, such as moulded pulp products.

From 2024 to 2034, the pharmaceutical end-user industry category is expected to grow largest. The rapidly increasing global pharmaceutical sector, increased frequency of chronic illnesses, and an ageing population are the key reasons driving the segment's growth. Because of its excellent unit dosage packing, pharmaceutical firms favour thermoformed blisters. Another important end-user industrial category is electronics, where thermoform containers, clamshells, and blisters are used to package various electronics items such as headphones, batteries, mobile accessories, and others. Increasing e-commerce penetration has considerably contributed to the expansion of the electronics sector, which is expected to have a beneficial influence on segment growth in the future years.

By Material

By Product

By Heat Seal Coating

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025