December 2023

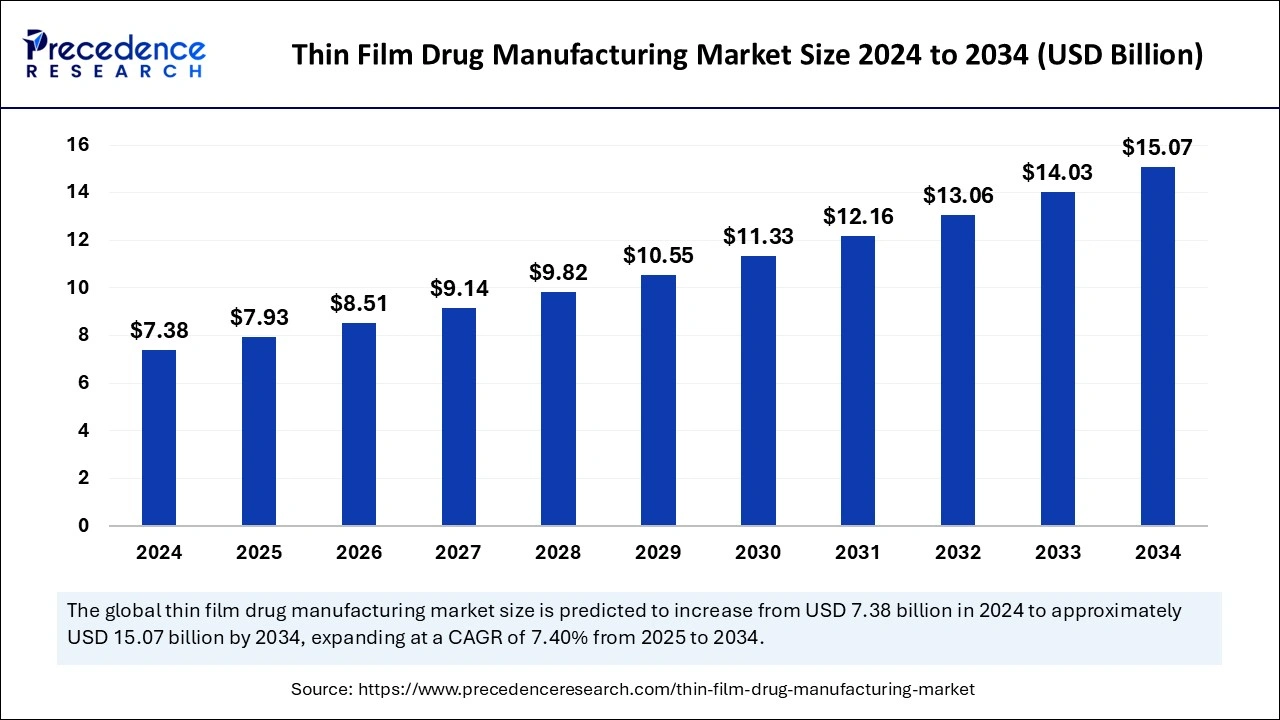

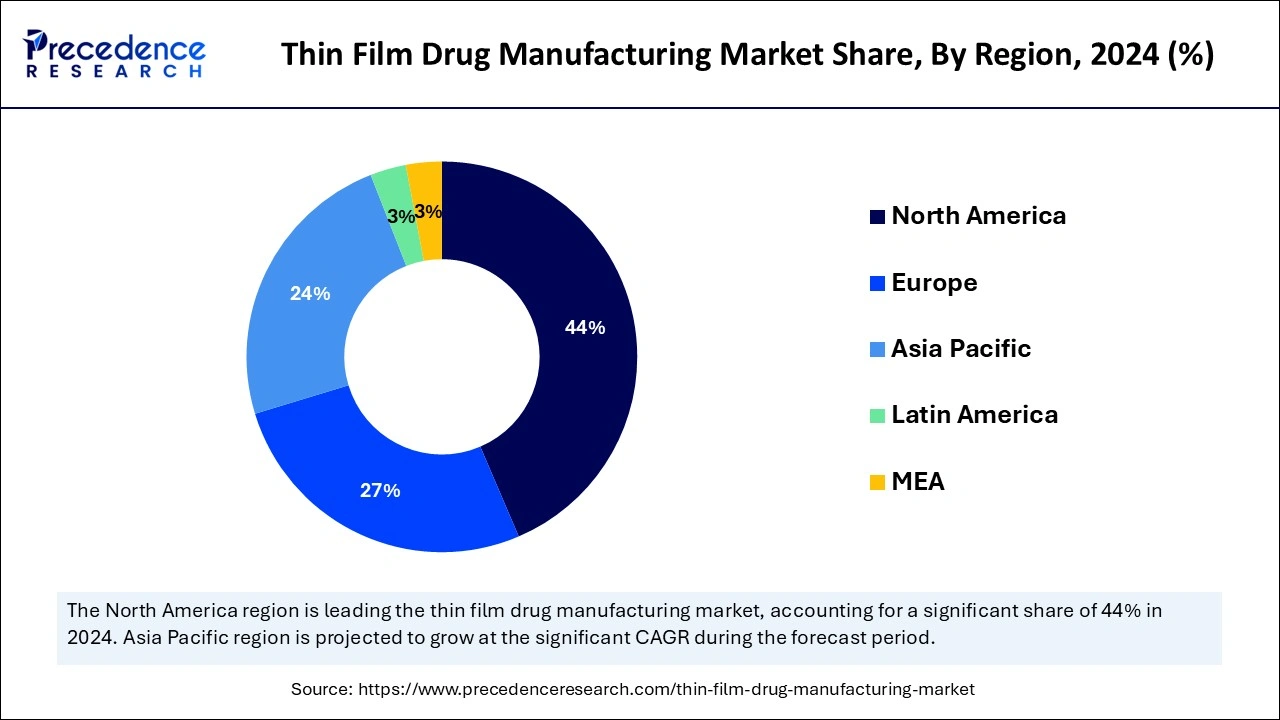

The global thin film drug manufacturing market size is accounted at USD 7.93 billion in 2025 and is forecasted to hit around USD 15.07 billion by 2034, representing a CAGR of 7.40% from 2025 to 2034. The North America market size was estimated at USD 3.25 billion in 2024 and is expanding at a CAGR of 7.38% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global thin film drug manufacturing market size was calculated at USD 7.38 billion in 2024 and is predicted to reach around USD 15.07 billion by 2034, expanding at a CAGR of 7.40% from 2025 to 2034. The demand for convenient and easy-to-use drugs is driving the growth of the global market. The need for fewer side effects and improved adherence to treatment is leveraging the market growth.

Artificial Intelligence algorithms have gained a crucial place in drug discovery and manufacturing over the past few years to improve the efficacy, safety, and pharmacokinetics of drugs. The application of AI in drug development and delivery has made them essential in drug manufacturing companies. Pharmaceutical companies have been committed to AI adoption for better data analysis and decision-making techniques. Moreover, the ability of AI to find biosimilars has extended their adoption in the development of personalized medicines.

The ongoing surge in oral thin film drug manufacturing has become a crucial adopter of AI. The ability of AI to enhance research and development processes, improve manufacturing efficiency, and facilitate personalized medicine plays a favorable role in the manufacturing of oral thin films. To improve consistency and quality according to resilient and adaptive consumer needs and demands, AI is transforming the tin film drug manufacturing procedures.

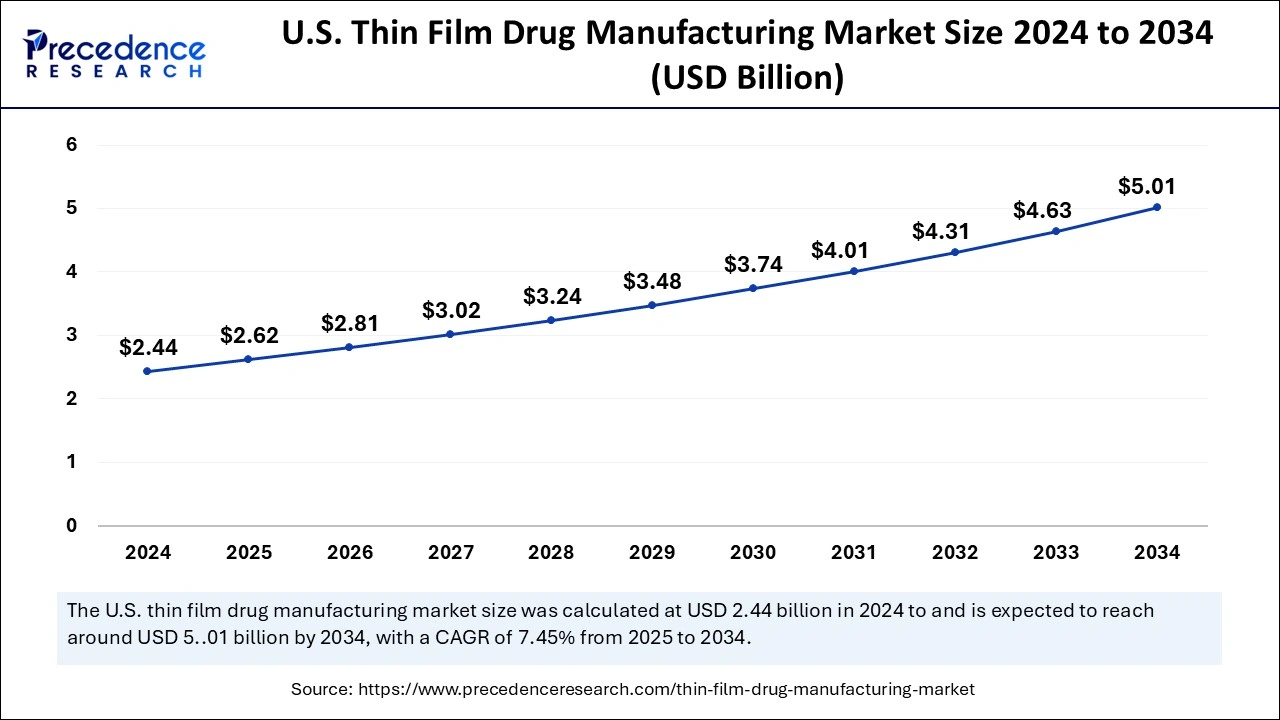

The U.S. thin film drug manufacturing market size was exhibited at USD 2.44 billion in 2024 and is projected to be worth around USD 5.01 billion by 2034, growing at a CAGR of 7.45% from 2025 to 2034.

North America contributed the biggest share of the thin film drug manufacturing market in 2024 due to the presence of advanced and well-established key competitors in the region. North America is the home for early adoption of advanced technologies, including thin film drug manufacturing, to enhance patient outcomes and drug delivery systems. Advancing healthcare infrastructure and government and regulatory investments in R&D are the major factors driving the growth of the market in North America. Moreover, regulatory approvals for novel, innovative technologies are further benefitting the region.

The United States is leading the regional market due to the rising prevalence of chronic disease in the country. A growing number of mental disorders are significantly driving the country's healthcare sector. Additionally, increased adoption of oral light film technology and government & regulatory incentives and investments for the development of innovative drugs and technologies are highly contributing to the market expansion. Canada, on the other hand, contributed a significant share of the regional market due to ongoing research and development activities for new polymeric thin films.

Asia Pacific is estimated to grow at the fastest CAGR in the thin film drug manufacturing market between 2025 and 2034 with the rising adoption of advanced technologies in the expanding healthcare sector. The growth is further being leveraged due to government investments in advising healthcare and pharmaceutical infrastructures. The rising prevalence of chronic disease in Asia requires the development of innovative drugs and technologies, making it essential for government and regulatory frameworks to invest in pharmaceutical research.

China is dominating the regional thin film drug manufacturing market due to the country's government focus and investments in a robust local manufacturing sector. Additionally, the growing prevalence of neurological disorders is driving the adoption of oral thin films in countries like China and Japan. On the other hand, India is accounted as the fastest-growing country in the regional market due to the presence of well-established pharmaceutical companies in the country.

Indian retail stores are playing a favorable role in the growth of the Asia Pacific thin film drug manufacturing market. The availability of advanced drugs for erectile dysfunction, opioid dependence, nausea and vomiting, schizophrenia, and migraine in retail stores has enhanced the purchasing capacity of thin film drugs in India. Indian pharmaceutical techniques, including solvent casting and aqueous slurry casting, are projected to draw novel approaches in the tin film drug manufacturing market.

Technological advancements have allowed for thin film formulation to improve drug delivery by administering through oral and transdermal routes. The rising prevalence of disease in pediatric and geriatric populations has surged the need for convenient and easy-to-use drugs. Furthermore, the growing prevalence of mental disorders has enhanced demand for steady, scalable, and high drug delivery, including thin films that improve long-acting properties to enhance patient adherence and outcomes. The demand for convenient over-the-counter drugs for pain management, allergies, infections, and CNS disorders is emerging, and the demand for thin film drugs is increasing.

The ongoing research in oral thin films is further emerging in the thin film drug manufacturing market. Over the past few years, pharmaceutical companies have attributed investments in the formulation of oral thin films to excel in the system of drug delivery. The need for drugs with high bioavailability is transforming the perspectives of research and developments. Moreover, the determination of pharmaceutical manufacturing companies to develop novel, innovative technologies due to increased demand for advanced patient convenience and adherence to drug intake by healthcare professionals and patients is transforming the current market.

| Report Coverage | Details |

| Market Size by 2024 | USD 7.38 Billion |

| Market Size in 2025 | USD 7.93 Billion |

| Market Size in 2034 | USD 15.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.40% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Indication, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased prevalence of chronic disease

The increased prevalence of chronic diseases like cancer, diabetes, neurological disorders, and respiratory disease is driving the thin film drug manufacturing market significantly. The prevalence of such diseases surged the demand for convenient medications with high efficiency, scalability, long-term management qualities, and easier administration and drug delivery. Moreover, increased disease prevalence among pediatric and elderly populations has increased the requirement for easy-to-use and convenient medications like thin-film drugs.

The need for drugs with high adherence to treatments and improved patient outcomes is driving the adoption of thin film drugs. Moreover, the rising demand for personalized medications is enhancing thin film formulations. With the growing need for orphan drugs with innovative applications for rising chronic diseases, the production of thin-film drugs is boosting.

Complex manufacturing process

The complexity of manufacturing, including scalability, material computability, uniformity, and consistency, are becoming major challenges in thin film drug formulations. The need to maintain drug quality through the manufacturing process has become challenging. Moreover, the high costs of equipment are hampering the development of thin film rugs. Moreover, a large surface area of thin films makes them non-adhesive in temperature resistance. High manufacturing and development costs are hampering the thin film drug manufacturing market. Limited scalability, high cost, and reduced efficiency make the manufacturing process more complex.

Technology advancements in drug delivery mechanisms

Advanced drug delivery systems are eager to improve the formulation and efficacy of the drugs, which is essential for the adoption of the thin film drug manufacturing market products. This advancement has been leveraged due to the rising demand for convenient and easy-to-use drugs among pediatric and aging populations. The adoption of advanced materials and manufacturing techniques, including nanotechnology and 3D printing, is allowing the development of thin film formulations with high bioavailability.

The rising rare diseases are driving the adoption of adhesive and mucoadhesive technologies in thin film formulations that adhere to specific tissues and mucous membranes, making possible the development of personalized medicines. Additionally, developments of smart thin films are being made easier thanks to the integration of advanced technologies with real-time drug delivery monitoring and patient response. The growing need for personalized medicines is seeing ways to make major developments with the integration of advanced technology in drug delivery.

The oral thin film segment held the largest thin film drug manufacturing market share in 2024 due to rapid demand for convenient, easy-to-use, and administrable drugs. Oral thin films are easier to administer and allow rapid absorption of active ingredients. Patients continuously seek non-invasive drugs, like oral drugs with fast delivery systems. The increased prevalence in the elderly and pediatric populations requires easier administrative drugs, which rapidly increased the manufacturing of oral thin films to enhance their swallowable capacity. Advancements in hot melt extrusion and solvent casting are improving the production of high-quality oral thin films. The increased demands for oral thin-filmed drugs for allergies, pain management, and infectious diseases are projected to further enhance the segment growth with rising companies’ determination to enhance taste and stability.

The schizophrenia segment generated the dominating share of the global thin film drug manufacturing market in 2024. The segment growth is attributed to the rising prevalence of schizophrenia and debilitating mental disorders. The need for a more sustainable release of medication for mental health issues patients is driving demand for thin film formulations. The surge in the production of innovative formulations for patients is enhancing thin film drug manufacturing. Growing awareness of mental health issues is driving the focus of government and regulatory bodies for investments in healthcare.

By Product

By Indication

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2023

August 2024

June 2023

January 2025