June 2024

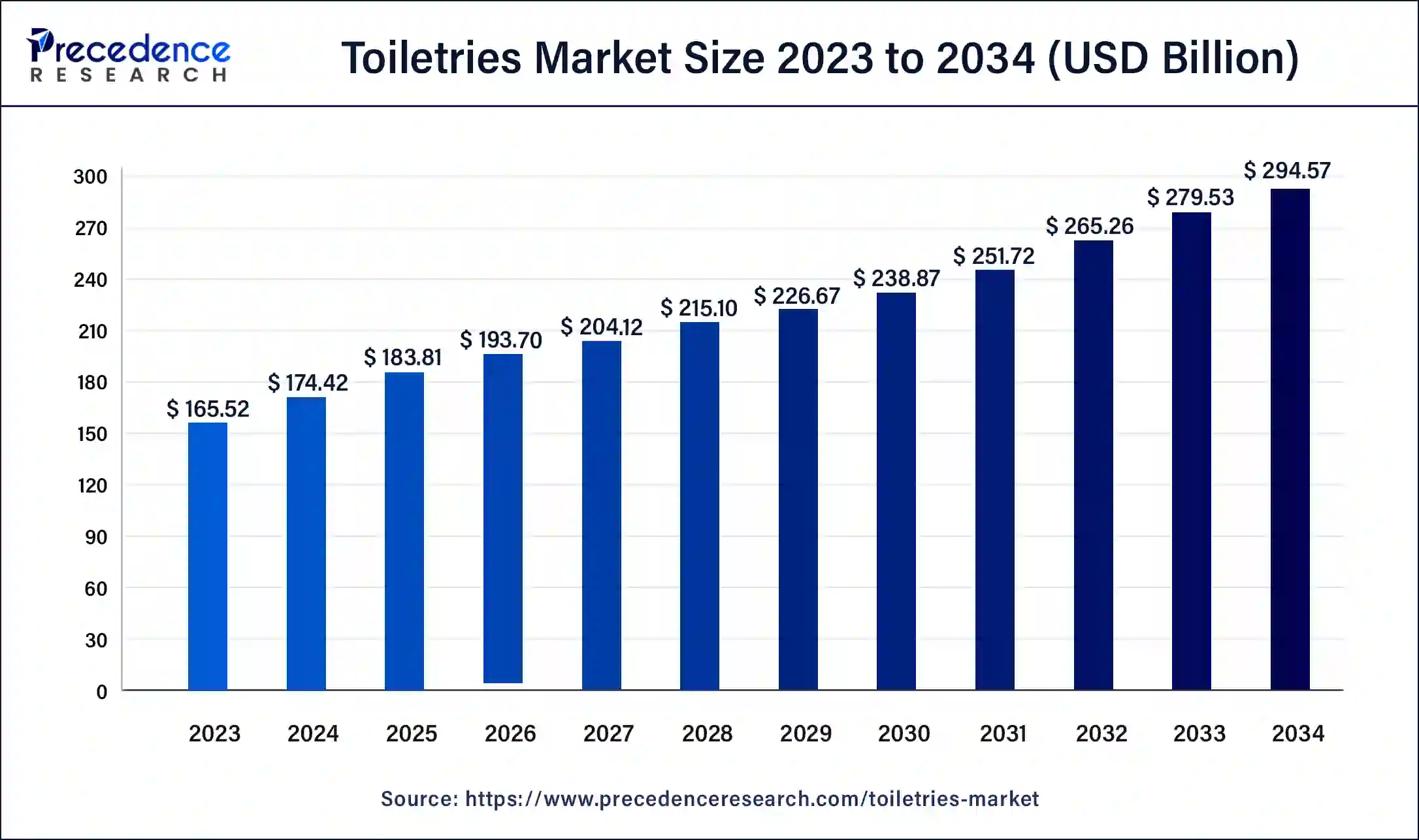

The global toiletries market size was USD 165.52 billion in 2023, calculated at USD 174.42 billion in 2024 and is expected to be worth around USD 294.57 billion by 2034. The market is slated to expand at 5.38% CAGR from 2024 to 2034.

The global toiletries market size is expected to be valued at USD 174.42 billion in 2024 and is anticipated to reach around USD 294.57 billion by 2034, expanding at a CAGR of 5.38% over the forecast period 2024 to 2034. Market demand is propelled by urbanization and changing lifestyles, while sustainability trends and diverse self-care products contribute to the growth of the toiletries market.

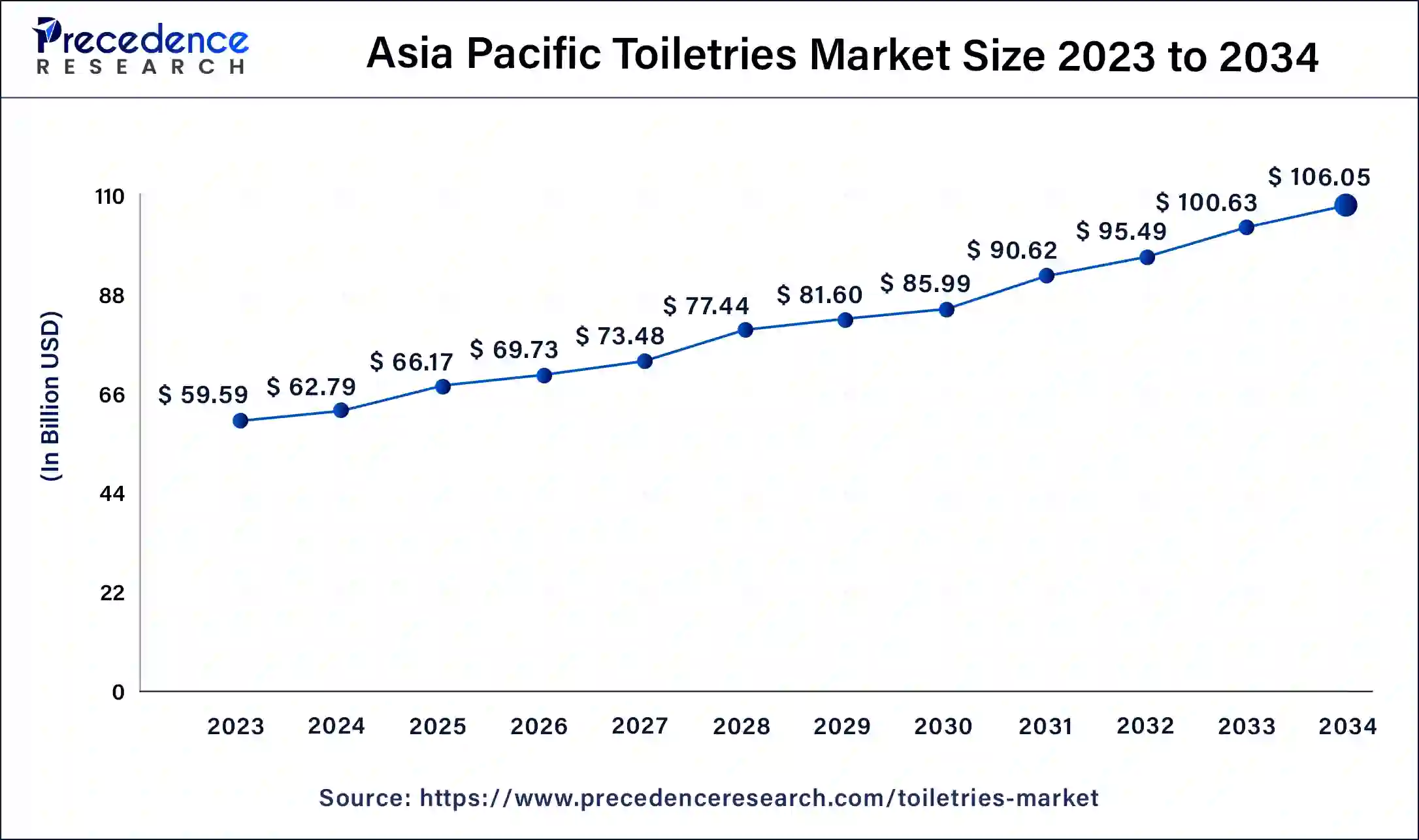

The Asia Pacific toiletries market size was exhibited at USD 59.59 billion in 2023 and is projected to be worth around USD 106.05 billion by 2034, poised to grow at a CAGR of 5.37% from 2024 to 2034.

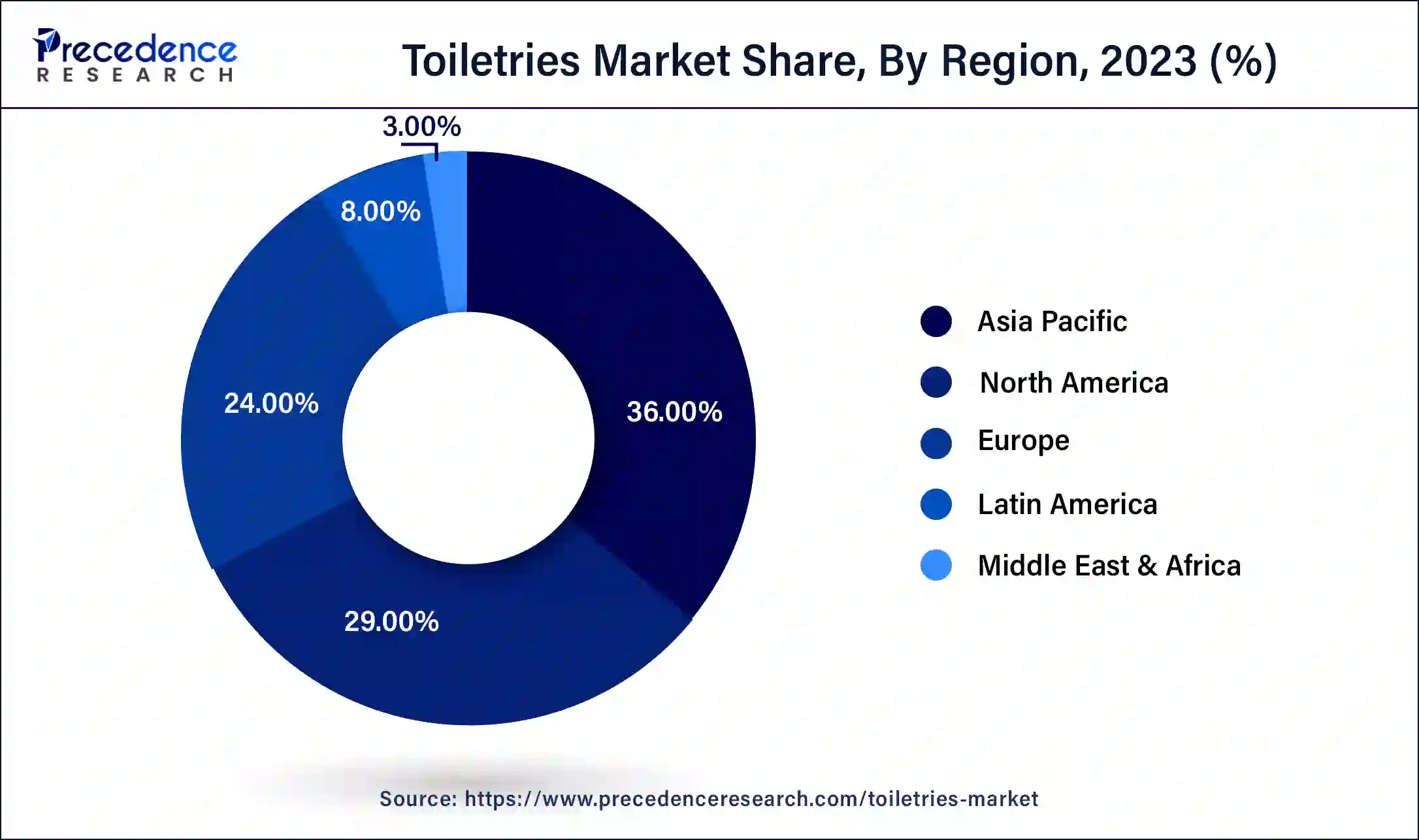

Asia Pacific accounted for the largest share of the toiletries market in 2023. In developing countries, the population of people living in cities such as India, China, and Indonesia has grown. The increasing disposable income, as well as the rising standards of the urban population, is leading to an increase in consciousness regarding raising personal standards. The needs stimulated by rapid urbanization and the growing individual health awareness of personal hygiene and beauty products have driven demand in the market. Also, the increased use of social networks and beauty standards has increased the Gen Z population and increased demand for various toiletries.

North America is anticipated to witness the fastest growth in the toiletries market during the forecasted years due to the growing awareness of personal care and related hygienic products among consumers. There is also an increasing demand for premium and natural products and an increased emphasis on e-commerce. The rising standards of the urban population are leading to an increase in consciousness regarding raising personal standards.

Toiletries are daily use personal care products used for cleaning and grooming purposes. Toiletries products are used in the enhancement of appearance and odor of the human body including hair care, skin care, and dental care. The advantages of personal care products include anti-aging, skin hydration, anti-inflammation, anti-oxidant, and anti-pollution. The toiletries market has steadily grown over the years due to an increase in customer awareness of personal hygiene and health. The key trends are the need for nature-derived and organic products, sustainability, and exciting packaging.

How can AI advance the Toiletries Market?

The use of artificial intelligence is to fuel the toiletries market. AI and augmented reality (AR) in beauty technologies are drastically redesigning brand and customer experiences. They use simple calculations for each skin type, problem, and taste, making brands create suitable solutions. Currently, through skin type, purchasing behavior, concerns, and interests, the AR has elevated skincare regimens. The algorithms can identify the state and state of specific skin, including texture and moisture, as well as potential issues such as acne, melasma, wrinkles, and others.

| Report Coverage | Details |

| Market Size by 2034 | USD 294.57 Billion |

| Market Size in 2024 | USD 174.42 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.38% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, End-user, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing awareness of personal hygiene

Developing and maintaining good personal hygiene is crucial for a healthy body and mind, and it significantly impacts the dynamics of the toiletries market. Personal hygiene involves practices to maintain cleanliness and well-being. It involves taking care of our bodies, the environment, and daily routines to avoid coming into contact with harmful pathogens. Factors such as increased urban population, growing competition, and higher consumer expectations are influencing the demand for more lifestyle products.

Urbanization trends

In areas such as large cities where society is more inclined to socialize and late parties in places such as hotels, cafés, theatres, etc, consumers here are more receptive to developing advanced grooming habits compared with consumers in rural areas. Moreover, players in the toiletries market are interested in these areas because internet connectivity is relatively high, and the necessary amenities exist. Besides that, consumers’ disposable income is comparatively higher than it is in the rural areas. Higher disposable income and emergent improvement in the standard of living are also the reasons for the increase in demand for personal care products.

Stringent regulatory compliance

When products come into direct contact with sensitive customer tissues, it is crucial to control the quality and safety of toiletries. There are certain regulations governing Ingredient safety, and these include the major regulatory bodies that supervise production, including the U.S. Food and Drug Administration, the European Commission, and Health Canada. Also, many products require safety tests in order to achieve necessary certifications, especially concerning the emissions of substances like fragrance. Governmental restrictions are more important for sustainability in sourcing and packages.

Rising eco-friendly grooming products

Consumers in the toiletries market have an increasing need for natural, sustainable, and grooming toiletries, which has contributed to this new trend. This proposed that more and more consumers are buying products from the green range due to toxic chemicals used in synthetic personal care products. These natural ingredients not only provide environmental benefits, but also resonate with the increasing consumer focus on health and wellness.

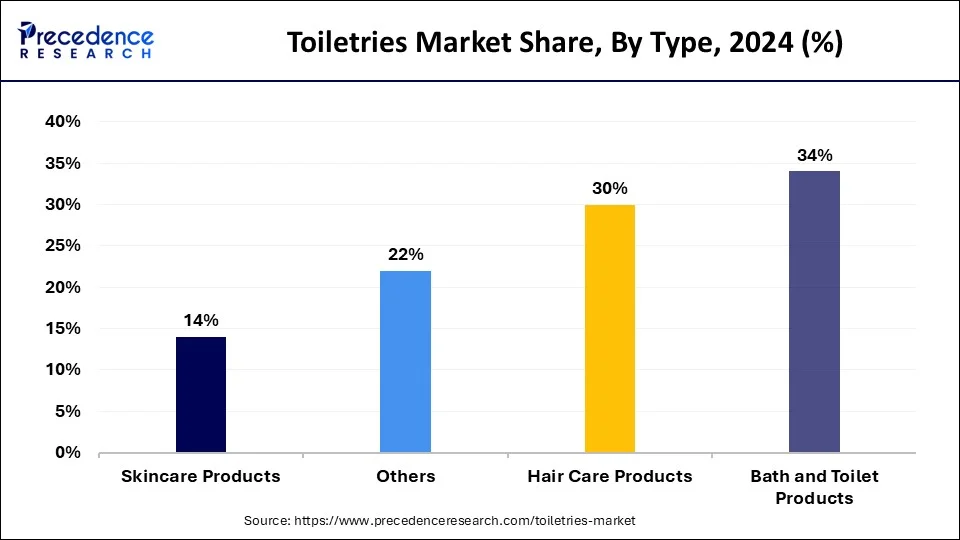

The bath & toilet products segment contributed the biggest share of the toiletries market in 2023, owing to increased consciousness about the benefits of hygiene and self-care. The ongoing focus on health has spurred demand for essential items like soaps, body washes, and sanitizers. Also, advancements have been made in product formulation, including organic and natural growing markets. Additionally, the trend towards self-care and luxury experiences contributed to the growth of interest in premium bath products.

The hair care products segment is anticipated to witness considerable growth in the toiletries market during the forecast period. Hair care products help men and women maintain their hair health and cleanliness and protect them from damage. The product is shampoo, conditioner, oil, serum, and others, which is used in nourishing hair and comes in liquid, gel, cream, and lotion form. Now, people start getting grey hair at a much earlier stage in their lives than the earlier generation, and hair fall has become much more common. The key factors triggering these issues have been changes in diet, pollution, rising stress levels, and the use of chemical-based hair care products.

The female segment held the dominant share of the toiletries market in 2023. Females tend to utilize more toiletries than males, toiletries that take care of the skin, hair, and private parts. Both in appearance and personal care, women have greatly influenced trends in skincare, hair, and body care. Growing beauty consciousness and consequent beauty routines and demand, coupled with rising disposable income.

The male segment is projected to witness the fastest growth in the toiletries market during the forecast period. Men’s grooming had been a category with a small product portfolio that included razors, blades, and deodorants. However, in the last decade, this trend experienced disruption as men started to become increasingly aware of maintaining good hygiene levels and staying groomed. All this put pressure on companies to produce products that meet the needs of men. Gen Z and Gen Alpha are population groups that are greatly responsible for increasing the demand of the market.

The offline segment led the global toiletries market in 2023, owing to the high purchase of these products through offline channels, which includes retail formats such as specialty stores, hypermarkets, supermarkets, convenience stores, and warehouse clubs. Physical retail store outlets presented an opportunity for easy accessibility of products that were tested and compared. In the same way, promotions and knowledgeable staff kept increasing the engagement of customers and the importance of offline shopping and e-commerce.

The online segment is projected to witness the fastest growth in the toiletries market during the forecast period. A rapidly expanding e-retail business is causing the expansion of online distribution channels in developing and developed economies globally. Due to this, there has been a tremendous influence on the toiletries market because of the convenience of shopping on the internet. The availability and affordability of international brands, coupled with easy doorstep deliveries, have greatly heightened online grooming toiletries purchasing spree. Marketing through social media and specific promotions added more to brand awareness. Social media has become a gradually significant platform for brands to showcase their products.

Segments Covered in the Report

By Type

By End-user

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024